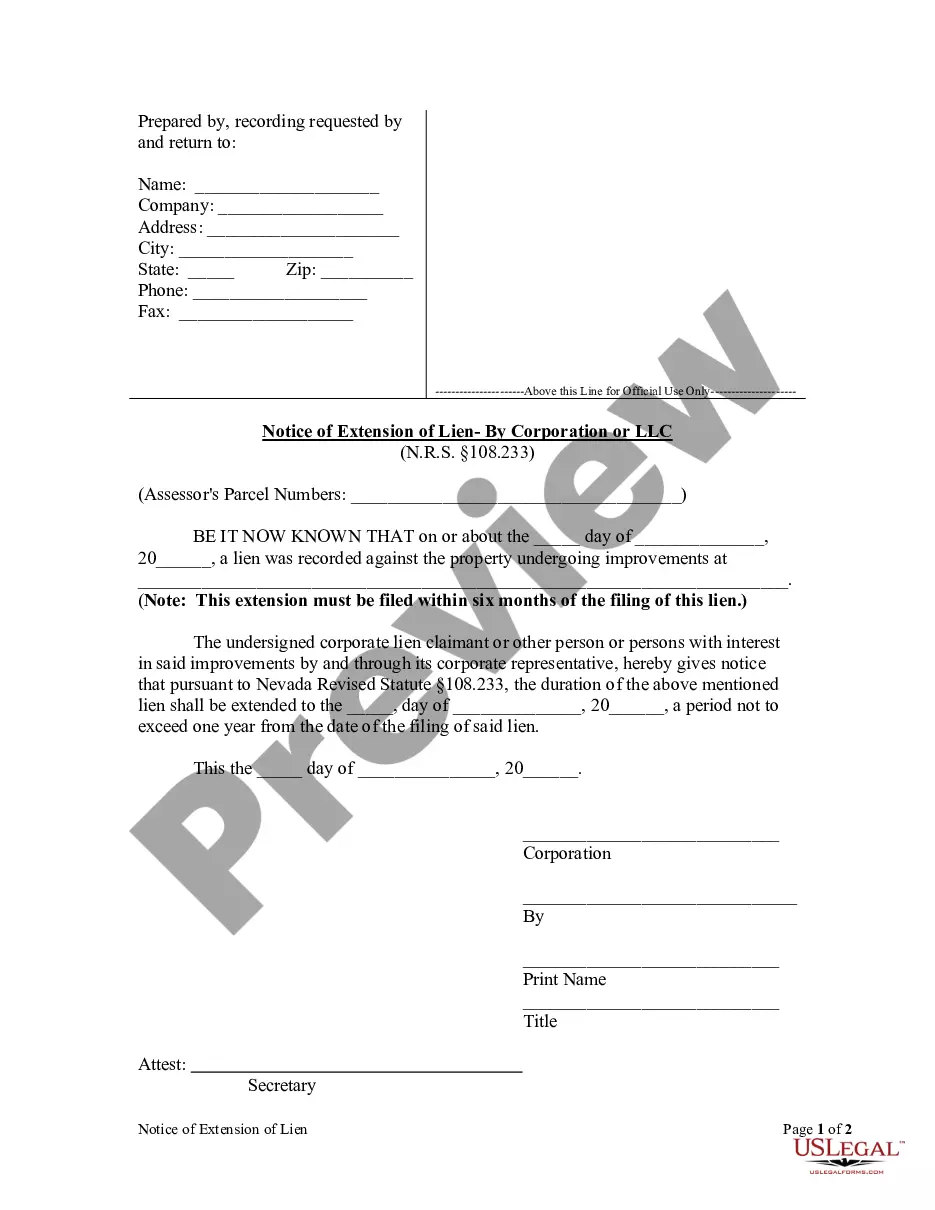

Pursuant to Nevada law, a properly filed lien is only effective for six months after it has been filed, unless the lien claimant files suit during that time. However, the party claiming the lien may extend the duration of his lien by filing a notice of extension. The notice of extension must be filed within six months of the original filing and may not extend the duration of the lien beyond one year from the original lien filing.

Nevada Notice of Extension of Lien - Corporation

Description

How to fill out Nevada Notice Of Extension Of Lien - Corporation?

US Legal Forms is actually a special system to find any legal or tax form for completing, including Nevada Notice of Extension of Lien - Corporation or LLC. If you’re sick and tired of wasting time looking for perfect samples and spending money on document preparation/lawyer service fees, then US Legal Forms is precisely what you’re seeking.

To experience all the service’s advantages, you don't have to download any software but just choose a subscription plan and register an account. If you already have one, just log in and get a suitable sample, download it, and fill it out. Downloaded files are all stored in the My Forms folder.

If you don't have a subscription but need to have Nevada Notice of Extension of Lien - Corporation or LLC, check out the instructions below:

- check out the form you’re looking at applies in the state you need it in.

- Preview the form its description.

- Simply click Buy Now to reach the sign up page.

- Choose a pricing plan and proceed registering by providing some info.

- Decide on a payment method to complete the registration.

- Save the document by selecting your preferred format (.docx or .pdf)

Now, fill out the document online or print it. If you are uncertain regarding your Nevada Notice of Extension of Lien - Corporation or LLC template, contact a legal professional to review it before you send out or file it. Get started without hassles!

Form popularity

FAQ

How Liens Work. A lien provides a creditor with the legal right to seize and sell the collateral property or asset of a borrower who fails to meet the obligations of a loan or contract. The property that is the subject of a lien cannot be sold by the owner without the consent of the lien holder.

A construction lien is a claim made against a property by a contractor or subcontractor who has not been paid for work done on that property. Construction liens are designed to protect professionals from the risk of not being paid for services rendered.

When your efforts to collect a bill from a business that owes you money have been unsuccessful, you can place a lien on the assets of the business. As a lienholder, you gain legal rights to the company's property and the authority to sell the property and use the proceeds to repay what is owed to you.

A contractor's lien (often known as a mechanic's lien, or a construction lien) is a claim made by contractors or subcontractors who have performed work on a property, and have not yet been paid.After all, contractors would rather work out a deal than go through the hassle of filing a lien against your property.

In Minnesota, all mechanics liens must be filed within 120 days from the claimant's last day providing materials or labor. In Minnesota, mechanics liens expire 1 year from the date of the lien claimant's last furnishing of labor or materials to the project.