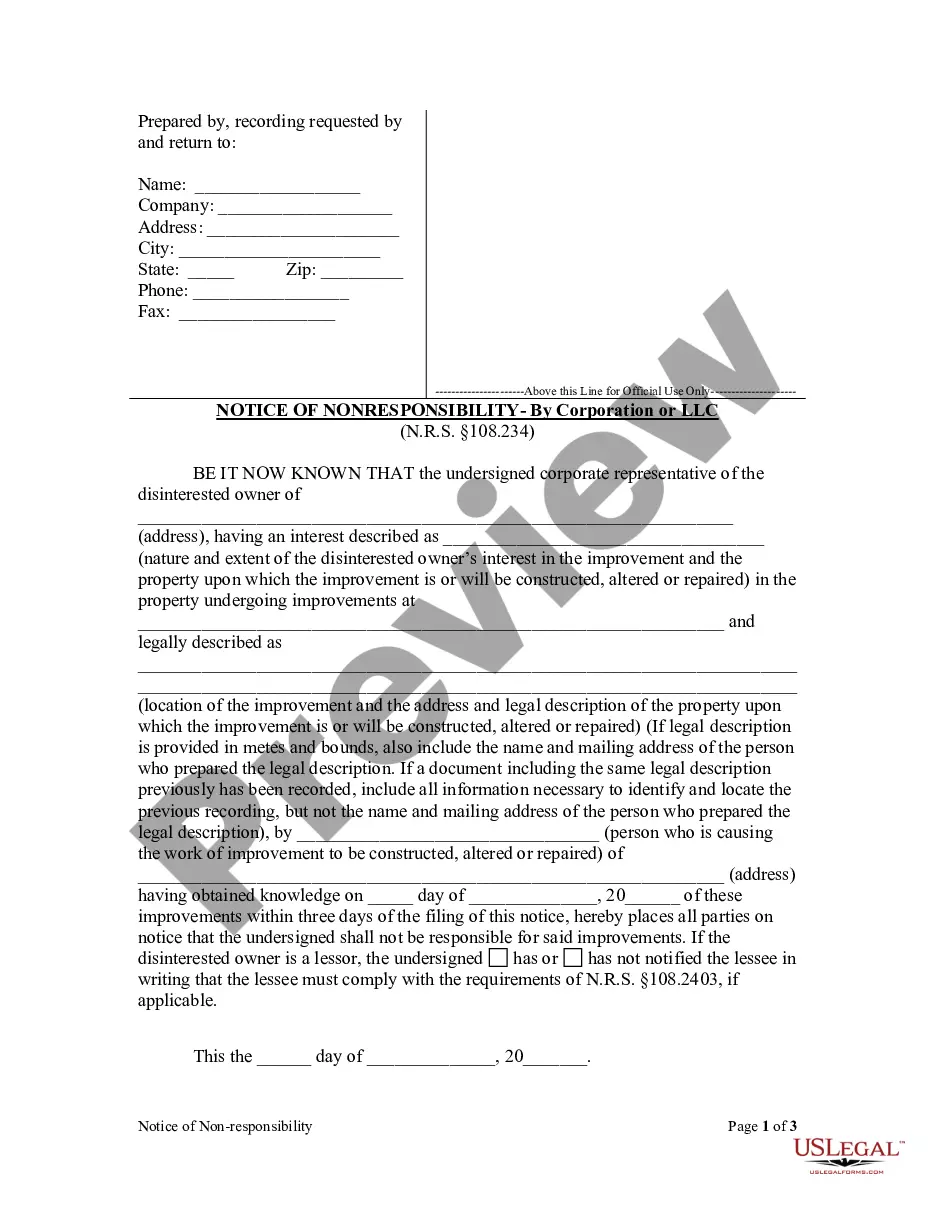

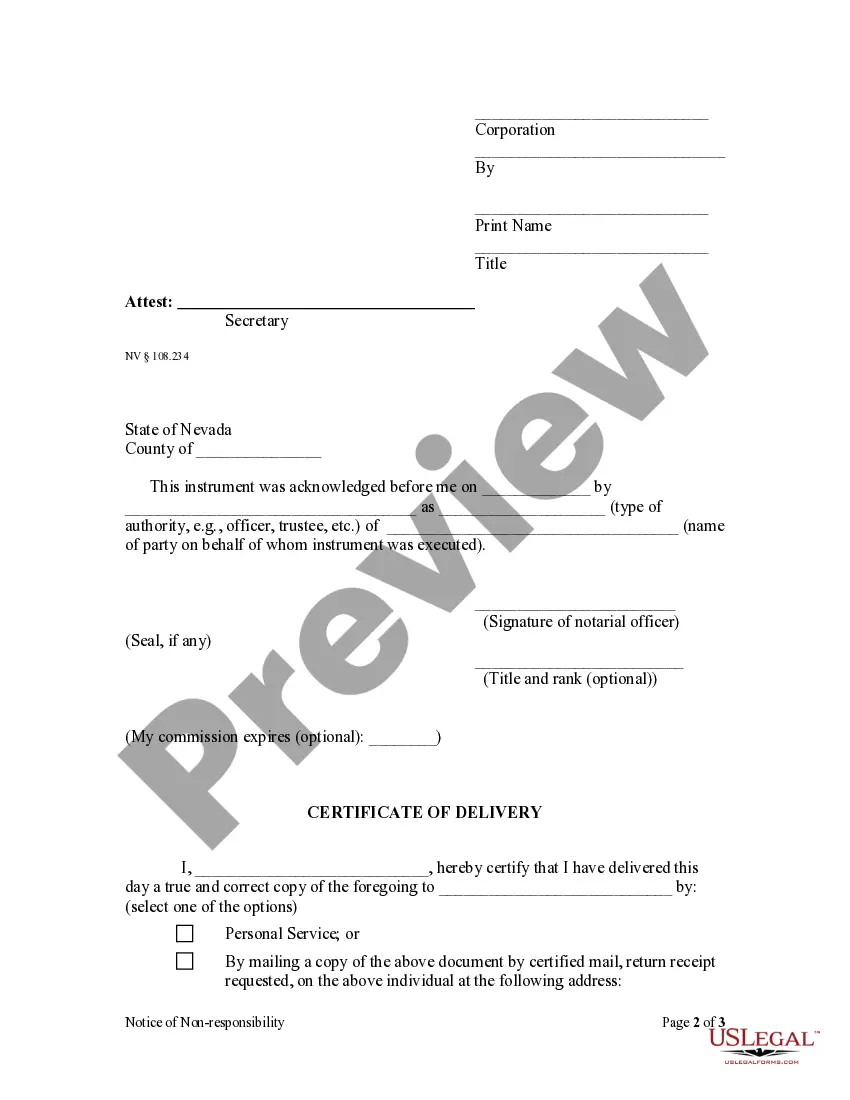

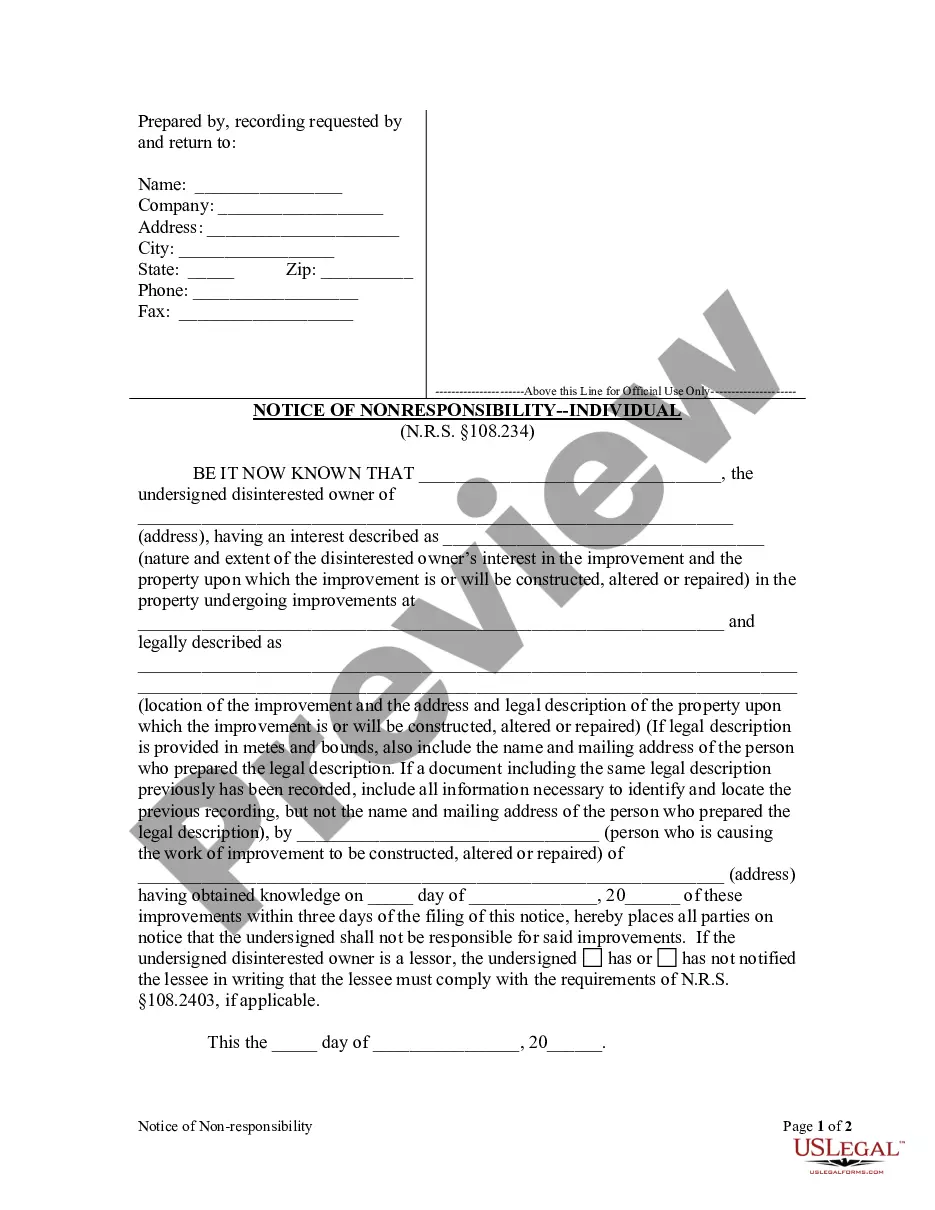

Nevada statutes presume that if individuals are furnishing labor or materials for the improvement of property they do so on behalf of the property owner and are entitled to a lien against the property for the value of the materials or labor provided. However, in the event that a person with an ownership interest in the property does not desire to be held responsible for the improvements, that party may file a notice of non-responsibility with the county recorder within three days of obtaining knowledge that improvements are being made.

Nevada Notice of Non Responsibility - Corporation

Description

How to fill out Nevada Notice Of Non Responsibility - Corporation?

US Legal Forms is really a special system to find any legal or tax form for submitting, such as Nevada Notice of Non Responsibility - Corporation or LLC. If you’re tired of wasting time searching for appropriate samples and paying money on papers preparation/attorney fees, then US Legal Forms is precisely what you’re trying to find.

To enjoy all of the service’s advantages, you don't need to install any application but just pick a subscription plan and create your account. If you already have one, just log in and find a suitable template, save it, and fill it out. Downloaded files are stored in the My Forms folder.

If you don't have a subscription but need Nevada Notice of Non Responsibility - Corporation or LLC, have a look at the recommendations below:

- check out the form you’re taking a look at is valid in the state you need it in.

- Preview the sample its description.

- Click on Buy Now button to reach the register webpage.

- Choose a pricing plan and keep on registering by providing some info.

- Decide on a payment method to complete the sign up.

- Save the file by choosing your preferred file format (.docx or .pdf)

Now, complete the document online or print out it. If you are uncertain concerning your Nevada Notice of Non Responsibility - Corporation or LLC template, contact a attorney to analyze it before you send or file it. Get started hassle-free!

Form popularity

FAQ

Member/Manager Information of LLCs Unlike some states, Nevada does not require members or managers to live in the state itself. In order to successfully form an LLC, you must be 18+ years old and file your articles of organization.

A professional limited liability company (PLLC) is a business entity designed for licensed professionals, such as lawyers, doctors, architects, engineers, accountants, and chiropractors.

Yes. You can register your LLC in a different state if you comply with the laws and regulations of both states.

Moreover, the new California Revised Uniform Limited Liability Company Act, effective as of January 1, 2014, provides that an out-of-state LLC may register in California and does not impose penalties for failing to do so.

If your business is not based out of Nevada, you must receive authorization to use the Nevada corporation in your state. For example, a California business that incorporates in Nevada must separately qualify to do business in California.

Consequently, for the Nevada LLC to operate in California, it must be registered with the California Secretary of State (Ca Rev & Tax Code Sec.This means the Nevada LLC will pay the initial California registration fee and $800 annual franchise tax, along with California income tax.

No state income, corporate or franchise taxes. No taxes on corporate shares or profits. Privacy protection for owners choosing to be anonymous. No operating agreements or annual meetings requirements. Low business registration fees and quick turnarounds.

Restricted LLCs can only be formed in Nevada. This type of LLC is used only for estate planning purposes, such as to gift property from one family member to another. A restricted LLC cannot make any distributions to members for 10 years after its formation, which can be seen as a drawback of this type of company.

So, you set up a Nevada LLC to own your California rental property.This also means having to pay double the fees just for a single LLC. Simply having an out of state LLC own your California rental property is not going to allow your business to accomplish what it needs and will not provide you the protection you want.