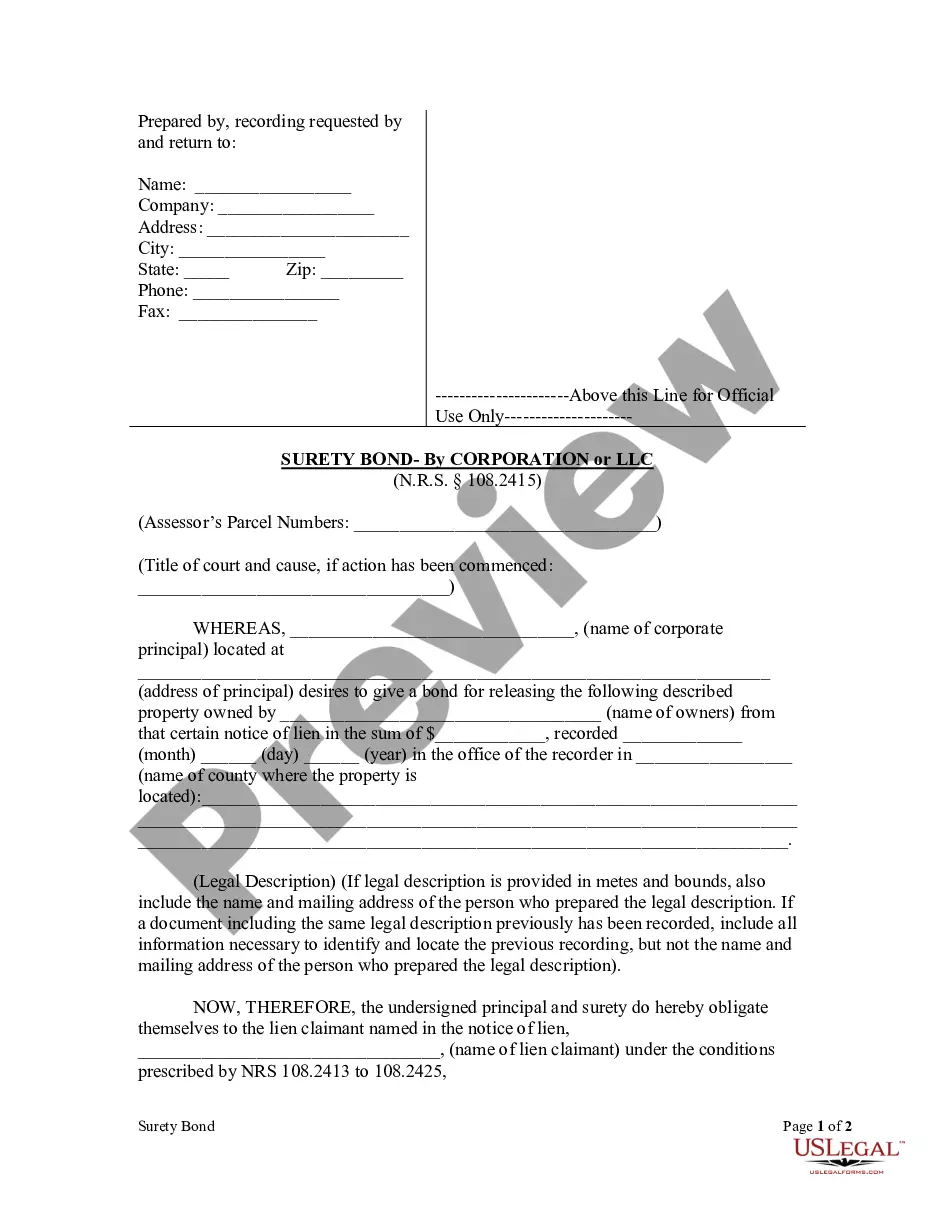

One principal method by which a mechanic's lien may be removed from a piece of improved property is for the property owner or principal contractor to obtain a bond in the amount of one and one-half times the amount of the lien claim. Nevada statutes require the bond to be substantially in the form of NV-06A-09.

Nevada Surety Bond Form - Corporation

Description

How to fill out Nevada Surety Bond Form - Corporation?

US Legal Forms is a unique platform to find any legal or tax document for submitting, including Nevada Surety Bond Form - Corporation or LLC. If you’re tired with wasting time searching for perfect samples and paying money on record preparation/attorney charges, then US Legal Forms is exactly what you’re searching for.

To reap all the service’s benefits, you don't have to install any software but just select a subscription plan and sign up your account. If you already have one, just log in and find an appropriate template, download it, and fill it out. Saved files are stored in the My Forms folder.

If you don't have a subscription but need to have Nevada Surety Bond Form - Corporation or LLC, check out the guidelines below:

- check out the form you’re checking out applies in the state you want it in.

- Preview the example its description.

- Click Buy Now to get to the sign up page.

- Pick a pricing plan and carry on registering by entering some information.

- Choose a payment method to finish the registration.

- Download the document by choosing the preferred format (.docx or .pdf)

Now, submit the file online or print out it. If you feel uncertain about your Nevada Surety Bond Form - Corporation or LLC form, contact a attorney to check it before you decide to send out or file it. Get started hassle-free!

Form popularity

FAQ

How do I get a Nevada bonded title for my vehicle? Begin by contacting the Department of Motor Vehicle's Title Research Section by visiting their website or by phone at (775) 684-4810. Obtain the Affidavit for Bonded Vehicle Title, and complete the parts one and two.

How long will it take to get my bond? In most instances, surety experts can issue a bond within 24 hours of the initial application. The turnaround time can take longer for riskier bonds that require more complicated underwriting processes, such as contract bonds for construction projects.

Gather the information required to apply for your surety bond. Common necessary details include your business name and address, license number (if you are renewing your bond), and ownership information.

A surety is someone who is often mentioned in a bail undertaking. If the defendant fails to appear, the money or property may be 'forfeited to the court'. Another condition used when defendants apply for bail, is the naming of a surety.

To verify the bond, you will need to contact the Surety and provide them with a scanned copy of the bond with your inquiry. If you do not have a copy, The Surety & Fidelity Association of America (SFAA) has provided a link to their Bond Authenticity Inquiry Form to supply the appropriate information.

Nevada certificate of title bonds up to $5,000 are issued instantly and cost $100. Bonds between $5,000 and $25,000 are also issued instantly at a rate of $20 for every $1,000 of coverage. Bonds greater than $25,000 are subject to review by an underwriter, although they are typically aproved at a low cost as well.

The bond must be written by a surety company authorized to transact business in the State of Nevada, and whose long-term obligations are rated A or better. An applicant or licensee can post a cash deposit In lieu of a surety bond. Cash deposits must be in the form of a Cashier's Check for the full amount of the bond.

Ideally, surety bond companies will look for credit scores higher than 670 and an absence of collections, liens, and judgments. If your credit score is under 670, that's usually okay, you will likely just have to pay more for your bond.

Examples of these bonds include construction and environmental performance, payment, supply, maintenance, and warranty bonds. Commercial surety helps obtain capacity at the lowest cost for all corporate surety needs.International surety examines the unique surety requirements internationally.