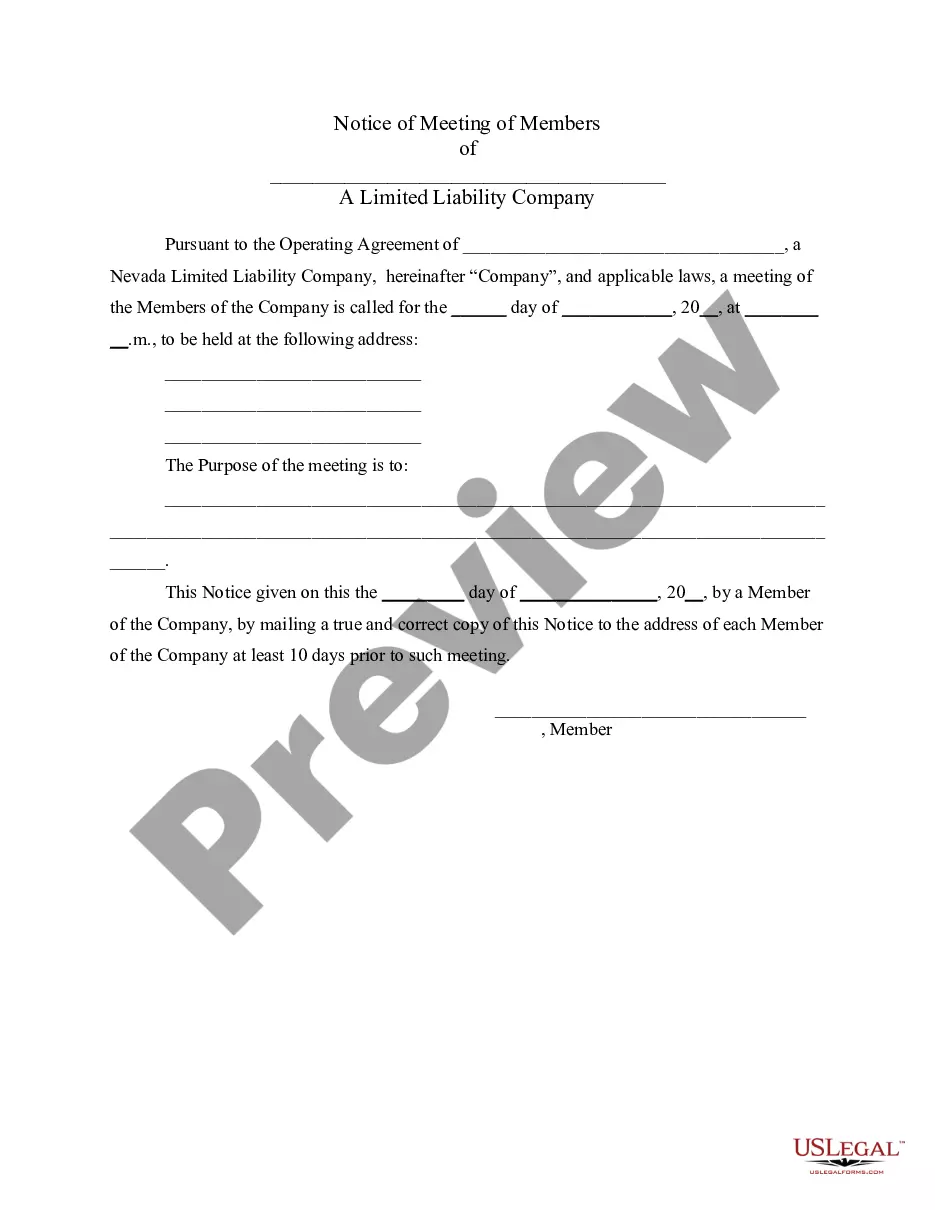

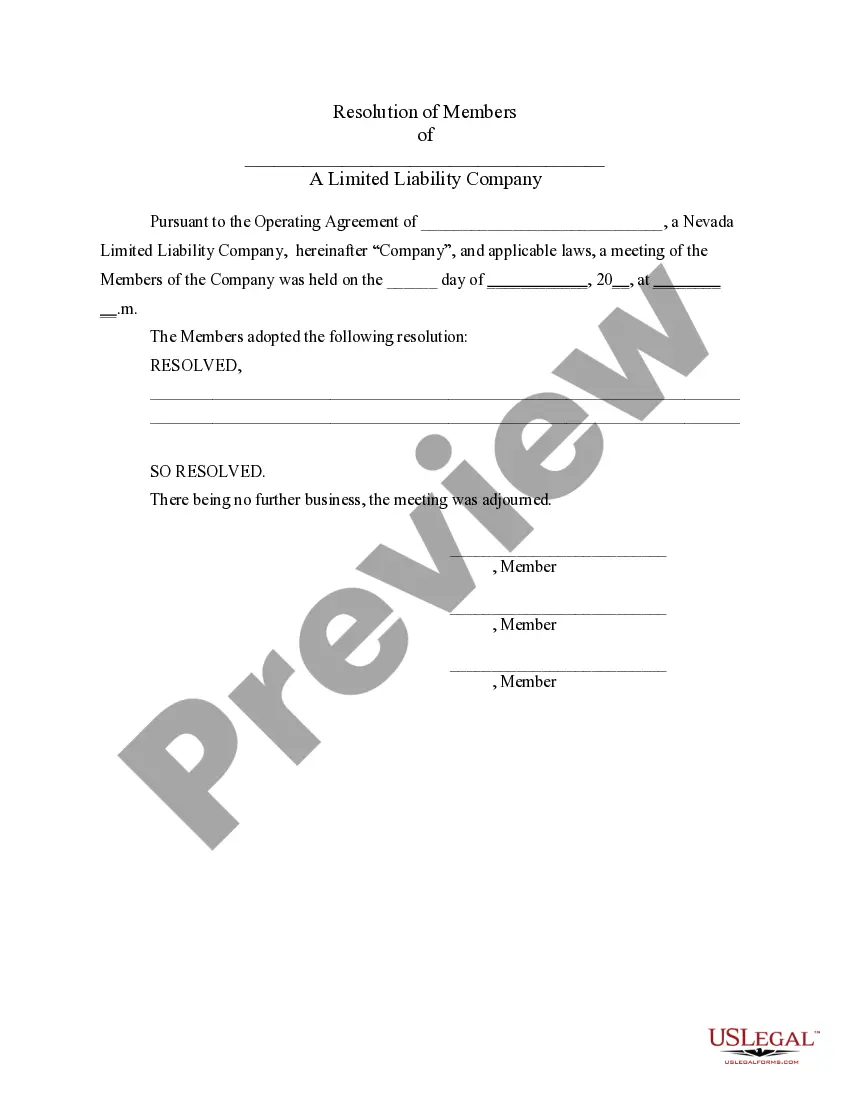

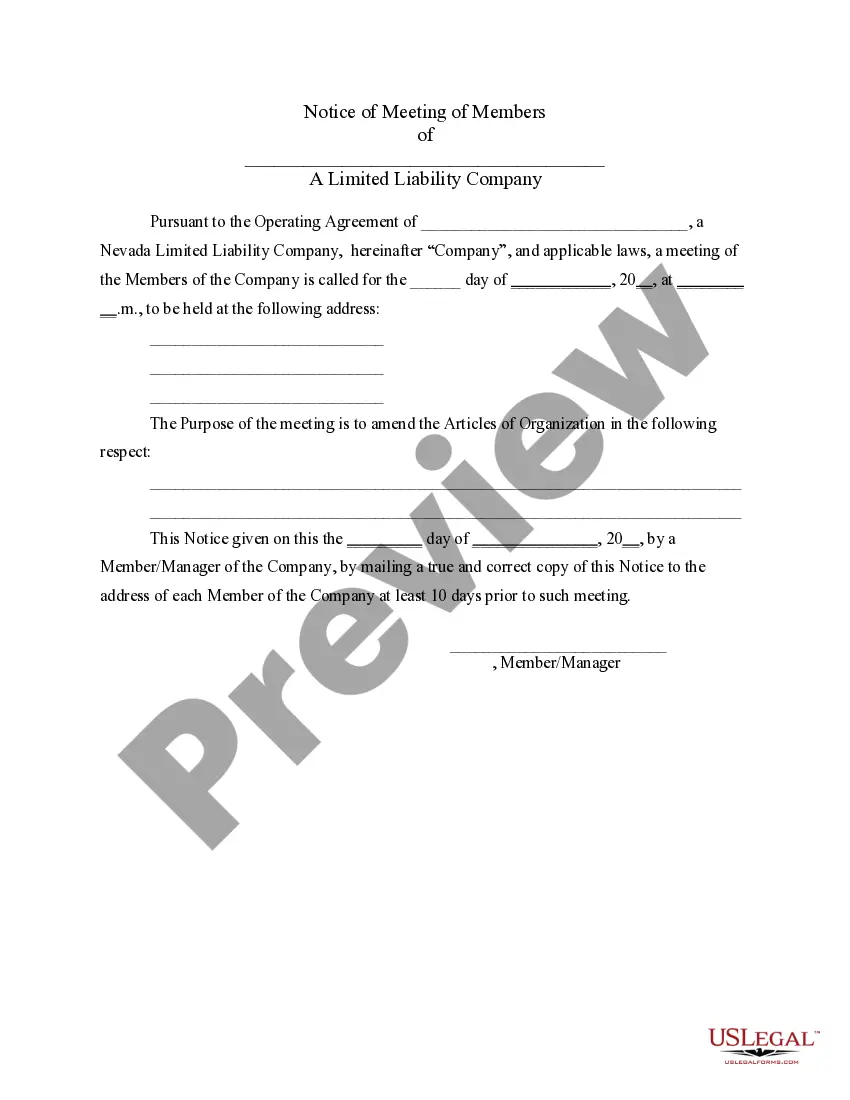

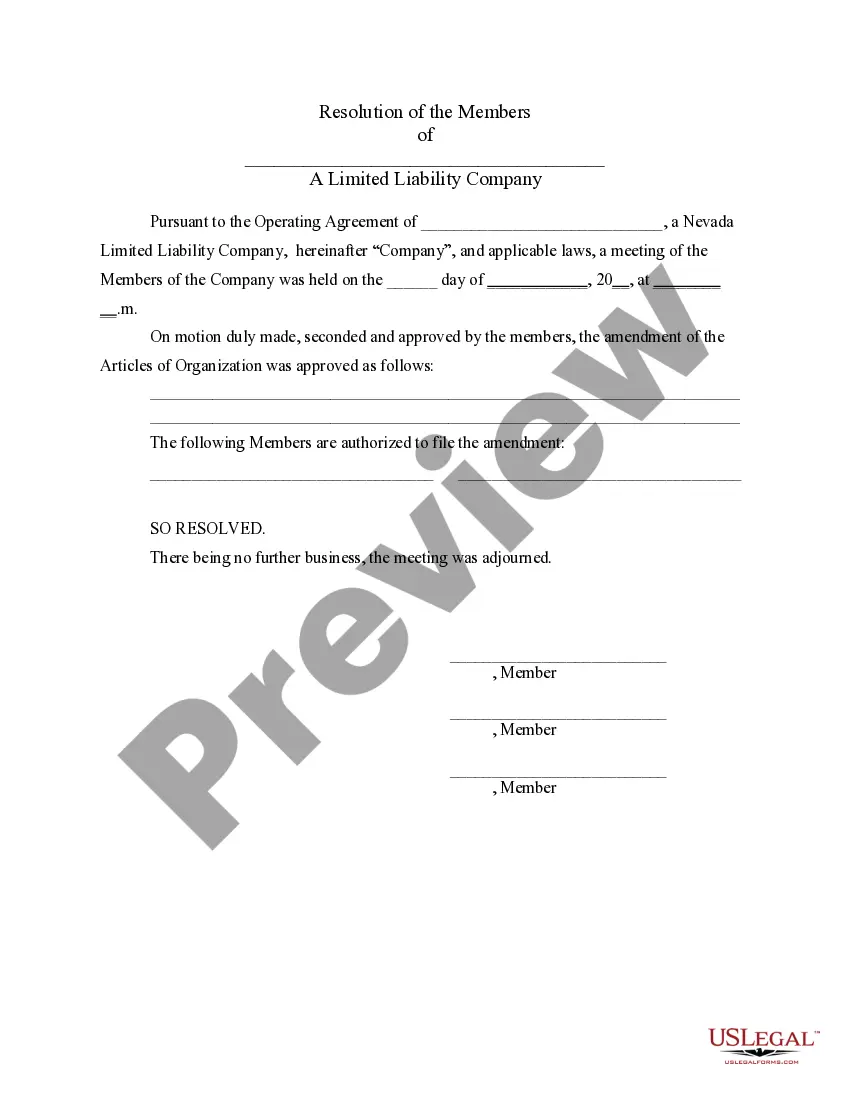

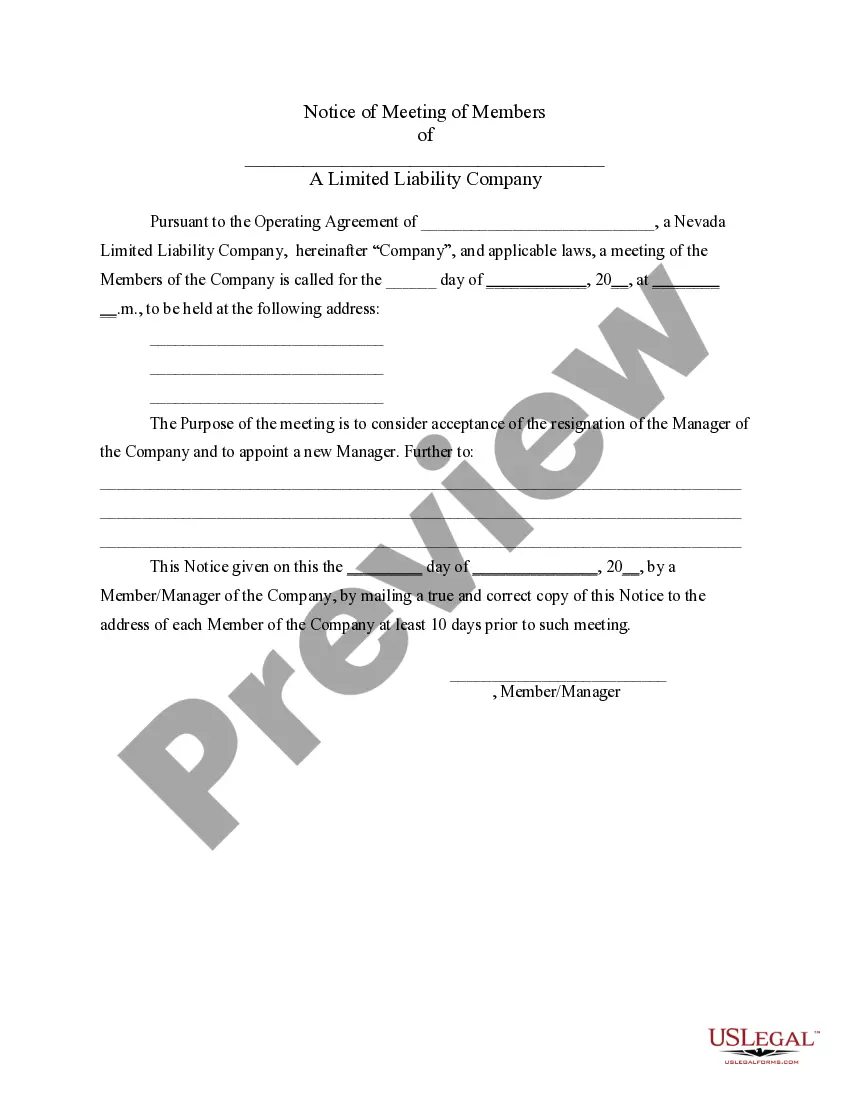

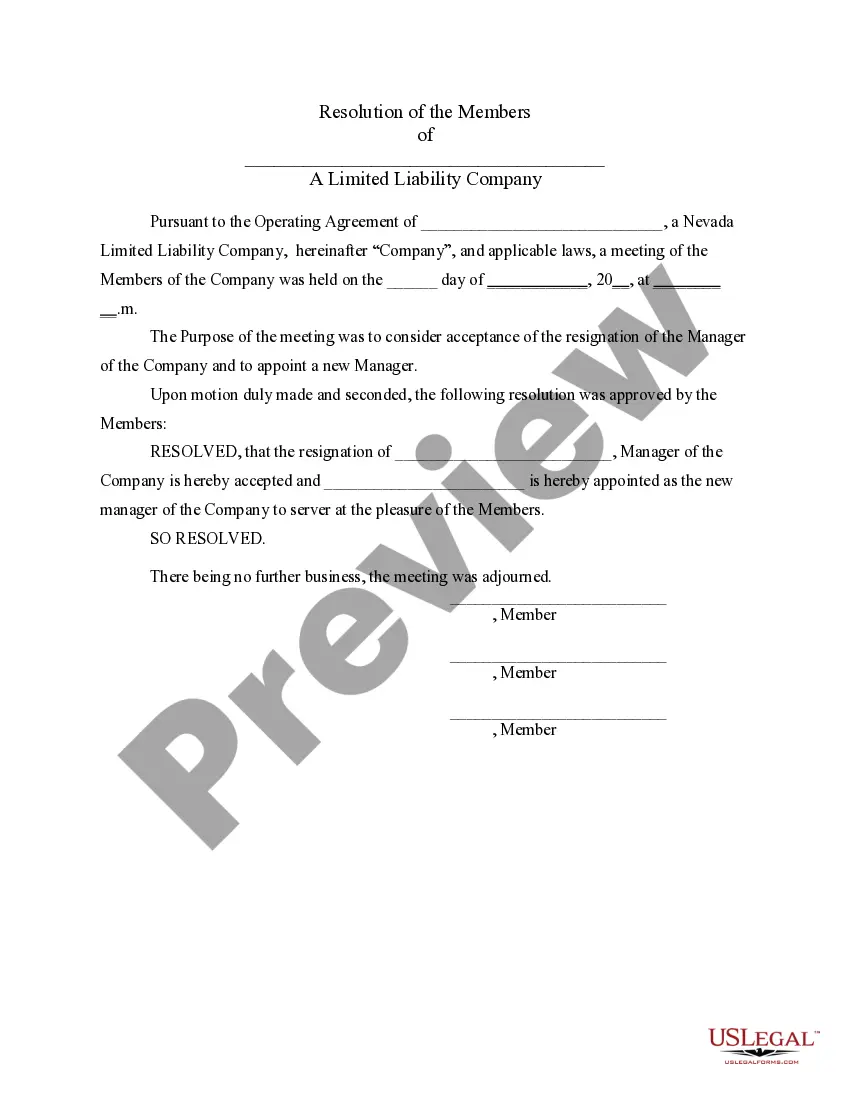

Nevada LLC Notices, Resolutions and other Operations Forms Package

Description Nevada Anonymous Llc

How to fill out Llc Cost Nevada?

US Legal Forms is really a unique system where you can find any legal or tax form for filling out, including Nevada LLC Notices, Resolutions and other Operations Forms Package. If you’re tired with wasting time seeking ideal samples and paying money on document preparation/legal professional service fees, then US Legal Forms is precisely what you’re trying to find.

To experience all the service’s benefits, you don't need to install any software but just choose a subscription plan and register an account. If you have one, just log in and find a suitable template, download it, and fill it out. Downloaded documents are kept in the My Forms folder.

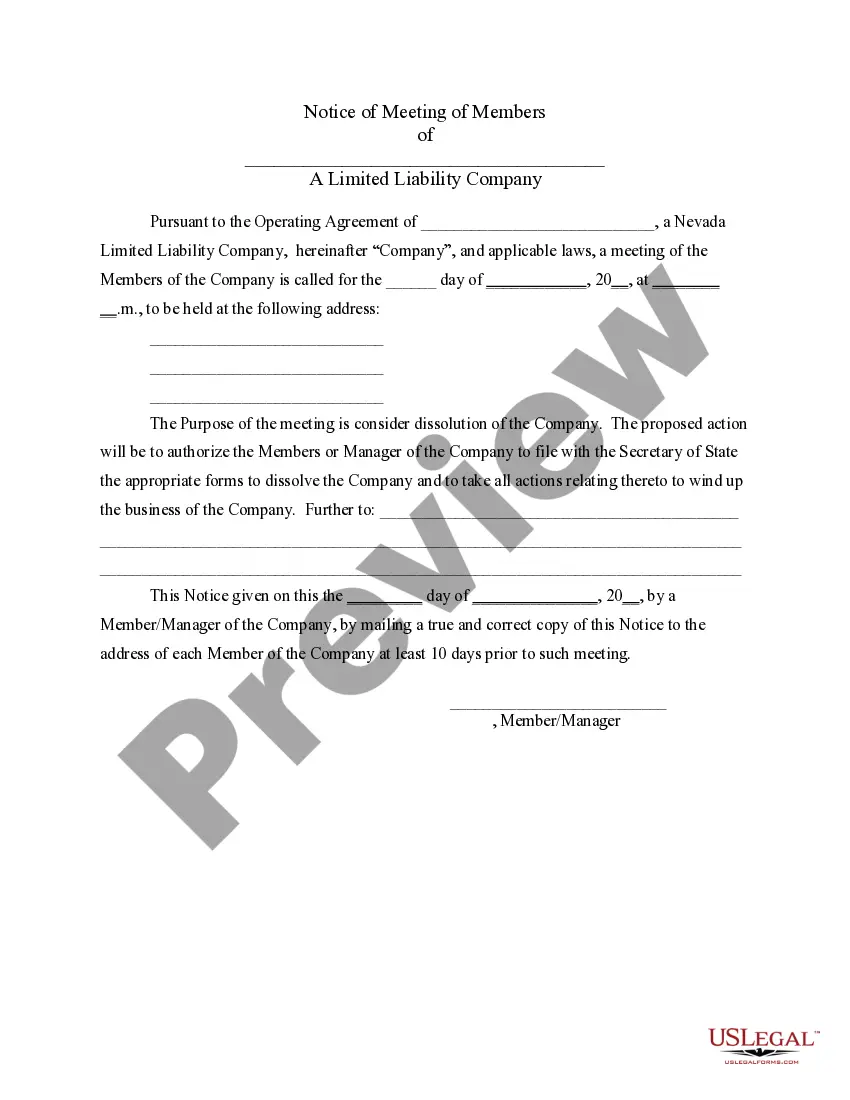

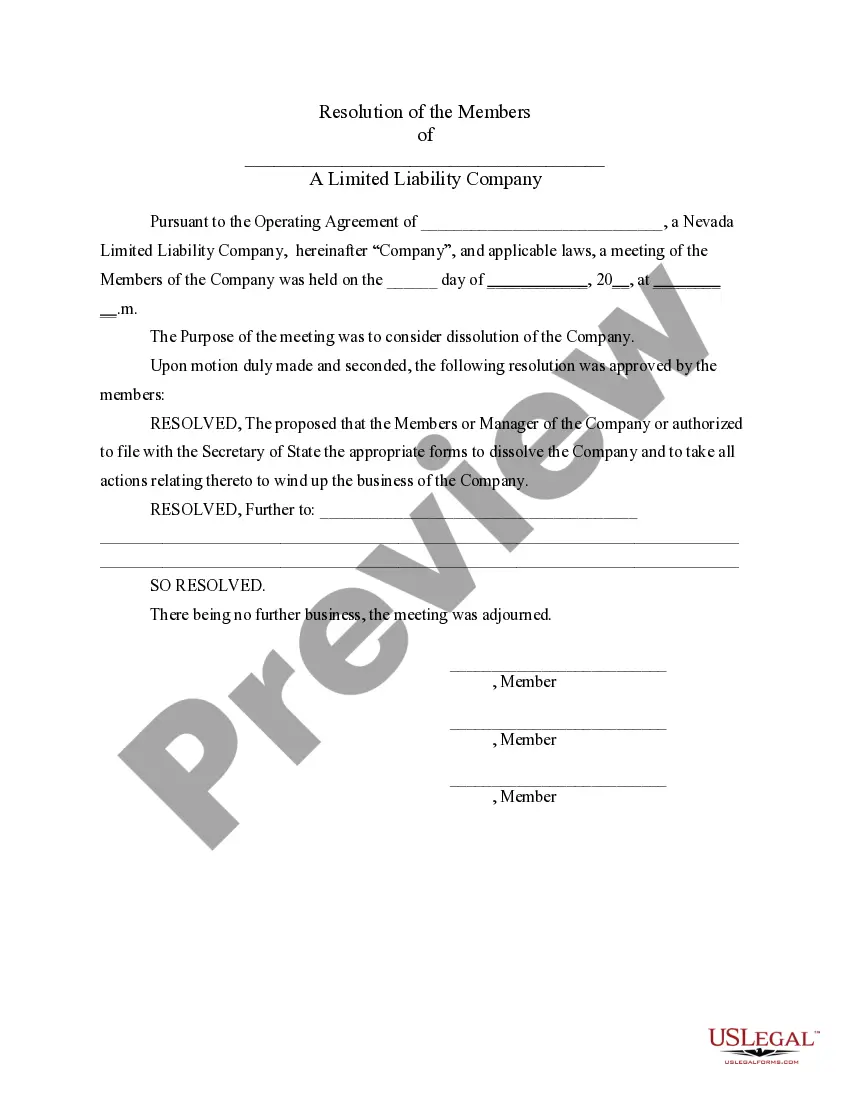

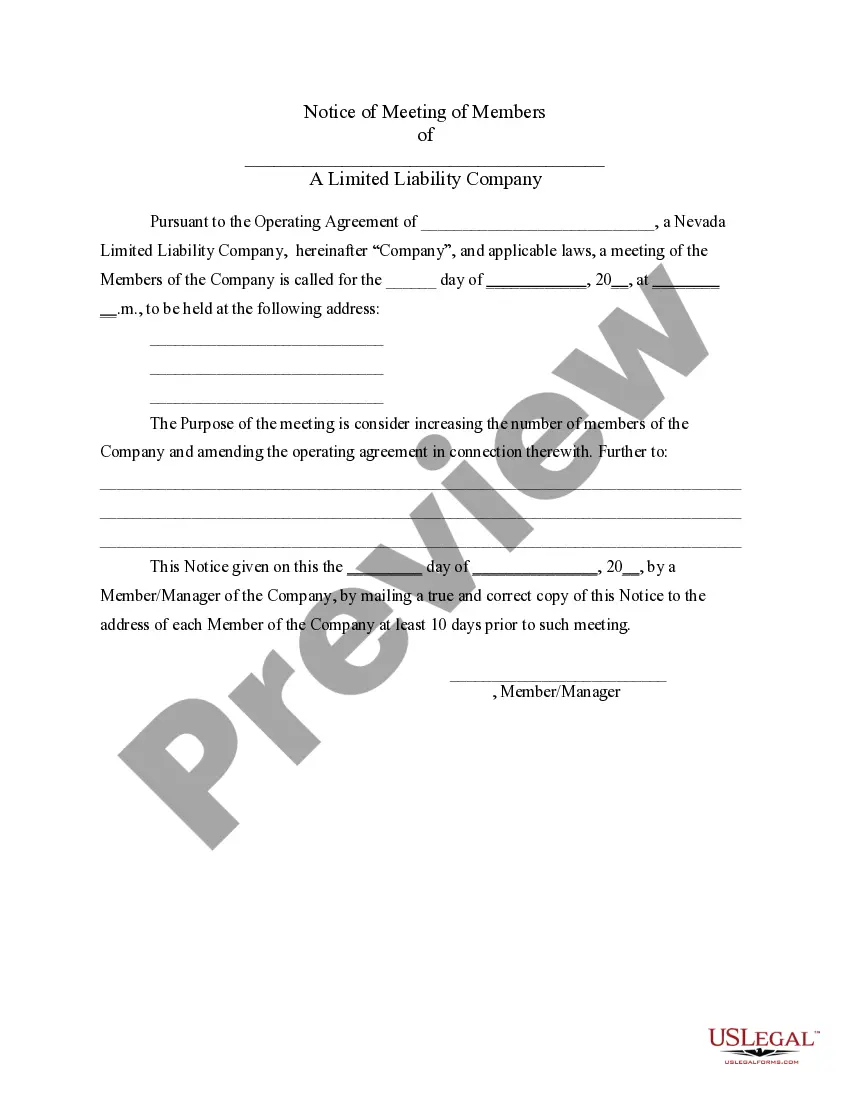

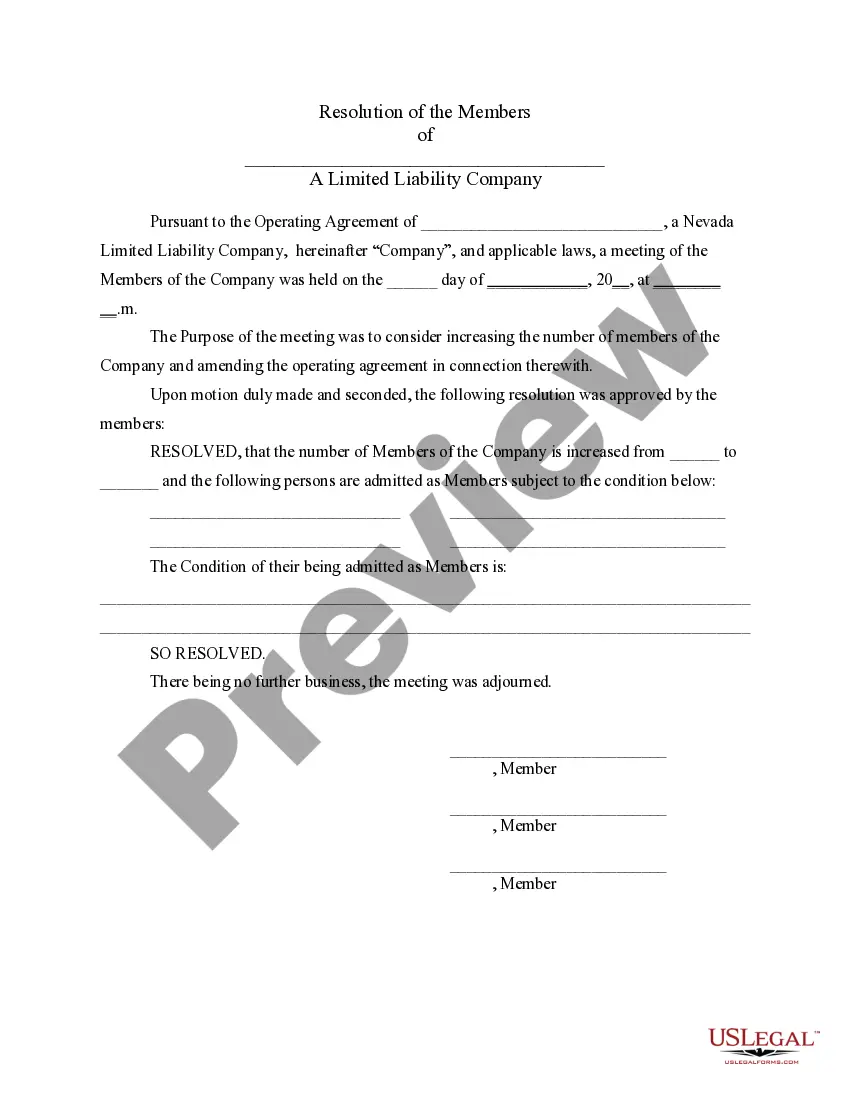

If you don't have a subscription but need Nevada LLC Notices, Resolutions and other Operations Forms Package, check out the guidelines below:

- check out the form you’re considering is valid in the state you need it in.

- Preview the sample and look at its description.

- Click Buy Now to reach the sign up webpage.

- Select a pricing plan and proceed signing up by providing some information.

- Select a payment method to complete the registration.

- Save the document by selecting the preferred file format (.docx or .pdf)

Now, fill out the document online or print it. If you feel uncertain about your Nevada LLC Notices, Resolutions and other Operations Forms Package form, contact a legal professional to review it before you send or file it. Start without hassles!

Limited Liability Company Form popularity

Nevada Llc Forms Other Form Names

Nv Llc Fees FAQ

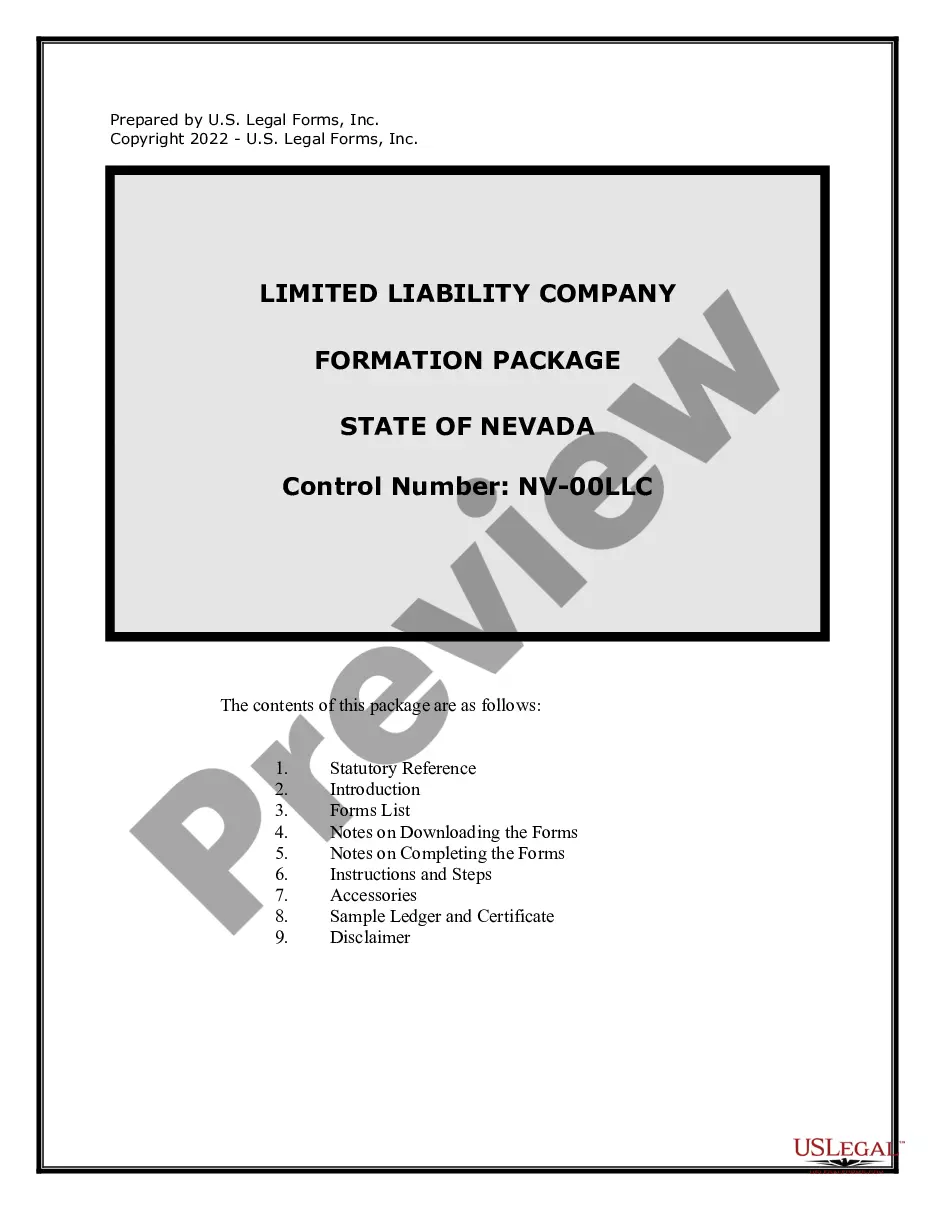

Forming an LLC in Nevada is easy. To form an LLC in Nevada you will need to file the Articles of Organization with the Nevada Secretary of State, which costs $75. You can apply online or by mail. The Articles of Organization is the legal document that officially creates your Nevada Limited Liability Company.

STEP 1: Name your Nevada LLC. STEP 2: Choose a Registered Agent in Nevada. STEP 3: File the Nevada LLC Articles of Organization. STEP 4: Create a Nevada LLC Operating Agreement. STEP 5: Get a Nevada LLC EIN.

There is a Nevada LLC forming fees of $75 (state fee). In order to form an LLC, you will be required to file the Articles of Organization and the state fee with the Secretary of State at 202 North Carson Street, Carson City, NV 89701-4201.

Member/Manager Information of LLCs Unlike some states, Nevada does not require members or managers to live in the state itself. In order to successfully form an LLC, you must be 18+ years old and file your articles of organization.

No state income, corporate or franchise taxes. No taxes on corporate shares or profits. Privacy protection for owners choosing to be anonymous. No operating agreements or annual meetings requirements. Low business registration fees and quick turnarounds.

No, you do not need an attorney to form an LLC. You can prepare the legal paperwork and file it yourself, or use a professional business formation service, such as .In all states, only one person is needed to form an LLC.

There is a Nevada LLC forming fees of $75 (state fee). In order to form an LLC, you will be required to file the Articles of Organization and the state fee with the Secretary of State at 202 North Carson Street, Carson City, NV 89701-4201.