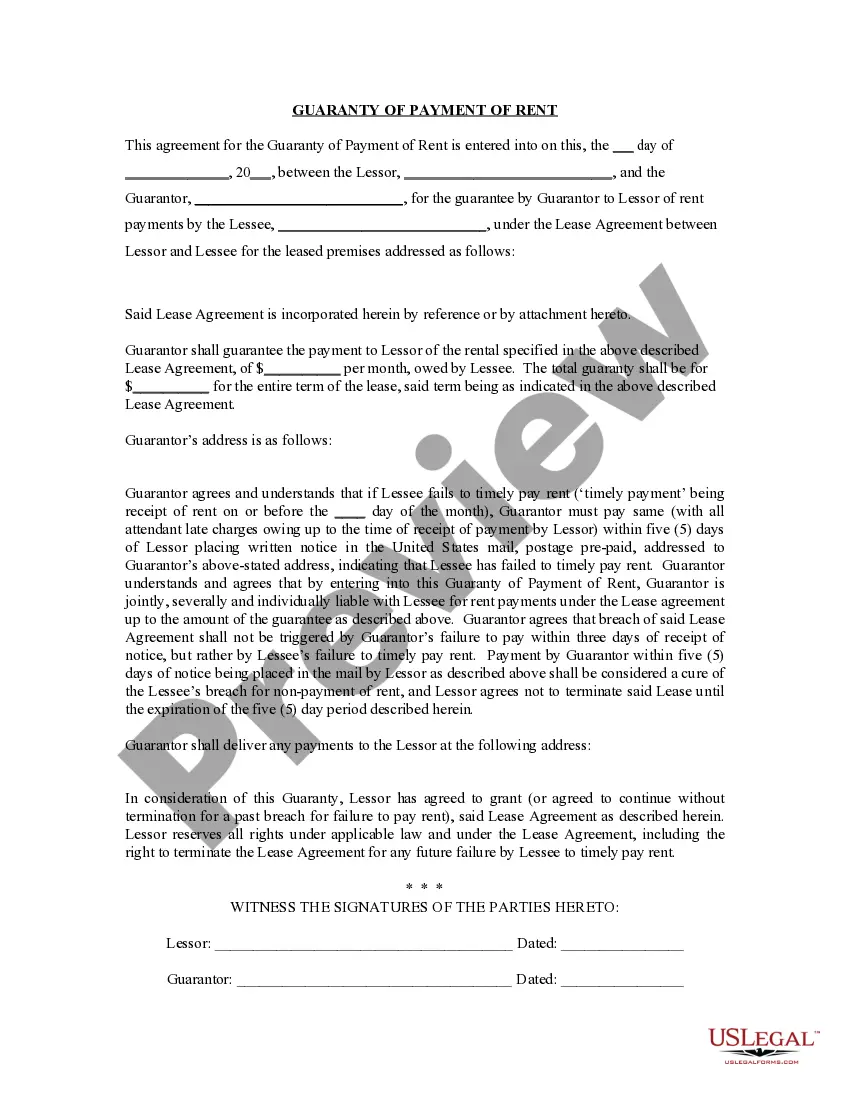

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

Nevada Guaranty or Guarantee of Payment of Rent

Description

How to fill out Nevada Guaranty Or Guarantee Of Payment Of Rent?

US Legal Forms is actually a special platform to find any legal or tax document for submitting, including Nevada Guaranty or Guarantee of Payment of Rent. If you’re tired of wasting time searching for suitable samples and paying money on record preparation/lawyer charges, then US Legal Forms is precisely what you’re seeking.

To reap all the service’s benefits, you don't need to download any software but just select a subscription plan and register an account. If you already have one, just log in and look for an appropriate template, download it, and fill it out. Saved files are kept in the My Forms folder.

If you don't have a subscription but need to have Nevada Guaranty or Guarantee of Payment of Rent, have a look at the instructions below:

- check out the form you’re looking at applies in the state you need it in.

- Preview the example and read its description.

- Click Buy Now to access the sign up webpage.

- Pick a pricing plan and keep on registering by entering some info.

- Pick a payment method to complete the registration.

- Save the file by choosing the preferred file format (.docx or .pdf)

Now, complete the file online or print out it. If you are uncertain regarding your Nevada Guaranty or Guarantee of Payment of Rent sample, speak to a attorney to review it before you send out or file it. Get started hassle-free!

Form popularity

FAQ

Business owners are often required to give a personal guarantee to get a business loan or to lease commercial space for their business. Most business advisors say you should keep business and personal financial matters separate, and the loan is for the business, not for the individual.

When The Lease Is Up When having a guarantor on the lease, the best way to be able to have him removed as soon as possible is to set a good payment record with the landlord.

A guarantor is a third party who 'guarantees' a loan, mortgage or rental agreement. This means they agree to repay the total amount owed if the borrower or renter can't pay what they owe. By guaranteeing the agreement, you become responsible for any arrears that occur.

If you're renting in London, you'll need to go through credit checks and referencing as part of the rental application process. If you're new to renting or you can't provide a reference from a previous landlord, you might be asked to provide a guarantor.

A lease guarantee is an official agreement signed by the landlord, tenant, and in addition, a third party who meets the monetary requirements of the landlord. A lease guarantor serves as a financial intermediary and is responsible for the tenant's defaults, which protects the tenant from eviction.

The most simple way to get out of being someone's guarantor is for the main borrower to pay off their loan and essentially, terminate the agreement.

One approach is as follows: a landlord and tenant agree that the guarantor is to be fully responsible for the performance of all tenant obligations and payment of all charges due under the lease for the entire term; if, however, the tenant does not default under any of the terms of the lease during some initial portion

Ask for an amendment to the lease after 12-24 months. Ask for the guarantee to expire after 12-24 months as long as you have paid rent payments on time. Try to renegotiate the guarantee terms.

Does being a guarantor affect my credit rating? Providing the borrower keeps up with their repayments your credit score won't be affected. However, should they fail to make their payments and the loan/mortgage falls into default, it will be added to your credit report.