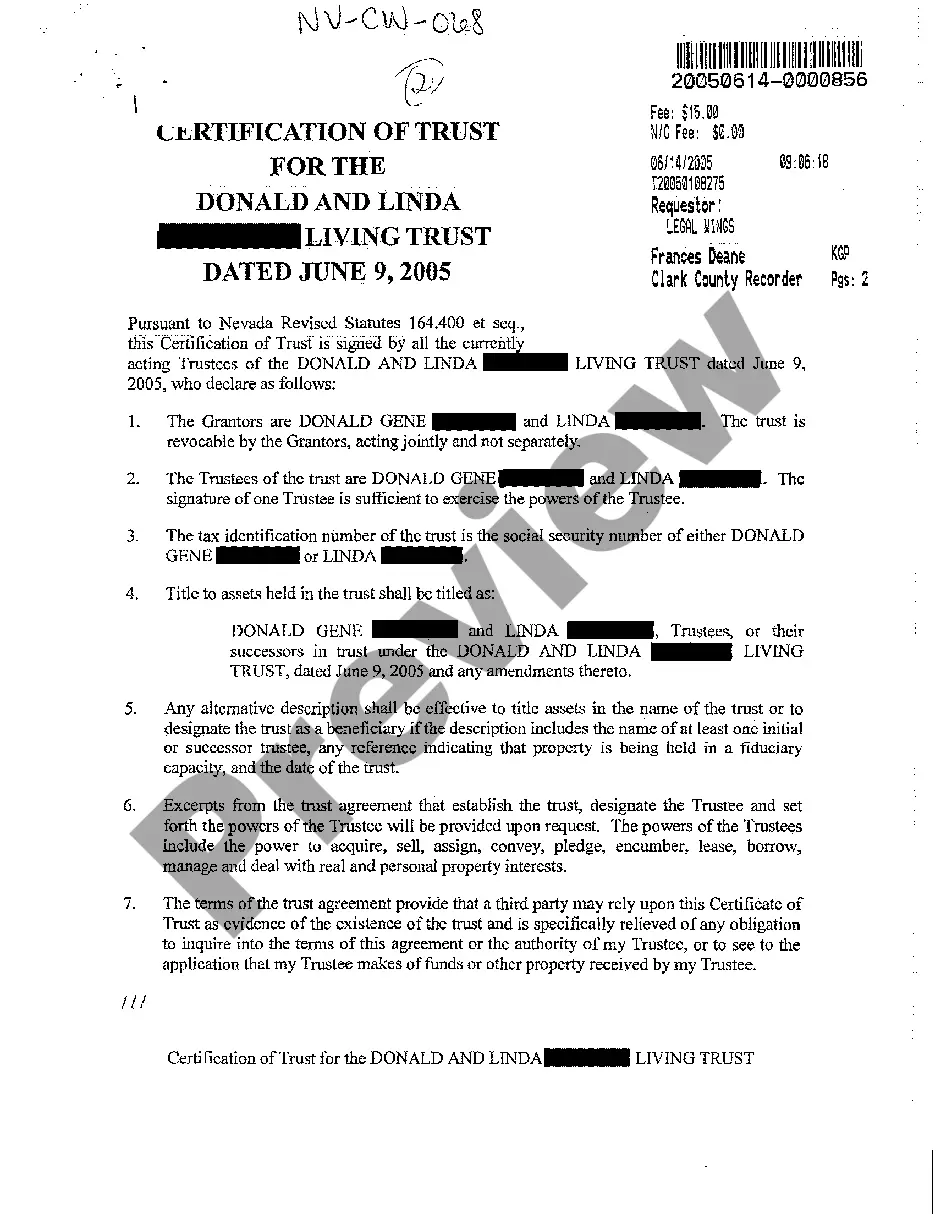

Nevada Certification of Living Trust

Description

How to fill out Nevada Certification Of Living Trust?

Among numerous free and paid samples that you can get online, you can't be certain about their accuracy. For example, who created them or if they are skilled enough to deal with what you need them to. Keep calm and use US Legal Forms! Find Nevada Certification of Living Trust samples made by professional legal representatives and prevent the expensive and time-consuming process of looking for an lawyer and then having to pay them to draft a papers for you that you can easily find on your own.

If you already have a subscription, log in to your account and find the Download button near the form you’re seeking. You'll also be able to access all of your previously downloaded files in the My Forms menu.

If you are using our service the first time, follow the tips below to get your Nevada Certification of Living Trust quickly:

- Make certain that the document you find applies in the state where you live.

- Review the file by reading the information for using the Preview function.

- Click Buy Now to start the ordering procedure or look for another sample utilizing the Search field located in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the needed file format.

When you have signed up and purchased your subscription, you may use your Nevada Certification of Living Trust as many times as you need or for as long as it continues to be active in your state. Change it with your favorite offline or online editor, fill it out, sign it, and print it. Do more for less with US Legal Forms!

Form popularity

FAQ

Normally a Nevada trust only requires a notary public affirmation; that is, witnesses are not required. If however the trust is likely to be administered in a state that requires witnesses, sound discretion would mandate that witnesses and a notary public be used in executing the trust.

When signing anything on behalf of the trust, always sign as John Smith, Trustee. By signing as Trustee, you will not be personally liable for that action as long as that action is within the scope of your authority under the trust.

A living trust, specifically a revocable living trust, is a legal document that places your assetsinvestments, bank accounts, real estate, vehicles and valuable personal propertyin trust for your benefit during your lifetime, and spells out where you'd like these things to go upon your death.

A trust document isn't required to be filed. If you are transferring real estate into a trust, a deed will need oo be filed at the county recorder's office.The declaration will detail the terms and conditions of the living trust, including who will serve as the Trustee.

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.

Create the certificate of trust Sign the living trust in front of a notary public to notarize it. In case your spouse or partner made the trust together, you both need to sign the certification. If one has died, the surviving part can make a certification.

Public RecordCalifornia law requires any deed transfer involving real estate property be recorded in the county clerk's or county recorder's office in the county where the property is located. The trust grantor must record the original trust document, real estate deed and appraisal report.

Trusts Are Not Public Record.However, trusts aren't recorded. Not having to file the trust with the court is one of the biggest benefits of a trust because it keeps the settlement a private matter between the successor trustees and trust beneficiaries.

A Certificate of Trust is recorded in the Official Records of the county in which any trust real property is located. It aids in clearing title to the property. Generally, where the trust owns no real property, there is no need to record a Certificate...