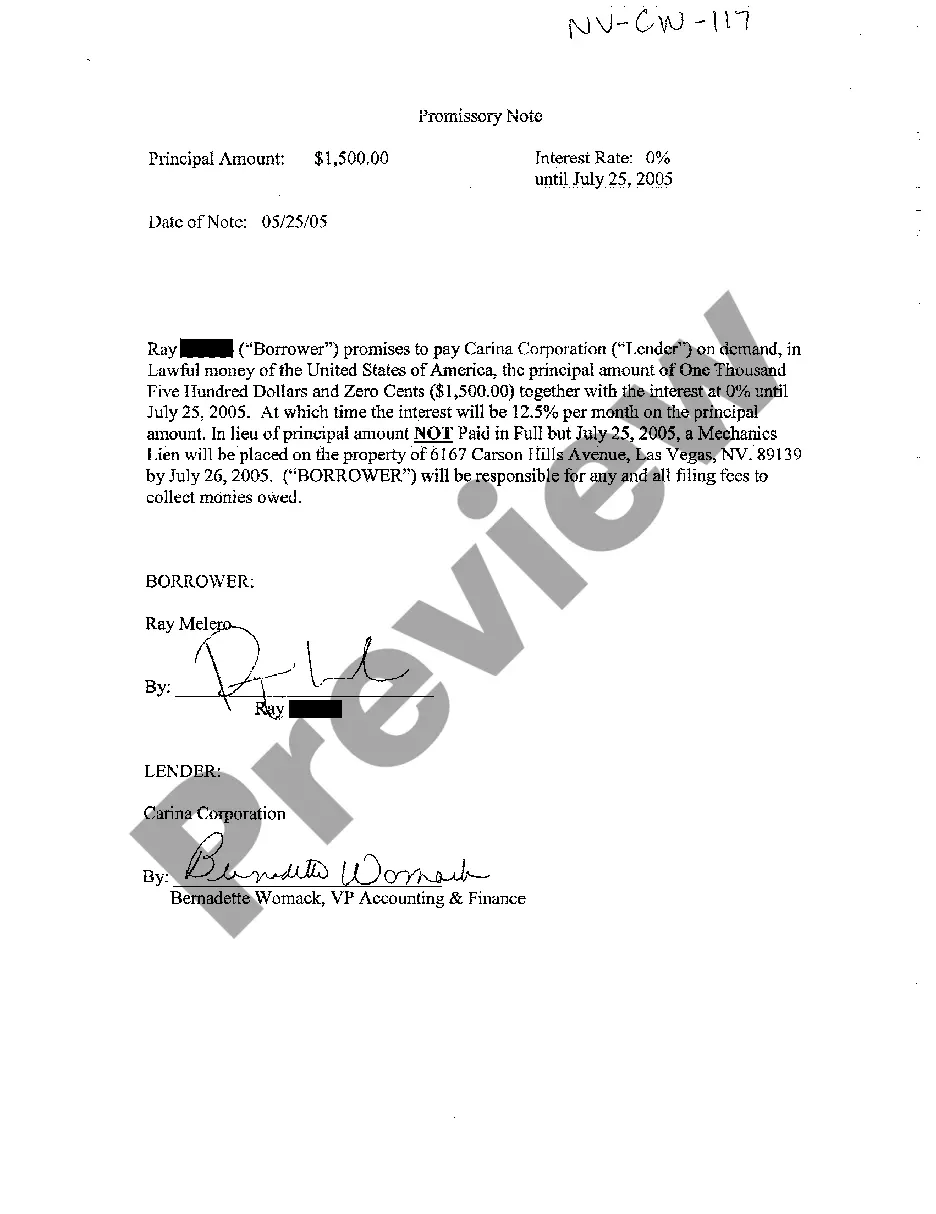

Nevada Promissory Note for small loan - No Interest

Description

How to fill out Nevada Promissory Note For Small Loan - No Interest?

Among numerous paid and free samples that you find online, you can't be sure about their reliability. For example, who made them or if they are qualified enough to deal with the thing you need them to. Always keep relaxed and utilize US Legal Forms! Locate Nevada Promissory Note for small loan - No Interest samples developed by professional legal representatives and prevent the high-priced and time-consuming process of looking for an attorney and then paying them to write a document for you that you can easily find on your own.

If you have a subscription, log in to your account and find the Download button near the file you’re searching for. You'll also be able to access all of your earlier acquired templates in the My Forms menu.

If you’re utilizing our website for the first time, follow the instructions below to get your Nevada Promissory Note for small loan - No Interest quick:

- Make sure that the file you find applies in the state where you live.

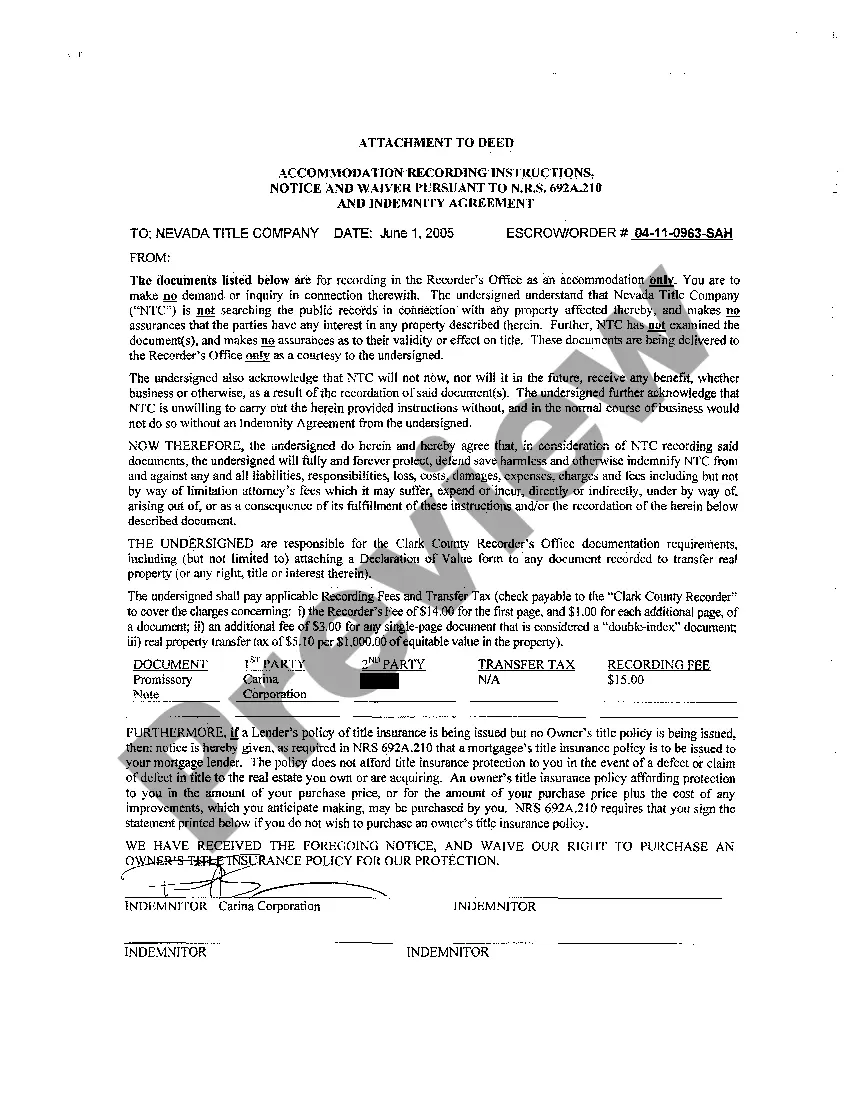

- Review the template by reading the information for using the Preview function.

- Click Buy Now to begin the purchasing procedure or find another template utilizing the Search field in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the required file format.

When you have signed up and bought your subscription, you can utilize your Nevada Promissory Note for small loan - No Interest as many times as you need or for as long as it continues to be valid where you live. Change it with your favored offline or online editor, fill it out, sign it, and print it. Do far more for less with US Legal Forms!

Form popularity

FAQ

Use our promissory note if you prefer a standard basic contract. Do I have to charge the Borrower interest? No, the Lender can choose whether or not to charge interest. If the Lender decides to charge interest, they can pick how much interest to charge.

Step 1 Agree to Terms. Before both parties sit down to write an agreement, the following should be verbally agreed upon: Step 2 Run a Credit Report. Step 3 Security and Co-Signer(s) Step 4 Writing the Promissory Note. Step 5 Paying Back the Borrowed Money.

Calculating Simple Interest If your loan is for a period of years, multiply the product of principal times interest by the number of years.For example, for a nine-month promissory note, divide 9 by 12 (the number of months in a year) to equal 0.75. Multiply 750 by 0.75 to equal 562.50.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

Full names of parties (borrower and lender) Repayment amount (principal and interest) Payment plan. Consequences of non-payment (default and collection) Notarization (if necessary) Other common details.

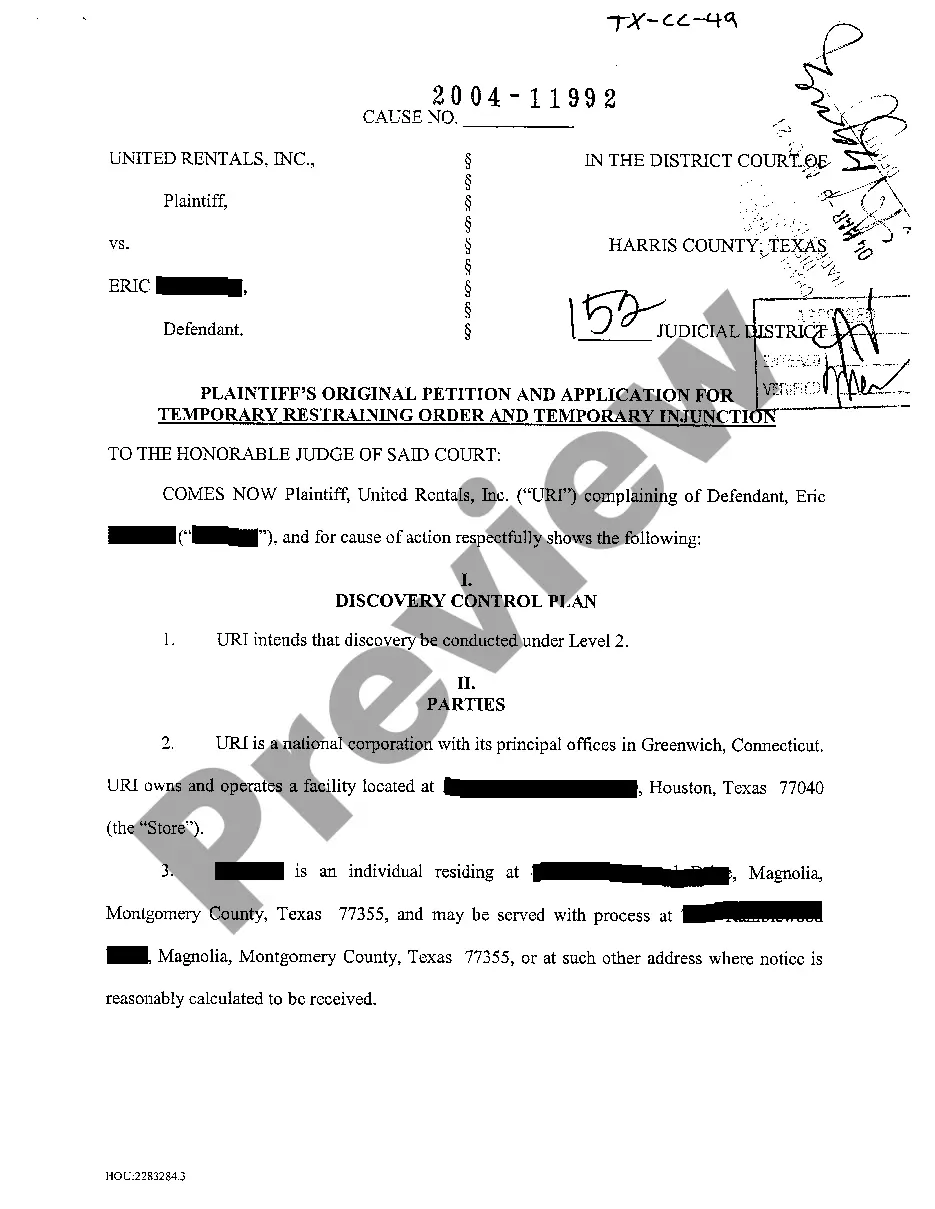

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.

Important Points to Remember about Promissory Notes A Promissory Note must always be written by hand. It must include all the mandatory elements such as the legal names of the payee and maker's name, amount being loaned / to be repaid, full terms of the agreement and the full amount of liability, beside other elements.

A promissory note typically contains all the terms pertaining to the indebtedness, such as the principal amount, interest rate, maturity date, date and place of issuance, and issuer's signature.

A promissory note is a written promise, basically an IOU, to pay money to someone. The note document serves as written evidence of the amount of the debt. To start, decide how much money you'll lend, the amount of interest you'll charge, if any, and the type of repayment schedule.