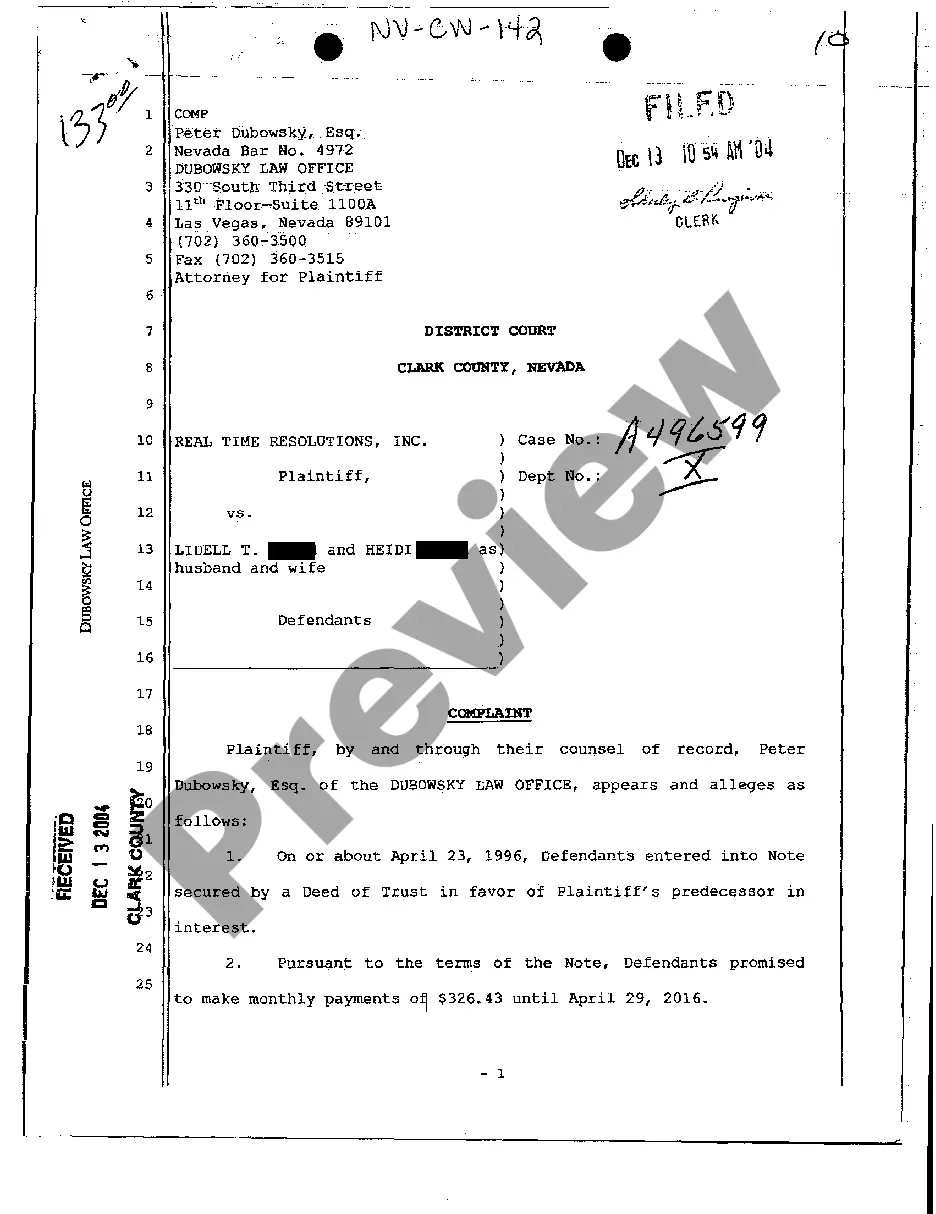

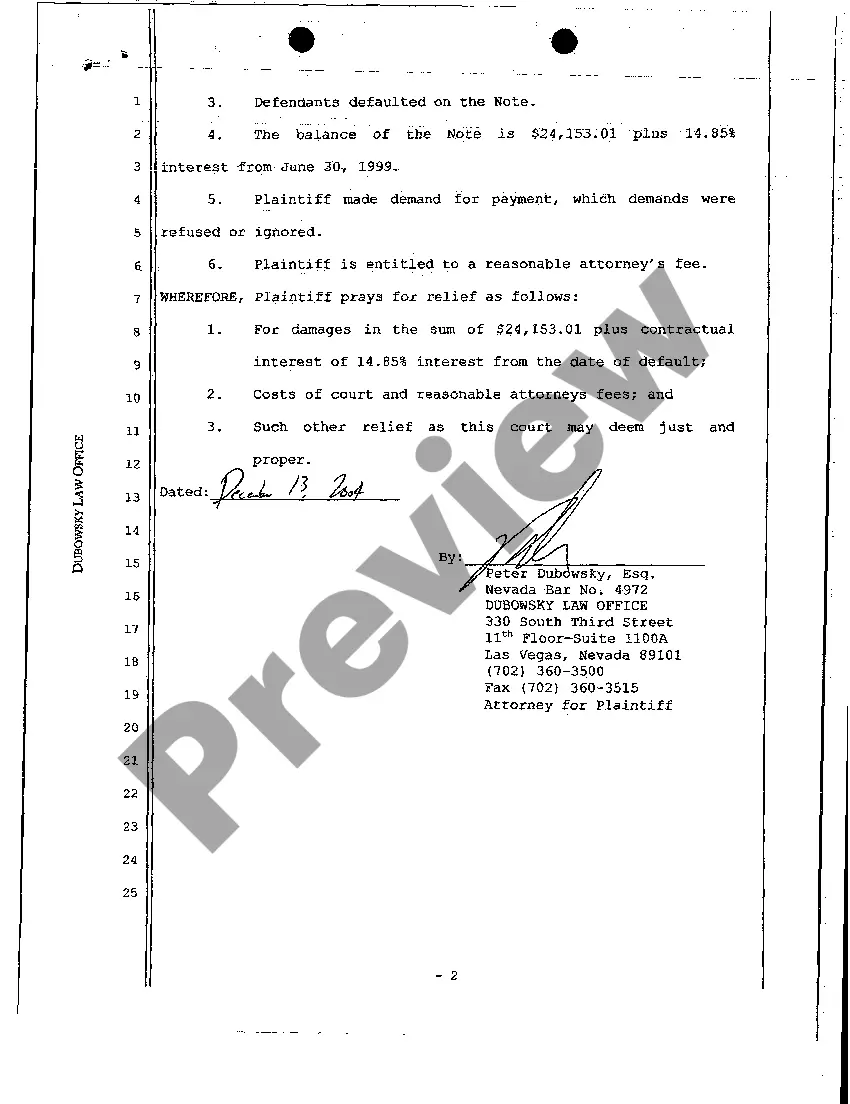

Nevada Complaint - Debt Collection Due to Default on Promissory Note

Description

How to fill out Nevada Complaint - Debt Collection Due To Default On Promissory Note?

Among hundreds of paid and free templates that you’re able to get on the net, you can't be certain about their reliability. For example, who created them or if they’re skilled enough to take care of what you need those to. Always keep relaxed and make use of US Legal Forms! Get Nevada Complaint - Debt Collection Due to Default on Promissory Note templates created by skilled lawyers and prevent the expensive and time-consuming process of looking for an lawyer or attorney and after that having to pay them to draft a document for you that you can find on your own.

If you have a subscription, log in to your account and find the Download button near the file you’re searching for. You'll also be able to access all your earlier acquired examples in the My Forms menu.

If you’re using our website the very first time, follow the guidelines listed below to get your Nevada Complaint - Debt Collection Due to Default on Promissory Note quickly:

- Make sure that the document you discover is valid in the state where you live.

- Look at the template by reading the information for using the Preview function.

- Click Buy Now to start the ordering procedure or find another example utilizing the Search field in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the needed file format.

As soon as you’ve signed up and purchased your subscription, you can use your Nevada Complaint - Debt Collection Due to Default on Promissory Note as often as you need or for as long as it continues to be valid in your state. Revise it with your preferred online or offline editor, fill it out, sign it, and print it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

To beat them, all you need to do is show up. Specifically, many debt collectors (Midland Funding LLC included) that file lawsuits against consumers are not actually prepared to prove their debt collection case in court.

Don't admit liability for the debt; force the creditor to prove the debt and your responsibility for it. File the Answer with the Clerk of Court. Ask for a stamped copy of the Answer from the Clerk of Court. Send the stamped copy certified mail to the plaintiff.

If you lose your case The creditor has to follow a second step to collect the money you owe. The creditor may have asked for an execution at the end of your case. If they get an execution from the judge, they can levy on the execution. This means it is legal for them to take your property.

You must reply to each paragraph/allegation in the complaint by admitting it, denying it, or denying it because you don't have enough knowledge or information to be able to admit it. You only have 20 days from the day you were served with the Summons and complaint to file and serve your Answer.

Here's some basic information you should write down anytime you speak with a debt collector: date and time of the phone call, the name of the collector you spoke to, name and address of collection agency, the amount you allegedly owe, the name of the original creditor, and everything discussed in the phone call.

Never Give Them Your Personal Information. A call from a debt collection agency will include a series of questions. Never Admit That The Debt Is Yours. Even if the debt is yours, don't admit that to the debt collector. Never Provide Bank Account Information.

Verify the timeline of events. Respond. Challenge the lawsuit. Decide whether to accept the judgment. Act impulsively. Ignore the debt collection lawsuit. Accept liability. Give access to your bank accounts.

Respond to the Lawsuit or Debt Claim. Challenge the Company's Legal Right to Sue. Push Back on Burden of Proof. Point to the Statute of Limitations. Hire Your Own Attorney. File a Countersuit if the Creditor Overstepped Regulations. File a Petition of Bankruptcy.