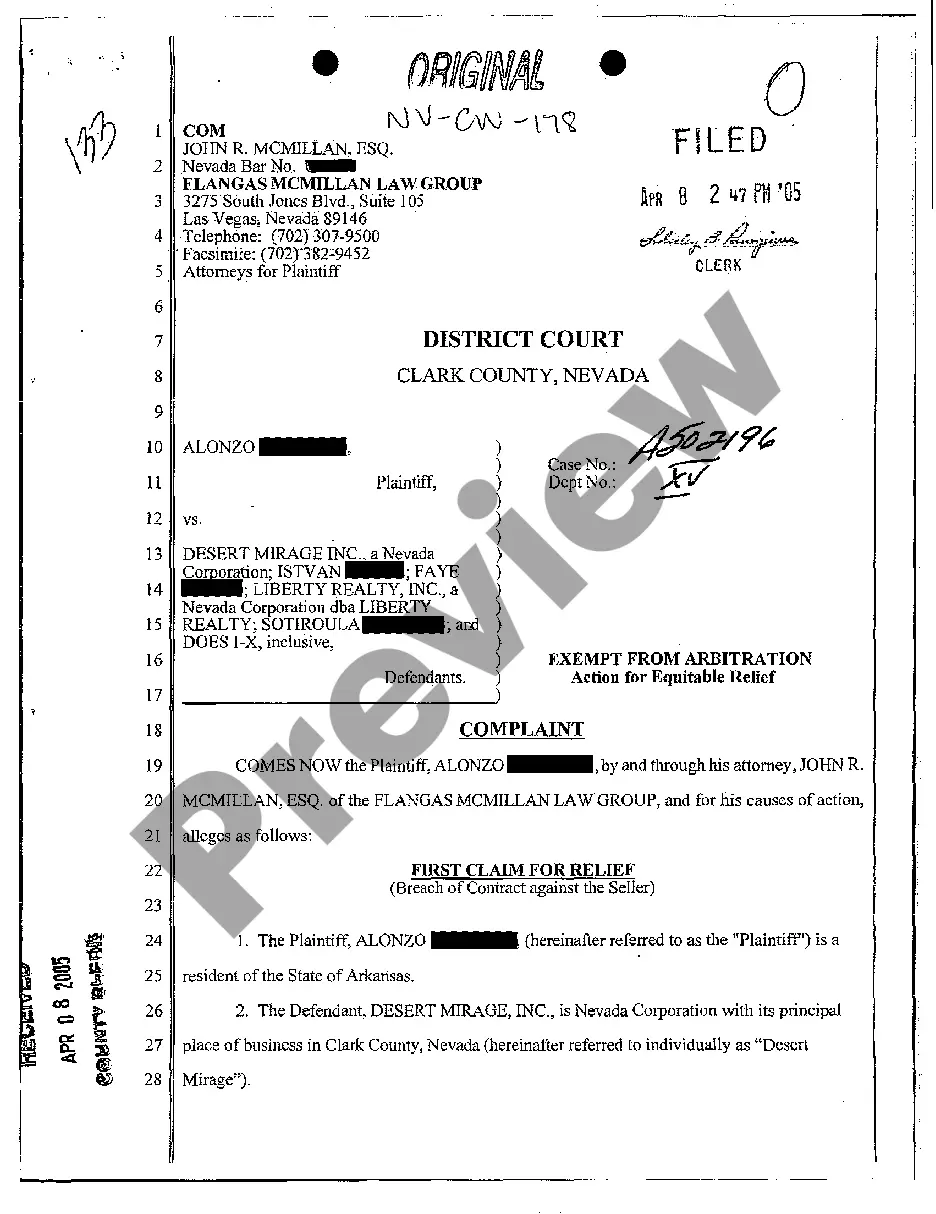

Nevada Complaint - Breach of Contract for Sale of Property Due to Error of Bank in Clearing Earnest Money Deposit

Description

How to fill out Nevada Complaint - Breach Of Contract For Sale Of Property Due To Error Of Bank In Clearing Earnest Money Deposit?

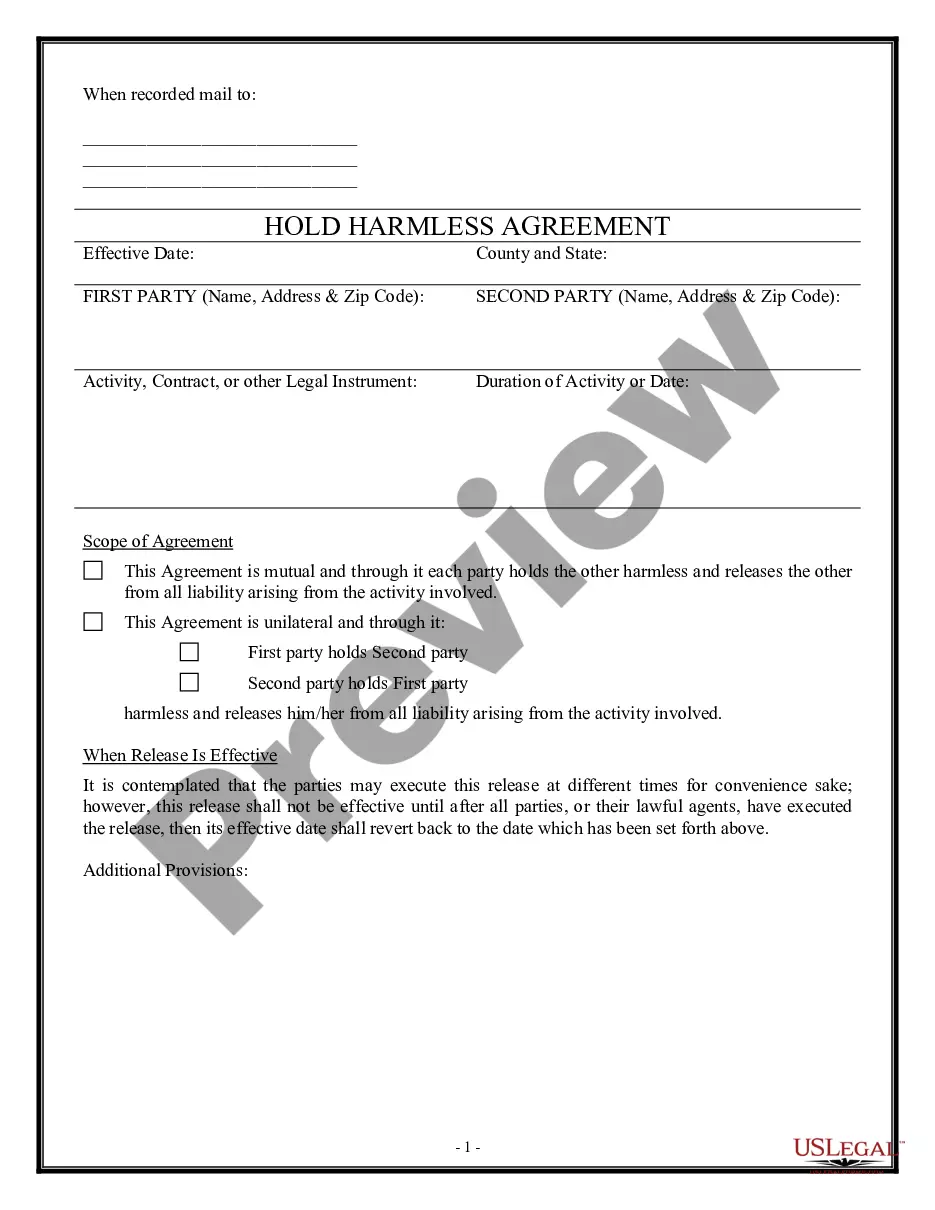

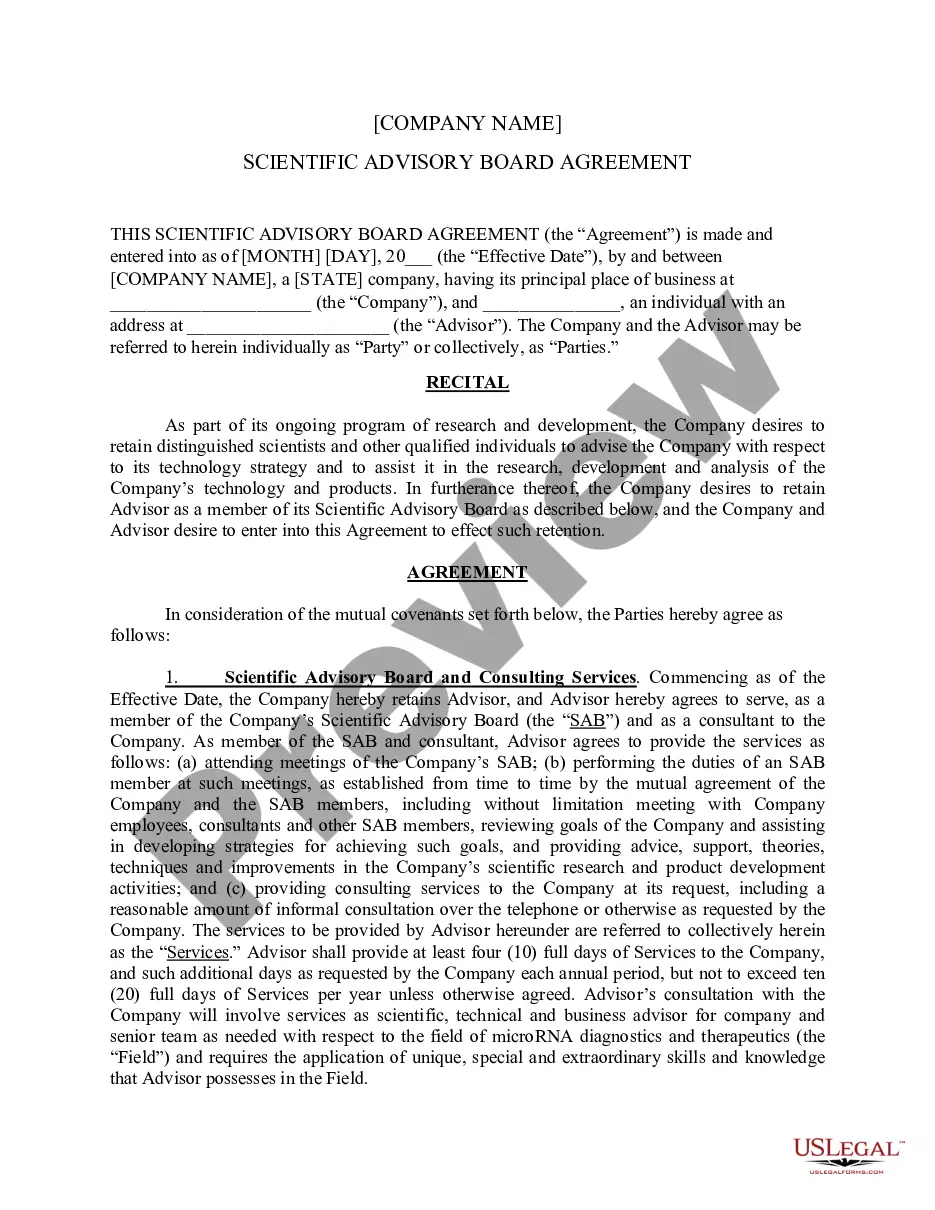

Among lots of paid and free templates that you’re able to get on the web, you can't be sure about their accuracy and reliability. For example, who created them or if they are skilled enough to deal with what you need these people to. Always keep relaxed and make use of US Legal Forms! Find Nevada Complaint - Breach of Contract for Sale of Property Due to Error of Bank in Clearing Earnest Money Deposit samples created by skilled attorneys and prevent the high-priced and time-consuming process of looking for an attorney and after that having to pay them to write a papers for you that you can find yourself.

If you have a subscription, log in to your account and find the Download button near the file you are seeking. You'll also be able to access your earlier downloaded examples in the My Forms menu.

If you’re making use of our platform the very first time, follow the guidelines below to get your Nevada Complaint - Breach of Contract for Sale of Property Due to Error of Bank in Clearing Earnest Money Deposit with ease:

- Make sure that the document you discover is valid where you live.

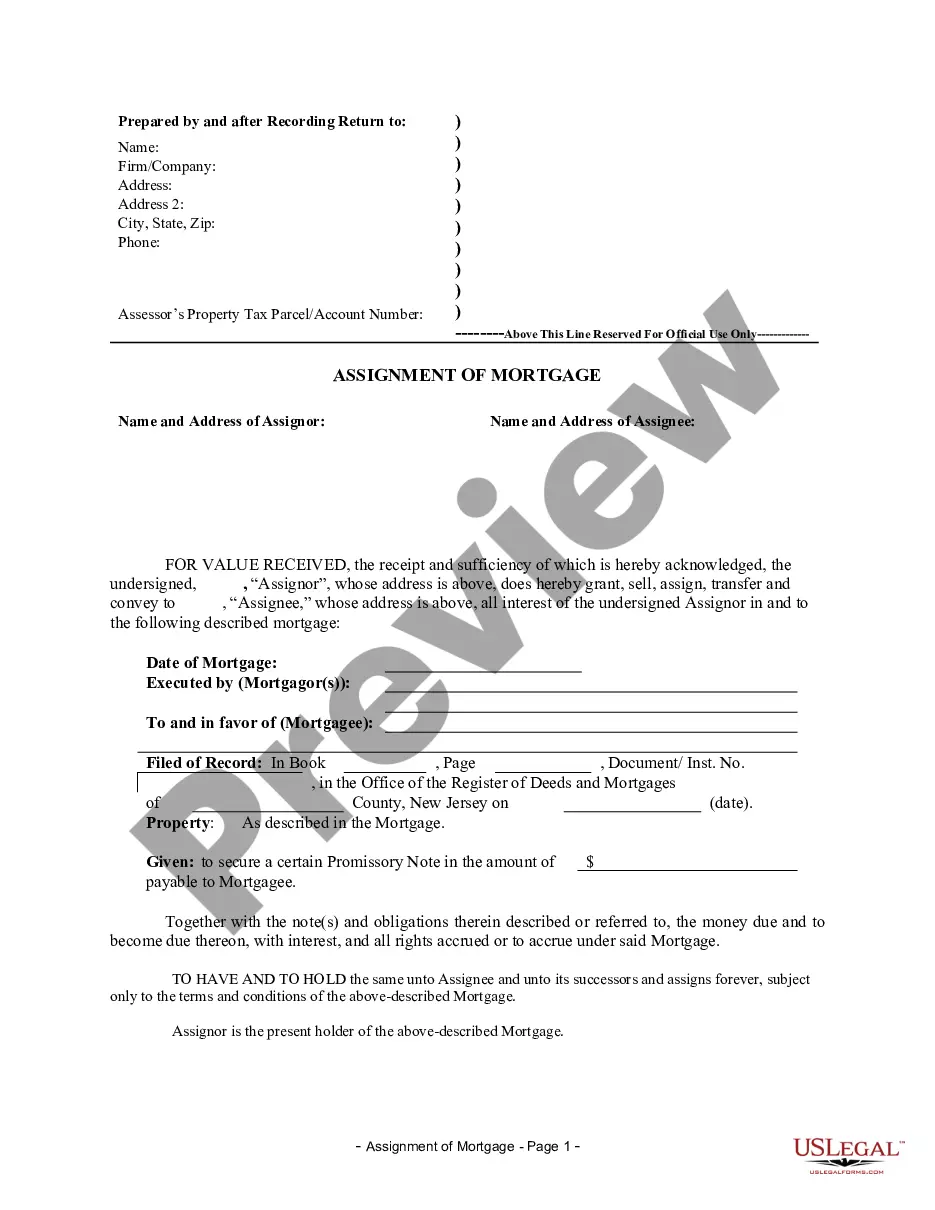

- Look at the file by reading the information for using the Preview function.

- Click Buy Now to begin the ordering procedure or look for another example utilizing the Search field located in the header.

- Select a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the required file format.

Once you’ve signed up and paid for your subscription, you can use your Nevada Complaint - Breach of Contract for Sale of Property Due to Error of Bank in Clearing Earnest Money Deposit as many times as you need or for as long as it remains valid in your state. Revise it with your favored editor, fill it out, sign it, and print it. Do far more for less with US Legal Forms!

Form popularity

FAQ

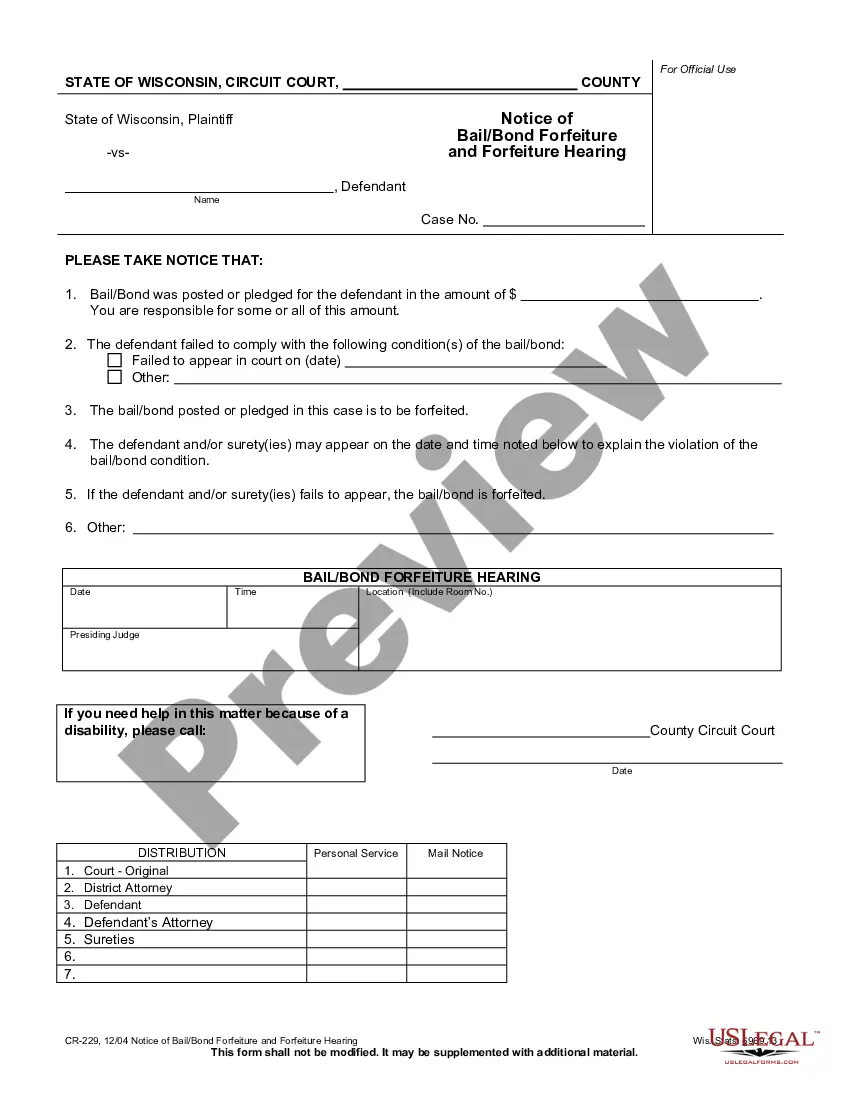

Some seller disclosure laws require you to take action against the seller within the specified statute of limitations, perhaps one or two years from the date you close. If you are within this window, you may be able to sue the seller for the repair to your issue.

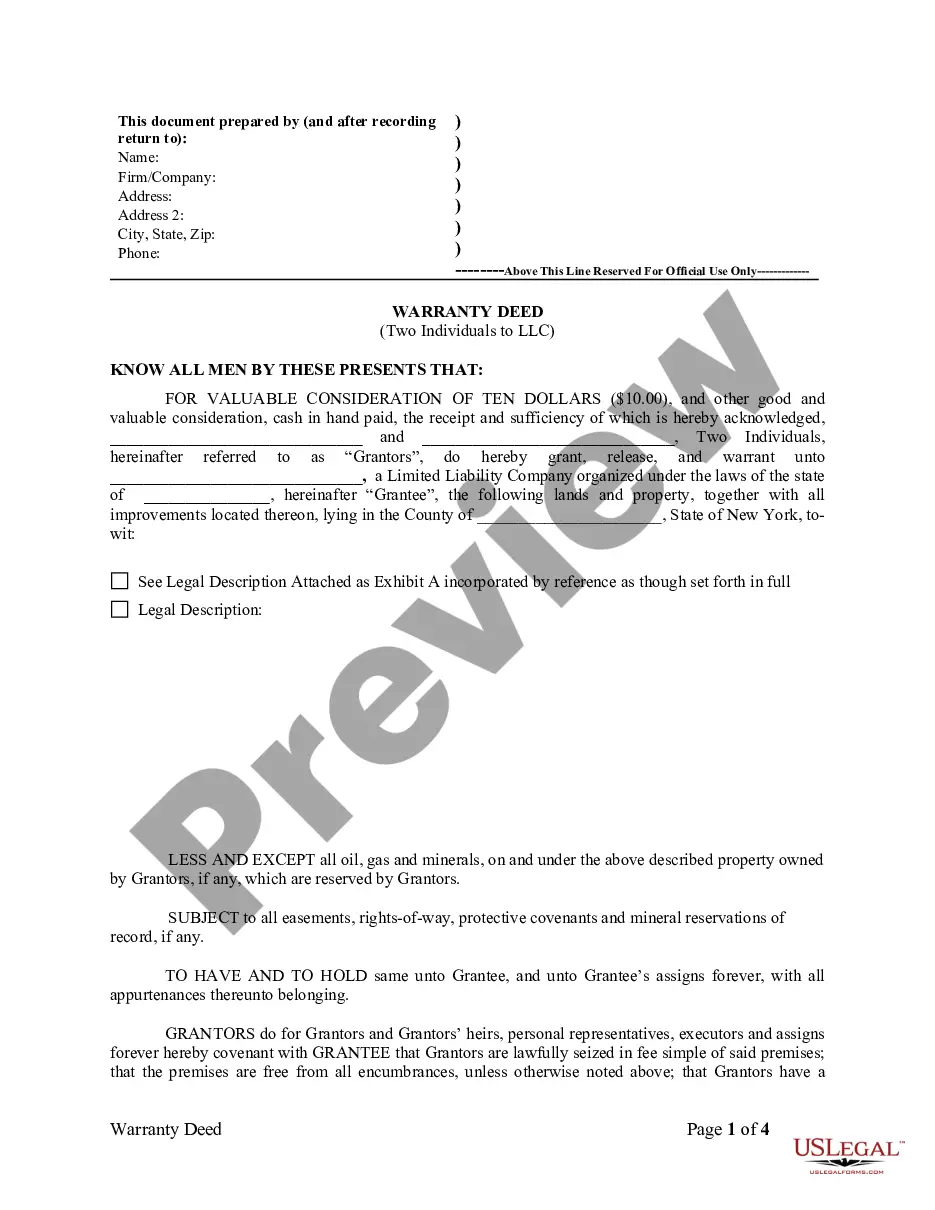

When title to your house is not clear, there is someone with a claim against the property. That claim can interfere with your ability to purchase title insurance, which makes the real estate less attractive to a buyer.Yet, sometimes a party with a claim may refuse to cooperate, leaving a cloud on the title.

What Happens If the Contract Is Breached. Let's imagine that the seller fails to provide an abstract of title showing clear title to the property.This means that the damages to the party not in breach of contract will be for a set amount of money, which is often the amount of the buyer's deposit or earnest money.

Many title issues can be resolved by filing one of three common documents: A quit claim deed removes an heir and clears up title among co-owners or spouses. A release of lien/judgment removes a paid mortgage or spousal or child support lien. A deed of reconveyance records payment of a mortgage under a deed of trust.

As a last resort, a homeowner may file a lawsuit against the seller within a limited amount of time, known as a statute of limitations. Statutes of limitations are typically two to 10 years after closing. Lawsuits may be filed in small claims court relatively quickly and inexpensively, and without an attorney.

The entire process of clearing a property's title takes roughly two weeks. But this can vary drastically depending on your transaction and property type. It is best to contact your escrow or title officer and realtor to get accurate, up-to-date information on your specific property's timeline.

A failure to deposit the earnest money in the escrow account will likely constitute a breach of the purchase agreement by the buyer. Once a breach occurs, the seller may be able to force specific performance from the buyer or completely walk away from the deal.

How Much To Sue Buyer For When a Breach Of Contract Occurs? If money damages are sought, a seller may bring a lawsuit against the buyer and ask for money damages when a buyer has not done what was agreed to in the contract.