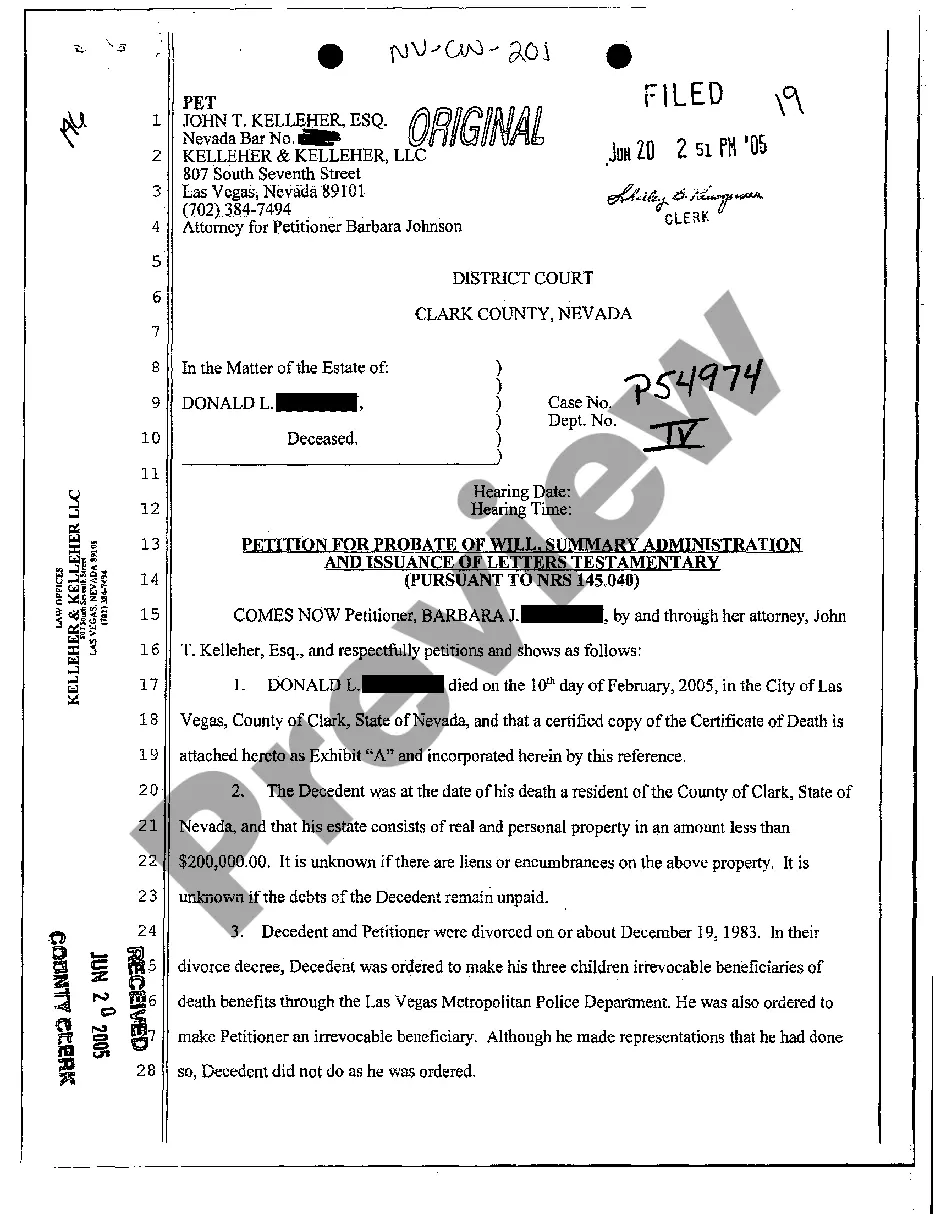

Nevada Petition for Probate of Will, Summary Administration and Issuance of Letters Testamentary

Description Sample Letter Of Administration Without Will

How to fill out Nevada Petition For Probate Of Will, Summary Administration And Issuance Of Letters Testamentary?

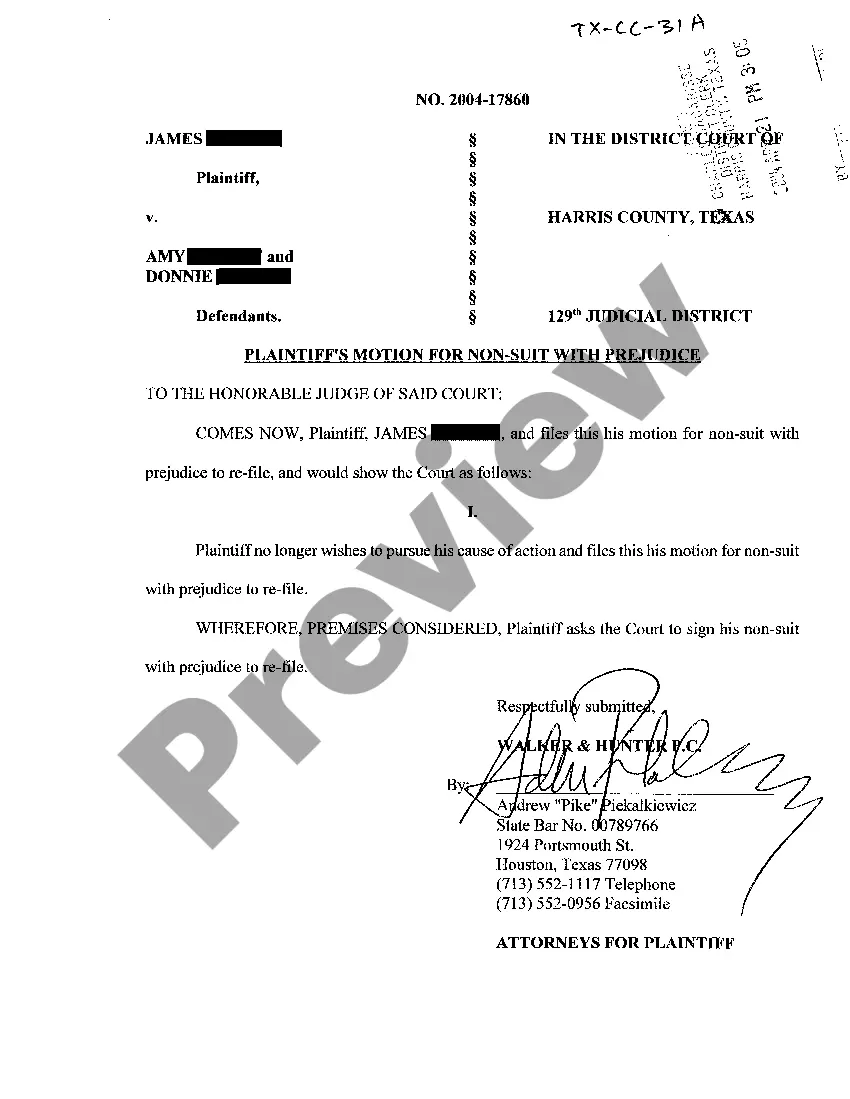

Among hundreds of free and paid templates which you find on the internet, you can't be certain about their accuracy and reliability. For example, who made them or if they’re qualified enough to deal with what you require these to. Always keep relaxed and make use of US Legal Forms! Locate Nevada Petition for Probate of Will, Summary Administration and Issuance of Letters Testamentary samples made by professional attorneys and avoid the expensive and time-consuming process of looking for an attorney and after that paying them to draft a papers for you that you can find yourself.

If you have a subscription, log in to your account and find the Download button next to the form you are looking for. You'll also be able to access all your previously acquired templates in the My Forms menu.

If you’re making use of our platform the very first time, follow the tips listed below to get your Nevada Petition for Probate of Will, Summary Administration and Issuance of Letters Testamentary fast:

- Make certain that the document you find applies where you live.

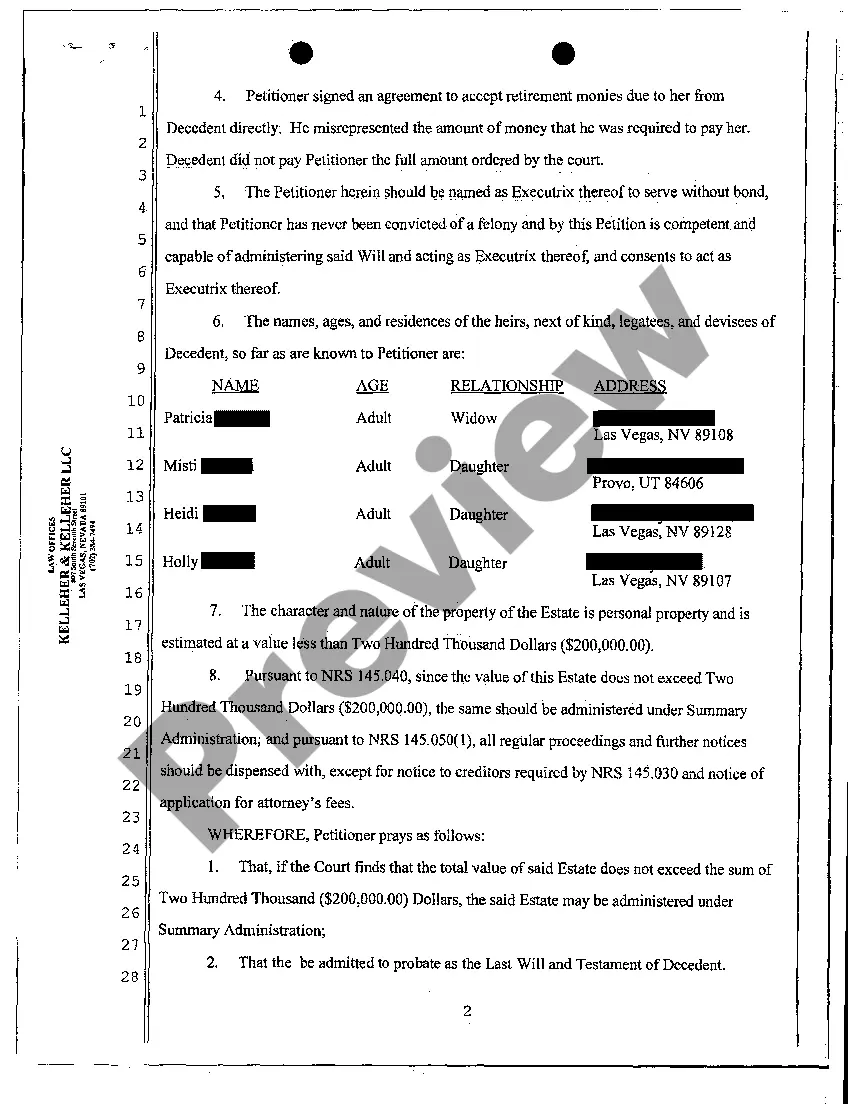

- Look at the file by reading the description for using the Preview function.

- Click Buy Now to start the ordering process or look for another sample utilizing the Search field in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the required file format.

Once you’ve signed up and purchased your subscription, you can use your Nevada Petition for Probate of Will, Summary Administration and Issuance of Letters Testamentary as often as you need or for as long as it remains valid where you live. Edit it in your favored offline or online editor, fill it out, sign it, and create a hard copy of it. Do far more for less with US Legal Forms!

Probate Letter Of Administration Form popularity

Petition For Letter Of Administration Other Form Names

FAQ

Children (or grandchildren if children have died) Parents. Siblings (or nieces and nephews over 18 if siblings have died) Half-siblings (or nieces and nephews over 18 if half-siblings have died) Grandparents. Aunts or uncles.

On average, in southern Nevada, the cost of a probate is between 5% and 8% of the gross value of the probate estate. This estimate takes into account the payment of Probate administration expenses and creditor claims. If federal estate taxes are due, the cost of Probate can be much higher.

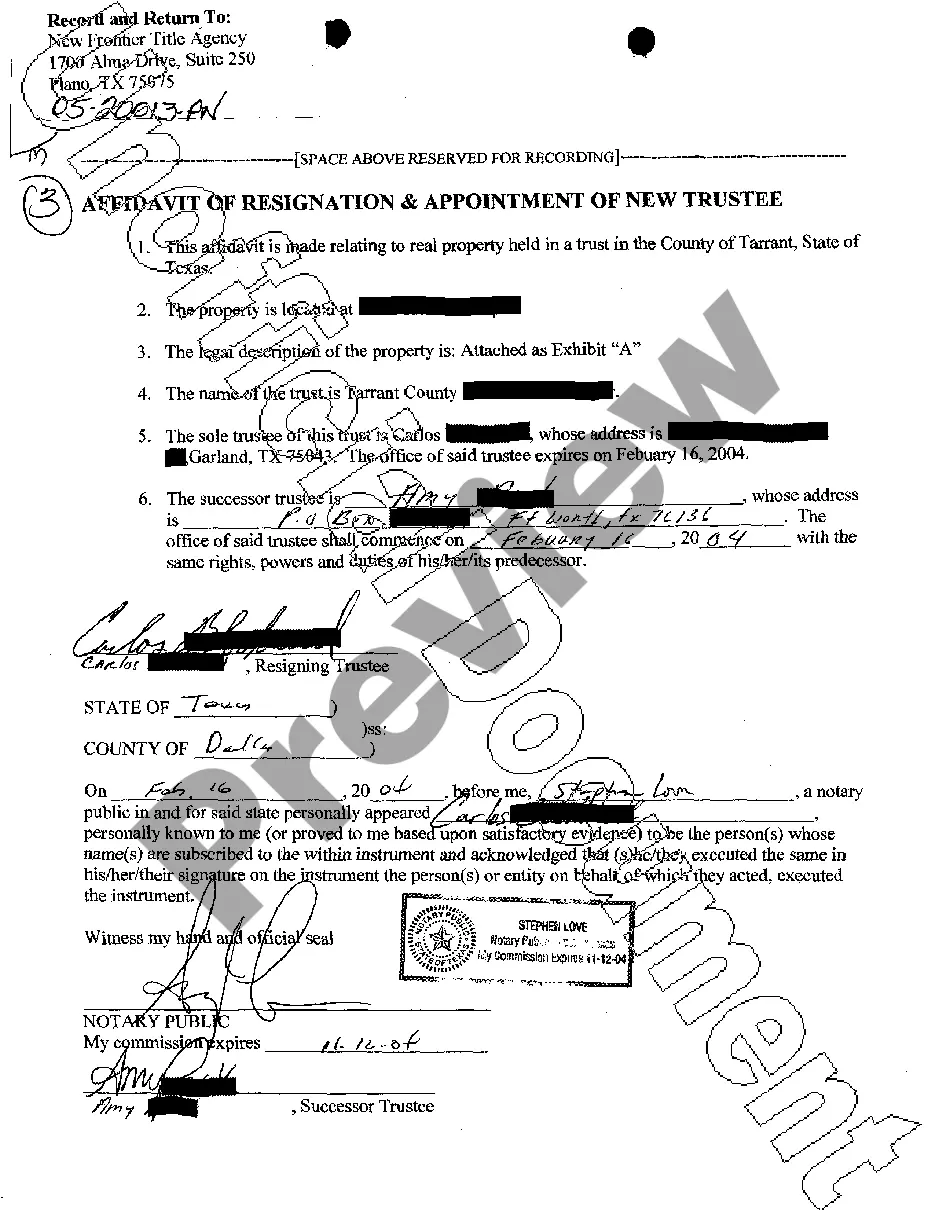

If someone dies interstate before administration of estate is entrusted to someone or when no executor is appointed under the will of deceased or when executor is appointed but he refuses to act, then Letters of administration may be issued to entitle the administrator to all rights required for effective

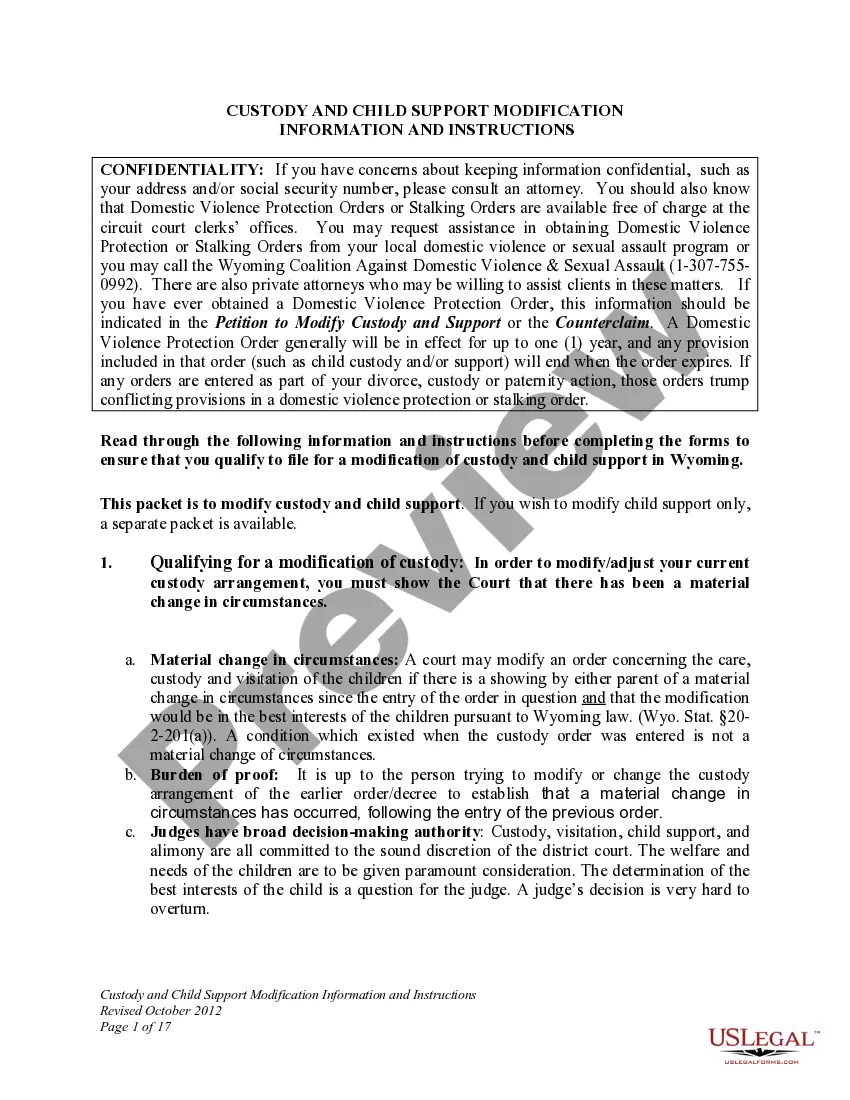

The court only allows someone to get letters of administration in probate in cases of a full probate procedure. Many estates are settled through trust administration or through small estate procedures for California.Smaller estates often don't need letters of administration at all.

Summary administration limits what you can do with the estate. This process may go faster than formal administration. No personal representative is appointed.

Subject to the provisions of this article, a person in the following relation to the decedent is entitled to appointment as administrator in the following order of priority: (a) Surviving spouse or domestic partner as defined in Section 37. (b) Children. (c) Grandchildren.

To apply for probate or letters of administration by post, you'll need to fill in a number of forms. You'll need PA1P if the person left a will and PA1A if they didn't. These forms ask for details about the person who died, their surviving relatives and, the personal representative.

(NHJB-2145-P) Form use. This form is used to ask the court to appoint an executor or administrator for a deceased's estate.

Nevada has a simplified probate process for small estates. To use it, an executor files a written request with the local probate court asking to use the simplified procedure. The court may authorize the executor to distribute the assets without having to jump through the hoops of regular probate.