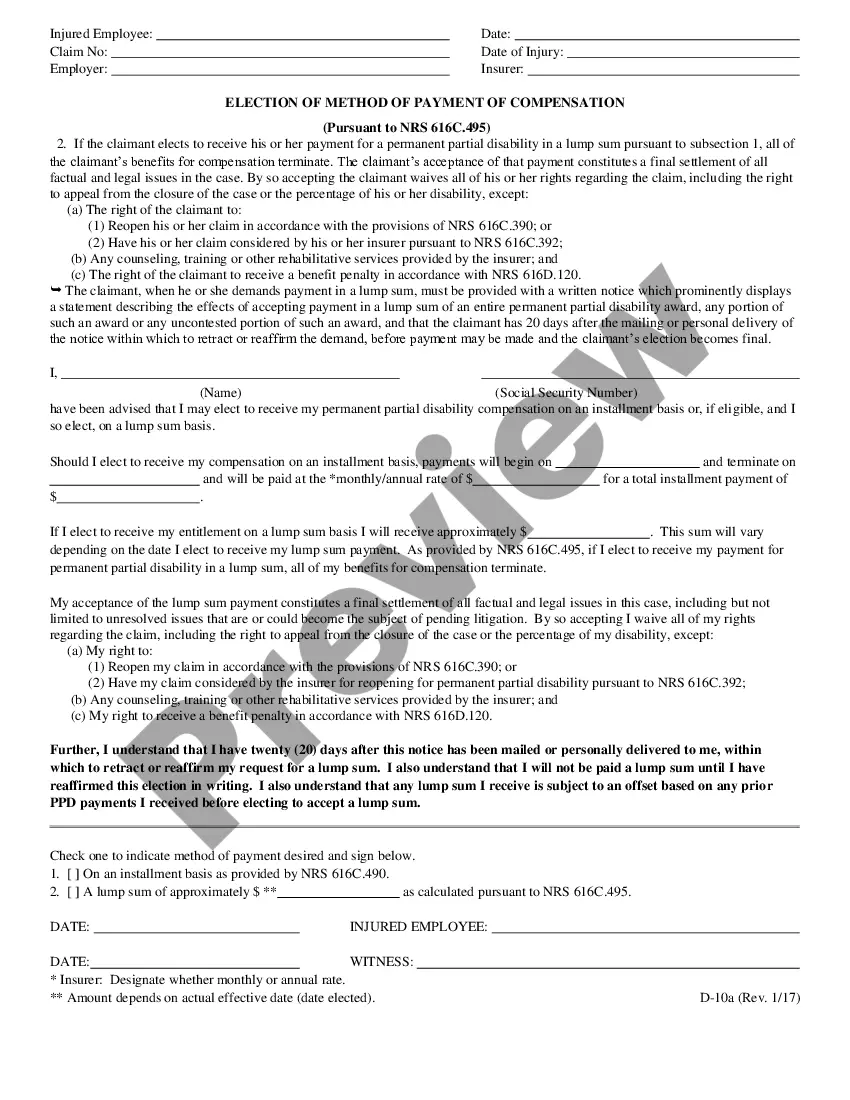

Nevada Election of Method of Payment of Compensation for Disability Greater than 25%

Description

How to fill out Nevada Election Of Method Of Payment Of Compensation For Disability Greater Than 25%?

US Legal Forms is a unique platform where you can find any legal or tax template for completing, such as Nevada Election of Method of Payment of Compensation for Disability Greater than 25%. If you’re sick and tired of wasting time seeking ideal examples and paying money on file preparation/legal professional service fees, then US Legal Forms is exactly what you’re searching for.

To experience all of the service’s benefits, you don't have to download any application but simply select a subscription plan and sign up an account. If you already have one, just log in and find an appropriate template, save it, and fill it out. Downloaded files are kept in the My Forms folder.

If you don't have a subscription but need to have Nevada Election of Method of Payment of Compensation for Disability Greater than 25%, take a look at the guidelines listed below:

- make sure that the form you’re taking a look at is valid in the state you need it in.

- Preview the example and look at its description.

- Simply click Buy Now to get to the register page.

- Pick a pricing plan and proceed signing up by providing some information.

- Decide on a payment method to complete the registration.

- Save the file by choosing your preferred file format (.docx or .pdf)

Now, fill out the document online or print it. If you feel uncertain about your Nevada Election of Method of Payment of Compensation for Disability Greater than 25% form, contact a attorney to review it before you send or file it. Start without hassles!

Form popularity

FAQ

To date, the largest settlement payment in a workers' comp case came in March of 2017, with a $10 million settlement agreement.

When it is all said and done, if you wish to settle your case, your workers' comp settlement should be a fair compromise whereby you give up your rights to receive continued ongoing benefits for your workers' compensation claim in exchange for a one-time payment representing a percentage of what those continued

Get your weekly disability check started, if you're not receiving it already. Maximize your weekly benefit check. Report all super-added injuries. Seek psychological care, when appropriate. Seek pain management care, when appropriate. Don't refuse medical procedures. Be very careful what you tell the doctor.

To calculate the impairment award, the CE multiplies the percentage points of the impairment rating of the employee's covered illness or illnesses by $2,500.00. For example, if a physician assigns an impairment rating of 40% or 40 points, the CE multiplies 40 by $2,500.00, to equal a $100,000.00 impairment award.

A "week of compensation" is calculated as an amount equal to two-thirds of the worker's average weekly earnings as of the injury date. A statutory maximum provides that this amount cannot be more than 55% of the average weekly wage in the state, and most states have similar caps.

Do all worker's comp cases end in a settlement? Most worker's compensation cases end in a settlement, meaning the insurance company offers either a lump sum of money or weekly payments for a specified period. The money may cover: Past and future medical care.

For each percent of impairment, you will receive 0.6% of your average monthly wage at the time of your injury. For example, suppose you have 10% impairment, and your average monthly wage is $2,400. Your permanent partial disability award would be calculated as follows: (. 006) x $2,400 x 10 = $144 per month.

The amount of your weekly permanent disability payments equals two-thirds of your average weekly wage at the time of your injury, limited by the minimum and maximum rates stated by the California Labor Code.

As a general rule of thumb, you should never discuss anything except the basic facts of the accident, including where it occurred, the date and time it occurred, what type of accident it was, and which body parts were injured.