Nevada Employees Declaration of Election To Report Tips

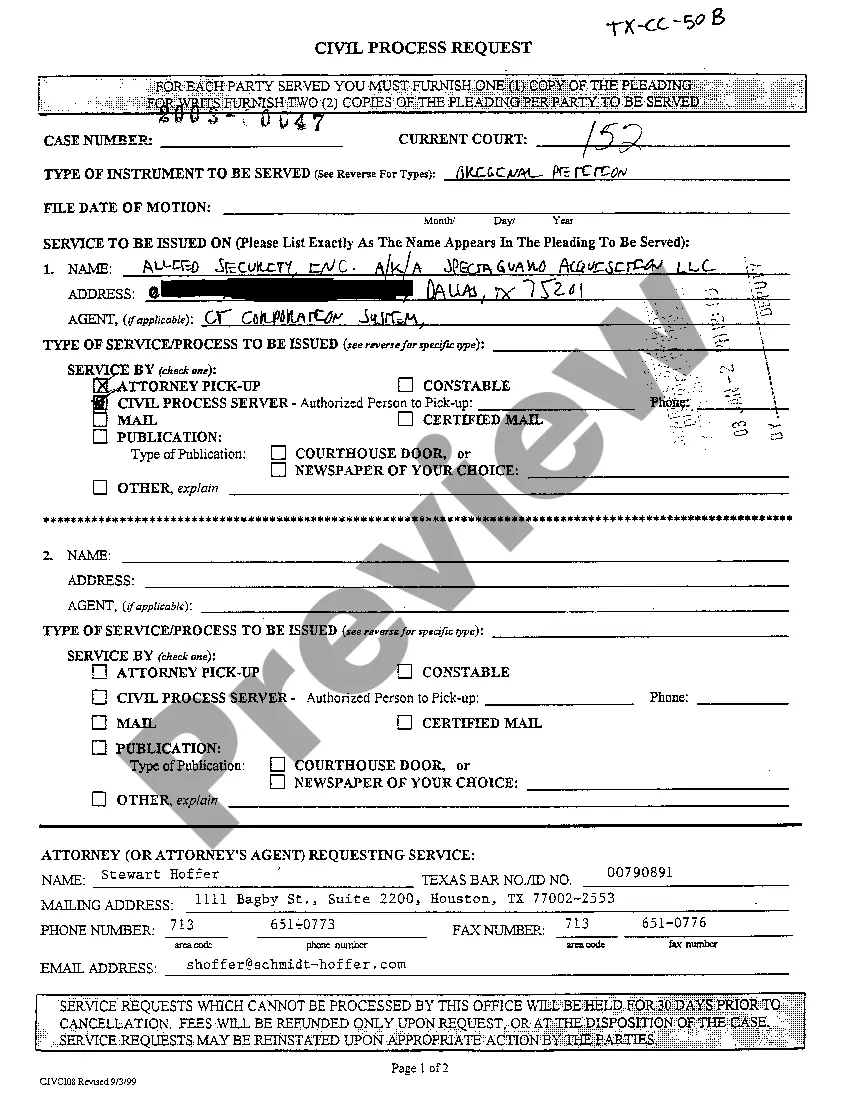

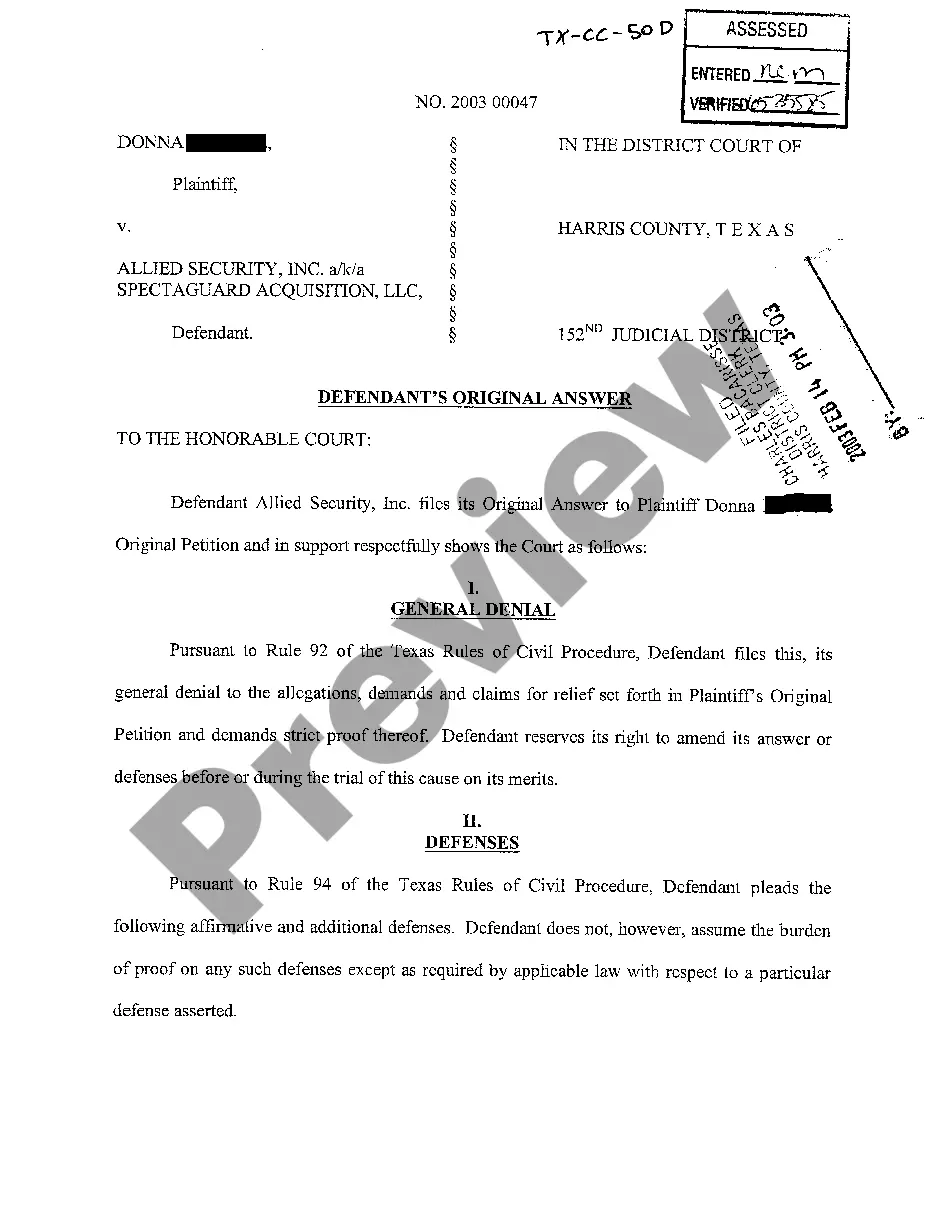

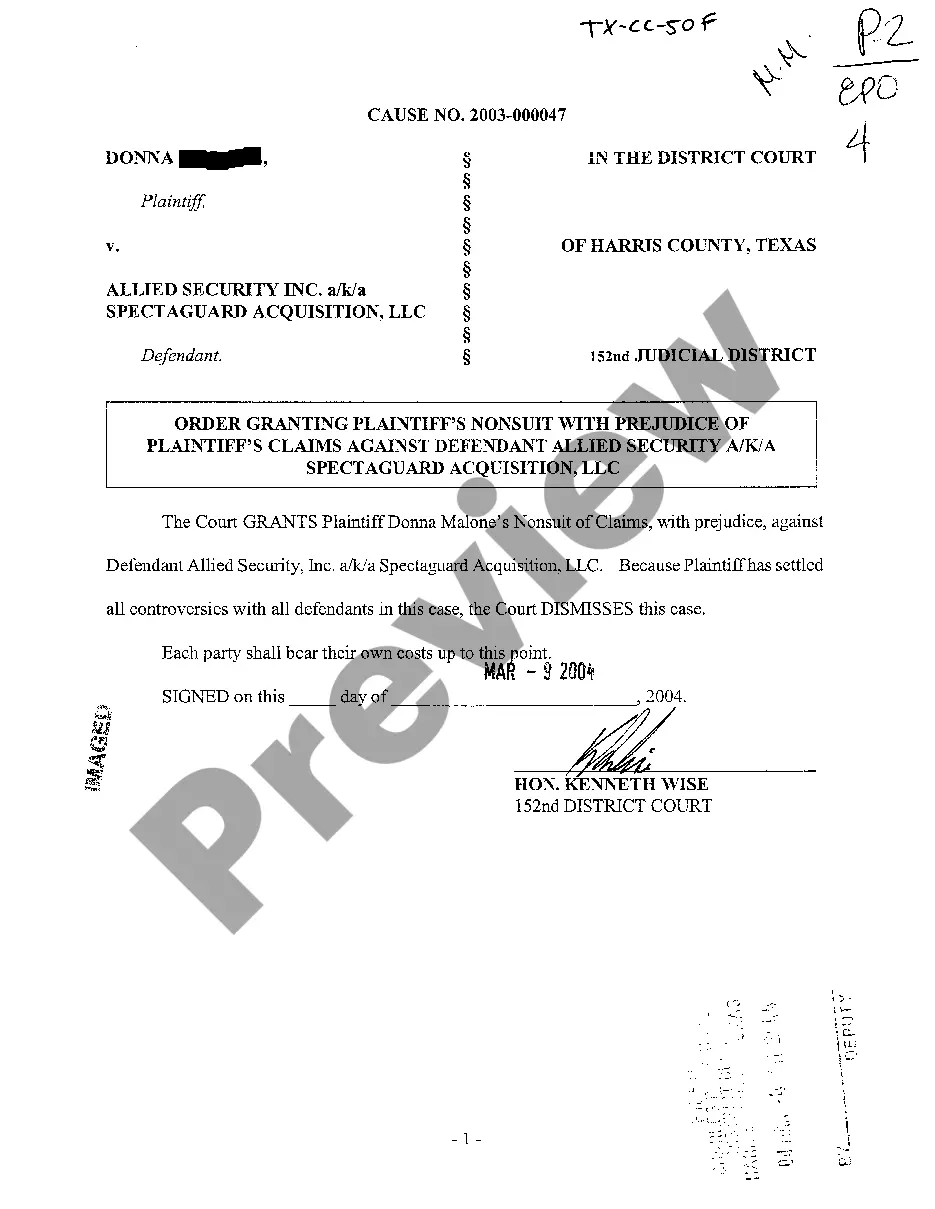

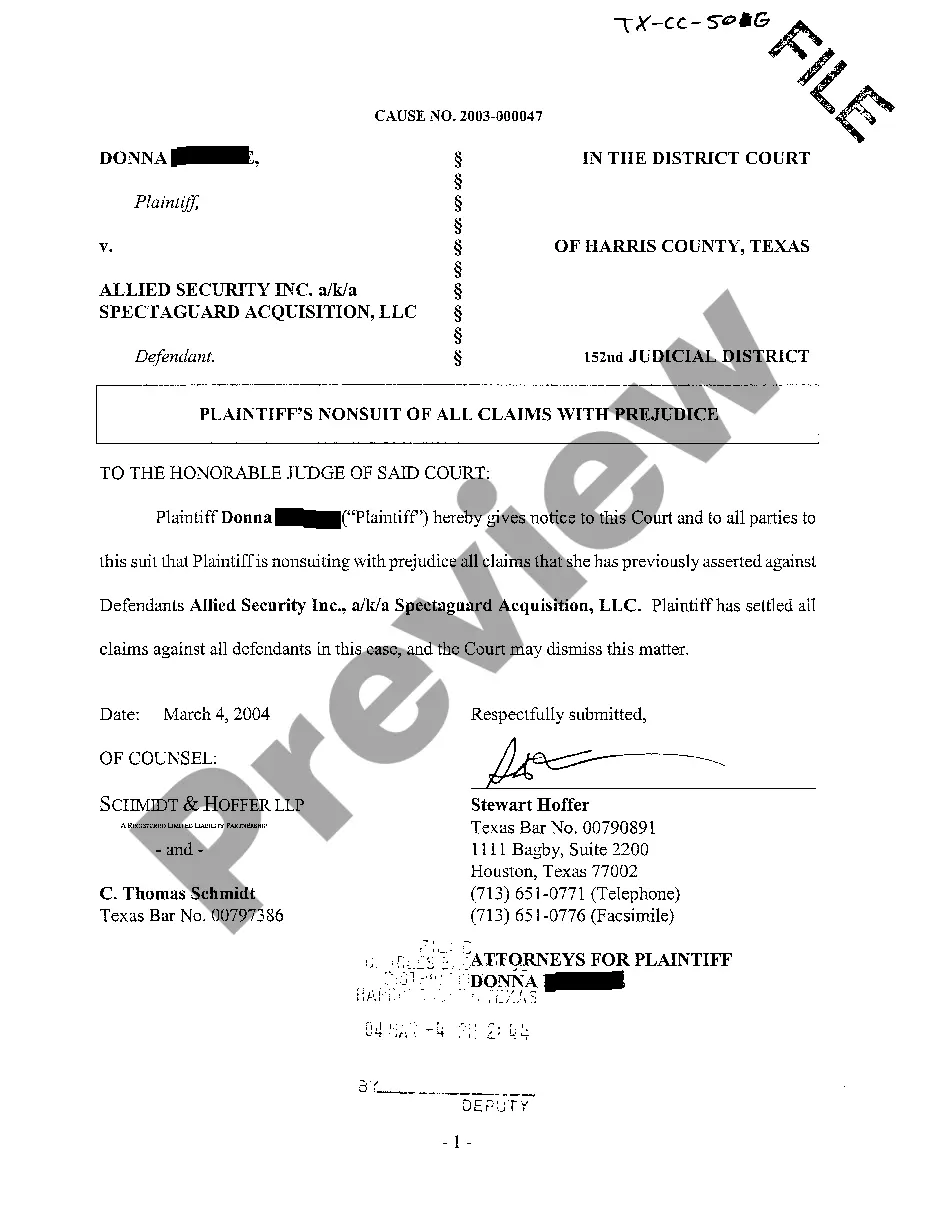

Description

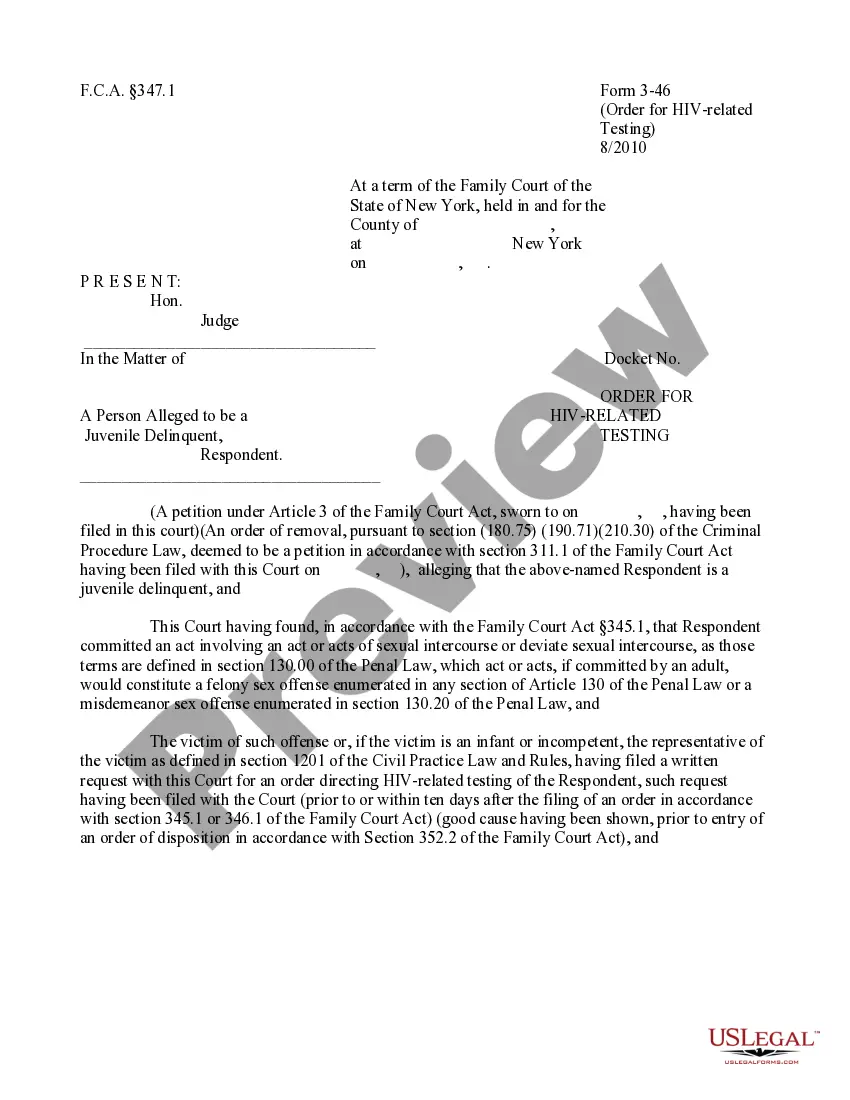

How to fill out Nevada Employees Declaration Of Election To Report Tips?

US Legal Forms is a unique platform to find any legal or tax form for submitting, such as Nevada Employees Declaration of Election to Report Tips. If you’re sick and tired of wasting time looking for appropriate examples and paying money on papers preparation/legal professional service fees, then US Legal Forms is exactly what you’re trying to find.

To experience all the service’s advantages, you don't have to download any software but just pick a subscription plan and register your account. If you already have one, just log in and get an appropriate sample, download it, and fill it out. Saved files are all kept in the My Forms folder.

If you don't have a subscription but need to have Nevada Employees Declaration of Election to Report Tips, check out the guidelines below:

- check out the form you’re checking out is valid in the state you need it in.

- Preview the form its description.

- Click Buy Now to reach the sign up page.

- Choose a pricing plan and keep on registering by providing some information.

- Select a payment method to complete the sign up.

- Download the file by selecting the preferred format (.docx or .pdf)

Now, complete the file online or print it. If you feel unsure concerning your Nevada Employees Declaration of Election to Report Tips template, speak to a legal professional to check it before you send or file it. Begin without hassles!

Form popularity

FAQ

An optional payment designated as a tip, gratuity, or service charge is not subject to sales tax. A mandatory payment designated as a tip, gratuity, or service charge is included in taxable gross receipts, even if it is subsequently paid by the retailer to employees.

The basic rule of tips is that they belong to employees, not the employer. Employees can't be required to give their tips to the company or to share tips with managers or supervisors. However, employers typically can pay tipped employees less than minimum wage and require employees to share their tips with coworkers.

Under California law, an employer cannot take any part of a tip that's left for an employee. This means that you can't be forced to share your tips with the owners, managers, or supervisors of the business (who are all considered to be the agents of the employer).

Under California tip laws, employers are responsible for all credit card fees on gratuities and tips. Also, when patrons leave tips on a credit card, the tips must be paid promptly to the employee. Labor Code 351 requires employers to give tips to employees by the next payday after the tip is paid.

The change in the law means that restaurant operators in most states including the seven states that do not have a tip credit (California, Oregon, Washington, Nevada, Minnesota, Montana and Alaska) are now free to ask servers to tip out the back of the house provided they pay employees at least the full minimum

Nevada law permits employers to establish mandatory tip pools, even when the tip pooling procedure requires gratuities to be shared among employees of different ranks, so long as the employer does not keep any of the tips for itself, the Nevada Supreme Court has held.

Furthermore it is illegal for employers to make wage deductions from gratuities, or from using gratuities as direct or indirect credits against an employee's wages.

Tip Basics Under California law, an employer cannot take any part of a tip that's left for an employee.However, California does not allow employers to take tip credits. Employers must pay employees at least the California minimum wage for each hour worked, in addition to any tips they may receive.

Many Las Vegas residents are nightclub, casino, or restaurant employees, and earn tip income in addition to their regular wages. Tips are considered wages and are subject to employment taxes, including Federal Insurance Contributions Act (FICA), Federal Unemployment Tax Act (FUTA), and Federal income tax withholding.