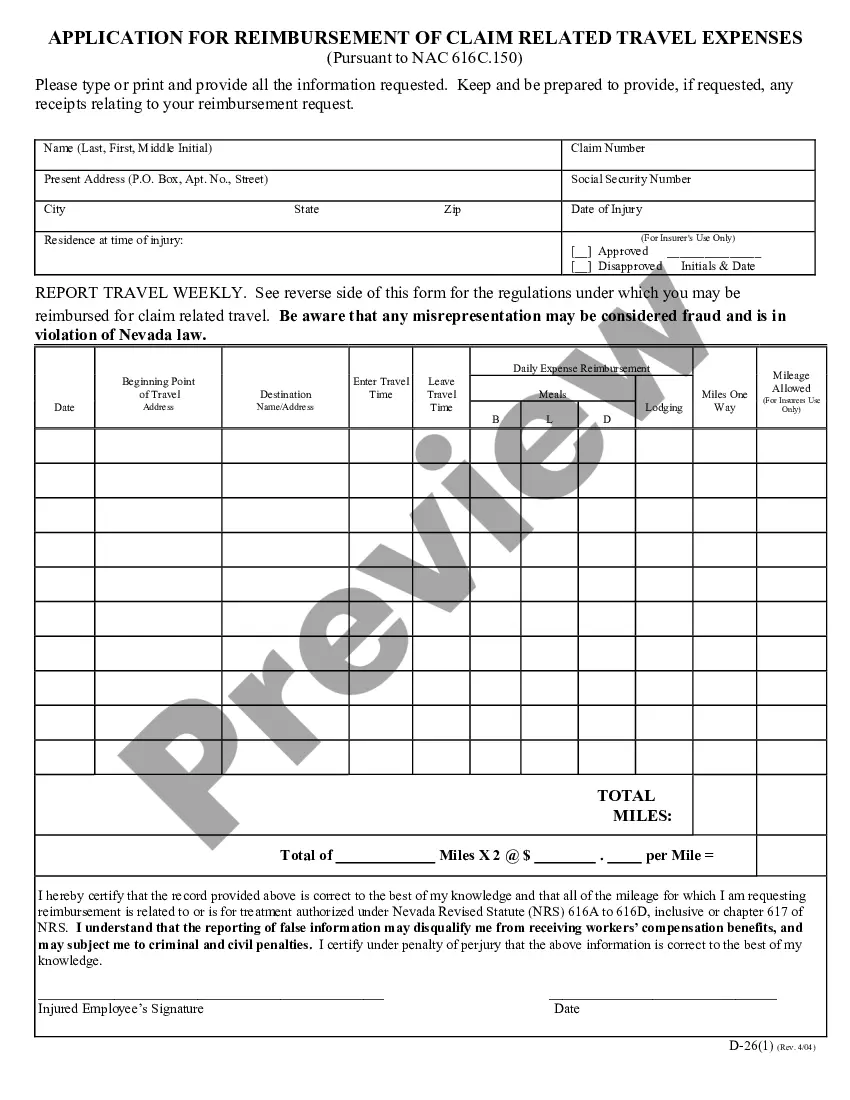

Nevada Request For Reimbursement of Expenses For Travel And Lost Wages

Description

How to fill out Nevada Request For Reimbursement Of Expenses For Travel And Lost Wages?

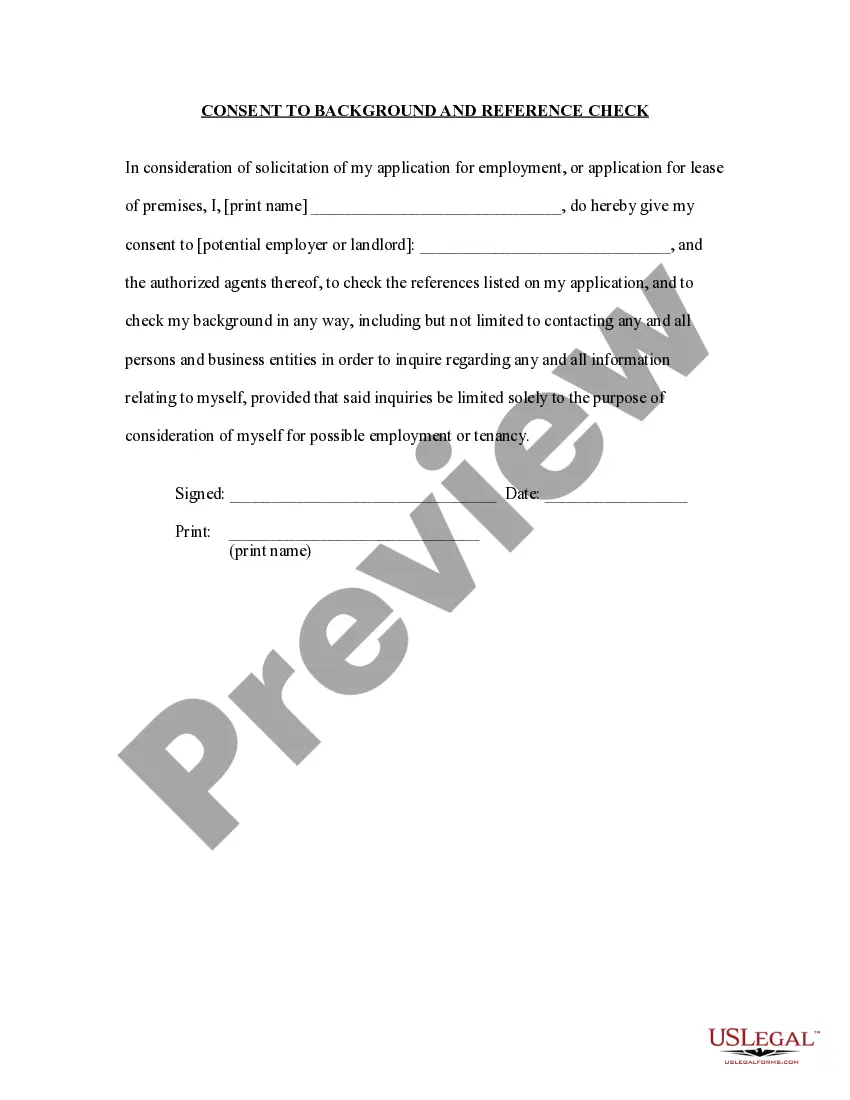

US Legal Forms is a special system where you can find any legal or tax template for completing, including Nevada Request for Reimbursement of Expenses for Travel and Lost Wages. If you’re sick and tired of wasting time searching for ideal samples and paying money on record preparation/lawyer service fees, then US Legal Forms is exactly what you’re looking for.

To enjoy all the service’s advantages, you don't have to download any software but simply select a subscription plan and register your account. If you have one, just log in and get an appropriate sample, save it, and fill it out. Downloaded files are all kept in the My Forms folder.

If you don't have a subscription but need Nevada Request for Reimbursement of Expenses for Travel and Lost Wages, have a look at the guidelines below:

- make sure that the form you’re looking at applies in the state you need it in.

- Preview the form and read its description.

- Click on Buy Now button to get to the register page.

- Select a pricing plan and continue registering by providing some information.

- Pick a payment method to complete the registration.

- Save the file by choosing your preferred file format (.docx or .pdf)

Now, complete the file online or print it. If you feel unsure about your Nevada Request for Reimbursement of Expenses for Travel and Lost Wages template, contact a lawyer to check it before you send out or file it. Start hassle-free!

Form popularity

FAQ

Generally, an employee may seek reimbursement of a necessary business expense within three years of incurring the expense. However, to lessen the risk of belated claims, employers should identify a deadline to submit reimbursements (i.e. 30 days after incurring the cost) in the written reimbursement policy.

As a general matter, no. Unfortunately, employers are not required to reimburse employees for expenses incurred in connection with their work, including travel expenses.If a contract, such as an employment contract, calls for reimbursement, that contract must be honored.

California law generally prohibits employers from requiring employees to bear the costs of business expenses.Additionally, under California Labor Code § 2804 an agreement to waive full reimbursement for expenses is not enforceable even if an employer requires the agreement as a term of employment.

The obligation to reimburse business expenses incurred by employees originates in California Labor Code section 2802, which requires an employer to "indemnify his or her employee for all necessary expenditures or losses incurred by the employee in direct consequence of the discharge of his or her duties . . . ." Simply

At the state and local level, there are currently 10 jurisdictions that have statutes or case law specifically addressing an employer's requirement to reimburse business expenses: California, Iowa, Illinois, Massachusetts, Montana, New Hampshire, North Dakota, South Dakota, District of Columbia, and Seattle, Washington

Mileage reimbursement is when employers offer employees reimbursement for expenses associated with driving on behalf of the business. These expenses can include fuel costs, maintenance and vehicle depreciation. Mileage reimbursement is typically set at a per-mile rate usually below $1 per mile.

If employees travel as part of their job, the company can use certain government-set rates to reimburse travel costs.If the reimbursement is done under an accountable plan up to the IRS standard mileage rate, there is no taxable compensation reportable to employees or subject to payroll taxes.