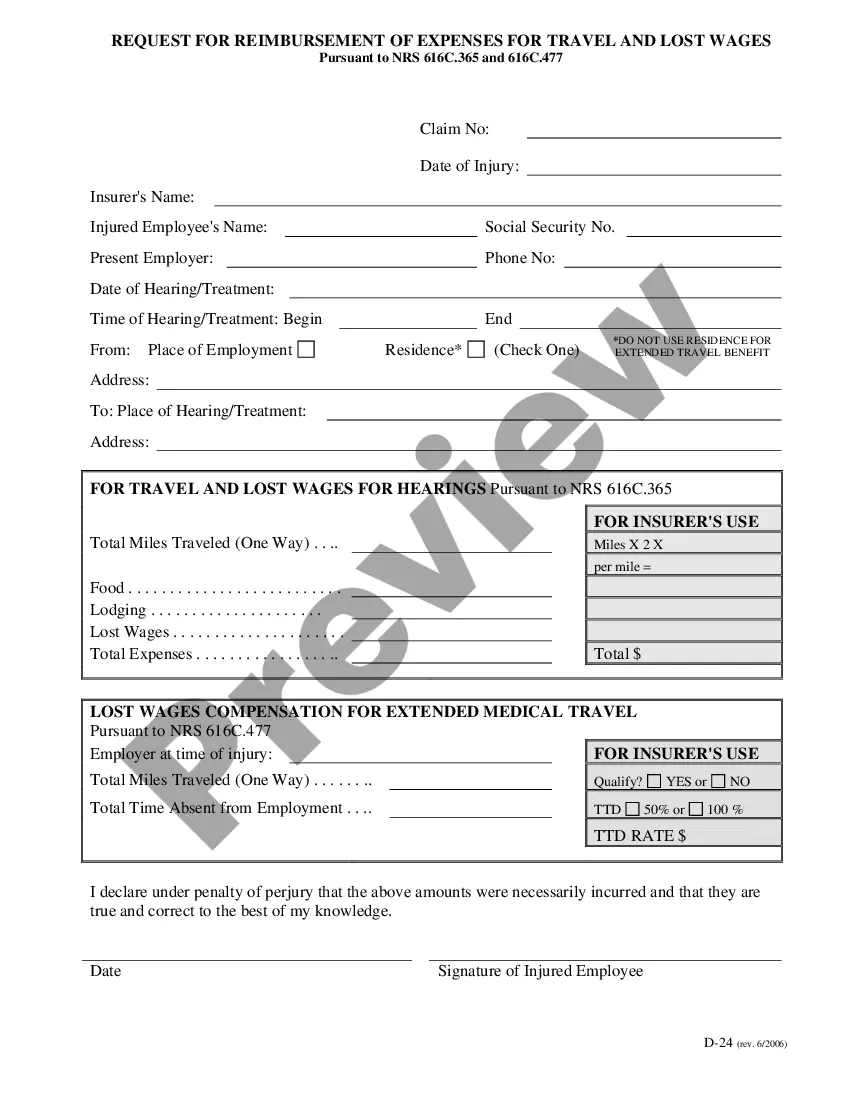

Nevada Application For Reimbursement of Claim Related Travel Expenses

Description

How to fill out Nevada Application For Reimbursement Of Claim Related Travel Expenses?

US Legal Forms is a unique platform where you can find any legal or tax document for filling out, including Nevada Application for Reimbursement of Claim Related Travel Expenses. If you’re sick and tired of wasting time searching for perfect examples and paying money on papers preparation/attorney charges, then US Legal Forms is precisely what you’re seeking.

To experience all the service’s benefits, you don't have to install any application but just choose a subscription plan and sign up an account. If you have one, just log in and get the right template, download it, and fill it out. Saved documents are all kept in the My Forms folder.

If you don't have a subscription but need to have Nevada Application for Reimbursement of Claim Related Travel Expenses, check out the instructions below:

- make sure that the form you’re checking out applies in the state you want it in.

- Preview the example and look at its description.

- Click on Buy Now button to access the register page.

- Select a pricing plan and proceed signing up by entering some info.

- Decide on a payment method to finish the registration.

- Save the file by choosing your preferred format (.docx or .pdf)

Now, submit the document online or print out it. If you are unsure regarding your Nevada Application for Reimbursement of Claim Related Travel Expenses sample, contact a legal professional to examine it before you decide to send out or file it. Begin without hassles!

Form popularity

FAQ

Form a policy for the expense reimbursement process. Determine what expenses employees can claim. Create a system for collecting employee expense claims. Verify the legitimacy of expenses. Pay reimbursements within a specified timeframe.

Make the expense billable. Create a new expense. Select the customer who is reimbursing you and check the box that says Billable. Save the expense. Invoice the expense. Select the particular expense. Click on the button Convert to Invoice.

Employees may charge most of the expenses they incur on a business trip to the company credit card. For reimbursement of incidentals such as tips and fast food, employees will need to fill out an expense report when they return from their trip.

While requesting a reimbursement, your tone should be fair and courteous so that your reader won't doubt your honesty. State your reason for requesting the refund. Then request the reimbursement. Send the relevant receipts or documents and ask the reader to take a look at them.

Add personal information. Enter purchase details. Sign the form. Attach receipts. Submit to the management or accounting department.

Reimbursement is the act of compensating someone for an out-of-pocket expense by giving them an amount of money equal to what was spent.Reimbursement is also used in insurance, when a provider pays for expenses after they have been paid directly by the policy holder or another party.

The obligation to reimburse business expenses incurred by employees originates in California Labor Code section 2802, which requires an employer to "indemnify his or her employee for all necessary expenditures or losses incurred by the employee in direct consequence of the discharge of his or her duties . . . ." Simply

Name, department, and contact information. List of itemized expense names. Date of purchase for each item. Receipts. Total amount spent. Purpose of the expense. Actual cost of item (subtraction of discounts) Repayment amount sought.

As a general matter, no. Unfortunately, employers are not required to reimburse employees for expenses incurred in connection with their work, including travel expenses.If a contract, such as an employment contract, calls for reimbursement, that contract must be honored.