Nevada Amendment to Living Trust

What this document covers

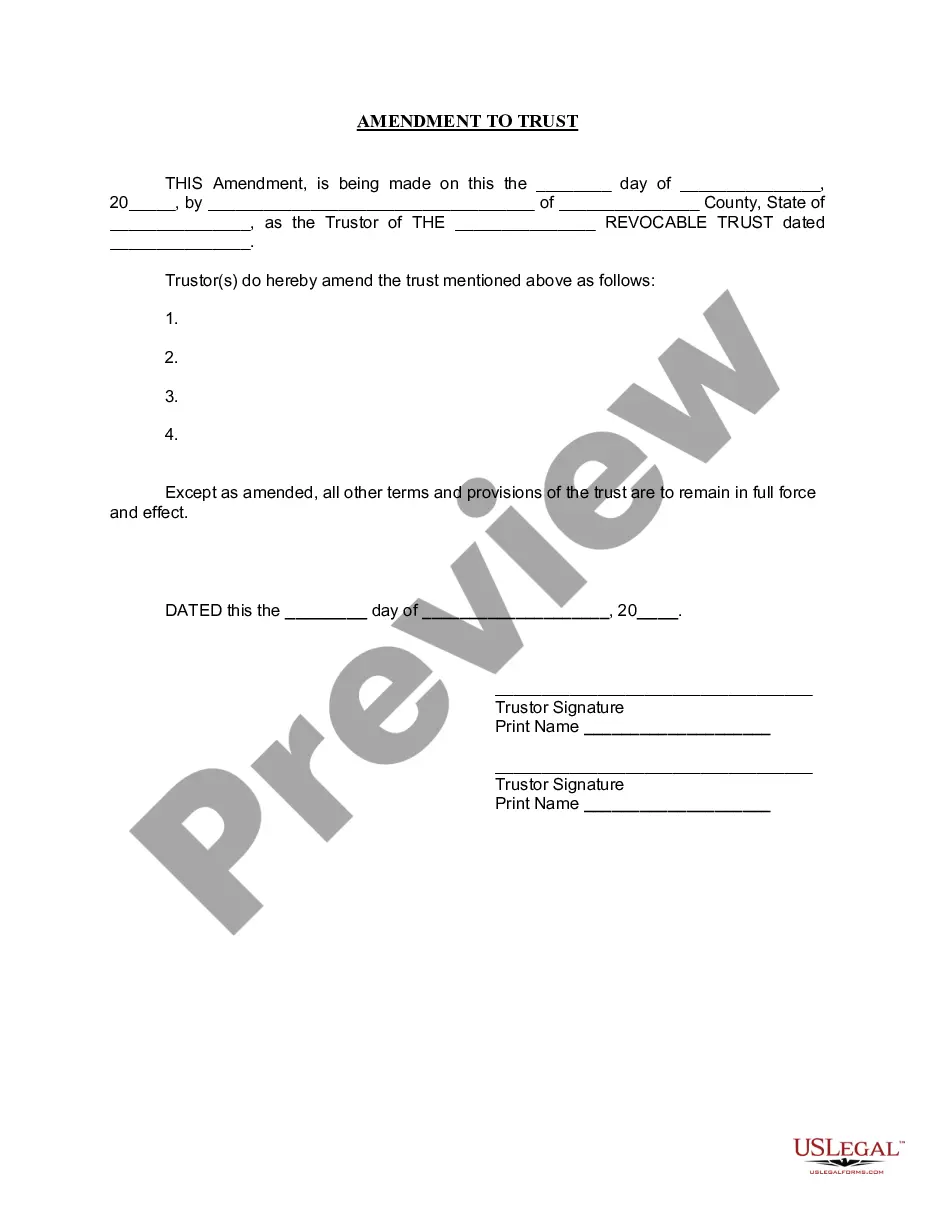

The Amendment to Living Trust is a legal document used to make changes to an existing living trust without altering its fundamental purpose or nature. This form allows the Trustor to amend specific provisions, ensuring that the remainder of the trust continues to function as originally intended. It's different from other trust forms as it focuses solely on amendments rather than creating a new trust or dissolving an existing one.

Key components of this form

- Date of amendment

- Name and details of the Trustor

- Description of the amended provisions

- Signature fields for the Trustor(s)

- Notary acknowledgment section

Common use cases

This form is essential when you need to update a living trust due to changes in personal circumstances, such as the birth of a child, marriage, divorce, or changes in asset ownership. Using this amendment form can help ensure your trust accurately reflects your current wishes and intentions regarding your assets and beneficiaries.

Intended users of this form

- Individuals who have established a living trust and wish to make changes.

- Trustors who need to update provisions due to changing family dynamics.

- Those seeking to amend a trust for estate planning purposes.

Steps to complete this form

- Identify the date of the amendment.

- Enter your full name and details relevant to your county and state.

- Specify the sections of the trust you are amending and clearly articulate the changes.

- Sign the form in front of a notary public.

- Ensure that the notary completes the acknowledgment section.

Is notarization required?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Mistakes to watch out for

- Failing to clearly specify the amended provisions.

- Not signing in front of a notary public.

- Using incorrect or outdated information about the trust.

- Not retaining a copy of the amendment for personal records.

Benefits of completing this form online

- Convenience of downloading and completing the form at your own pace.

- Editability to ensure all information is accurate before finalizing.

- Access to templates drafted by licensed attorneys for reliability.

Form popularity

FAQ

You can change your living trust, usually without incurring lawyer bills.Because you and your spouse made the trust together, you should both sign the amendment, and when you sign it, get your signatures notarized, just like the original. Another way to go is to create a "restatement" of your trust.

Locate the original trust. The grantor must locate the original trust documents and identify the specific provisions that require amendment. Prepare an amendment form. Get the amendment form notarized. Attach amendment form to original trust.

An amendment to a trust is not required to be notarized or witnessed unless the terms of the original trust require it.

We also reserve the right to modify our fees at any time. Typical pricing is as follows: $300 to Amend Nomination of Successor Trustees & Executors. $400 minimum to Amend Gift, Inheritance & Beneficiary Provisions.

A court can, when given reasons for a good cause, amend the terms of irrevocable trust when a trustee and/or a beneficiary petitions the court for a modification.Such modification provisions are common with charitable trusts, to allow modifications when federal tax law changes.

Locate the original trust. The grantor must locate the original trust documents and identify the specific provisions that require amendment. Prepare an amendment form. Get the amendment form notarized. Attach amendment form to original trust.

You can change your living trust, usually without incurring lawyer bills.Because you and your spouse made the trust together, you should both sign the amendment, and when you sign it, get your signatures notarized, just like the original. Another way to go is to create a "restatement" of your trust.

Sign a complete trust restatement that's valid under your applicable state law. Sign a complete revocation of the original trust agreement and any amendments, then transfer the assets held in the revoked trust back into your own name. You can then create and fund a brand new revocable living trust if you choose.