Nevada Assumption Agreement of Deed of Trust and Release of Original Mortgagors

Description

How to fill out Nevada Assumption Agreement Of Deed Of Trust And Release Of Original Mortgagors?

US Legal Forms is a special platform where you can find any legal or tax template for filling out, such as Nevada Assumption Agreement of Deed of Trust and Release of Original Mortgagors. If you’re tired of wasting time seeking perfect samples and paying money on record preparation/lawyer fees, then US Legal Forms is exactly what you’re searching for.

To enjoy all the service’s benefits, you don't have to install any software but just pick a subscription plan and register your account. If you have one, just log in and get a suitable template, download it, and fill it out. Downloaded files are saved in the My Forms folder.

If you don't have a subscription but need to have Nevada Assumption Agreement of Deed of Trust and Release of Original Mortgagors, take a look at the guidelines below:

- Double-check that the form you’re looking at is valid in the state you want it in.

- Preview the sample its description.

- Click Buy Now to reach the sign up page.

- Select a pricing plan and proceed registering by entering some information.

- Choose a payment method to complete the registration.

- Download the document by choosing your preferred format (.docx or .pdf)

Now, fill out the document online or print it. If you feel uncertain regarding your Nevada Assumption Agreement of Deed of Trust and Release of Original Mortgagors form, contact a legal professional to check it before you decide to send out or file it. Start without hassles!

Form popularity

FAQ

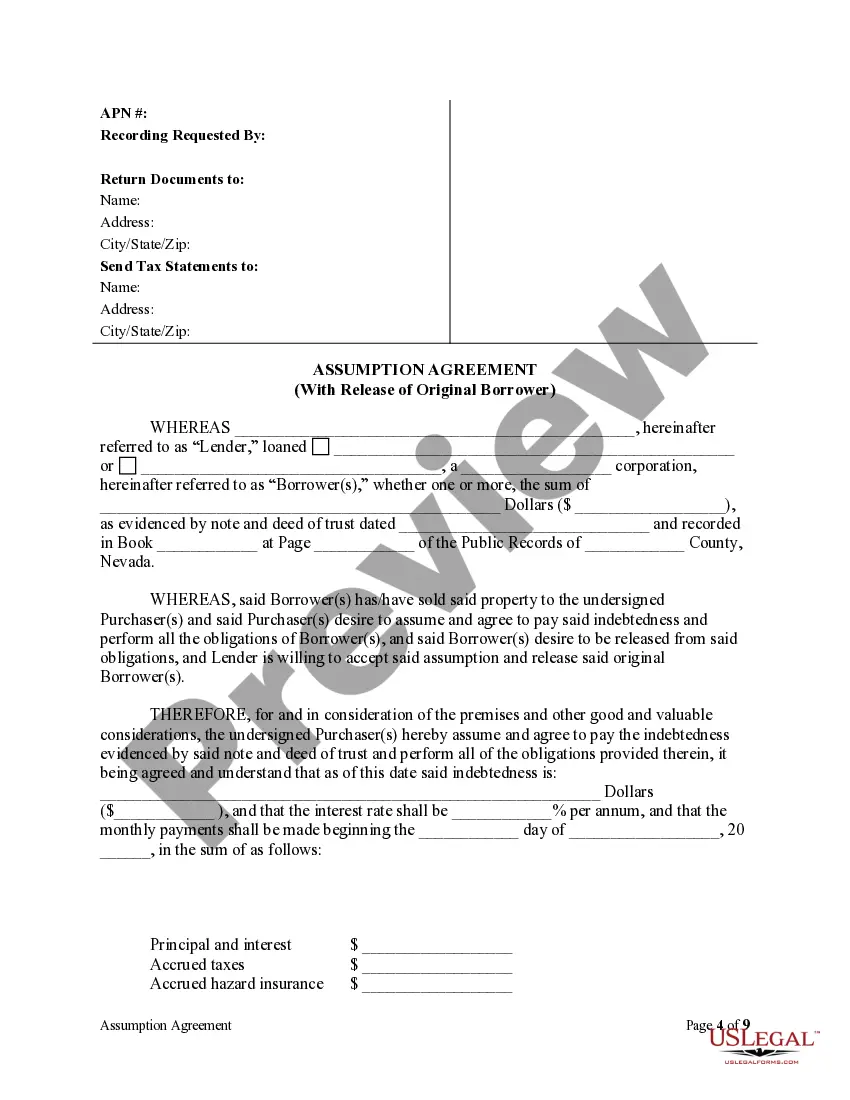

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia,

A Deed of Trust is essentially an agreement between a lender and a borrower to give the property to a neutral third party who will serve as a trustee. The trustee holds the property until the borrower pays off the debt.

Whether you have a deed of trust or a mortgage, they both serve to assure that a loan is repaid, either to a lender or an individual person. A mortgage only involves two parties the borrower and the lender. A deed of trust adds an additional party, a trustee, who holds the home's title until the loan is repaid.

The deed of trust is currently used in Alabama, Alaska, Arkansas, Arizona, California, Colorado, District of Columbia, Georgia, Hawaii, Idaho, Iowa, Michigan, Minnesota, Mississippi, Missouri, Montana, Nevada, New Hampshire, North Carolina, Oklahoma, Oregon, Rhode Island, South Dakota, Tennessee, Texas, Utah, Virginia,

Whether you have a deed of trust or a mortgage, they both serve to assure that a loan is repaid, either to a lender or an individual person. A mortgage only involves two parties the borrower and the lender. A deed of trust adds an additional party, a trustee, who holds the home's title until the loan is repaid.

Some owners are put off using solicitors duke to the deed of trust cost. Individuals can write out their own, and use someone else as a witness. However, this may have errors or not be a legally binding document. The investment of getting a deed of trust when buying a property is often worth it in the long term.

A deed of trust acts as an agreement between youthe homebuyerand your lender. It states not just that you'll repay the loan, but that a third party called the trustee will hold legal title to the property until you do. A deed of trust is the security for your loan, and it's recorded in the public records.

A deed conveys ownership; a deed of trust secures a loan.

Can I make a declaration of trust myself? Some owners are put off using solicitors duke to the deed of trust cost. Individuals can write out their own, and use someone else as a witness. However, this may have errors or not be a legally binding document.