Summary Administration Package for Estates Valued at $300,000 or Less - Small Estates

Small Estates General Summary: Small Estate laws were enacted in order to enable heirs to obtain property of the deceased without probate, or with shortened probate proceedings, provided certain conditions are met. Small estates can be administered with less time and cost. If the deceased had conveyed most property to a trust but there remains some property, small estate laws may also be available. Small Estate procedures may generally be used regardless of whether there was a Will. In general, the two forms of small estate procedures are recognized:

1. Small Estate Affidavit -Some States allow an affidavit to be executed by the spouse and/or heirs of the deceased and present the affidavit to the holder of property such as a bank to obtain property of the deceased. Other states require that the affidavit be filed with the Court. The main requirement before you may use an affidavit is that the value of the personal and/or real property of the estate not exceed a certain value.

2. Summary Administration -Some states allow a Summary administration. Some States recognize both the Small Estate affidavit and Summary Administration, basing the requirement of which one to use on the value of the estate. Example: If the estate value is 10,000 or less an affidavit is allowed but if the value is between 10,000 to 20,000 a summary administration is allowed.

Nevada Statues provide the following three small estate or abbreviated probate procedures:

1. Letter of Entitlement pursuant to Section 146.080. This section is only applicable to a states that do not exceed $20,000 and have no assets consisting of real property in Nevada. At least 40 days must have passed since the date of death of the decedent to use this affidavit.

2. Set Aside Estate Without Administration pursuant to Section 146.070. This section is only applicable to a states whose net value do not exceed $75,000. It is applicable to both real and personal property owned by a Nevada resident. The net value is computed by taking the fair market value of all probate assets of the estate and subtracting there from all mortgages and/or liens but not non-secure debt. At least 30 days must have passed since the death of the decedent before petition can be filed.

3. Summary Administration pursuant to Section 145.010 consists of an abbreviated version of general or complete administration. All probate proceedings and notices are dispensed with except: (a) Notice of initial petition for summary administration; (b) Notice and Confirmation of Sale of Real Property; (c) Notice of Final Account and Petition for Distribution and request for attorneys fees; (d) Notice to Creditors; and (e) Inventory. Limited to estates with a gross value that does not exceed $300,000.

Nevada requirements are set forth in the statutes below.

Chapter 145 - SUMMARY ADMINISTRATION OF ESTATES

Nev. Rev, Stat. 145.010 Application of chapter.

The provisions of this chapter apply only to estates of which summary administration is ordered. Upon the granting of summary administration, all regular proceedings and further notices required by this title are waived, except for the notices required by NRS 144.010, 145.060, 145.070 and 145.075.

[Part 308:107:1941; 1931 NCL 9882.308] (NRS A 2001, 2345)

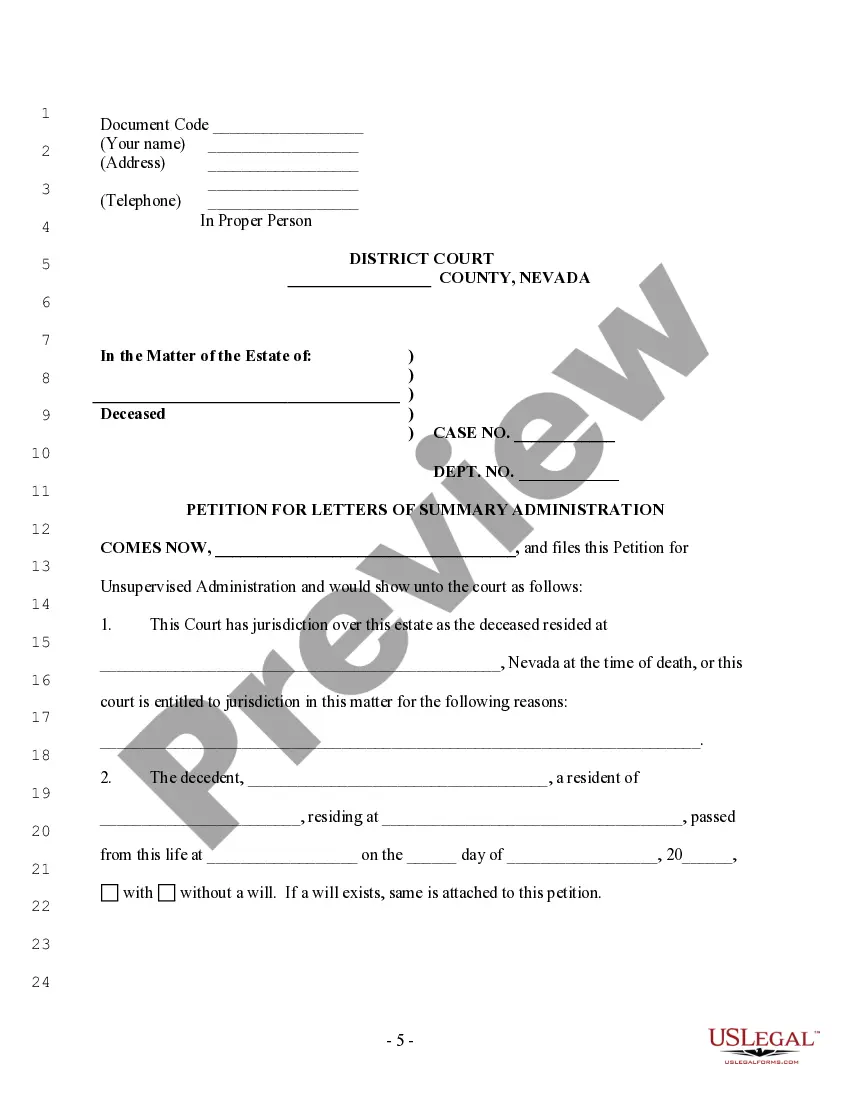

Nev. Rev. Stat. 145.020 Contents of petition seeking summary administration.

All proceedings taken under this chapter, whether or not the decedent left a will, must be originated by a petition for letters testamentary or letters of administration containing:

1. Jurisdictional information;

2. A description of the property of the decedent, including the character and estimated value of the property;

3. The names and residences of the heirs and devisees of the decedent and the age of any who is a minor and the relationship of each heir and devisee to the decedent, so far as known to the petitioner; and

4. A statement indicating whether the person to be appointed as personal representative has been convicted of a felony.

[Part 308:107:1941; 1931 NCL 9882.308] (NRS A 1997, 1487; 1999, 2301; 2009, 1628)

Nev. Rev. Stat. 145.030 Notice required.

Notice of a petition for the probate of a will and the issuance of letters must be given as provided in NRS 155.010.

[Part 308:107:1941; 1931 NCL 9882.308] (NRS A 1975, 1770; 1987, 780; 1989, 647; 1995, 2572; 1999, 2302)

Nev. Rev. Stat. 145.040 Conditions for ordering summary administration.

If it is made to appear to the court that the gross value of the estate, after deducting any encumbrances, does not exceed $300,000, the court may, if deemed advisable considering the nature, character and obligations of the estate, enter an order for a summary administration of the estate.

[Part 308:107:1941; 1931 NCL 9882.308] (NRS A 1965, 172; 1973, 431; 1975, 1770; 1983, 294; 1997, 1487; 1999, 2302; 2007, 896; 2015, 789)

Nev. Rev. Stat. 145.060 Creditors' claims: Notice, filing, approval and payment; procedure if claim of Department of Health and Human Services rejected.

1. A personal representative shall publish and mail notice to creditors in the manner provided in NRS 155.020.

2. Creditors of the estate must file their claims, due or to become due, with the clerk, within 60 days after the mailing to the creditors for those required to be mailed, or 60 days after the first publication of the notice to creditors pursuant to NRS 155.020, and within 15 days thereafter the personal representative shall allow or reject the claims filed.

3. Any claim which is not filed within the 60 days is barred forever, except that if it is made to appear, by the affidavit of the claimant or by other proof to the satisfaction of the court, that the claimant did not have notice as provided in NRS 155.020, the claim may be filed at any time before the filing of the final account.

4. Every claim which is filed as provided in this section and allowed by the personal representative must then, and not until then, be ranked as an acknowledged debt of the estate and be paid in the course of administration, except that payment of small debts in advance may be made pursuant to subsection 3 of NRS 150.230.

5. If a claim filed by the Department of Health and Human Services is rejected by the personal representative, the Director of the Department may, within 20 days after receipt of the written notice of rejection, petition the court for summary determination of the claim. A petition for summary determination must be filed with the clerk, who shall set the petition for hearing, and the petitioner shall give notice for the period and in the manner required by NRS 155.010.

Allowance of the claim by the court is sufficient evidence of its correctness, and it must be paid as if previously allowed by the personal representative.

[Part 308:107:1941; 1931 NCL 9882.308] (NRS A 1975, 1771; 1987, 781; 1995, 2572; 1999, 2302; 2001, 2345; 2003, 881, 2511)

Nev. Rev. Stat. 145.070 Sales of real property: Notice and procedure.

All sales of real property, if summary administration is ordered, must be made upon notice given and in the manner required by chapter 148 of NRS.

[Part 308:107:1941; 1931 NCL 9882.308] (NRS A 1999, 2303)

Nev. Rev. Stat. 145.075 Hearing and notices required upon filing of final account and petition for distribution.

1. Upon the filing of a final account and petition for distribution of an estate for which summary administration was ordered, the notice of hearing, the account and petition, together with notice of the amount agreed or requested as attorney's fees, must be given to the persons entitled thereto.

2. The petitioner shall give notice of hearing for the period and in the manner provided in NRS 155.010.

(Added to NRS by 1999, 2301)

Nev. Rev. Stat. 145.080 Close of administration and distribution.

The administration of the estate may be closed and distribution made at any time after the expiration of the time for the personal representative to act on the claims, if it appears to the court that all the debts of the estate, expenses and charges of administration and allowances to the family, if any, have been paid, and the estate is in condition to be finally settled.

[Part 308:107:1941; 1931 NCL 9882.308] (NRS A 1971, 1163; 1999, 2303)

Nev. Rev. Stat. 145.110 Revocation of summary administration.

If at any time after the entry of an order for the summary administration of an estate it appears that the gross value of the estate, after deducting any encumbrances, exceeds $300,000 as of the death of the decedent, the personal representative shall petition the court for an order revoking summary administration. The court may, if deemed advisable considering the nature, character and obligations of the estate, provide in its order revoking summary administration that regular administration of the estate may proceed unabated upon providing such portions of the regular proceedings and notices as were dispensed with by the order for summary administration.

(Added to NRS by 1999, 2301; A 2007, 896; 2015, 789)

Chapter 146 SUPPORT OF FAMILY; SMALL ESTATES

Nev. Rev. Stat. 146.070 Estates not exceeding $100,000: Procedure to set aside estate; exceptions; petition; notice; fees; reduction of estate by non-probate transfer; hearing; findings; distribution of interest of minor.

1. If the value of a decedent's estate does not exceed $100,000, the estate may be set aside without administration by the order of the court.

2. Except as otherwise provided in subsection 3, the whole estate must be assigned and set apart in the following order:

(a) To the payment of the petitioner's attorney's fees and costs incurred relative to the proceeding under this section;

(b) To the payment of funeral expenses, expenses of last illness, money owed to the Department of Health and Human Services as a result of payment of benefits for Medicaid and creditors, if there are any;

(c) To the payment of other creditors, if any; and

d) Any balance remaining to the claimant or claimants entitled thereto pursuant to a valid will of the decedent, and if there is no valid will, pursuant to intestate succession in accordance with chapter 134 of NRS.

3. If the decedent is survived by a spouse or one or more minor children, the court must set aside the estate for the benefit of the surviving spouse or the minor child or minor children of the decedent, subject to any reduction made pursuant to subsection 4 or 5. The court may allocate the entire estate to the surviving spouse, the entire amount to the minor child or minor children, or may divide the estate among the surviving spouse and minor child or minor children.

4. As to any amount set aside to or for the benefit of the surviving spouse or minor child or minor children of the decedent pursuant to subsection 3, the court must set aside the estate without the payment of creditors except as the court finds necessary to prevent a manifest injustice.

5. To prevent an injustice to creditors when there are non-probate transfers that already benefit the surviving spouse or minor child or minor children of the decedent, the court has the discretion to reduce the amount set aside under subsection 3 to the extent that the value of the estate, when combined with the value of non-probate transfers, as defined in NRS 111.721, from the decedent to or for the benefit of the surviving spouse or minor child or minor children of the decedent exceeds $100,000.

6. In exercising the discretion granted in this section, the court shall consider the needs and resources of the surviving spouse and minor child or minor children, including any assets received by or for the benefit of the surviving spouse or minor child or minor children from the decedent by non-probate transfers.

7. For the purpose of this section, a non-probate transfer from the decedent to one or more trusts or custodial accounts for the benefit of the surviving spouse or minor child or minor children shall be considered a transfer for the benefit of such spouse or minor child or minor children.

8. Proceedings taken under this section must not begin until at least 30 days after the death of the decedent and must be originated by a petition containing:

(a) A specific description of all property in the decedent's estate;

(b) A list of all known liens and encumbrances against estate property at the date of the decedent's death, with a description of any that the petitioner believes may be unenforceable;

(c) An estimate of the value of the property, together with an explanation of how the estimated value was determined;

(d) A statement of the debts of the decedent so far as known to the petitioner;

(e) The names and residences of the heirs and devisees of the decedent and the age of any who is a minor and the relationship of the heirs and devisees to the decedent, so far as known to the petitioner; and

(f) If the decedent left a will, a statement concerning all evidence known to the petitioner that tends to prove that the will is valid.

9. If the petition seeks to have the estate set aside for the benefit of the decedent's surviving spouse or minor child or minor children without payment to creditors, the petition must also contain:

(a) A specific description and estimated value of property passing by one or more non-probate transfers from the decedent to the surviving spouse or minor child or minor children; or

(b) An allegation that the estimated value of the property sought to be set aside, combined with the value of all non-probate transfers from the decedent to the surviving spouse or minor child or minor children who are seeking to receive property pursuant to this section, is less than $100,000.

10. When property is distributed pursuant to an order granted under this section, the court may allocate the property on a prorata basis or a non-prorata basis.

11. The clerk shall set the petition for hearing and the petitioner shall give notice of the petition and hearing in the manner provided in NRS 155.010 to the decedent's heirs and devisees and to the Director of the Department of Health and Human Services. If a complete copy of the petition is not enclosed with the notice, the notice must include a statement setting forth to whom the estate is being set aside.

12. No court or clerk's fees may be charged for the filing of any petition in, or order of court thereon, or for any certified copy of the petition or order in an estate not exceeding $2,500 in value.

13. At the hearing on a petition under this section, the court may require such additional evidence as the court deems necessary to make the findings required under subsection 14.

14. The order granting the petition shall include:

(a) The court's finding as to the validity of any will presented;

(b) The court's finding as to the value of the estate and, if relevant for the purposes of subsection 5, the value of any property subject to non-probate transfers;

(c) The court's determination of any property set aside under subsection 2;

(d) The court's determination of any property set aside under subsection 3, including, without limitation, the court's determination as to any reduction made pursuant to subsection 4 or 5; and

(e) The name of each distributee and the property to be distributed to the distributee.

15. As to the distribution of the share of a minor child set aside pursuant to this section, the court may direct the manner in which the money may be used for the benefit of the minor child as is deemed in the court's discretion to be in the best interests of the minor child, and the distribution of the minor child's share shall be made as permitted for the minor child's share under the terms of the decedent's will or to one or more of the following:

(a) A parent of such minor child, with or without the filing of any bond;

(b) A custodian under chapter 167 of NRS; or

(c) A court-appointed guardian of the estate, with or without bond.

16. For the purposes of this section, the value of property must be the fair market value of that property, reduced by the value of all enforceable liens and encumbrances. Property values and the values of liens and encumbrances must be determined as of the date of the decedent's death.

[117:107:1941; A 1941, 130; 1931 NCL 9882.117] (NRS A 1963, 1271; 1965, 171; 1973, 431; 1975, 1772; 1981, 1794; 1983, 193; 1989, 647; 1995, 2573; 1997, 113, 1249, 1487; 1999, 2305; 2003, 881, 2512; 2007, 896; 2015, 3530)

Nev. Rev. Stat. 146.080 Estates not exceeding certain amounts: Transfer of assets without issuance of letters of administration or probate of will; affidavit showing right to assets.

1. If a decedent leaves no real property, nor interest therein, nor mortgage or lien thereon, in this State, and the gross value of the decedent's property in this State, over and above any amounts due to the decedent for services in the Armed Forces of the United States and the value of any motor vehicles registered to the decedent, does not exceed the applicable amount, a person who has a right to succeed to the property of the decedent pursuant to the laws of succession for a decedent who died intestate or pursuant to the valid will of a decedent who died testate, on behalf of all persons entitled to succeed to the property claimed, or the Director of the Department of Health and Human Services or public administrator on behalf of the State or others entitled to the property, may, 40 days after the death of the decedent, without procuring letters of administration or awaiting the probate of the will, collect any money due the decedent, receive the property of the decedent, and have any evidences of interest, indebtedness or right transferred to the claimant upon furnishing the person, representative, corporation, officer or body owing the money, having custody of the property or acting as registrar or transfer agent of the evidences of interest, indebtedness or right, with an affidavit showing the right of the affiant or affiants to receive the money or property or to have the evidence transferred.

2. An affidavit made pursuant to this section must state:

(a) The affiant's name and address, and that the affiant is entitled by law to succeed to the property claimed;

(b) The date and place of death of the decedent;

(c) That the gross value of the decedent's property in this State, except amounts due the decedent for services in the Armed Forces of the United States or the value of any motor vehicles registered to the decedent, does not exceed the applicable amount, and that the property does not include any real property nor interest therein, nor mortgage or lien thereon;

(d) That at least 40 days have elapsed since the death of the decedent, as shown in a certified copy of the certificate of death of the decedent attached to the affidavit;

(e) That no petition for the appointment of a personal representative is pending or has been granted in any jurisdiction;

(f) That all debts of the decedent, including funeral and burial expenses, and money owed to the Department of Health and Human Services as a result of the payment of benefits for Medicaid, have been paid or provided for;

(g) A description of the personal property and the portion claimed;

(h) That the affiant has given written notice, by personal service or by certified mail, identifying the affiant's claim and describing the property claimed, to every person whose right to succeed to the decedent's property is equal or superior to that of the affiant, and that at least 14 days have elapsed since the notice was served or mailed;

(i) That the affiant is personally entitled, or the Department of Health and Human Services is entitled, to full payment or delivery of the property claimed or is entitled to payment or delivery on behalf of and with the written authority of all other successors who have an interest in the property;

(j) That the affiant has no knowledge of any existing claims for personal injury or tort damages against the decedent; and

(k) That the affiant acknowledges an understanding that filing a false affidavit constitutes a felony in this State.

3. If the affiant:

(a) Submits an affidavit which does not meet the requirements of subsection 2 or which contains statements which are not entirely true, any money or property the affiant receives is subject to all debts of the decedent.

(b) Fails to give notice to other successors as required by subsection 2, any money or property the affiant receives is held by the affiant in trust for all other successors who have an interest in the property.

4. A person who receives an affidavit containing the information required by subsection 2 is entitled to rely upon that information, and if the person relies in good faith, the person is immune from civil liability for actions based on that reliance.

5. Upon receiving proof of the death of the decedent and an affidavit containing the information required by this section:

(a) A transfer agent of any security shall change the registered ownership of the security claimed from the decedent to the person claiming to succeed to ownership of that security.

(b) A governmental agency required to issue certificates of title, ownership or registration to personal property shall issue a new certificate of title, ownership or registration to the person claiming to succeed to ownership of the property. The governmental agency may not refuse to accept an affidavit containing the information required by this section, regardless of the form of the affidavit.

6. If any property of the estate not exceeding the applicable amount is located in a state which requires an order of a court for the transfer of the property, or if the estate consists of stocks or bonds which must be transferred by an agent outside this State, any person qualified pursuant to the provisions of subsection 1 to have the stocks or bonds or other property transferred may do so by obtaining a court order directing the transfer. The person desiring the transfer must file a petition, which may be ex-parte, containing:

(a) A specific description of all the property of the decedent.

(b) A list of all the liens and mortgages of record at the date of the decedent's death.

(c) An estimate of the value of the property of the decedent.

(d) The names, ages of any minors and residences of the decedent's heirs and devisees.

(e) A request for the court to issue an order directing the transfer of the stocks or bonds or other property if the court finds the gross value of the estate does not exceed the applicable amount.

(f) An attached copy of the executed affidavit made pursuant to subsection 2.

If the court finds that the gross value of the estate does not exceed the applicable amount and the person requesting the transfer is entitled to it, the court may enter an order directing the transfer.

7. As used in this section, applicable amount means:

(a) If the claimant is the surviving spouse of the decedent, $100,000.

(b) For any other claimant, $25,000.

(Added to NRS by 1957, 130; A 1975, 1773; 1979, 478; 1983, 194; 1995, 2574; 1997, 1250, 1488; 1999, 2306; 2001, 2346; 2003, 476, 882; 2015, 789)