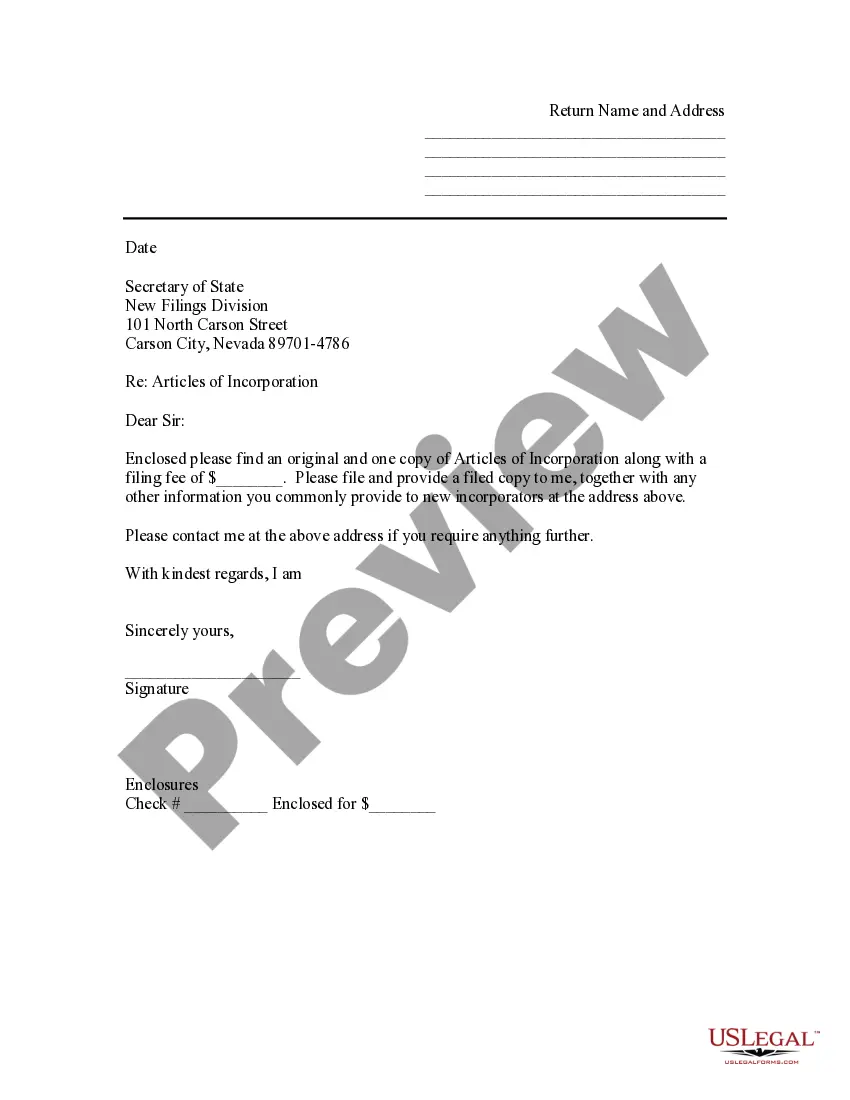

Use this sample letter as a cover sheet to accompany the Articles of Incorporation for filing with the Secretary of State's Office.

Nevada Sample Transmittal Letter to Secretary of State's Office to File Articles of Incorporation

Description

How to fill out Nevada Sample Transmittal Letter To Secretary Of State's Office To File Articles Of Incorporation?

US Legal Forms is actually a unique system to find any legal or tax template for submitting, such as Sample Transmittal Letter to Secretary of State's Office to File Articles of Incorporation - Nevada. If you’re fed up with wasting time seeking ideal examples and spending money on file preparation/lawyer service fees, then US Legal Forms is precisely what you’re searching for.

To experience all the service’s advantages, you don't have to download any software but just pick a subscription plan and register your account. If you have one, just log in and look for the right template, download it, and fill it out. Saved documents are all stored in the My Forms folder.

If you don't have a subscription but need Sample Transmittal Letter to Secretary of State's Office to File Articles of Incorporation - Nevada, take a look at the recommendations listed below:

- check out the form you’re considering is valid in the state you need it in.

- Preview the form and read its description.

- Click on Buy Now button to get to the register webpage.

- Pick a pricing plan and proceed registering by providing some info.

- Choose a payment method to finish the sign up.

- Download the document by selecting the preferred format (.docx or .pdf)

Now, fill out the file online or print out it. If you are unsure regarding your Sample Transmittal Letter to Secretary of State's Office to File Articles of Incorporation - Nevada form, speak to a attorney to analyze it before you decide to send out or file it. Start hassle-free!

Form popularity

FAQ

To renew your State Business License, go to the SilverFlume home page at www.nvsilverflume.gov and select Manage Your Business > File Annual List and/or Renew State Business License. Questions? Call the Secretary of State's Office at (775) 684-5708 or email support@nvsilverflume.gov.

For details you may call (775) 684-5708, visit www.nvsos.gov, or write to the Secretary of State, 202 North Carson Street, Carson City, NV 89701-4201.

To file your Articles of Incorporation, the Nevada Secretary of State charges a minimum filing fee of $75. You must also file the initial list of officers, which costs $150. All corporations doing business in Nevada must also file an annual business license fee, which is $500.

The name of the LLC. The names of the members and managers of the LLC. The address of the LLC's principal place of business.

Under the Constitution, the President of the United States determines U.S. foreign policy. The Secretary of State, appointed by the President with the advice and consent of the Senate, is the President's chief foreign affairs adviser.

Articles of organization are part of a formal legal document used to establish a limited liability company (LLC) at the state level. The materials are used to create the rights, powers, duties, liabilities, and other obligations between each member of an LLC and also between the LLC and its members.

Do the Articles of Organization need to be notarized? Some states require that you have your Articles of Organization documents notarized. For your state's notarization requirements, choose your state from the drop-down list above.

A company that is registered in Nevada can order certified copies of its formation documents from the secretary of state of Nevada.

What is a Nevada certificate of authority? Companies are required to register with the Nevada Secretary of State before doing business in Nevada.Doing so registers the business as a foreign entity and eliminates the need to incorporate a new entity.