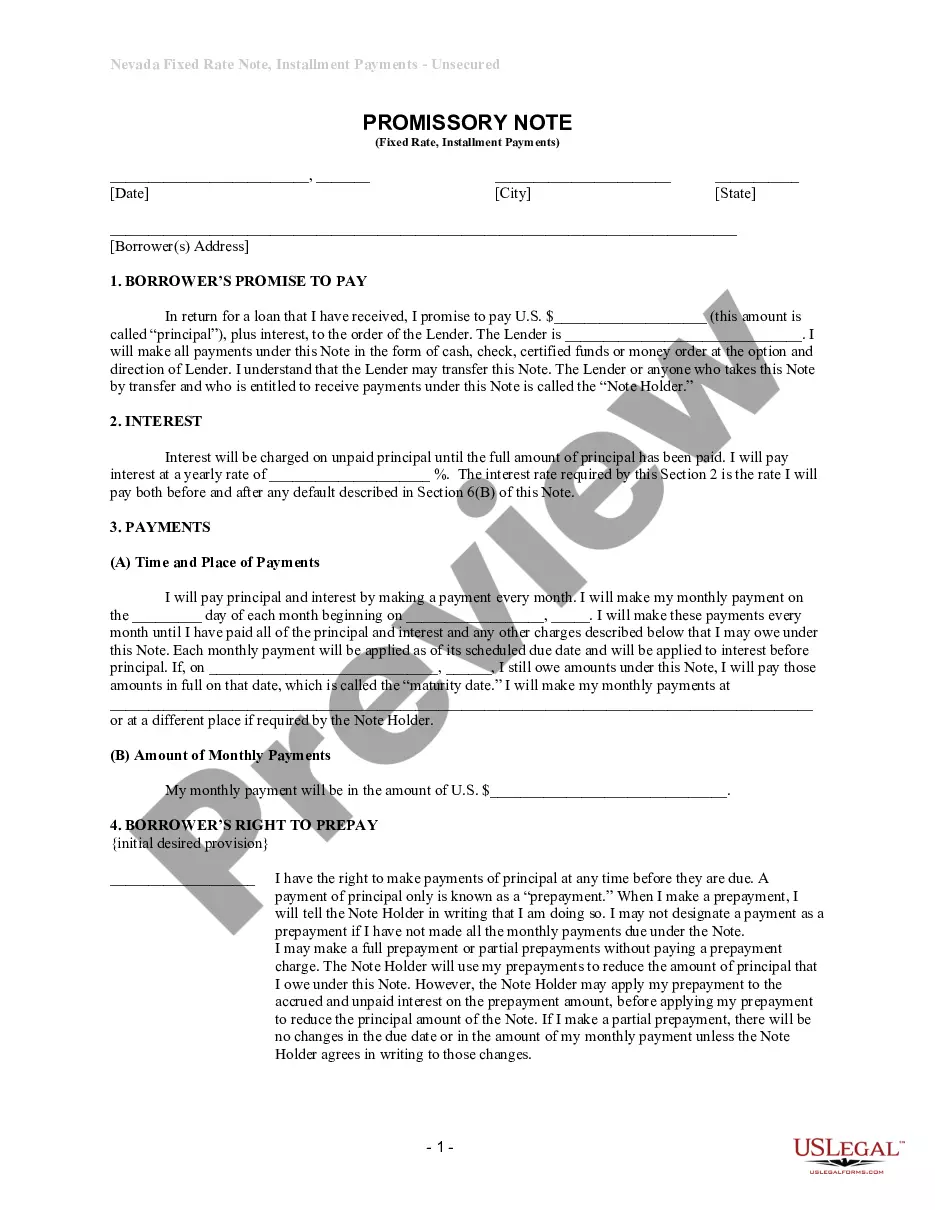

Nevada Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out Nevada Unsecured Installment Payment Promissory Note For Fixed Rate?

US Legal Forms is really a special platform to find any legal or tax form for submitting, such as Nevada Unsecured Installment Payment Promissory Note for Fixed Rate. If you’re tired with wasting time looking for appropriate examples and paying money on papers preparation/legal professional charges, then US Legal Forms is exactly what you’re trying to find.

To experience all of the service’s benefits, you don't need to download any application but simply pick a subscription plan and register your account. If you have one, just log in and find a suitable sample, save it, and fill it out. Downloaded files are all stored in the My Forms folder.

If you don't have a subscription but need Nevada Unsecured Installment Payment Promissory Note for Fixed Rate, have a look at the recommendations listed below:

- make sure that the form you’re taking a look at applies in the state you want it in.

- Preview the example and read its description.

- Click Buy Now to reach the sign up page.

- Choose a pricing plan and continue signing up by providing some info.

- Select a payment method to complete the registration.

- Save the document by choosing your preferred format (.docx or .pdf)

Now, complete the file online or print out it. If you are unsure regarding your Nevada Unsecured Installment Payment Promissory Note for Fixed Rate form, contact a legal professional to review it before you send out or file it. Begin without hassles!

Form popularity

FAQ

Unsecured Promissory Notes An unsecured promissory note is an obligation for payment without any property securing the payment.A short-term unsecured promissory note is the type most often used when a relatively small amount of money is borrowed from a friend or relative.

In general, under the Securities Acts, promissory notes are defined as securities, but notes with a maturity of 9 months or less are not securities.The US Supreme Court in Reves recognizes that most notes are, in fact, not securities.

Step 1 Agree to Terms. Before both parties sit down to write an agreement, the following should be verbally agreed upon: Step 2 Run a Credit Report. Step 3 Security and Co-Signer(s) Step 4 Writing the Promissory Note. Step 5 Paying Back the Borrowed Money.

Promissory notes are commonly written by banks, lenders and attorneys, but a promissory note written properly can be just as legal when entered into by two individuals.

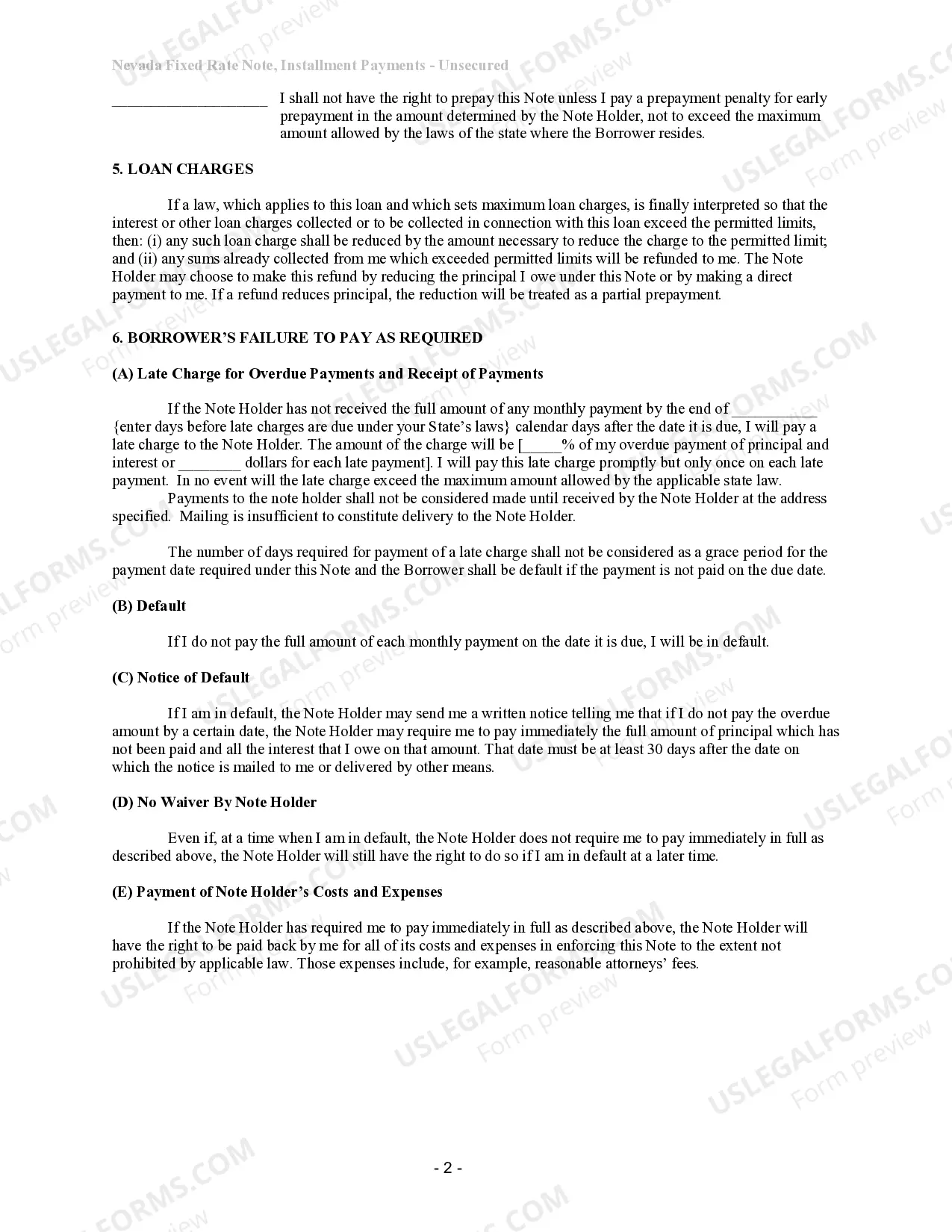

Collecting on an unsecured promissory note through the courts is a two-step process. First, you need to go through the court process to obtain a judgment against the borrower. Then you need to try to attach the borrower's wages, bank accounts, or other assets in order actually get paid.

The first step in enforcing an unsecured promissory note is to file a petition with the courts and get a judgment in your favor. Although this is a powerful legal enforcement of your rights under the promissory note, it does not in and of itself guarantee repayment of the note.

Where a contract is in writing, generally, it must be signed by the party against whom the contract is being enforced.A party seeking to enforce an unsigned agreement may also have a claim for unjust enrichment or promissory estoppel.

Secured or unsecured? Generally, promissory notes are unsecured which means it is more like a formal IOU. However, lenders can request some security for the loan. For personal secured promissory notes, a house or car is often used as collateral.

An unsecured note is a loan that is not secured by the issuer's assets. Unsecured notes are similar to debentures but offer a higher rate of return. Unsecured notes provide less security than a debenture. Such notes are also often uninsured and subordinated.