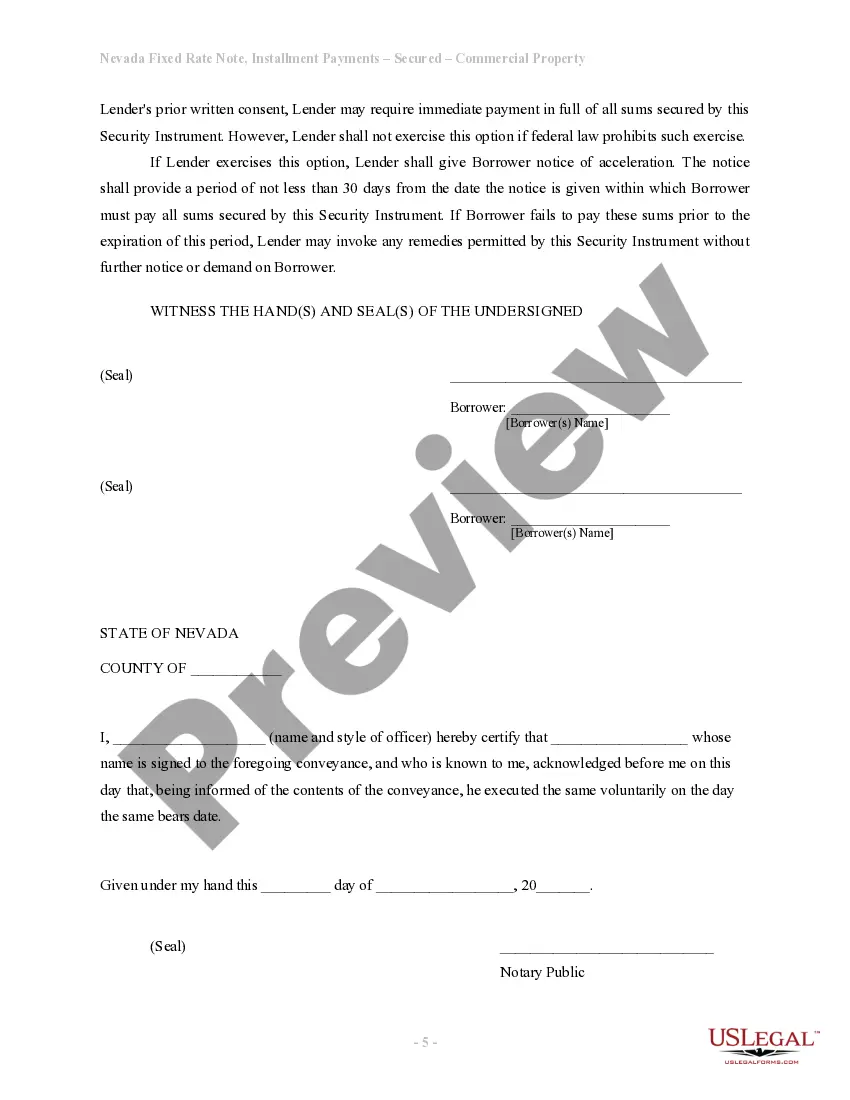

Nevada Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Description

How to fill out Nevada Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

US Legal Forms is really a unique platform where you can find any legal or tax document for filling out, such as Nevada Installments Fixed Rate Promissory Note Secured by Commercial Real Estate. If you’re sick and tired of wasting time looking for appropriate samples and paying money on document preparation/lawyer fees, then US Legal Forms is precisely what you’re searching for.

To enjoy all of the service’s benefits, you don't need to install any application but just select a subscription plan and create an account. If you have one, just log in and look for a suitable sample, save it, and fill it out. Saved documents are all saved in the My Forms folder.

If you don't have a subscription but need to have Nevada Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, take a look at the guidelines listed below:

- Double-check that the form you’re considering applies in the state you need it in.

- Preview the form and read its description.

- Simply click Buy Now to reach the register webpage.

- Choose a pricing plan and continue signing up by entering some information.

- Pick a payment method to finish the sign up.

- Save the document by selecting your preferred format (.docx or .pdf)

Now, fill out the document online or print it. If you are unsure concerning your Nevada Installments Fixed Rate Promissory Note Secured by Commercial Real Estate form, speak to a attorney to analyze it before you decide to send out or file it. Start without hassles!

Form popularity

FAQ

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

The lender holds the promissory note while the loan is being repaid, then the note is marked as paid and returned to the borrower when the loan is satisfied. Promissory notes aren't the same as mortgages, but the two often go hand in hand when someone is buying a home.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.

The individual who promises to pay is the maker, and the person to whom payment is promised is called the payee or holder. If signed by the maker, a promissory note is a negotiable instrument.

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

In order for a promissory note to be valid, both the lender and the borrower must sign the documentation. If you are a co-signer for the loan, you are required to sign the promissory note. Being a co-signer requires you to repay the loan amount in the instance that the borrower defaults on payment.

Navigate to the website: www.studentloans.gov. Click "Log In." Enter your FSA ID and Password. Click "Complete Master Promissory Note." Select the appropriate loan type. Enter Your Personal Information.

Writing the Promissory Note Terms You don't have to write a promissory note from scratch. You can use a template or create a promissory note online.