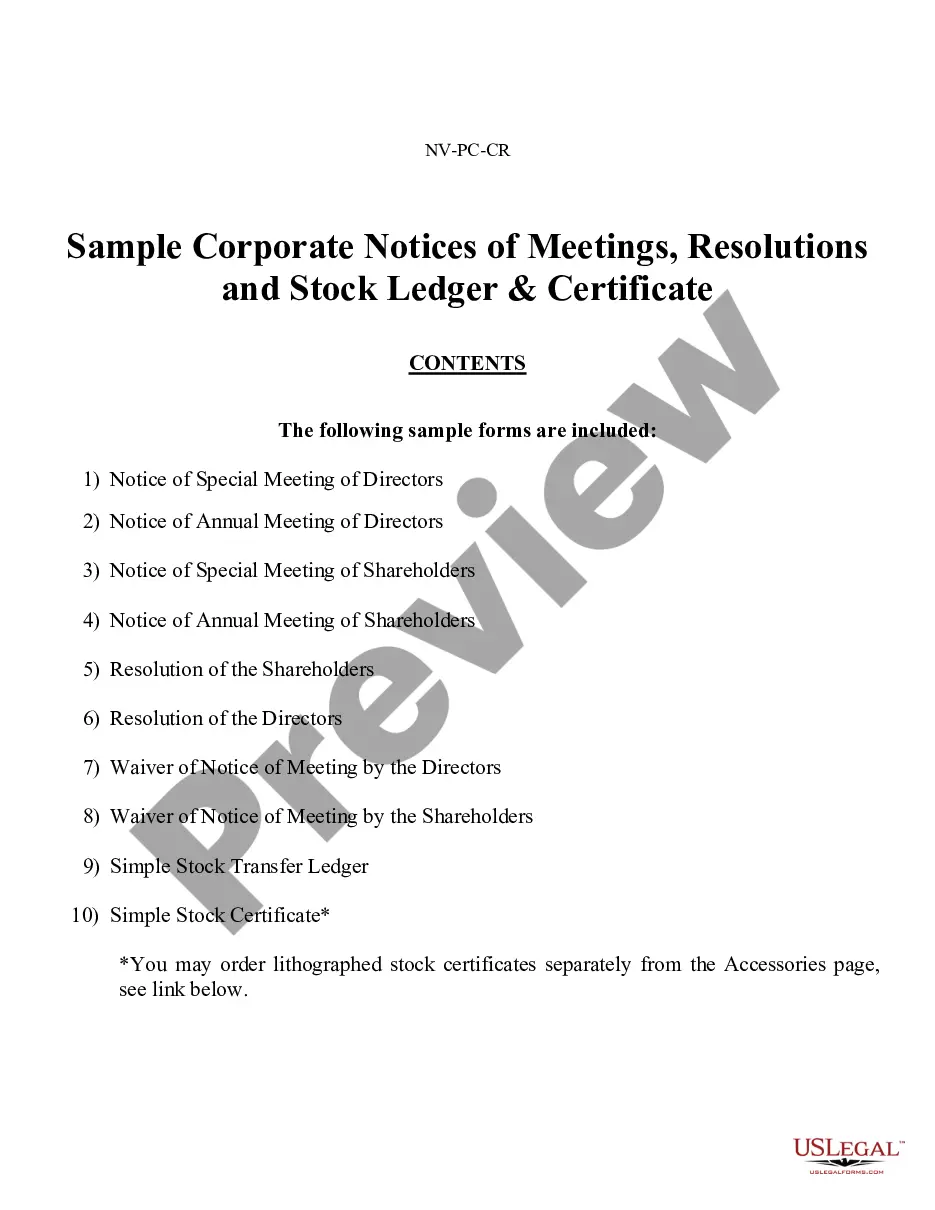

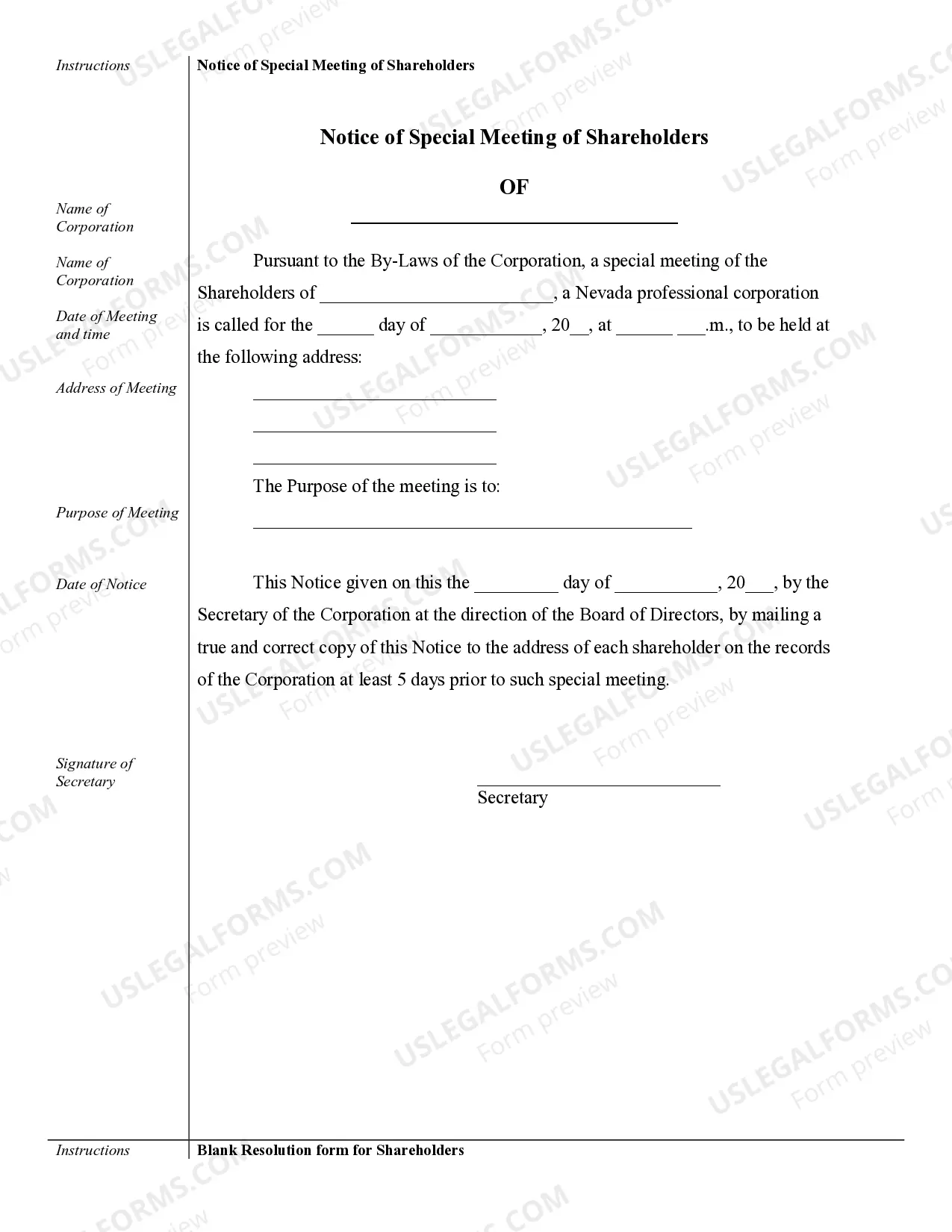

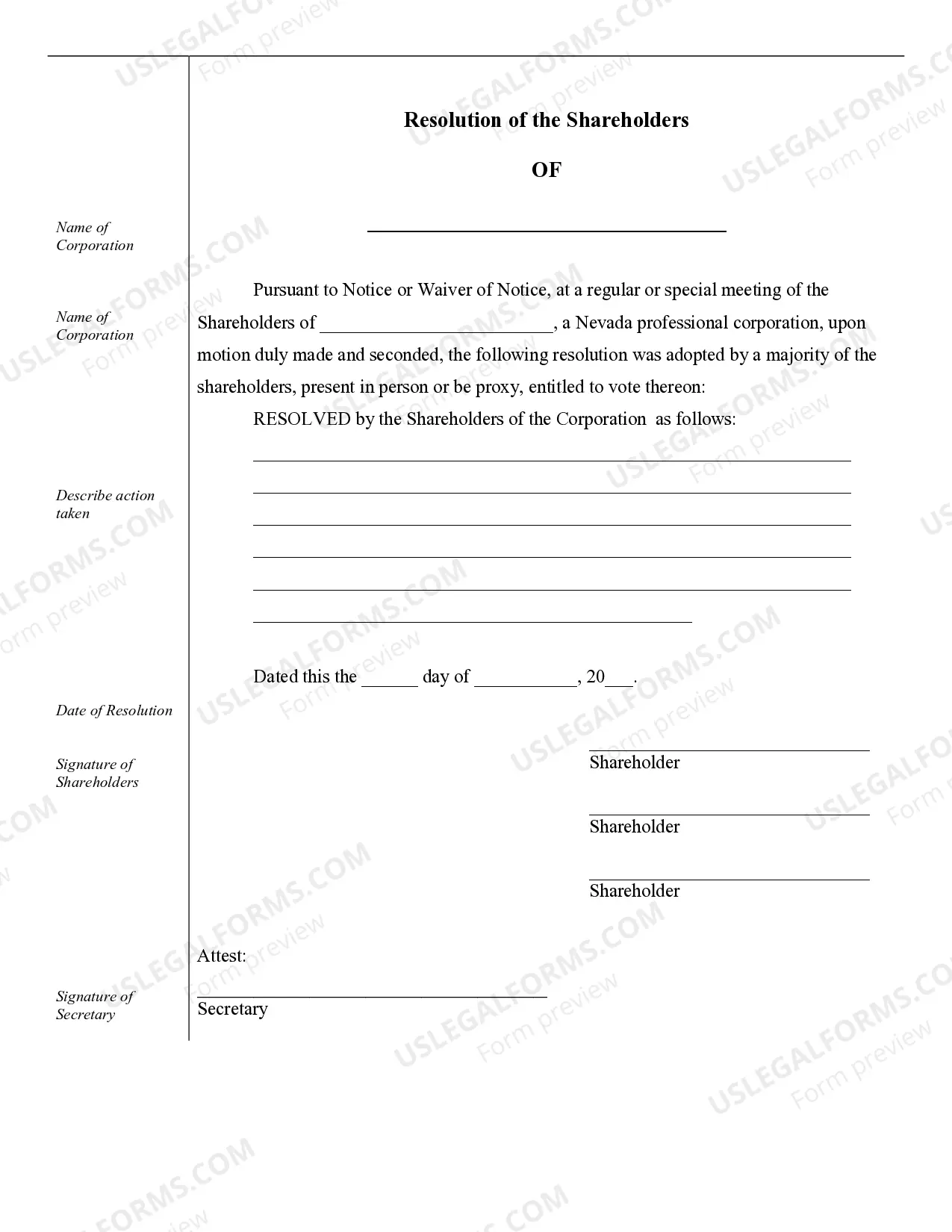

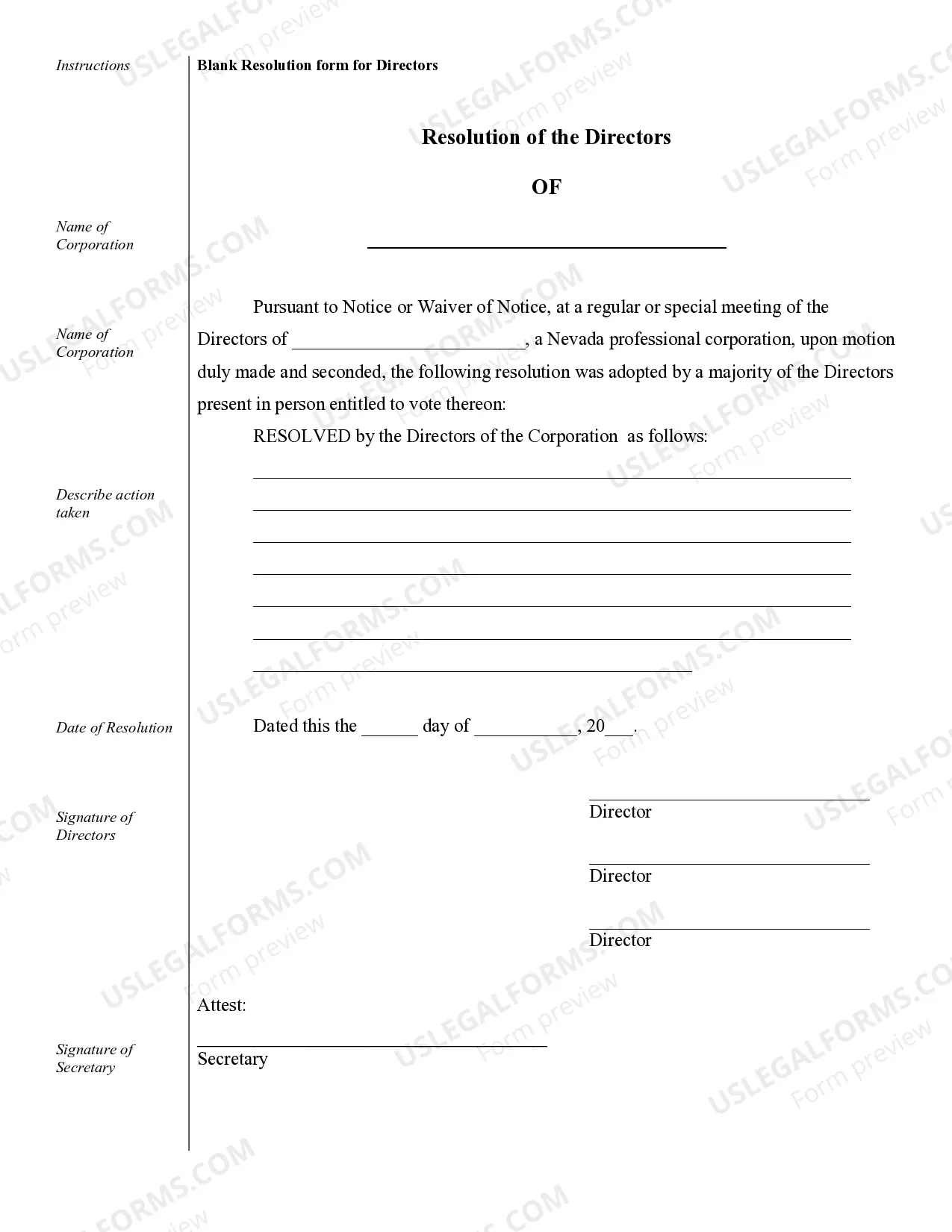

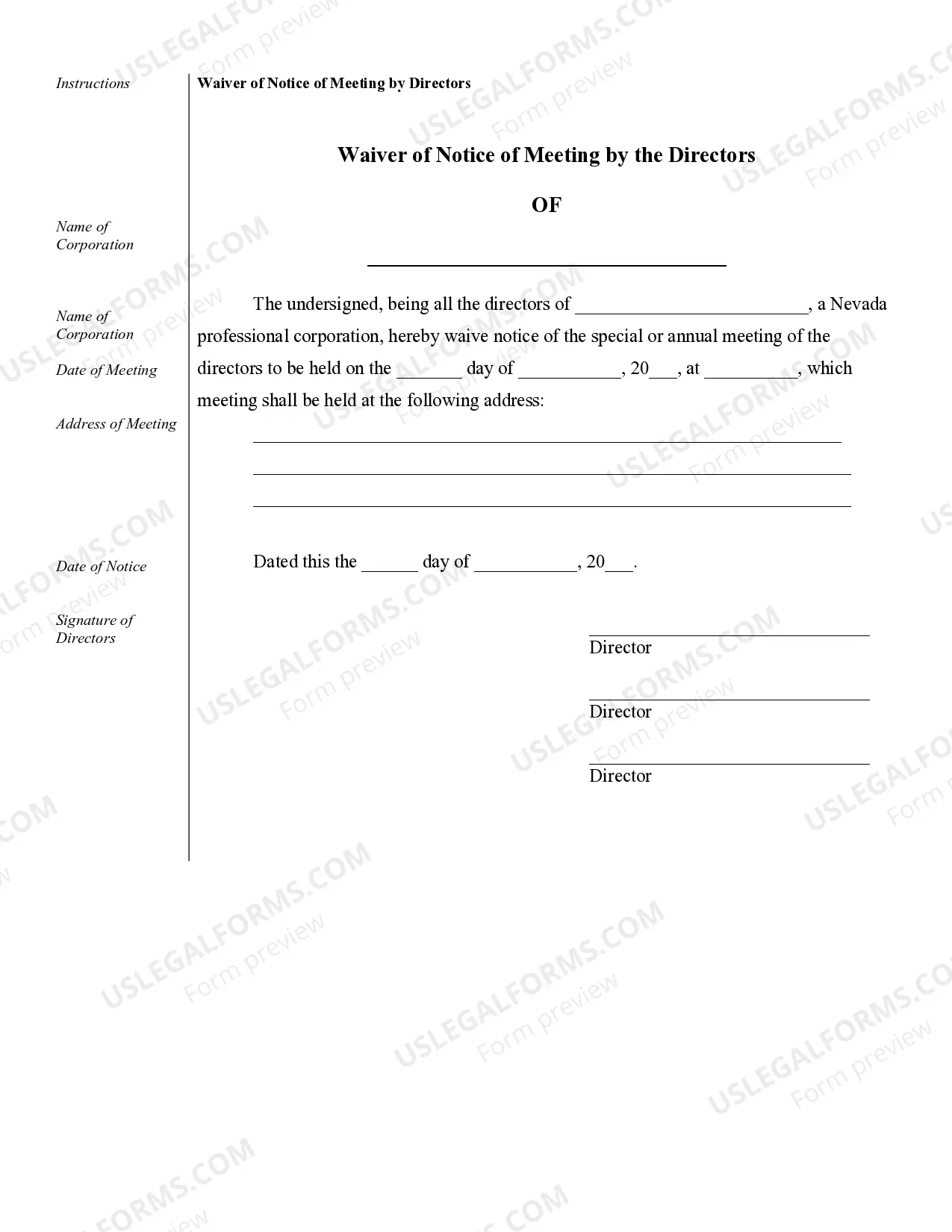

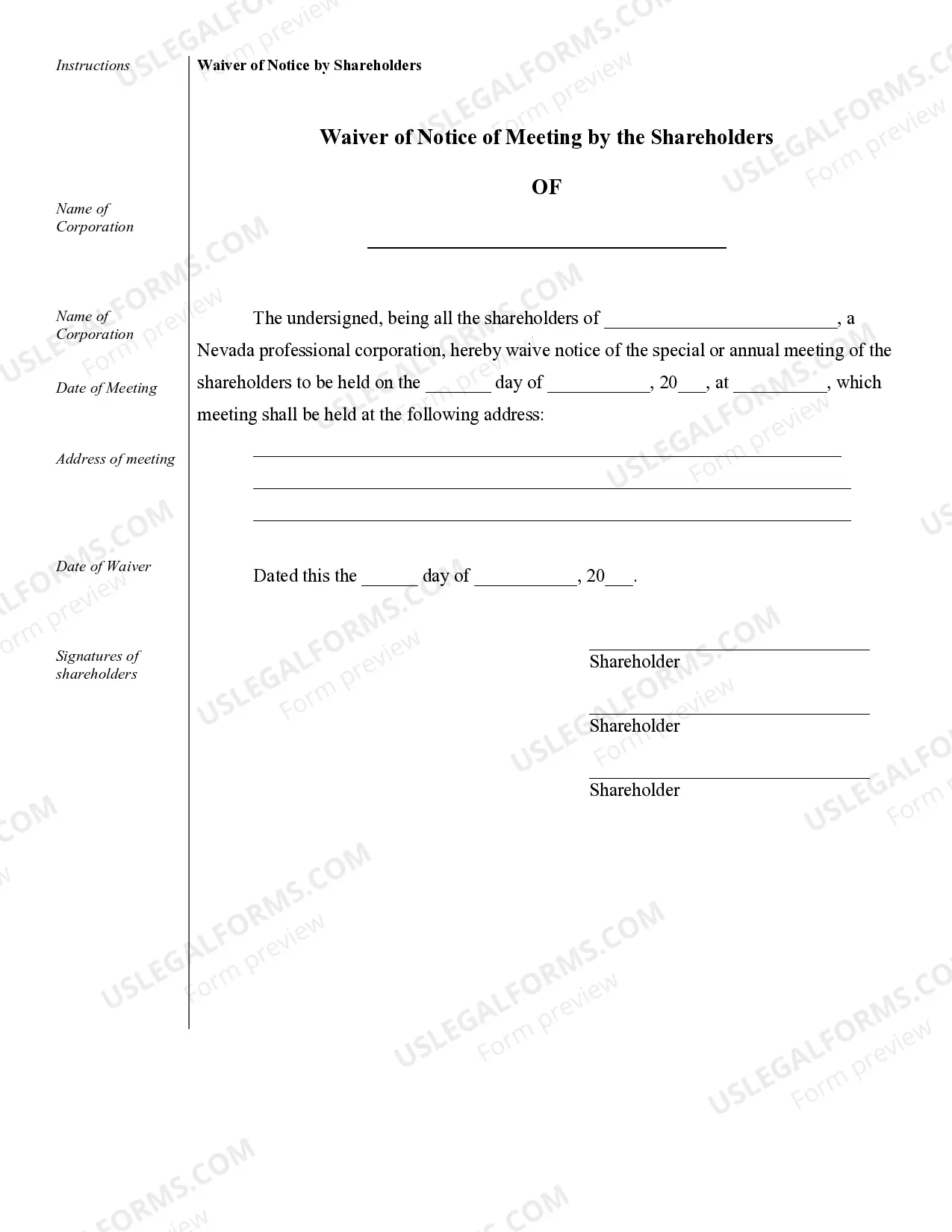

Sample Corporate Records for a Nevada Professional Corporation

Description

How to fill out Sample Corporate Records For A Nevada Professional Corporation?

US Legal Forms is a unique platform to find any legal or tax document for submitting, such as Sample Corporate Records for a Nevada Professional Corporation. If you’re fed up with wasting time searching for suitable samples and spending money on papers preparation/lawyer charges, then US Legal Forms is exactly what you’re looking for.

To enjoy all of the service’s benefits, you don't have to download any application but just select a subscription plan and create an account. If you already have one, just log in and look for an appropriate template, save it, and fill it out. Saved documents are all kept in the My Forms folder.

If you don't have a subscription but need to have Sample Corporate Records for a Nevada Professional Corporation, check out the recommendations below:

- Double-check that the form you’re considering applies in the state you need it in.

- Preview the sample its description.

- Click Buy Now to reach the register page.

- Select a pricing plan and proceed registering by providing some information.

- Pick a payment method to complete the sign up.

- Download the file by choosing the preferred format (.docx or .pdf)

Now, fill out the document online or print it. If you are uncertain concerning your Sample Corporate Records for a Nevada Professional Corporation template, speak to a attorney to analyze it before you decide to send or file it. Begin without hassles!

Form popularity

FAQ

The Nevada Business Identification Number (NV Business ID) is a unique number assigned to every business entity in the State of Nevada. For Title 7 entities, this is the number assigned to your entity when you filed your organizational documents.

The Nevada Business Identification Number (NV Business ID) is a unique number assigned to every business entity in the State of Nevada.For non-Title 7 entities (NT7) , the ID is issued with the State Business License, exception or exemption.

To renew your State Business License, go to the SilverFlume home page at www.nvsilverflume.gov and select Manage Your Business > File Annual List and/or Renew State Business License.

Your State Business License is proof; or you may visit www.nvsos.gov and utilize the Nevada Business Search to verify the status of your business/license.

All businesses operating in Nevada must obtain a State Business License issued by the Nevada Secretary of State. The license is renewable annually. You may apply online or obtain the forms from their website (www.nvsos.gov). 202 North Carson St.

Nevada requires director names and addresses to be listed in the Articles of Incorporation. Nevada does not require officer names and addresses to be listed in the Articles of Incorporation.

To file your Articles of Incorporation, the Nevada Secretary of State charges a minimum filing fee of $75. You must also file the initial list of officers, which costs $150. All corporations doing business in Nevada must also file an annual business license fee, which is $500.

There is no minimum capital requirement to incorporate in Nevada. Nevada requires only minimal disclosure of personal information at the time of start-up and at the time of annual filings. Directors and officers need not live in Nevada, hold meetings in Nevada or be a Nevada resident.

Any person who wishes to operate a business in Unincorporated Clark County is required by Clark County Code to obtain a business license.You may also apply for a general license online. Click on the button below for more information.