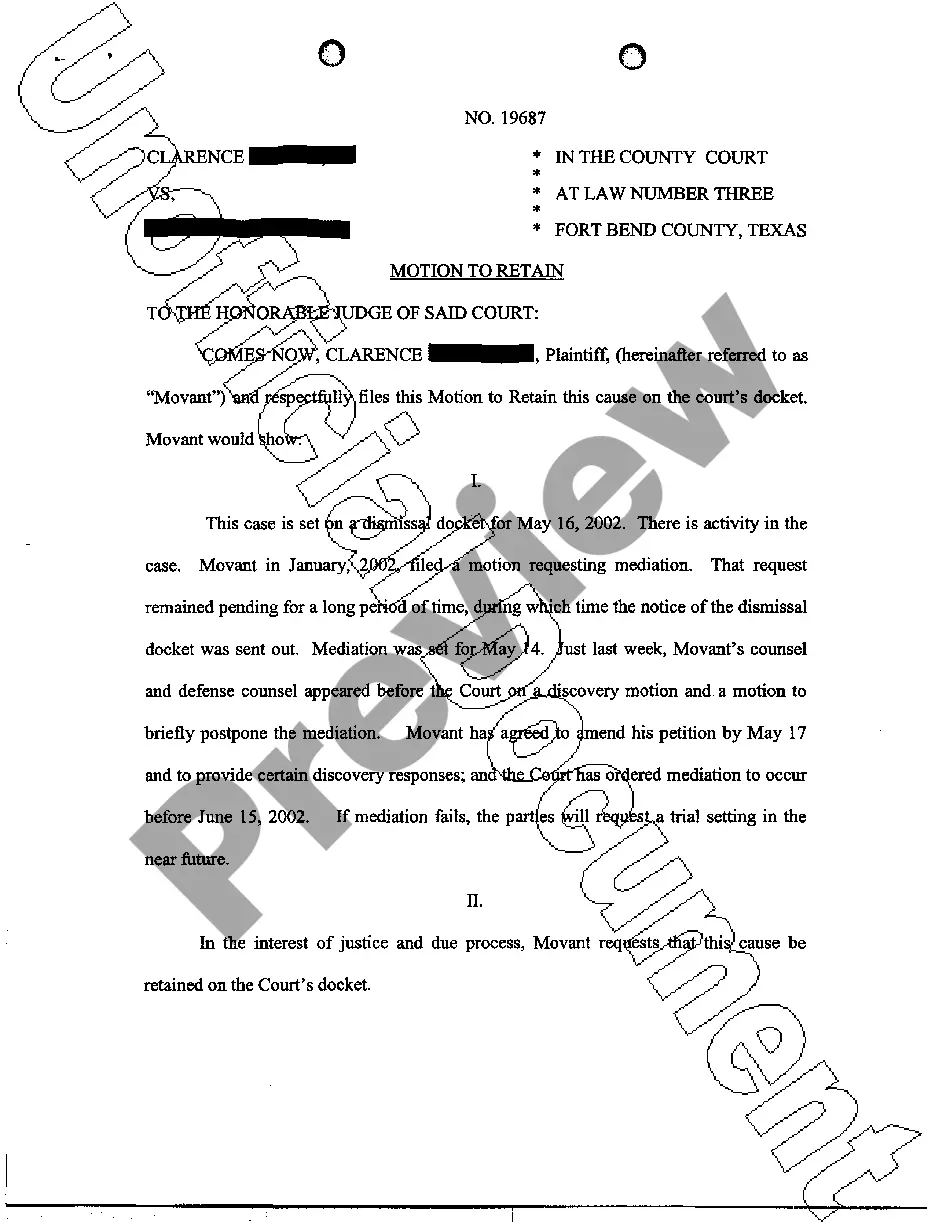

This form is a Fiduciary Deed for the transfer of a condominium. Grantor grants the described property to grantee. This deed complies with all state statutory laws.

Nevada Fiduciary Deed for Condominium

Description

How to fill out Nevada Fiduciary Deed For Condominium?

US Legal Forms is really a special system where you can find any legal or tax form for submitting, including Nevada Fiduciary Deed for Condominium. If you’re tired of wasting time looking for suitable samples and paying money on record preparation/lawyer service fees, then US Legal Forms is precisely what you’re looking for.

To experience all the service’s advantages, you don't need to download any software but just select a subscription plan and sign up your account. If you already have one, just log in and find an appropriate template, save it, and fill it out. Saved files are all saved in the My Forms folder.

If you don't have a subscription but need to have Nevada Fiduciary Deed for Condominium, check out the recommendations below:

- make sure that the form you’re looking at applies in the state you need it in.

- Preview the example its description.

- Click on Buy Now button to get to the register webpage.

- Select a pricing plan and carry on registering by providing some information.

- Choose a payment method to complete the registration.

- Save the file by choosing the preferred format (.docx or .pdf)

Now, submit the file online or print out it. If you feel uncertain regarding your Nevada Fiduciary Deed for Condominium template, speak to a attorney to analyze it before you send or file it. Begin without hassles!

Form popularity

FAQ

A fiduciary deed is used to transfer property when the executor is acting in his official capacity. A fiduciary deed warrants that the fiduciary is acting in the scope of his appointed authority but it does not guarantee title of the property.

States that allow TOD deeds are Alaska, Arizona, Arkansas, California, Colorado, District of Columbia, Hawaii, Illinois, Indiana, Kansas, Maine, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Ohio, Oklahoma, Oregon, South Dakota, Texas, Utah, Virginia, Washington, West Virginia,

Fiduciary deeds are just one of several types of deeds used in property transfers. This type is used to transfer property such as real estate when the owner can't sign a deed for legal or other reasons.The fiduciary is required to act only in the best interests of the owner.

A grant, bargain, and sale deed is commonly used in Nevada for a conveyance of real property.A certificate of the acknowledgement or proof of execution, signed by the person taking the acknowledgment or proof, and under the seal or stamp of that person, will entitle the deed to be recorded (NRS 111.310).

A beneficiary form states who will directly inherit the asset at your death. Under a TOD arrangement, you keep full control of the asset during your lifetime and pay taxes on any income the asset generates as you own it outright. TOD arrangements require minimal paperwork to establish.

A transfer on death deed (TOD) lets a property owner pass land or real estate to a designated beneficiary outside of the probate process.While you can use a last will and testament to transfer your property to someone when you die, it must be proven during probate, which takes time.

Benefits of a California TOD Deed Form Probate Avoidance A transfer-on-death deed allows homeowners to avoid probate at death.Saving Legal Fees Although the goals of a transfer-on-death deed could also be accomplished with a living trust, a transfer-on-death deed provides a less expensive alternative.

The Nevada Deed Upon Death is like a regular deed you might use to transfer real estate located in Nevada, but with a crucial difference: It doesn't take effect until your death. At your death, the real estate goes automatically to the person you named to inherit it, without the need for probate court proceedings.

California mainly uses two types of deeds: the grant deed and the quitclaim deed. Most other deeds you will see, such as the common interspousal transfer deed, are versions of grant or quitclaim deeds customized for specific circumstances.