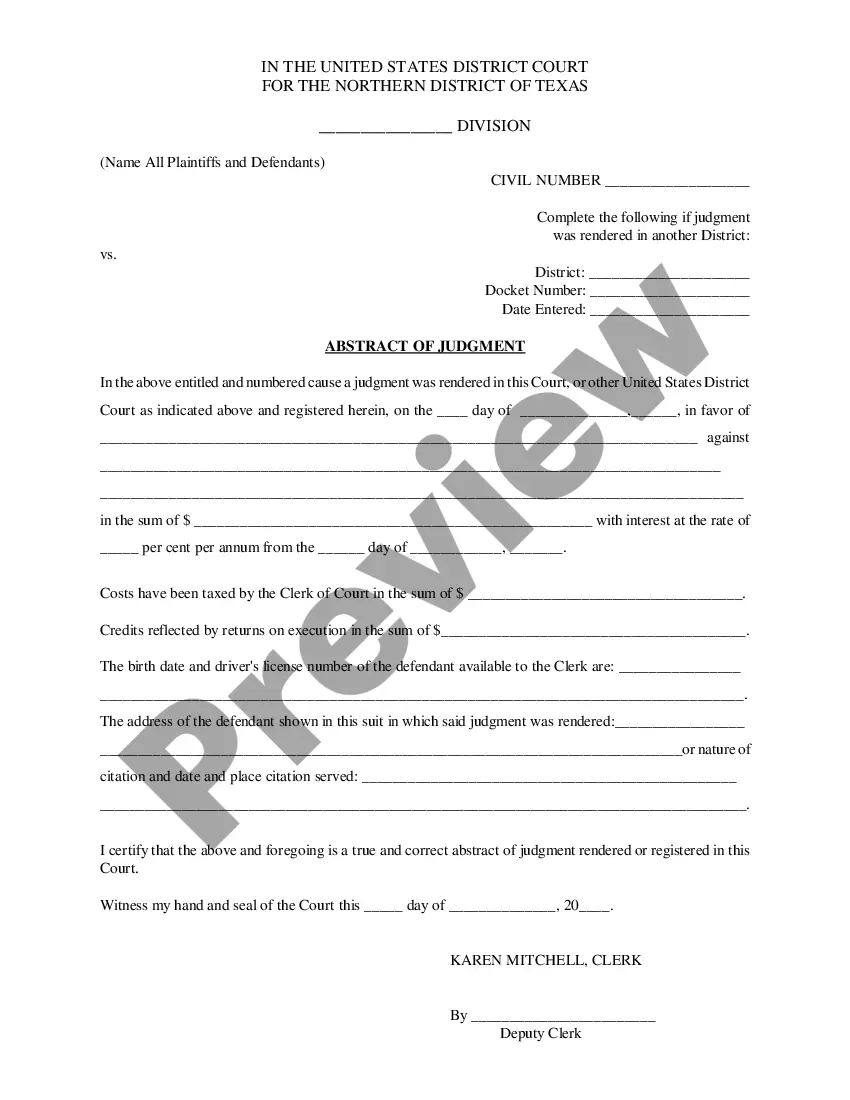

Nevada Notice to Creditors is a document used by a decedent's estate in the state of Nevada to identify and contact creditors of the estate. This document is required by the Nevada Probate Law in order to ensure that all creditors have the opportunity to file claims with the estate. There are two types of Nevada Notice to Creditors: general and individual. The general notice is published in a newspaper and is sent to all known creditors. The individual notice is sent to each creditor personally with a copy of the claim form enclosed. Both types of notices include the decedent's name and address, the name and address of the personal representative, the date of death, the deadline for filing claims, and the address for filing claims.

Nevada Notice to Creditors

Description

How to fill out Nevada Notice To Creditors?

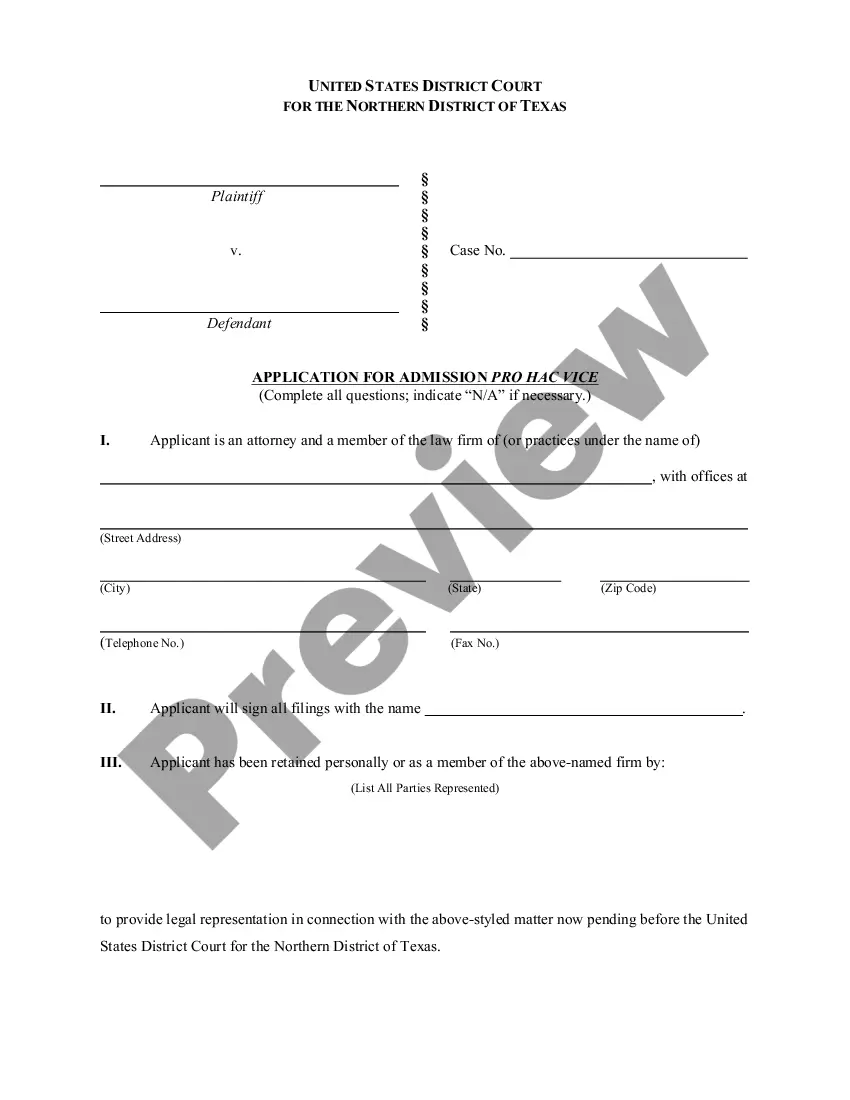

Working with official paperwork requires attention, accuracy, and using well-drafted templates. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your Nevada Notice to Creditors template from our service, you can be sure it complies with federal and state regulations.

Working with our service is easy and quick. To get the necessary paperwork, all you’ll need is an account with a valid subscription. Here’s a quick guideline for you to find your Nevada Notice to Creditors within minutes:

- Make sure to attentively look through the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Look for another official template if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the Nevada Notice to Creditors in the format you prefer. If it’s your first time with our service, click Buy now to proceed.

- Create an account, select your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to obtain your form and click Download. Print the blank or upload it to a professional PDF editor to submit it electronically.

All documents are drafted for multi-usage, like the Nevada Notice to Creditors you see on this page. If you need them in the future, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and accomplish your business and personal paperwork quickly and in total legal compliance!

Form popularity

FAQ

Claims are filed with the Clerk of the Court. In estates worth less than $300,00.00, creditors have 60 days to file claims. NRS 147.040(4), NRS 145.060(1). For estates worth more than $300,000.00, the window is 90 days.

Amended inventories must be filed within 20 days of discovering new assets or debts. A Notice to Creditors must be published in a newspaper and mailed to all known creditors. Depending on the type of probate, creditors have 60 or 90 days in which to respond to a Notice to Creditors.

Nevada Set Aside Procedure The procedure for obtaining a Set Aside in Nevada starts with filing a ?Petition to Set Aside Estate Without Administration? in the local probate court. This petition must include, among other things, whether the Decedent was married and/or had minor children.

How Long Do You Have to File Probate After a Death in Nevada? The will must be filed with the court within 30 days of the person's death even if a petition to file probate is not submitted at the same time. There is no deadline or statute of limitations to file probate in Nevada.