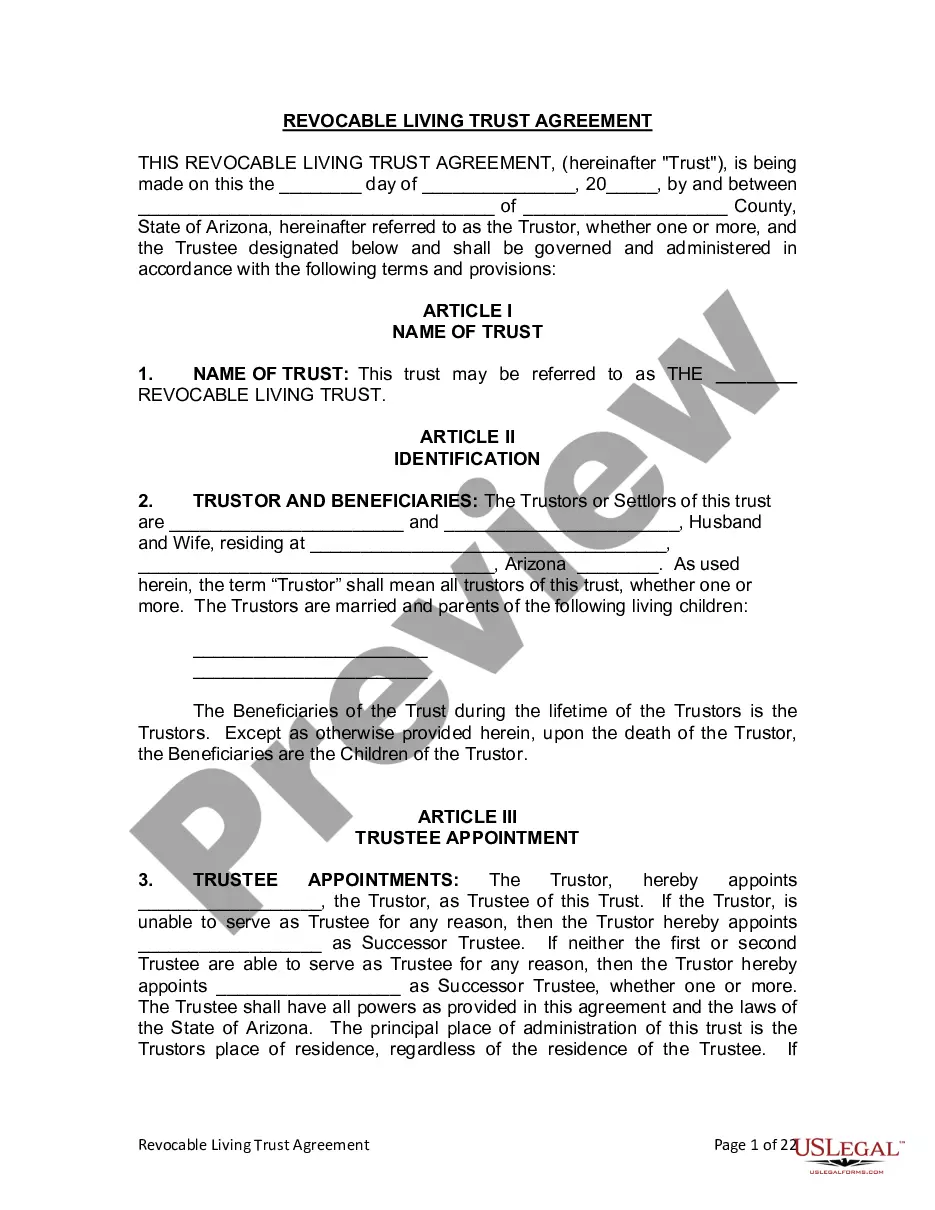

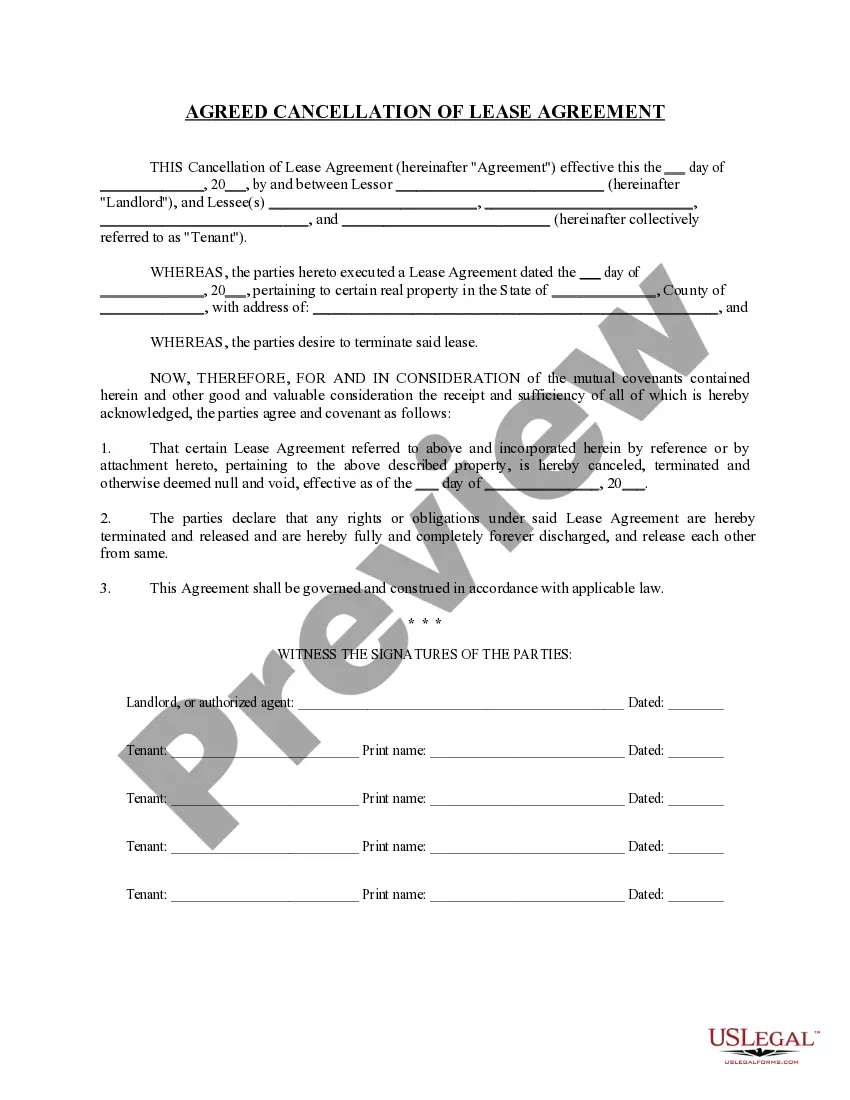

The Nevada Certificate of Business Trust is a legal document which serves as evidence that an individual or entity has established a business trust in the State of Nevada. It is a formal document issued by the Nevada Secretary of State, which includes the name of the trust, the trustees, and any beneficiaries of the trust. The Nevada Certificate of Business Trust outlines the purpose of the trust, its governing documents, and the powers and duties of the trustees. There are two types of Nevada Certificate of Business Trust: the General Certificate of Business Trust and the Limited Certificate of Business Trust. The General Certificate of Business Trust is used when the trust is open-ended and can be used for any purpose. The Limited Certificate of Business Trust is used when the trust is limited to a specific purpose, such as a charitable trust, a revocable trust, or a trust for the benefit of a named beneficiary. Both types of Certificate of Business Trust are issued by the Nevada Secretary of State upon the filing of the trust documents and payment of the filing fee.

Nevada Certificate of Business Trust

Description

How to fill out Nevada Certificate Of Business Trust?

How much time and resources do you normally spend on drafting formal paperwork? There’s a better way to get such forms than hiring legal experts or spending hours searching the web for a proper blank. US Legal Forms is the leading online library that provides professionally designed and verified state-specific legal documents for any purpose, such as the Nevada Certificate of Business Trust.

To get and prepare an appropriate Nevada Certificate of Business Trust blank, follow these easy steps:

- Examine the form content to make sure it meets your state regulations. To do so, read the form description or use the Preview option.

- If your legal template doesn’t satisfy your needs, locate another one using the search tab at the top of the page.

- If you already have an account with us, log in and download the Nevada Certificate of Business Trust. If not, proceed to the next steps.

- Click Buy now once you find the right document. Choose the subscription plan that suits you best to access our library’s full opportunities.

- Register for an account and pay for your subscription. You can make a transaction with your credit card or via PayPal - our service is absolutely secure for that.

- Download your Nevada Certificate of Business Trust on your device and fill it out on a printed-out hard copy or electronically.

Another advantage of our library is that you can access previously downloaded documents that you safely store in your profile in the My Forms tab. Pick them up at any moment and re-complete your paperwork as often as you need.

Save time and effort preparing formal paperwork with US Legal Forms, one of the most reliable web solutions. Sign up for us now!

Form popularity

FAQ

An individual trust typically contains assets such as money or property, but a business trust holds the rights to an individual's stake or interest in a business. As a result, a business trust can be the legal entity that technically owns a business. Business trusts can have one or multiple beneficiaries.

Creating a living trust in Nevada is accomplished when you do two things. You must sign the trust document before a notary. Secondly, you must fund the trust by transferring ownership of your assets to its name. This last step is crucial for the trust to be effective.

Domestic asset protection trust Nevada is widely considered to be the best jurisdiction for a Domestic Asset Protection Trust. It is one of the only states that has a two-year statute of limitations for existing creditors (versus four years in other states).

No. Unlike a Will that does need to be filed with the Clerk of Court within a certain amount of days following the passing of the deceased, a trust can allow you to keep personal financial information out of probate.

A certificate that is trusted by the relying party on the basis of secure and authenticated delivery.

No. Unlike a Will that does need to be filed with the Clerk of Court within a certain amount of days following the passing of the deceased, a trust can allow you to keep personal financial information out of probate.

A certificate of trust ? also called a ?trust certificate? or ?memorandum of trust? ? is a legal document that's often used to prove (or ?certify?) a trust exists and to provide information about its important terms.

A Nevada certification of trust is a document presented by a trustee, either voluntarily or upon request, to any party conducting business with a trustee. In Nevada, the certificate is codified at NRS 164.410.