Nevada (87A) Limited-Liability Limited Partnership Registration (NRS CHAPTER 87A) is the process of registering a limited liability limited partnership (LL LP) in the state of Nevada. An LL LP is a business structure that offers the limited liability of a corporation while allowing the tax benefits of a partnership. By registering an LL LP in Nevada, businesses can take advantage of the state's business-friendly laws and favorable taxes. In order to register an LL LP in Nevada, the business must file a Certificate of Limited Liability Limited Partnership (Form LLC-4) with the Nevada Secretary of State. The LLC-4 must include the name of the LL LP, the address of its registered office, the names and addresses of each of the partners, and the name and address of the agent for service of process. The business must also pay the required filing fee. Once the LL LP is registered, the business must maintain the LL LP in good standing with the Nevada Secretary of State by filing an Annual List of Partners (Form LLC-5) on an annual basis. The LLC-5 must include the name of the LL LP, the names and addresses of each of the partners, and the name and address of the agent for service of process. The business must also pay the required filing fee. The types of Nevada (87A) Limited-Liability Limited Partnership Registration (NRS CHAPTER 87A) are: Certificate of Limited Liability Limited Partnership (Form LLC-4) and Annual List of Partners (Form LLC-5).

Nevada (87A) Limited-Liability Limited Partnership Registration(NRS CHAPTER 87A )

Description

How to fill out Nevada (87A) Limited-Liability Limited Partnership Registration(NRS CHAPTER 87A )?

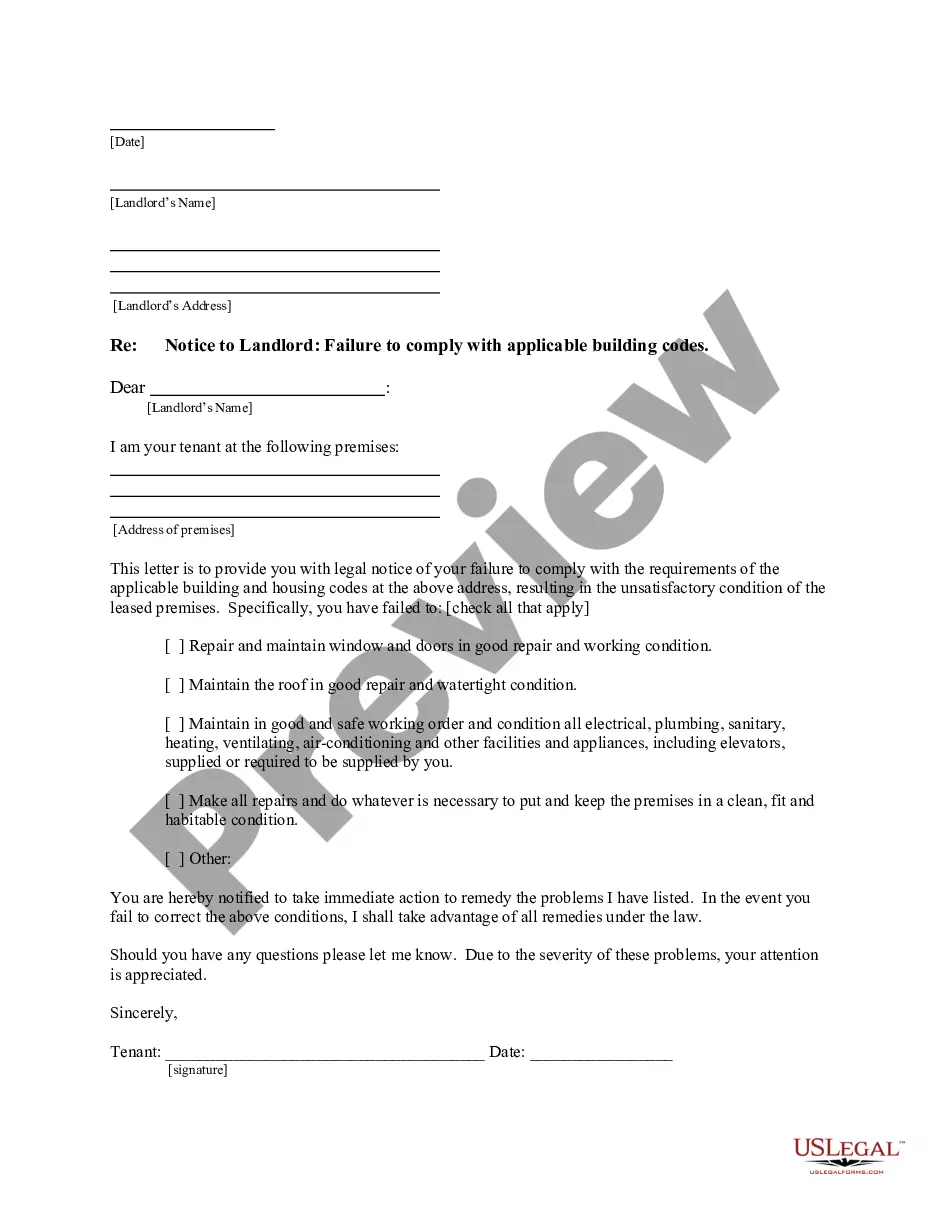

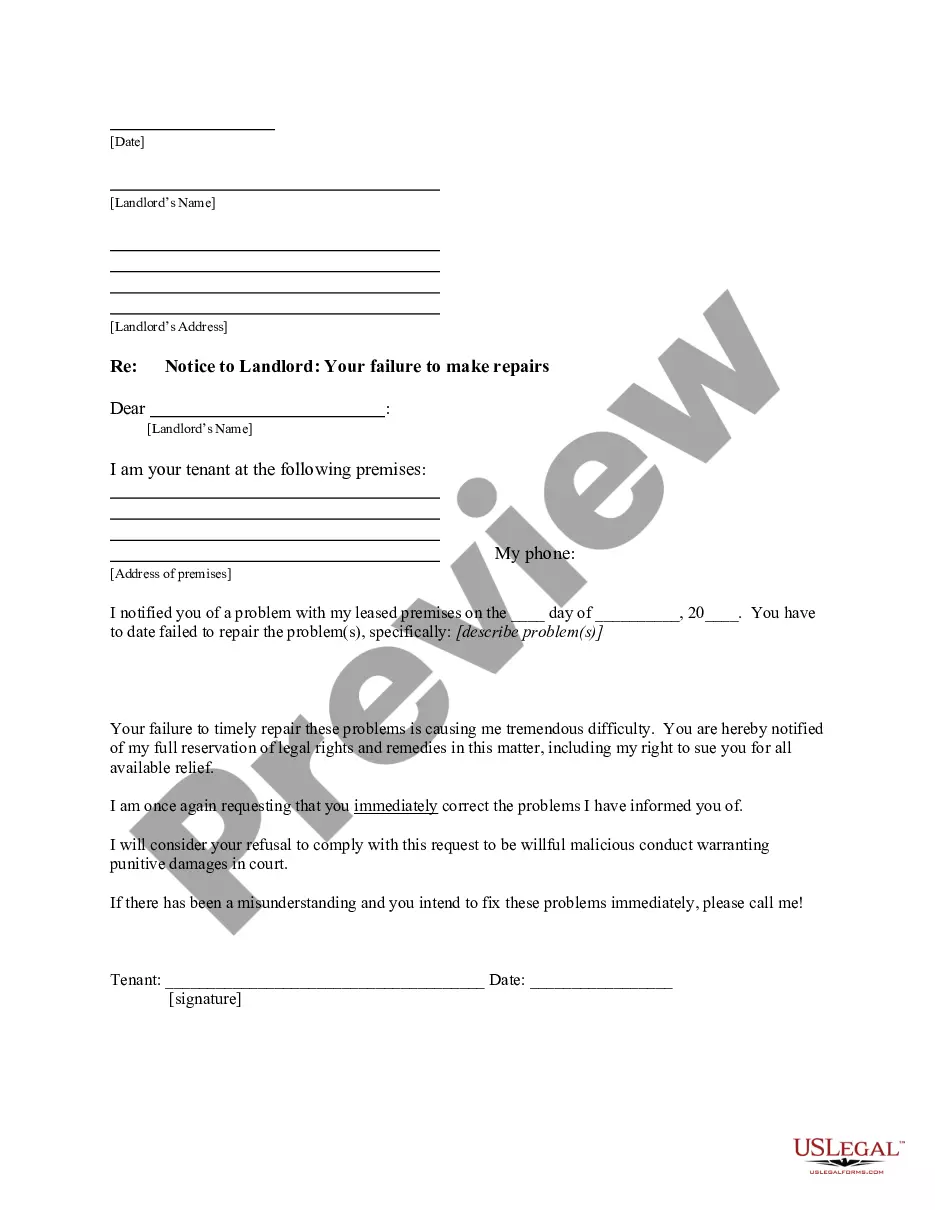

Working with legal paperwork requires attention, precision, and using properly-drafted blanks. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your Nevada (87A) Limited-Liability Limited Partnership Registration(NRS CHAPTER 87A ) template from our library, you can be sure it complies with federal and state laws.

Dealing with our service is simple and quick. To get the required document, all you’ll need is an account with a valid subscription. Here’s a brief guide for you to find your Nevada (87A) Limited-Liability Limited Partnership Registration(NRS CHAPTER 87A ) within minutes:

- Remember to attentively examine the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Search for an alternative formal template if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Nevada (87A) Limited-Liability Limited Partnership Registration(NRS CHAPTER 87A ) in the format you need. If it’s your first experience with our website, click Buy now to proceed.

- Register for an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to save your form and click Download. Print the blank or upload it to a professional PDF editor to submit it paper-free.

All documents are drafted for multi-usage, like the Nevada (87A) Limited-Liability Limited Partnership Registration(NRS CHAPTER 87A ) you see on this page. If you need them one more time, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and prepare your business and personal paperwork quickly and in total legal compliance!

Form popularity

FAQ

Multi-member LLCs can, in most states, be formed by any business. Partners of an LLP have liability protection from other partners' actions and debts. In a multi-member LLC, there are cases where members can be held liable for other members' actions. An LLP can't change its tax classification.

A limited liability partnership (LLP) is a type of partnership where all partners have limited liability. All partners can also partake in management activities. This is unlike a limited partnership, where at least one general partner must have unlimited liability and limited partners cannot be part of management.

An LLC offers personal liability protection from any debts or lawsuits filed against the business for all individual members. With an LLP, partners are personally liable, but only for their own negligence. This means that one partners is not held responsible for the actions of another partner.

A limited liability partnership is similar to a limited liability company (LLC) in that all partners are granted limited liability protection. However, in some states the partners in an LLP get less liability protection than in an LLC. LLP requirements vary from state to state.

Partners in a general partnership have shared liability for the debts and obligations of the business. Every partner agrees to unlimited personal liability for their actions, the actions of all other partners, and those of any and all employees.

Another difference between the two Chapters would be that Chapter 88 requires a dissolution date for your LP, while 87A allows for your limited partnership to exist forever. Regardless of the type of limited partnership, the partnership must register as such with the Nevada Secretary of State.

If you decide to form a partnership in Nevada, there are a few mandatory steps you must go through in order to properly create the partnership. Step 1: Select a business name.Step 2: File trademark on business name.Step 3: Complete required paperwork.Step 4: Determine if you need an EIN, additional licenses, or tax IDs.