Nevada (88) Foreign Limited Partnership Registration (NRS CHAPTER88) is a registration process that allows a foreign limited partnership to do business within the state of Nevada. It is a set of requirements that the partners must meet in order to be legally recognized as a Nevada foreign limited partnership. The process includes filing certain forms with the Nevada Secretary of State which detail the name of the partnership, the address of the principal office, the names and addresses of the partners, and other pertinent information. Foreign limited partnerships must also pay a filing fee and keep the NV SOS informed of any changes to the partnership. There are two types of Nevada (88) Foreign Limited Partnership Registration (NRS CHAPTER88): the Standard Registration and the Expedited Registration. The Standard Registration requires that a limited partnership file the certificate of registration with the Nevada Secretary of State. The Expedited Registration allows the partnership to be registered in as little as 24 hours.

Nevada (88) Foreign Limited Partnership Registration(NRS CHAPTER88)

Description

How to fill out Nevada (88) Foreign Limited Partnership Registration(NRS CHAPTER88)?

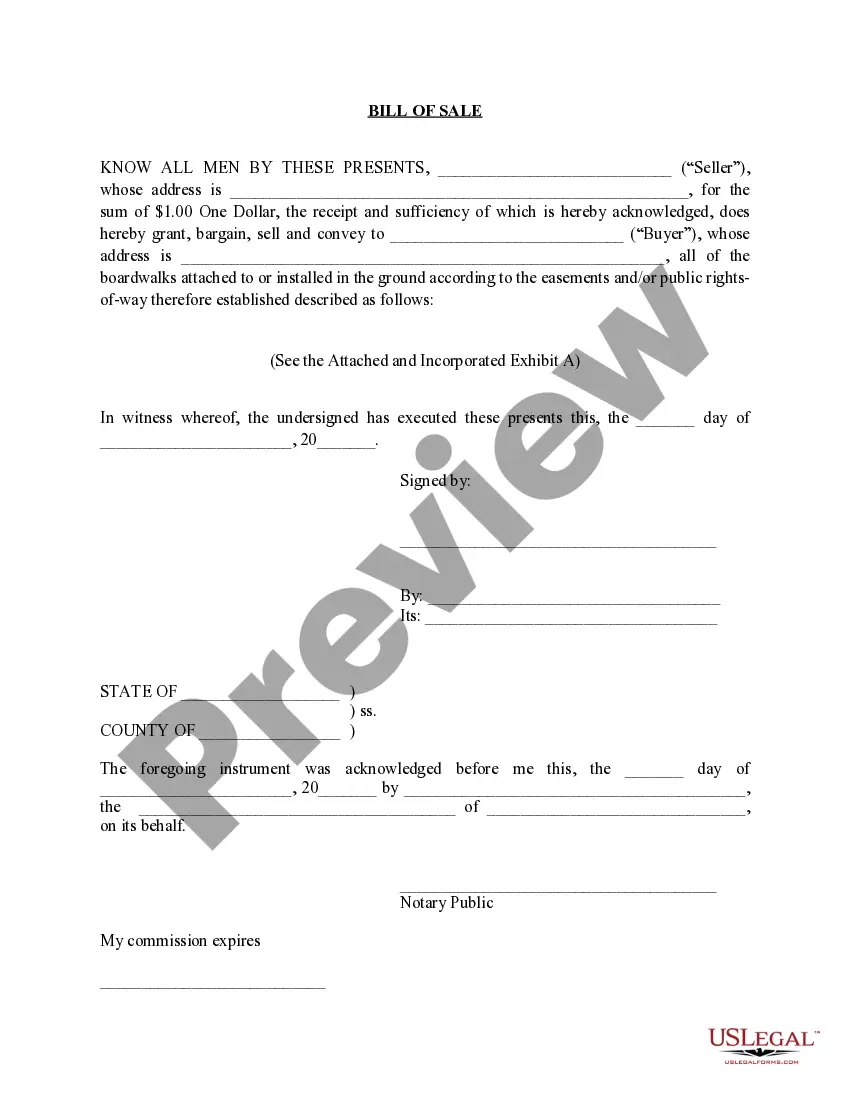

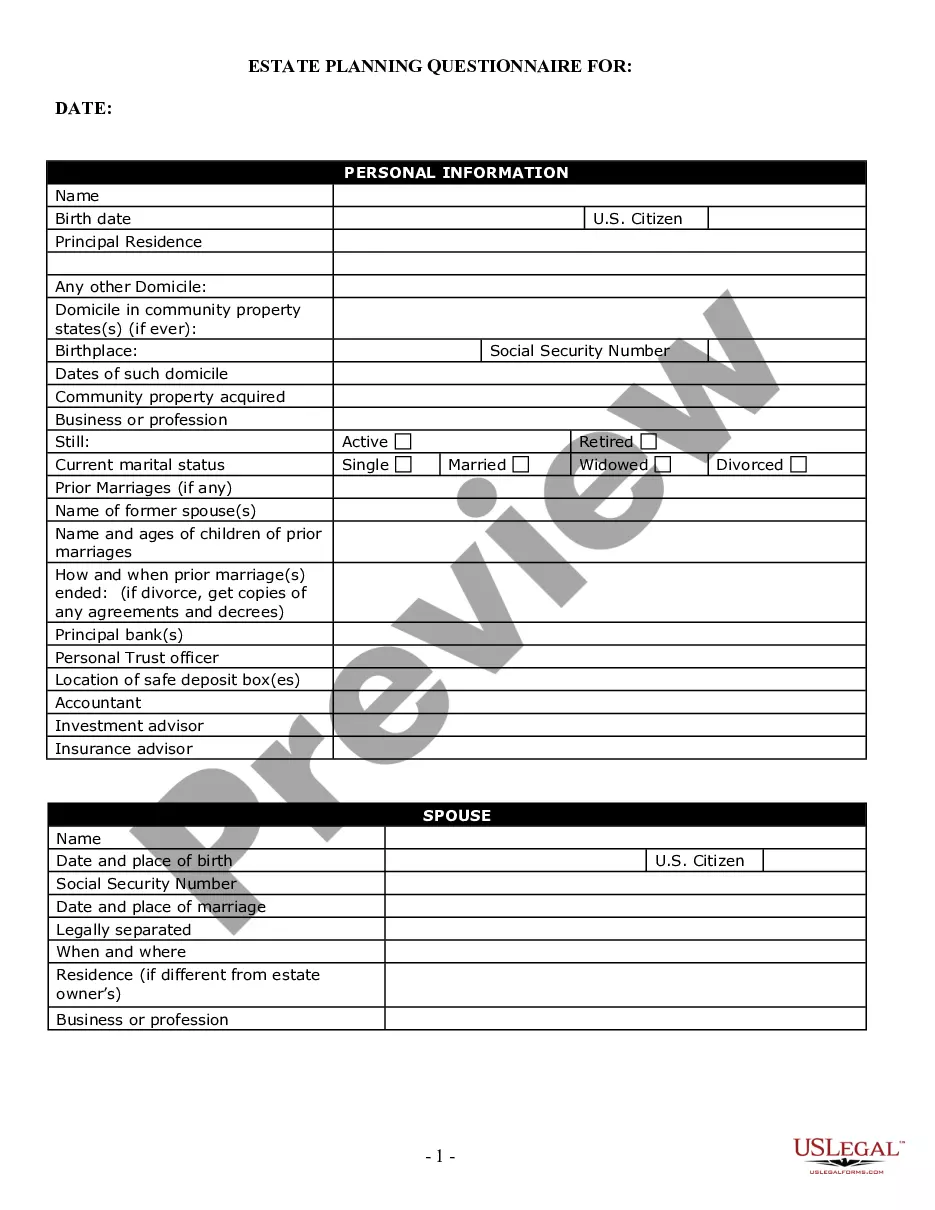

Preparing legal paperwork can be a real burden unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you obtain, as all of them correspond with federal and state regulations and are verified by our specialists. So if you need to prepare Nevada (88) Foreign Limited Partnership Registration(NRS CHAPTER88), our service is the best place to download it.

Obtaining your Nevada (88) Foreign Limited Partnership Registration(NRS CHAPTER88) from our catalog is as easy as ABC. Previously authorized users with a valid subscription need only sign in and click the Download button after they locate the proper template. Later, if they need to, users can get the same blank from the My Forms tab of their profile. However, even if you are unfamiliar with our service, registering with a valid subscription will take only a few minutes. Here’s a brief instruction for you:

- Document compliance check. You should carefully review the content of the form you want and make sure whether it satisfies your needs and complies with your state law regulations. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). If you find any inconsistencies, browse the library using the Search tab above until you find a suitable blank, and click Buy Now once you see the one you need.

- Account registration and form purchase. Create an account with US Legal Forms. After account verification, log in and choose your most suitable subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your Nevada (88) Foreign Limited Partnership Registration(NRS CHAPTER88) and click Download to save it on your device. Print it to complete your paperwork manually, or take advantage of a multi-featured online editor to prepare an electronic version faster and more efficiently.

Haven’t you tried US Legal Forms yet? Subscribe to our service today to get any official document quickly and easily every time you need to, and keep your paperwork in order!

Form popularity

FAQ

Another difference between the two Chapters would be that Chapter 88 requires a dissolution date for your LP, while 87A allows for your limited partnership to exist forever. Regardless of the type of limited partnership, the partnership must register as such with the Nevada Secretary of State.

Partners in a general partnership have shared liability for the debts and obligations of the business. Every partner agrees to unlimited personal liability for their actions, the actions of all other partners, and those of any and all employees.

In a Nevada general partnership, taxes are straightforward. For tax purposes, the partnership's income will be passed directly to you and your partners. This means you do not have to pay a separate corporate income tax like you would with a corporation.

You don't have to file paperwork to establish a partnership?you create a partnership simply by agreeing to go into business with another person. While you can form a partnership without formally filing or registering the entity, partnerships must comply with licensing and tax requirements that apply to all businesses.

GENERAL PARTNERSHIP General Partnerships are not required to file formation documents with the Secretary of State's office. However, a Nevada State Business License or Notice of Exemption is required before conducting business in the state of Nevada.

Steps to Create a Nevada General Partnership Determine if you should start a general partnership. Choose a business name. File a DBA name (if needed) Draft and sign partnership agreement. Obtain licenses, permits, and clearances. Get an Employer Identification Number (EIN) Get Nevada state tax identification numbers.

Forming a Business Partnership? 6 Things to Consider First Make sure you share similar values.Set clear expectations from the start.Outline how you'll manage business finances.Decide what type of legal partnership you'll choose.Decide how you'll handle partnership dissolution.Have an attorney draw up legal documents.

If you decide to form a partnership in Nevada, there are a few mandatory steps you must go through in order to properly create the partnership. Step 1: Select a business name.Step 2: File trademark on business name.Step 3: Complete required paperwork.Step 4: Determine if you need an EIN, additional licenses, or tax IDs.