This form is a deed of trust modification. It is to be entered into by a borrower, co-grantor, and the lender. The agreement modifies the mortgage or deed of trust to secure a debt described within the agreement. Other provisions include: renewal and extension of the lien, co-grantor liability, and note payment terms.

Nevada Change or Modification Agreement of Deed of Trust

Description

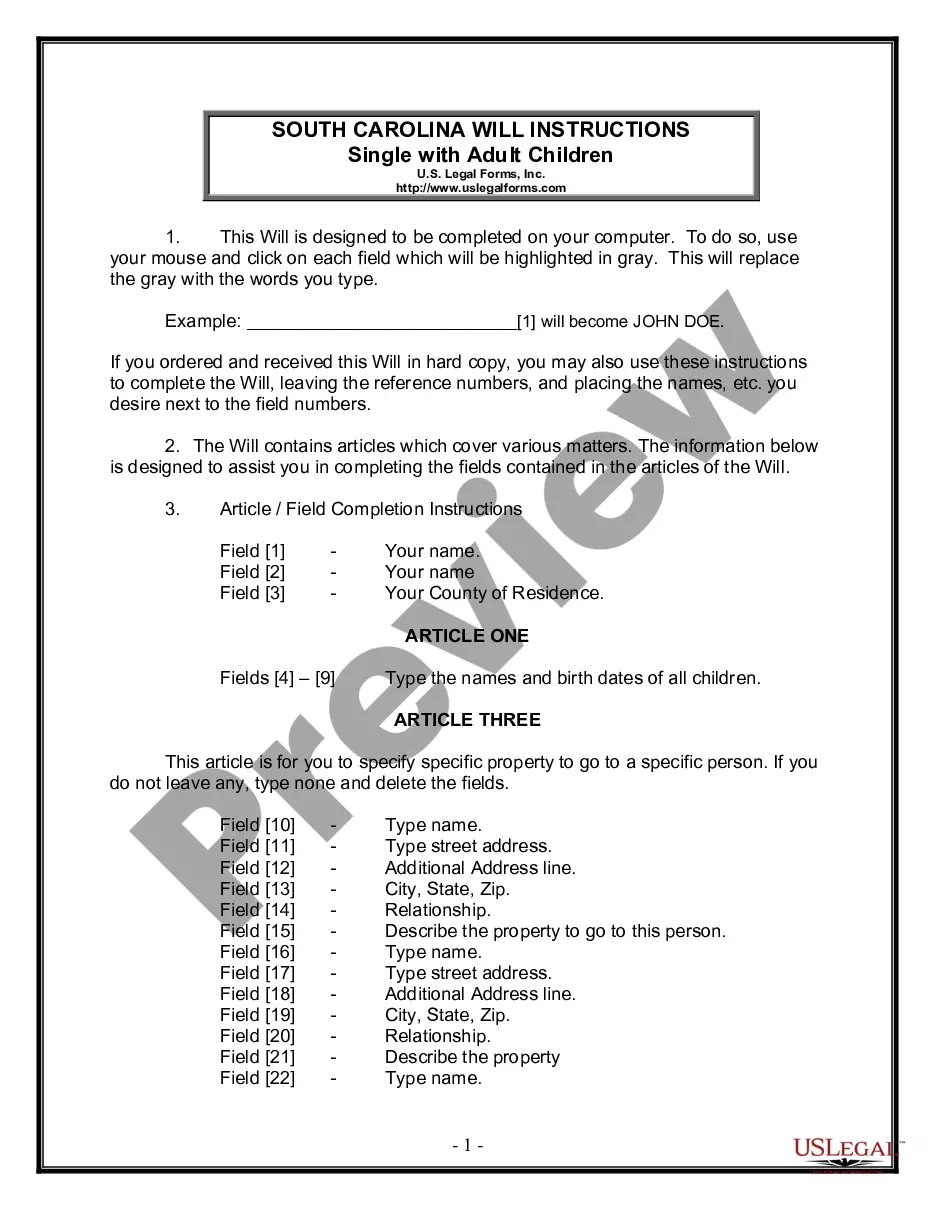

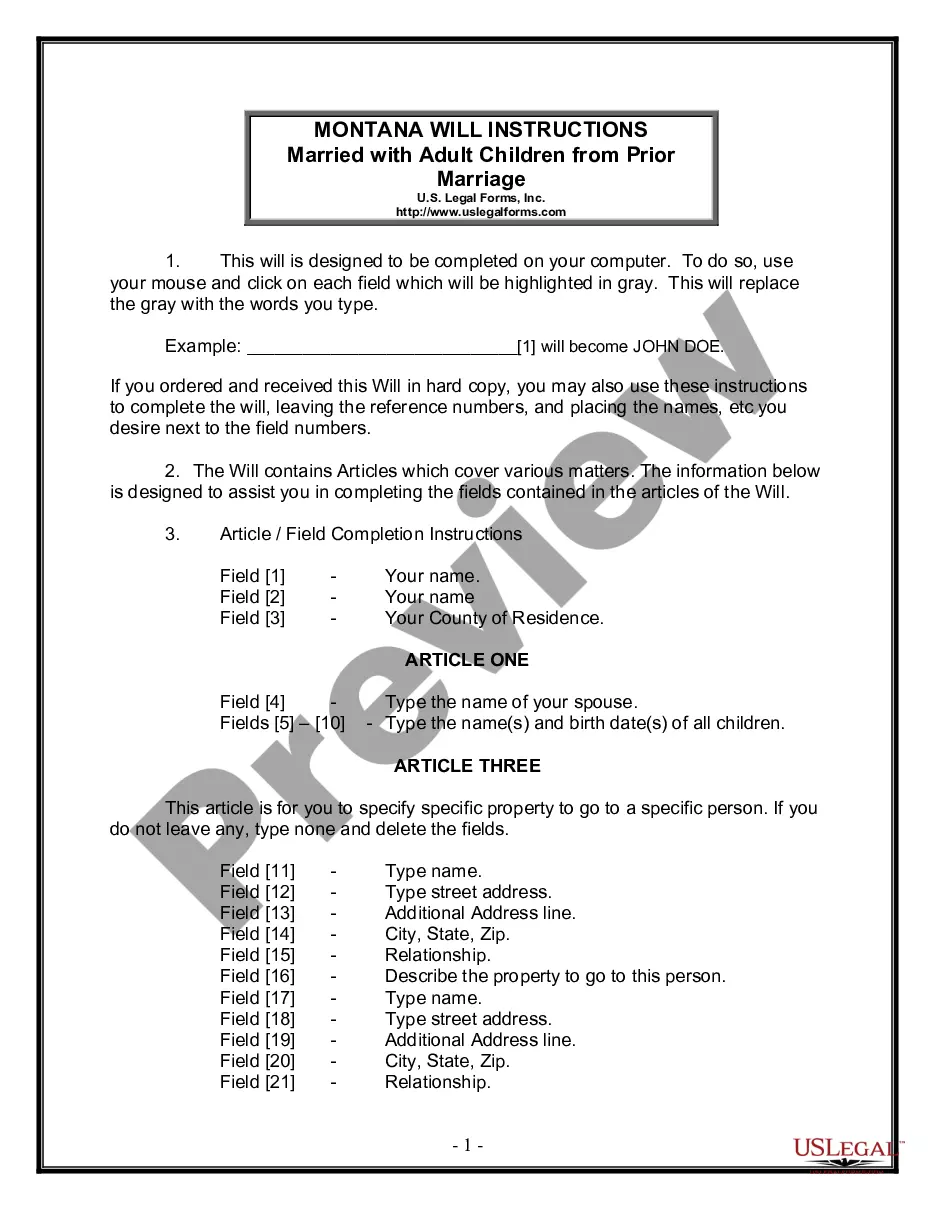

How to fill out Change Or Modification Agreement Of Deed Of Trust?

Are you presently in a placement where you need papers for sometimes enterprise or individual uses just about every time? There are plenty of legitimate record layouts accessible on the Internet, but discovering versions you can rely on isn`t effortless. US Legal Forms offers thousands of form layouts, just like the Nevada Change or Modification Agreement of Deed of Trust, that happen to be published to fulfill federal and state requirements.

When you are currently informed about US Legal Forms site and have your account, simply log in. Following that, you are able to down load the Nevada Change or Modification Agreement of Deed of Trust design.

Should you not have an account and wish to begin using US Legal Forms, adopt these measures:

- Obtain the form you want and make sure it is to the appropriate city/region.

- Take advantage of the Preview button to analyze the shape.

- Look at the explanation to actually have chosen the right form.

- In case the form isn`t what you`re trying to find, make use of the Research industry to obtain the form that meets your requirements and requirements.

- Once you get the appropriate form, simply click Get now.

- Opt for the prices prepare you would like, complete the necessary details to create your account, and purchase the order making use of your PayPal or bank card.

- Decide on a handy data file file format and down load your duplicate.

Get each of the record layouts you have purchased in the My Forms menus. You can get a extra duplicate of Nevada Change or Modification Agreement of Deed of Trust any time, if needed. Just click the needed form to down load or produce the record design.

Use US Legal Forms, the most comprehensive collection of legitimate types, to conserve some time and stay away from errors. The services offers appropriately created legitimate record layouts which can be used for an array of uses. Make your account on US Legal Forms and commence producing your lifestyle easier.

Form popularity

FAQ

The easiest method to make a change is to amend the trust to the extent allowed by the trust instrument. Irrevocable trusts cannot usually be amended; however, some irrevocable trusts permit administrative amendments, which do not change beneficiaries but simply change some of the trust's administrative provisions.

A deed of trust is an instrument with transfer title to a trustee as security for a loan.

Modifications of a note secured by a trust deed usually arise out of a financial necessity experienced by the owner of the secured property. However, for an oral modification to be enforceable, both the lender and the borrower must put the oral modification into effect by taking action on it, called execution.

Also, the statute of limitations on a contract is 6 years on a ?contract, obligation or liability founded upon an instrument in writing: NRS 11.190(1)(b). However, the statute of limitations on a mortgage or deed of trust is 10 years. NRS 106.240.

What is the difference between a deed of trust and a mortgage? The mortgage only includes the borrower and the lender while a deed of trust will include the deed of trust will include the borrower, the lender, and the trustee.

Deed of Trust Modification means, with respect to any Deed of Trust, a modification agreement entered into between the Borrower or the Project Owner, as applicable, and the Lender, modifying the terms and conditions of the Deed of Trust in order to (i) add to the lien of the Deed of Trust Additional Lots, or (ii) make ...

Unlike many other states, Nevada allows trustees and beneficiaries to modify irrevocable trusts. With some limits under the law, as long as the trustor, trustee, and beneficiaries agree to the modifications, the process can be relatively straightforward.

A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.