Partnerships may be dissolved by acts of the partners, order of a Court, or by operation of law. From the moment of dissolution, the partners lose their authority to act for the firm.

From the moment of dissolution, the partners lose their authority to act for the firm except as necessary to wind up the partnership affairs or complete transactions which have begun, but not yet been finished.

A partner has the power to withdraw from the partnership at any time. However, if the withdrawal violates the partnership agreement, the withdrawing partner becomes liable to the co partners for any damages for breach of contract. If the partnership relationship is for no definite time, a partner may withdraw without liability at any time.

DISSOLUTION BY ACT OF THE PARTIES

A partnership is dissolved by any of the following events:

* agreement by and between all partners;

* expiration of the time stated in the agreement;

* expulsion of a partner by the other partners; or

* withdrawal of a partner.

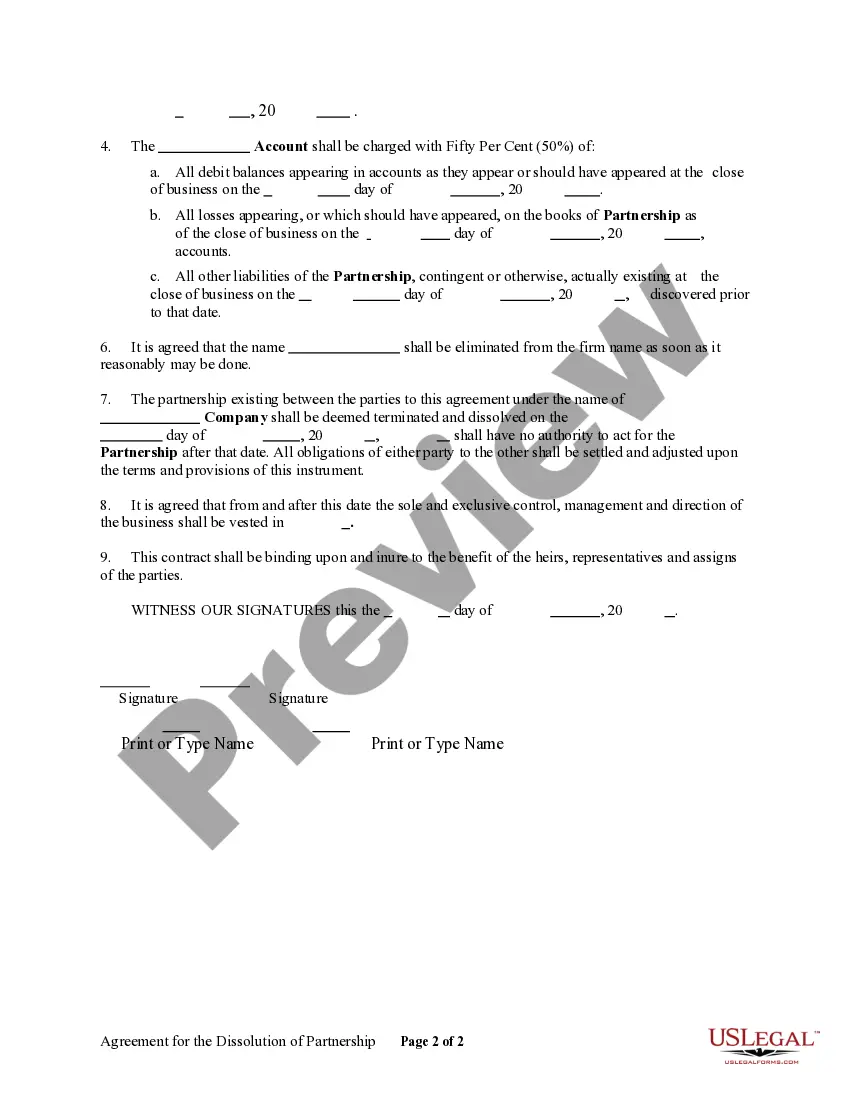

The Nevada Agreement for the Dissolution of a Partnership refers to a legally binding document that outlines the process of ending a business partnership in the state of Nevada. This agreement serves as a crucial resource for partners to navigate the dissolution process and resolve various aspects related to the termination of their partnership. The agreement typically begins by clearly identifying the partners involved in the dissolution, including their full names, addresses, and any other relevant details. It also mentions the name and address of the partnership itself, ensuring there is no confusion regarding the specific business entity being dissolved. Next, the agreement proceeds to outline the terms and conditions of the dissolution. This includes specifying the date when the partnership will officially dissolve and the effective date from which the dissolution will become applicable. The agreement may also contain provisions regarding the division and distribution of partnership assets, liabilities, and debts. In some cases, the agreement may emphasize the responsibilities of each partner in settling outstanding debts and obligations. Partners may agree upon a certain timeframe within which these matters must be resolved or establish specific procedures for handling outstanding financial matters individually or collaboratively. Additionally, the agreement may address the allocation of partnership profits and losses, including any residual profits or losses resulting from the dissolution process. Partners often agree on an equitable distribution formula to divide these remaining assets, ensuring a fair outcome for all parties involved. Furthermore, the Nevada Agreement for the Dissolution of a Partnership may explicitly state that the partnership will cease to conduct any new business activities after the dissolution date, setting a clear demarcation between PRE- and post-dissolution operations. It is worth noting that there are different types of Nevada agreements for the dissolution of a partnership, including voluntary and involuntary dissolution. A voluntary dissolution occurs when partners mutually agree to terminate the partnership, usually due to various reasons such as retirement, financial difficulties, or pursuing individual business ventures. Conversely, an involuntary dissolution occurs when a partner is expelled from the partnership against their will, or when certain legal circumstances arise, such as a partner's bankruptcy or death. In conclusion, the Nevada Agreement for the Dissolution of a Partnership is a comprehensive and legally binding document that governs the termination of a business partnership in the state of Nevada. It covers key aspects related to the dissolution, including partner identification, dissolution dates, asset and liability distribution, debt settlement, profit and loss allocation, and the discontinuation of business activities. Different types of dissolution agreements exist based on the circumstances under which the partnership is dissolved, including voluntary and involuntary dissolution.