Sample Letter to Nevada State Tax Commission Concerning Decedent's Estate [Your Name] [Your Address] [City, State, ZIP] [Email Address] [Phone Number] [Date] Nevada State Tax Commission [Address] [City, State, ZIP] Subject: Request for Information and Guidance regarding Decedent's Estate Taxes Dear Nevada State Tax Commission, I am writing to seek your guidance and assistance in understanding the tax obligations and requirements associated with the estate of a deceased individual in Nevada. I am the executor of the estate of [Decedent's Full Name], who passed away on [Date of Death], and I am responsible for fulfilling all tax-related obligations on behalf of the estate. I kindly request you to provide information and instructions on the following matters: 1. Estate Tax Return Filing Requirements: a. Please outline the criteria that determine whether the estate of a deceased individual in Nevada is liable to file an estate tax return. b. Provide guidance on the due date for filing the estate tax return and any applicable extensions. c. Clarify the necessary forms and documents that must accompany the estate tax return as per Nevada state requirements. 2. Estate Tax Rate and Deductions: a. Inform me about the current estate tax rates applicable in Nevada. b. Provide details regarding any deductions or exemptions available for the estate, such as the spousal exemption or credits related to charitable bequests. 3. Payment of Estate Taxes: a. Explain the process for calculating and remitting estate taxes owed to the Nevada State Tax Commission. b. Provide information regarding acceptable payment methods and any associated forms or documentation required. 4. Estate Tax Closing Letter: a. Clarify the procedure for obtaining an estate tax closing letter from the Nevada State Tax Commission once all estate tax obligations have been fulfilled. Additionally, if there are any additional considerations, exemptions, or specific guidelines that apply to Nevada state taxes for decedent's estates, please provide details to ensure that I can comply with all necessary regulations. I would be grateful for any resources, publications, or forms that you could provide to assist me in navigating the tax obligations of the estate. Any examples of previously submitted estate tax returns specific to Nevada would also be greatly appreciated, as they would help me ensure accurate completion of the required forms. Thank you for your attention to this matter. I look forward to your prompt response and guidance. Please feel free to contact me at [Your Phone Number] or [Your Email Address] if you require any additional information. Yours sincerely, [Your Name]

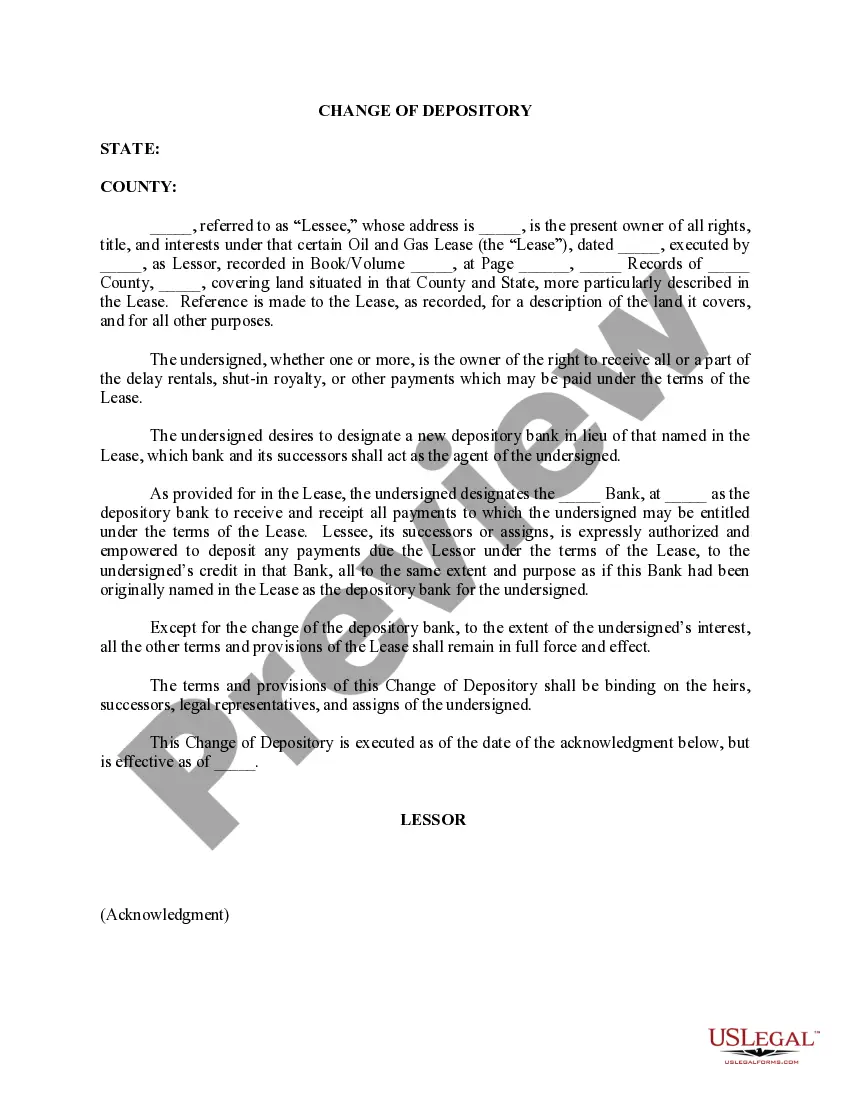

Nevada Sample Letter to State Tax Commission concerning Decedent's Estate

Description

How to fill out Nevada Sample Letter To State Tax Commission Concerning Decedent's Estate?

Choosing the right legal file format might be a struggle. Needless to say, there are plenty of web templates accessible on the Internet, but how do you discover the legal type you require? Take advantage of the US Legal Forms site. The support delivers a large number of web templates, like the Nevada Sample Letter to State Tax Commission concerning Decedent's Estate, which you can use for business and private needs. Each of the kinds are inspected by experts and fulfill state and federal demands.

When you are previously authorized, log in to the accounts and click the Acquire switch to obtain the Nevada Sample Letter to State Tax Commission concerning Decedent's Estate. Make use of accounts to search throughout the legal kinds you have bought previously. Visit the My Forms tab of your accounts and get yet another version of your file you require.

When you are a brand new customer of US Legal Forms, listed here are easy directions so that you can stick to:

- First, be sure you have selected the appropriate type for your city/region. It is possible to look through the form making use of the Preview switch and study the form information to ensure this is the best for you.

- When the type fails to fulfill your requirements, utilize the Seach industry to obtain the proper type.

- Once you are positive that the form is suitable, click on the Buy now switch to obtain the type.

- Opt for the rates prepare you would like and enter the essential information. Build your accounts and pay for an order utilizing your PayPal accounts or Visa or Mastercard.

- Pick the document formatting and down load the legal file format to the device.

- Comprehensive, change and produce and sign the obtained Nevada Sample Letter to State Tax Commission concerning Decedent's Estate.

US Legal Forms will be the greatest collection of legal kinds where you can discover different file web templates. Take advantage of the company to down load appropriately-manufactured documents that stick to state demands.

Form popularity

FAQ

Testamentary trust example ing to the trust terms you laid out, after your death, your best friend will manage the trust funds and make decisions in your child's best interest until they reach the age of 25. At that point, the trust will terminate, and your child will receive the money.

Time Limits for Notice to Creditors in Deceased Estates Creditor claims are filed with the Clerk of Court in the county where the deceased person lived. If the value of the estate is less than $300,000, creditors have 60 days to file a claim. If the estate is worth more than $300,000, creditors have 90 days.

CLOSING THE ESTATE A Nevada estate can be closed when the assets are ready for distribution and all creditor claims have been paid or are barred by law. The estate cannot be closed if: There is pending litigation involving the estate. Assets need to be sold before distribution.

The administrator of the estate is usually named in the letters. Special letters of administration, on the other hand, are issued by the court for an estate only in certain circumstances specified under Nevada law. They include: where letters of administration have been granted irregularly.

A Letter of Testamentary is a document granted to the Executor of an estate by the probate court. This document gives the Executor the authority he or she will need to formally act on behalf of the decedent. It gives the right to handle financial and other affairs related to closing out the estate.

Letters of Testamentary, also called Letters of Administration or Letters of Representation, is a document issued by the probate court. The document grants the authority to an estate administrator, executor or personal representative to manage the deceased taxpayer's affairs and estate.

Otherwise known as a letter of intent, a letter of instruction is designed to provide the executor of the Will and anyone else who may need to interpret the contents with an easy-to-understand explanation of the deceased's intentions.

If you apply for the transcript online, the IRS will mail it to the decedent's last known address. To get the transcript mailed to you, you must file Form 4506-T (Request for Transcript of Tax Return). To find out how much they owed in back taxes, contact the closest Taxpayer Assistance Center for a payoff number.