Nevada Corporation - Resolution

Description

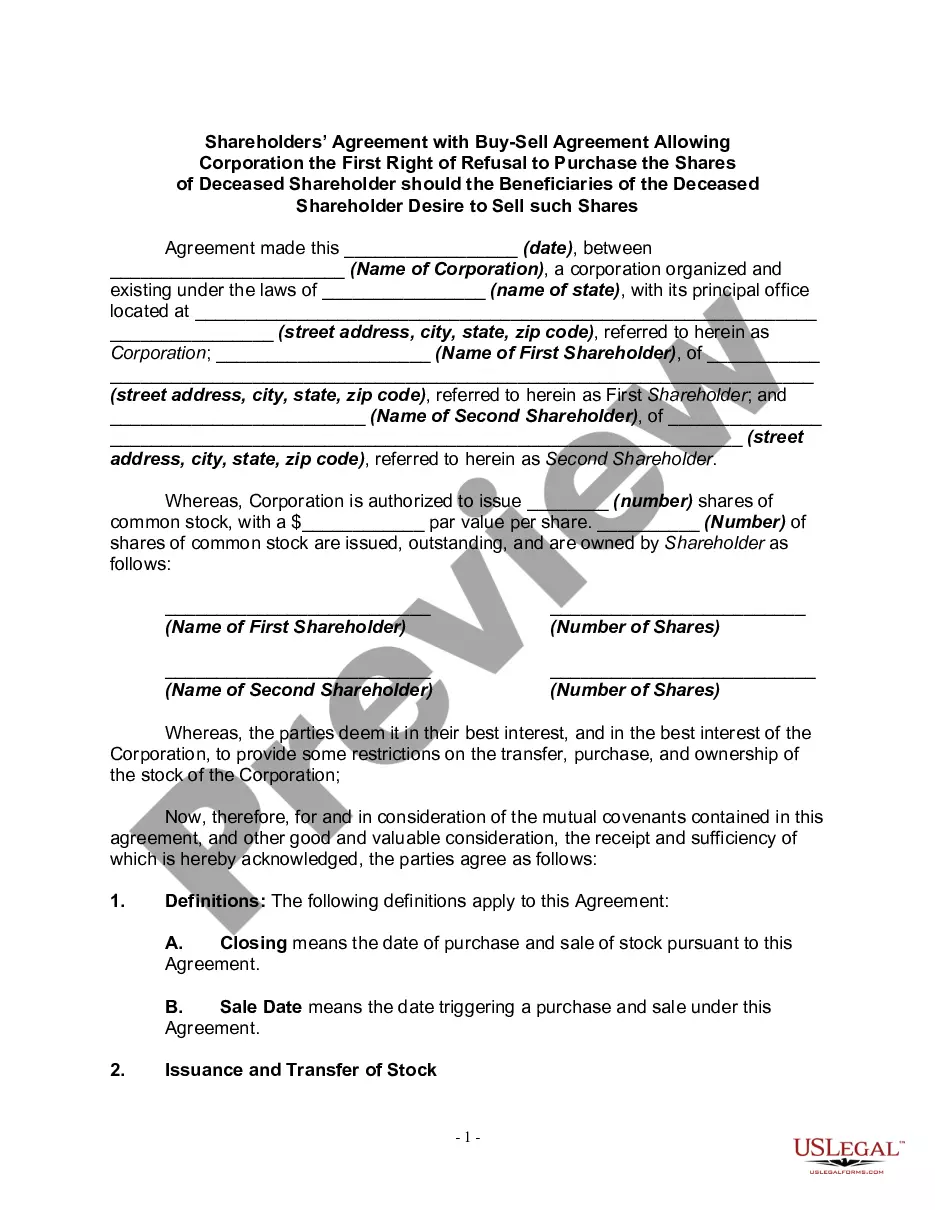

How to fill out Corporation - Resolution?

Selecting the optimal legal document design can be quite challenging.

Naturally, there are numerous templates accessible online, but how do you obtain the legal type you need? Utilize the US Legal Forms website.

The service provides thousands of templates, such as the Nevada Corporation - Resolution, which can be utilized for both business and personal purposes.

You can view the form using the Preview button and examine the form's summary to confirm it is indeed the right one for you.

- All of the varieties are reviewed by experts and satisfy state and federal requirements.

- If you are already registered, Log In to your account and then click the Acquire button to obtain the Nevada Corporation - Resolution.

- Use your account to browse through the legal templates you have previously acquired.

- Navigate to the My documents section of your account and download an additional copy of the documents you need.

- If you are a new user of US Legal Forms, here are straightforward instructions that you should adhere to.

- First, ensure that you have selected the appropriate type for your specific city/region.

Form popularity

FAQ

The Nevada Internal Affairs Doctrine states that the internal affairs of a corporation are governed by the law of the state where the corporation is incorporated. This doctrine plays a crucial role in determining applicable corporate governance rules and emphasizes the importance of adhering to Nevada Corporation laws. Understanding this doctrine can aid directors and shareholders in making informed decisions.

The Nevada corporate opportunity doctrine ensures that directors and officers must prioritize the interests of the corporation over personal gain. This doctrine prohibits directors from taking business opportunities that could benefit the corporation without proper disclosure and approval. Knowing this doctrine is vital for any Nevada Corporation to avoid legal pitfalls.

Section 78.315 of the Nevada General Corporation Law outlines the obligations of directors regarding corporate opportunities and conflicts of interest. This statute clarifies how directors should handle situations where a potential opportunity arises that could benefit both the corporation and themselves. Understanding this section is crucial for maintaining compliance within your Nevada Corporation.

The corporate opportunity doctrine is a legal rule that prevents company directors from pursuing opportunities that rightfully belong to the corporation. Directors have a fiduciary duty to act in the best interest of the Nevada Corporation, ensuring that potential business opportunities benefit the company first and foremost. Violating this doctrine can lead to legal consequences.

The theory of corporate opportunity addresses the rights of a corporation regarding business opportunities. This legal principle states that corporate directors cannot take a business opportunity for themselves if it belongs to the corporation. It emphasizes the duty of loyalty to the Nevada Corporation and encourages transparency in decision-making.

Yes, S Corporations do typically require corporate resolutions. A corporate resolution serves as a formal record of decisions made by the corporation’s directors or shareholders. These resolutions ensure compliance with laws governing Nevada Corporations and provide documentation for significant business decisions.

Closing your Nevada MBT account involves submitting a final tax return and checking for any outstanding balances. You will also need to notify the Nevada Department of Taxation that you wish to terminate your account. By ensuring that you follow these steps for your Nevada Corporation, you can avoid future obligations. Our platform, U.S. Legal Forms, can help you navigate the closure process effectively.

To obtain a corporate resolution for your Nevada Corporation, you first need to understand the specific decisions that require a resolution. Generally, you can draft a resolution document stating the details and decisions made by the board or shareholders. If you're uncertain about how to create this document, U.S. Legal Forms provides templates and guidance, ensuring that your resolution meets all legal requirements.

To officially close a Nevada corporation, you need to file Articles of Dissolution with the Secretary of State. Ensure that you settle any outstanding debts and obligations before you file. Completing this for your Nevada Corporation can help you avoid any future tax liabilities. U.S. Legal Forms offers resources to help you understand the process and complete the necessary forms.

To obtain a copy of the articles of incorporation for your Nevada Corporation, you can visit the Nevada Secretary of State's website. You'll find a searching tool that allows you to locate your corporation by name or ID number. Once you find your corporation, you can request a certified copy directly online. Using our platform, U.S. Legal Forms, simplifies this process further by guiding you through the necessary steps.