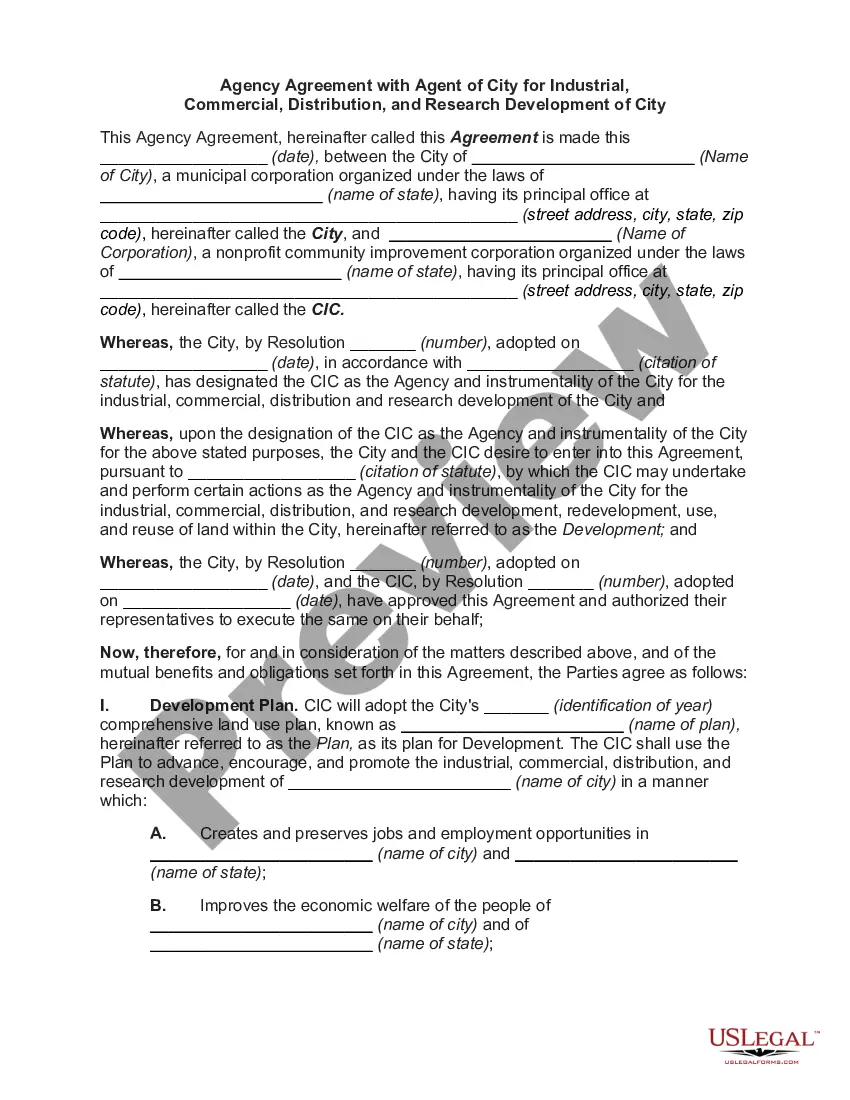

A Nevada Credit Agreement is a legally binding document that outlines the terms and conditions between a lender and a borrower in the state of Nevada. This agreement establishes the agreement's scope, responsibilities, and rights of both parties involved in a credit transaction. The Nevada Credit Agreement is commonly used in various financial transactions, such as loans, lines of credit, and credit facilities. It provides a framework for borrowers to receive funds or credit from lenders while specifying the terms of repayment, interest rates, collateral, and any penalties or fees associated with the credit. There are several types of Nevada Credit Agreements, tailored to specific financial arrangements: 1. Nevada Personal Credit Agreement: This agreement is commonly used for personal loans or credit extended between individuals or small businesses. It outlines the terms, including the loan amount, repayment schedule, interest rates, and any applicable fees. 2. Nevada Business Credit Agreement: This type of agreement is designed for larger financial transactions involving businesses. It can be used to establish lines of credit, term loans, or other credit facilities. It typically includes details such as the loan amount, interest rates, collateral, repayment terms, and any covenants or warranties required by the lender. 3. Nevada Real Estate Credit Agreement: This agreement is specific to real estate transactions, such as mortgages or construction loans, where the property serves as collateral. It includes provisions related to loan amount, interest rates, repayment terms, property valuation, insurance requirements, and any necessary permits or approvals. 4. Nevada Credit Card Agreement: This agreement governs the relationship between a card issuer and a credit cardholder. It outlines the terms and conditions of using the credit card, including interest rates, credit limits, payment terms, late fees, and other applicable charges. It is important for both parties involved in a Nevada Credit Agreement to carefully review and understand all the terms before signing. Legal advice may be sought to ensure compliance with Nevada state laws and regulations surrounding lending and credit practices.

Nevada Credit Agreement

Description

How to fill out Nevada Credit Agreement?

US Legal Forms - among the biggest libraries of lawful kinds in the United States - offers a variety of lawful file layouts it is possible to download or print out. Using the web site, you can get 1000s of kinds for organization and individual reasons, sorted by classes, claims, or keywords.You will find the latest models of kinds like the Nevada Credit Agreement in seconds.

If you already have a membership, log in and download Nevada Credit Agreement from the US Legal Forms library. The Acquire switch can look on every kind you perspective. You get access to all formerly delivered electronically kinds within the My Forms tab of your account.

In order to use US Legal Forms for the first time, allow me to share straightforward directions to obtain began:

- Ensure you have selected the correct kind for your metropolis/state. Select the Preview switch to check the form`s information. See the kind outline to actually have selected the right kind.

- If the kind doesn`t suit your needs, utilize the Look for industry on top of the monitor to get the one who does.

- If you are content with the shape, validate your option by visiting the Acquire now switch. Then, select the prices strategy you prefer and provide your qualifications to register for an account.

- Method the purchase. Use your bank card or PayPal account to complete the purchase.

- Find the format and download the shape on your system.

- Make changes. Load, change and print out and indicator the delivered electronically Nevada Credit Agreement.

Each and every design you put into your bank account does not have an expiration date and is also yours permanently. So, in order to download or print out another backup, just go to the My Forms section and then click around the kind you want.

Obtain access to the Nevada Credit Agreement with US Legal Forms, by far the most extensive library of lawful file layouts. Use 1000s of skilled and condition-distinct layouts that fulfill your business or individual needs and needs.