Subject: Nevada Sample Letter to State Tax Commission Sending Payment Dear State Tax Commission of Nevada, I am writing this letter to submit my payment towards my outstanding tax liability. I fully understand the importance of fulfilling my tax obligations, and I would like to ensure timely payment for the taxes owed to the State of Nevada. Name of Organization/Individual: [Your name or name of the organization] Taxpayer Identification Number: [Your Tax ID or Social Security Number] Tax Period: [Specify the tax period or year for which the payment is being made] Payment Details: Amount Paid: [Specify the monetary amount being paid] Payment Method: [Specify the method of payment, such as check, money order, or electronic transfer] Payment Date: [Indicate the date on which the payment was or will be made] Please find enclosed [or attached] the payment instrument (check/money order/reference number) for the aforementioned payment amount. Kindly ensure that the payment is credited to the correct taxpayer account accordingly. Please keep a record of this letter and the payment for your reference, and send a confirmation of receipt upon processing the payment. If there are any discrepancies or issues identified during the processing of the payment, please contact me at the phone number or email address provided below. I understand that any failure to adhere to my tax obligations may result in penalties, interests, or further legal action. Therefore, I am taking this opportunity to promptly settle my outstanding tax liability and request that you update my account accordingly. Thank you for your attention to this matter. I appreciate your dedication and assistance in ensuring accurate tax management. Should you require any additional information or documentation, please do not hesitate to contact me. Sincerely, [Your Name] [Your Address] [City, State, ZIP Code] [Phone Number] [Email Address] Additional Nevada Sample Letter to State Tax Commission Sending Payment: 1. Nevada Sample Letter to State Tax Commission Requesting Payment Plan: This type of letter is used when an individual or organization wants to request a payment plan for their tax liability. It may include details on the proposed payment schedule, reasons for the request, and any supporting documents. 2. Nevada Sample Letter to State Tax Commission Requesting Tax Relief: Individuals or organizations experiencing financial hardships may use this letter to request tax relief from the State of Nevada. The letter could include information about the specific circumstances, any supporting documentation, and a request for a waiver of penalties or interests. 3. Nevada Sample Letter to State Tax Commission Applying for Installment Agreement: In case a taxpayer cannot pay their tax liability in full, they may choose to apply for an installment agreement. This letter would contain details about the applicant's financial situation, the proposed installment plan, and reasons justifying the need for an agreement. Note: The sample letters mentioned above may vary in content and structure depending on individual circumstances. It is essential to adapt and personalize the letter as per your specific situation while ensuring adherence to the instructions provided by the State Tax Commission of Nevada.

Nevada Sample Letter to State Tax Commission sending Payment

Description

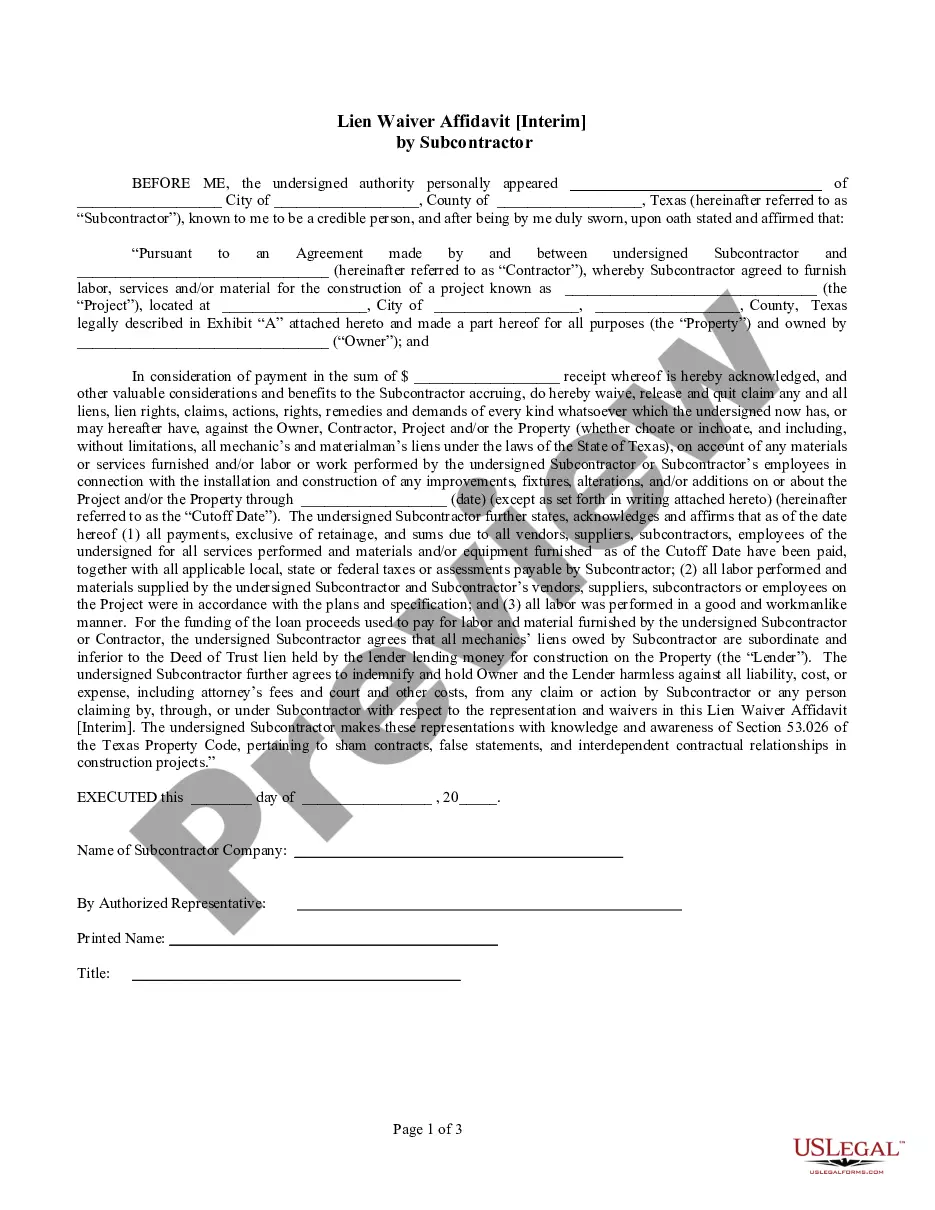

How to fill out Nevada Sample Letter To State Tax Commission Sending Payment?

If you have to complete, obtain, or print out lawful file themes, use US Legal Forms, the most important selection of lawful kinds, that can be found online. Use the site`s basic and convenient search to obtain the files you want. Various themes for business and specific uses are sorted by classes and states, or keywords. Use US Legal Forms to obtain the Nevada Sample Letter to State Tax Commission sending Payment in just a couple of mouse clicks.

In case you are already a US Legal Forms consumer, log in for your profile and then click the Obtain key to obtain the Nevada Sample Letter to State Tax Commission sending Payment. You can even access kinds you previously delivered electronically within the My Forms tab of your profile.

If you use US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Be sure you have selected the shape for the appropriate city/region.

- Step 2. Use the Review solution to look over the form`s articles. Never forget to read the outline.

- Step 3. In case you are unsatisfied together with the kind, make use of the Research field near the top of the screen to discover other types from the lawful kind web template.

- Step 4. When you have located the shape you want, go through the Purchase now key. Pick the costs plan you favor and add your references to sign up for the profile.

- Step 5. Procedure the transaction. You should use your bank card or PayPal profile to finish the transaction.

- Step 6. Select the file format from the lawful kind and obtain it in your device.

- Step 7. Full, change and print out or sign the Nevada Sample Letter to State Tax Commission sending Payment.

Each lawful file web template you buy is your own property eternally. You may have acces to each and every kind you delivered electronically within your acccount. Go through the My Forms segment and pick a kind to print out or obtain yet again.

Compete and obtain, and print out the Nevada Sample Letter to State Tax Commission sending Payment with US Legal Forms. There are millions of specialist and status-particular kinds you can utilize for your business or specific needs.

Form popularity

FAQ

Amending a Tax Return Include a copy of the original return. Write the word ?AMENDED? in black ink in the upper right-hand corner of the return. Line-through the original figures, in black ink, leaving original figures legible. Enter corrected figures, in black ink, next to or above the lined-through figures.

If you have general questions regarding your account, and do not require liaison assistance, please contact the Department's Call Center at 866-962-3707.

Products delivered electronically or by load and leave are not subject to Nevada Sales or Use Tax. However, products ordered via the internet and shipped into Nevada are taxable, as well as any software transferred via a disk or other tangible media.

What is a Nevada Tax Status Compliance Certificate? In Nevada a Tax Status Compliance Certificate is called a Tax Compliance Certificate and is issued by the Nevada Department of Taxation for a Company (Corporation or LLC) or Sole Proprietor which has met all of its Nevada tax obligations.

Methods of Submitting Payments Payments can be made via cash only with visits to the district offices. Payments of check or money orders are accepted in office and through the mail. You can also pay via Electronic Funds Transfer (EFT) on the Department of Taxation's interactive website, .nevadatax.nv.gov.

You have three options for filing and paying your Nevada sales tax: File online File online at the Nevada Department of Taxation. You can remit your payment through their online system. File by mail You can use Form TXR-01.01c and file and pay through the mail. AutoFile ? Let TaxJar file your sales tax for you.

RETURN AND MAIL TO: Nevada Department of Taxation, PO Box 52609, Phoenix, AZ 85072-2609 or drop off at your local office. DO NOT SUBMIT A PHOTOCOPY OF A PRIOR PERIOD FORM, YOUR FILING WILL POST INCORRECTLY. If you have questions concerning this return, please call our Department's Call Center at (866) 962-3707.

Nevada is a destination-based state. This means you're responsible for applying the sales tax rate determined by the ship-to address on all taxable sales.