Nevada Balloon Unsecured Promissory Note

Description

How to fill out Balloon Unsecured Promissory Note?

Are you presently within a location where you will require documentation for either commercial or specific purposes almost every working day? There are numerous legal document templates accessible on the internet, but finding reliable ones isn’t easy.

US Legal Forms offers a vast array of form templates, such as the Nevada Balloon Unsecured Promissory Note, that are designed to comply with state and federal regulations.

If you are already familiar with the US Legal Forms site and have an account, simply Log In. After that, you can download the Nevada Balloon Unsecured Promissory Note template.

- Locate the form you need and ensure it is for the correct city/region.

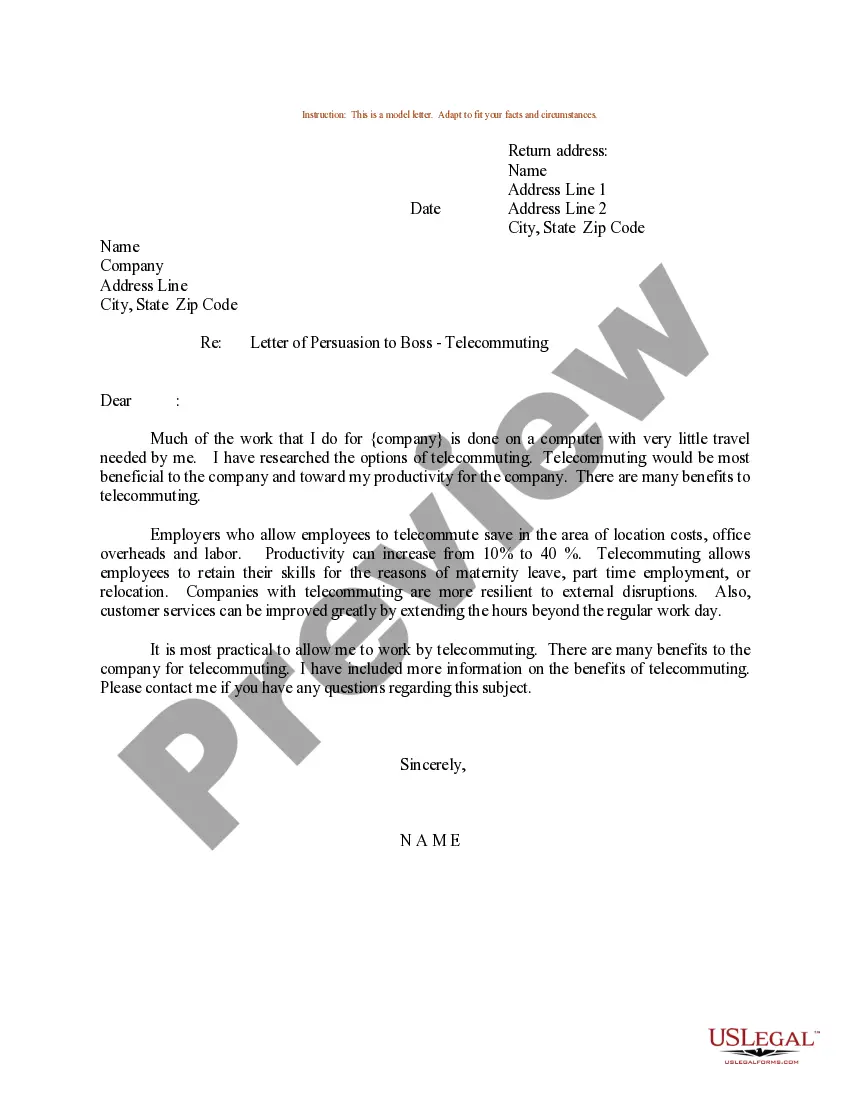

- Use the Preview button to view the document.

- Read the description to ensure you have selected the proper form.

- If the form isn’t what you’re looking for, utilize the Search field to find the document that matches your needs and requirements.

- Once you have the right form, click Buy now.

- Choose the payment plan you prefer, fill in the required information to create your account, and pay for the transaction using your PayPal or credit card.

- Select a convenient document format and download your copy.

Form popularity

FAQ

Generally, a promissory note can hold up in court, provided it meets legal requirements. A well-drafted, clear note establishes the terms of repayment and the parties involved. Courts recognize signed agreements as long as they comply with state laws, including those governing Nevada Balloon Unsecured Promissory Notes. Having a skilled legal team can ensure your note is solid and enforceable.

A company may choose to issue unsecured notes to raise funds without tying up assets as collateral. This flexibility allows businesses to access capital quickly for growth or operational expenses. Additionally, unsecured notes can offer a streamlined approach compared to secured loans, making them an attractive option. When considering a Nevada Balloon Unsecured Promissory Note, companies should weigh these benefits carefully.

An unsecured promissory note typically does not qualify as a security in the traditional sense. However, the classification can depend on specific state laws and the context of its use. Therefore, understanding your obligations under Nevada law is essential. If you're uncertain, consulting a legal expert can clarify your position regarding a Nevada Balloon Unsecured Promissory Note.

Investors looking for alternative financing options often buy unsecured promissory notes. These buyers seek opportunities with less risk than traditional investment avenues. Companies in need of immediate capital may also find value in issuing these notes. By purchasing a Nevada Balloon Unsecured Promissory Note, investors can gain access to potentially lucrative returns.

Filling out a promissory note requires detailed attention to various elements such as the principal amount, interest rate, and repayment terms. For your Nevada Balloon Unsecured Promissory Note, provide accurate borrower and lender information, and clearly state any significant conditions. Double-check your notes for clarity to prevent misunderstandings. This careful approach helps ensure mutual agreement.

In Nevada, notarization is not mandatory for a promissory note. However, having your Nevada Balloon Unsecured Promissory Note notarized can add an extra layer of authenticity. It may also help in case of disputes regarding the terms. Therefore, while it is not required, it can be beneficial.

To obtain your promissory note, first check with the lender or financial institution that issued the note. They are required to provide you with a copy upon request, especially if you are near the end of the payment period of your Nevada Balloon Unsecured Promissory Note. If you encounter difficulties, consider utilizing platforms like uslegalforms, which can streamline the retrieval process and ensure you receive all necessary documentation.

Negotiating a balloon payment can seem daunting, but it's quite manageable. Start by clearly communicating with your lender about your financial situation and your willingness to find a solution. Often, lenders are open to restructuring the payment terms of a Nevada Balloon Unsecured Promissory Note to make it easier for you to manage. It may be helpful to gather your financial records and propose a realistic payment plan before initiating the conversation.