A Nevada Sale of Business Noncom petitionon Agreement - Asset Purchase Transaction refers to a legal document outlining the terms and conditions under which the sale of a business's assets takes place in Nevada. This agreement also includes provisions for noncom petition, preventing the seller from engaging in similar business activities within a specific geographical area for a designated period. The Nevada Sale of Business Noncom petitionon Agreement - Asset Purchase Transaction typically entails several key elements and provisions, ensuring a smooth transfer of ownership, protection of intellectual property, and restriction on competition. Some essential components commonly found in this agreement include: 1. Parties involved: The agreement identifies the buyer and seller, providing their legal names and any relevant business information. 2. Asset description: A thorough description of the assets being sold is included, such as equipment, inventory, licenses, patents, trademarks, or real estate. 3. Consideration: The agreement outlines the purchase price or value exchanged for the assets and specifies the mode of payment, whether in cash, installments, or other arrangements. 4. Representations and warranties: Both parties make certain statements and guarantees regarding the accuracy of information and the condition of assets being sold. 5. Noncom petition clause: This provision restricts the seller from engaging in similar business ventures within a specified distance or geographical area for a certain period of time. 6. Duration and geographic scope: The noncom petition clause defines the duration of the restriction, typically ranging from one to five years, and specifies the geographical boundaries within which the seller is prohibited from competing. 7. Consideration for noncom petition: In exchange for agreeing to the noncom petition clause, the seller receives consideration, such as a lump sum payment, periodic payments, or other negotiated benefits. 8. Confidentiality and non-disclosure: To protect the buyer's interests, the agreement may contain provisions prohibiting the seller from disclosing confidential information to third parties. Different types of Nevada Sale of Business Noncom petitionon Agreement - Asset Purchase Transaction may include variations in the scope of restrictions, duration of noncom petition, or consideration given for noncom petition. Some alternative terms commonly used in different types of such agreements are: 1. Limited Noncom petition Agreement: This agreement restricts the seller from competing within a specific industry or market segment, rather than a broad prohibition on all competing activities. 2. Temporary Noncom petition Agreement: In this variation, the noncom petition clause lasts for a shorter duration, typically less than a year, providing the seller with more flexibility to enter a similar business in the near future. 3. Non-Solicitation Agreement: Instead of a broad noncom petition clause, this type of agreement focuses on preventing the seller from soliciting the business's clients, customers, or employees. 4. Non-Disclosure Agreement: While still relevant to the sale of business assets, this agreement primarily aims to protect confidential information and trade secrets from disclosure or unauthorized use. In summary, a Nevada Sale of Business Noncom petitionon Agreement - Asset Purchase Transaction is a legally binding document governing the sale of a business's assets and restricting the seller from competing within a designated area for a specified period. This agreement protects the buyer's interests, ensures a smooth transition of ownership, and safeguards proprietary information. Various types of such agreements exist, each tailored to specific circumstances and incorporating different provisions to meet the needs of the parties involved.

Nevada Sale of Business - Noncompetition Agreement - Asset Purchase Transaction

Description

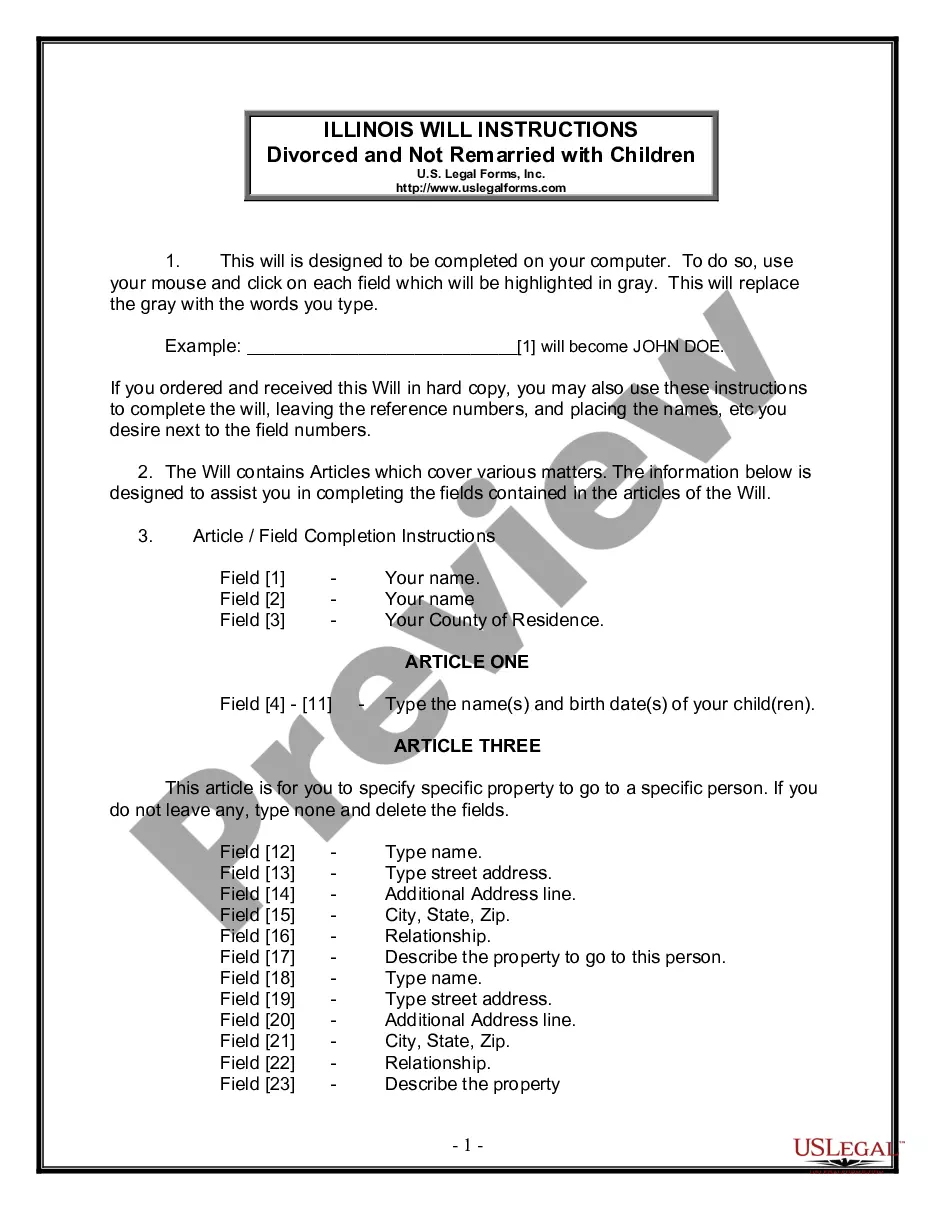

How to fill out Sale Of Business - Noncompetition Agreement - Asset Purchase Transaction?

Finding the appropriate legal document format can be a challenge. Indeed, there are numerous templates accessible online, but how do you locate the legal form you need? Visit the US Legal Forms website. The service offers a vast array of templates, including the Nevada Sale of Business - Non-Competition Agreement - Asset Purchase Transaction, suitable for both business and personal purposes. All forms are reviewed by experts and meet state and federal regulations.

If you are already registered, Log In to your account and click the Download button to access the Nevada Sale of Business - Non-Competition Agreement - Asset Purchase Transaction. Utilize your account to browse through the legal forms you have previously purchased. Navigate to the My documents section of your account and obtain another copy of the document you need.

If you are a new user of US Legal Forms, here are simple instructions you should follow: First, ensure that you have selected the correct form for your city/county. You can examine the form by clicking the Preview button and reviewing the form details to confirm it is suitable for you. If the form does not meet your requirements, use the Search box to find the right form. Once you are confident that the form is accurate, click the Purchase now button to obtain the form.

US Legal Forms is the largest collection of legal documents where you can find a variety of document templates. Utilize the service to download professionally prepared documents that adhere to state requirements.

- Choose the pricing plan you want and enter the necessary information.

- Create your account and pay for the order using your PayPal account or credit card.

- Select the file format and download the legal document to your device.

- Complete, modify, print, and sign the acquired Nevada Sale of Business - Non-Competition Agreement - Asset Purchase Transaction.

Form popularity

FAQ

A purchase agreement is a type of contract that outlines terms and conditions related to the sale of goods. As a legally binding contract between buyer and seller, the agreements typically relate to buying and selling goods rather than services.

Parts of an Asset Purchase AgreementRecitals. The opening paragraph of an asset purchase agreement includes the buyer and seller's name and address as well as the date of signing.Definitions.Purchase Price and Allocation.Closing Terms.Warranties.Covenants.Indemnification.Governance.More items...

In an asset sale the target's contracts are transferred to the buyer by means of assigning the contracts to the buyer. The default rule is generally that a party to a contract has the right to assign the agreement to a third party (although the assigning party remains liable to the counter-party under the agreement).

While buyer's counsel typically prepares the first draft of an asset purchase agreement, there may be circumstances (such as an auction) when seller's counsel prepares the first draft.

Recording the purchase and its effects on your balance sheet can be done by:Creating an assets account and debiting it in your records according to the value of your assets.Creating another cash account and crediting it by how much cash you put towards the purchase of the assets.More items...

In an asset sale, the seller retains possession of the legal entity and the buyer purchases individual assets of the company, such as equipment, fixtures, leaseholds, licenses, goodwill, trade secrets, trade names, telephone numbers, and inventory.

An asset purchase agreement is exactly what it sounds like: an agreement between a buyer and a seller to transfer ownership of an asset for a price. The difference between this type of contract and a merger-acquisition transaction is that the seller can decide which specific assets to sell and exclude.

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.

The asset purchase agreement is often drafted up towards the end of the negotiation stage, so that the parties can have a final record of their agreement. The document essentially operates as a contract, creating legally binding duties on each of the parties involved.

An asset purchase agreement is a legal contract to buy the assets of a business. It can also be used to purchase specific assets from a business, especially if they are significant in value.

Interesting Questions

More info

Sign It!.