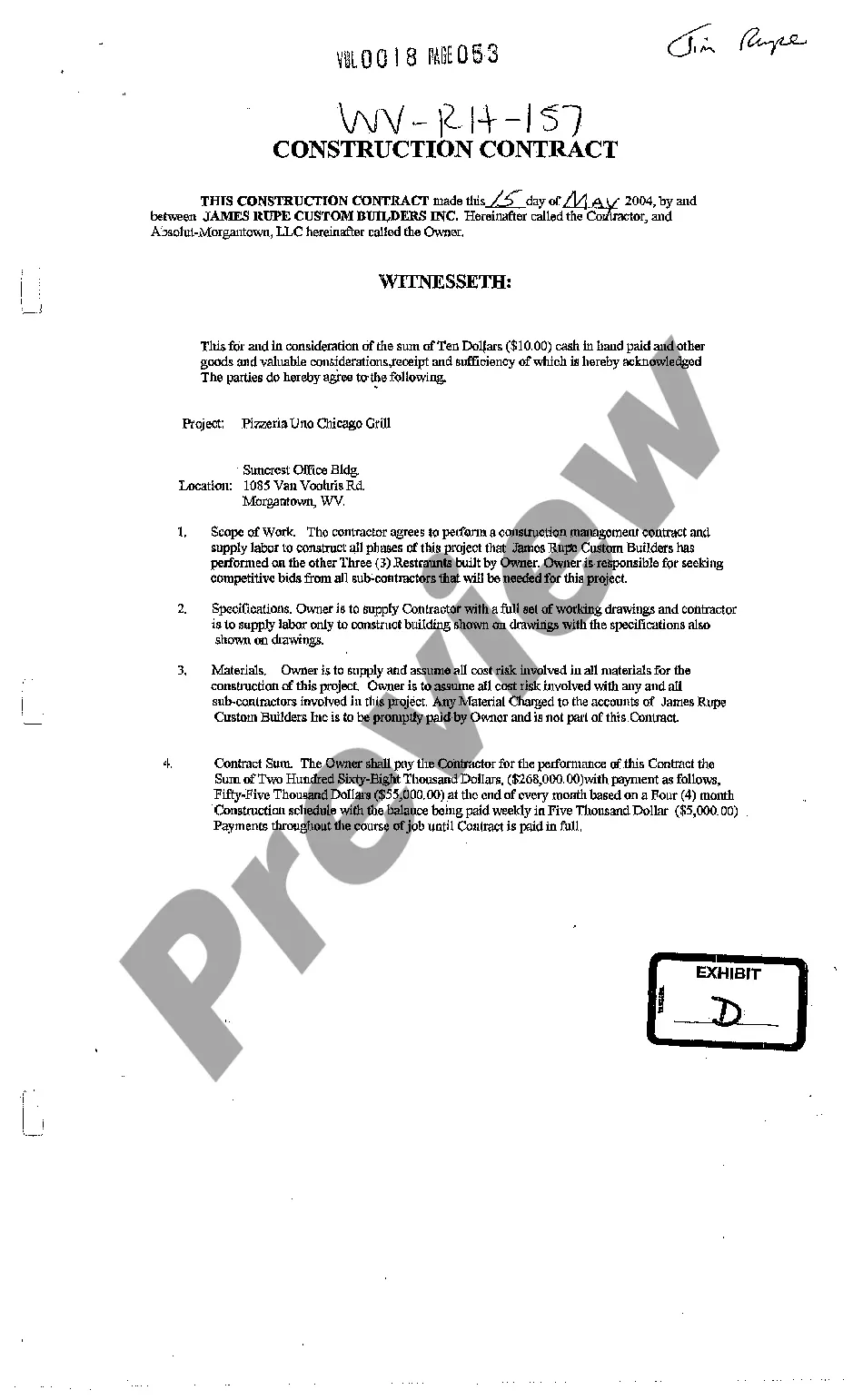

A Nevada Sale of Business — Retained EmployeeAgreementen— - Asset Purchase Transaction refers to a legal contract that outlines the terms and conditions related to the sale of a business, where the buyer retains certain employees as part of the acquisition. This agreement ensures a seamless transition of employees from the seller to the buyer, protecting the interests and rights of both parties involved. In a Nevada Sale of Business — Retained EmployeeAgreementen— - Asset Purchase Transaction, various aspects are covered to ensure clarity and enforceability. Firstly, the agreement clearly defines the scope of the transaction, specifying the assets and liabilities included in the purchase. It may involve physical assets such as inventory, equipment, and property, along with intangible assets like trademarks, copyrights, or customer contracts. The agreement also outlines the specific terms and conditions related to the retention of employees by the buyer. This can include the number of employees to be retained, their roles and responsibilities after the acquisition, and any necessary training or certifications. The agreement ensures that the buyer takes on the employees with proper documentation and without violating any labor laws. Additionally, the agreement may address the transfer of employee benefits, such as healthcare plans, retirement accounts, and accrued leave or vacation time. It may entail the buyer's responsibility for honoring existing employment contracts or collective bargaining agreements. There may be different types of Nevada Sale of Business — Retained EmployeeAgreementen— - Asset Purchase Transactions, based on the specific nature of the business and the terms negotiated by the buyer and seller. Some variations include: 1. Full Retention Agreement: In this type of agreement, the buyer agrees to retain all or a significant majority of the seller's employees, ensuring minimal disruption to the workforce and maintaining continuity in operations. 2. Partial Retention Agreement: Here, the buyer retains only a select number of key employees or those deemed essential for a smooth transition. This arrangement often occurs when the buyer already has an existing workforce or strategic hiring plans. 3. Temporary Retention Agreement: This agreement involves the buyer's commitment to retaining employees for a specific period, allowing them time to evaluate the workforce and make necessary adjustments. At the end of this period, the buyer may choose to retain or release certain employees based on performance and strategic needs. In summary, a Nevada Sale of Business — Retained EmployeeAgreementen— - Asset Purchase Transaction is a comprehensive legal document that governs the sale of a business while retaining specific employees. It ensures a smooth transition of assets and personnel, protecting the interests of both parties involved in the transaction.

Nevada Sale of Business - Retained Employees Agreement - Asset Purchase Transaction

Description

How to fill out Nevada Sale Of Business - Retained Employees Agreement - Asset Purchase Transaction?

You can spend numerous hours online attempting to locate the legal document template that meets the federal and state standards you require.

US Legal Forms provides thousands of legal forms that have been reviewed by experts.

You can conveniently download or print the Nevada Sale of Business - Retained Employees Agreement - Asset Purchase Transaction from our platform.

If available, utilize the Preview option to review the document template as well.

- If you possess a US Legal Forms account, you may sign in and select the Download option.

- Afterward, you are permitted to complete, modify, print, or sign the Nevada Sale of Business - Retained Employees Agreement - Asset Purchase Transaction.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of any purchased form, visit the My documents section and click the respective option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, verify that you have selected the correct document template for the county/city of your preference.

- Review the form description to ensure you have selected the right form.

Form popularity

FAQ

By definition, employees are not assets since companies do not have control over them. Workers must convert raw materials be they commodities or blank computer screens into finished inventory to be paid, but if these workers want to quit, they can take their skills and training with them.

The employees who are employed by the target entity will generally come with the transaction, like a stock purchase. If certain employees at the seller/parent company provide significant services to the target entity, then the transaction will act like an asset purchase with respect to this group of employees.

In an asset purchase, the buyer agrees to purchase specific assets and liabilities. This means that they only take on the risks of those specific assets. This could include equipment, fixtures, furniture, licenses, trade secrets, trade names, accounts payable and receivable, and more.

An asset acquisition strategy is when one company buys another company through the process of buying its assets, as opposed to a traditional acquisition strategy, which involves the purchase of stock.

An asset purchase agreement is exactly what it sounds like: an agreement between a buyer and a seller to transfer ownership of an asset for a price. The difference between this type of contract and a merger-acquisition transaction is that the seller can decide which specific assets to sell and exclude.

If the merger or acquisition is the result of a stock purchase and employees are absorbed by the new entity, any current employment forms may remain intact unless substantive changes need to be addressed (e.g., policy changes, benefits changes, nondisclosure agreements, change in job duties or pay).

While buyer's counsel typically prepares the first draft of an asset purchase agreement, there may be circumstances (such as an auction) when seller's counsel prepares the first draft.

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.

At the closing of an asset purchase, employees of the seller are generally terminated as employees of the seller, and after closing, those employees are rehired by the purchaser.

An asset purchase involves the purchase of the selling company's assets -- including facilities, vehicles, equipment, and stock or inventory. A stock purchase involves the purchase of the selling company's stock only.

Interesting Questions

More info

Just choose a plan below.