Nevada Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price

Description

How to fill out Agreement For Sale Of Business By Sole Proprietorship With Seller To Finance Part Of Purchase Price?

Selecting the appropriate legal document template may be challenging. Certainly, there is a wide array of templates available online, but how do you locate the legal form you require? Utilize the US Legal Forms website.

This service offers thousands of templates, such as the Nevada Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price, which you can utilize for business and personal needs. All of the forms are vetted by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click on the Download button to obtain the Nevada Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price. Use your account to review the legal forms you have previously acquired. Visit the My documents section of your account to retrieve another copy of the documents you require.

Fill out, modify, print, and sign the obtained Nevada Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price. US Legal Forms boasts the largest collection of legal forms where you can access various document templates. Use this service to download professionally crafted paperwork that meets state requirements.

- If you are a new user of US Legal Forms, here are simple instructions that you can follow.

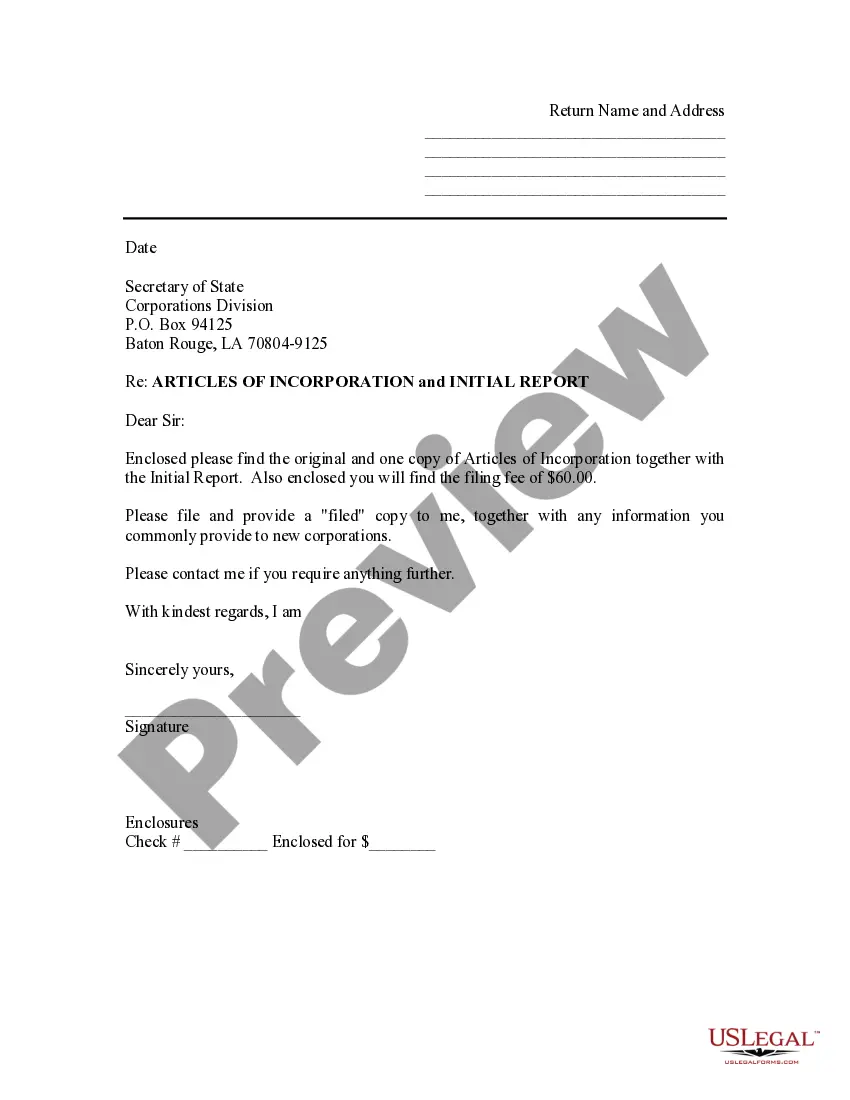

- First, ensure you have selected the correct form for your city or county. You can preview the form using the Preview button and read the form's description to confirm it is suitable for you.

- If the form does not meet your needs, use the Search field to find the appropriate form.

- Once you are confident the form is right, click the Buy Now button to purchase the form.

- Choose the pricing plan you want and enter the required information. Create your account and complete the payment using your PayPal account or credit card.

- Select the document format and download the legal document template to your device.

Form popularity

FAQ

The key elements of a buy-sell agreement include:Element 1. Identify the parties.Element 2. Triggered buyout event.Element 3. Buy-sell structure.Element 4. Company valuation.Element 5. Funding resources.Element 6. Taxation considerations.

Buy and sell agreements are designed to help partners manage potentially difficult situations in ways that protect the business and their own personal and family interests. For example, the agreement can restrict owners from selling their interests to outside investors without approval from the remaining owners.

How to Write a Business Purchase Agreement?Step 1 Parties and Business Information. A business purchase agreement should detail the names of the buyer and seller at the start of the agreement.Step 2 Business Assets.Step 3 Business Liabilities.Step 4 Purchase Price.Step 6 Signatures.

For a contract to be legally binding it must contain four essential elements:an offer.an acceptance.an intention to create a legal relationship.a consideration (usually money).

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.

Potential buyers could be current partners / co-owners, members of staff or even competitors. It's therefore possible for a sole proprietor or sole-owner to enter into a buy and sell contract.

The acquired assets usually include all fixed assets (usually supported by a detailed list), all inventory, all supplies, tools, computers and related software, websites, all social media accounts used in connection with the Business, all permits, patents, trademarks, service marks, trade names (including but not

A sole proprietorship was designed to have only one owner. Therefore, when the owner dies or the business is sold, the structure automatically dissolves. A sole proprietorship cannot be transferred to another party. However, it may able to have its assets transferred to a new owner.

How to Draft a Sales ContractIdentity of the Parties/Date of Agreement. The first topic a sales contract should address is the identity of the parties.Description of Goods and/or Services. A sales contract should also address what is being bought or sold.Payment.Delivery.Miscellaneous Provisions.Samples.

What to include in a business sales contract.Name the parties. Clearly state the names and locations of the buyer and seller.List the assets.Define liabilities.Set sale terms.Include other agreements.Make your sales agreement digital.