A Nevada Trust Agreement — Irrevocable, also known as an Irrevocable Trust, is a legal document that creates a trust in the state of Nevada. This type of trust agreement cannot be easily changed or revoked once it is established, ensuring it retains its legal standing and structure. The Nevada Trust Agreement — Irrevocable is a popular choice for individuals due to its various advantages, including asset protection, estate planning, and tax benefits. It provides a secure way for individuals to protect their assets from creditors, lawsuits, and potential financial liabilities. By placing assets into an irrevocable trust, individuals can shield them from potential adverse events and ensure their preservation for future generations. There are several types of Nevada Trust Agreement — Irrevocable that can be tailored to meet specific needs and goals. Some common types include: 1. Nevada Dynasty Trust Agreement — Irrevocable: This trust is created to provide long-term wealth management for successive generations within a family. It allows assets to grow and be distributed to beneficiaries over multiple generations without being subject to estate taxes. 2. Nevada Special Needs Trust Agreement — Irrevocable: This type of trust is specifically designed to manage the assets of an individual with special needs while still allowing them to qualify for government benefits. It ensures that the individual's financial needs are met while preserving their eligibility for programs such as Medicaid or Supplemental Security Income (SSI). 3. Nevada Charitable Trust Agreement — Irrevocable: This trust is established with the intention of benefiting charitable organizations or causes. It allows individuals to donate assets, receive tax deductions, and ensure their philanthropic goals are met even after their passing. 4. Nevada Life Insurance Trust Agreement — Irrevocable: This trust is created to hold life insurance policies outside the insured individual's estate. By doing so, the life insurance proceeds can be protected from estate taxes and used to provide financial security for beneficiaries. It is essential to consult with a qualified attorney or financial advisor when considering a Nevada Trust Agreement — Irrevocable. They can provide an in-depth understanding of the legalities involved in establishing and managing the trust, ensuring it aligns with individual circumstances and goals.

Irrevocable Trusts

Description

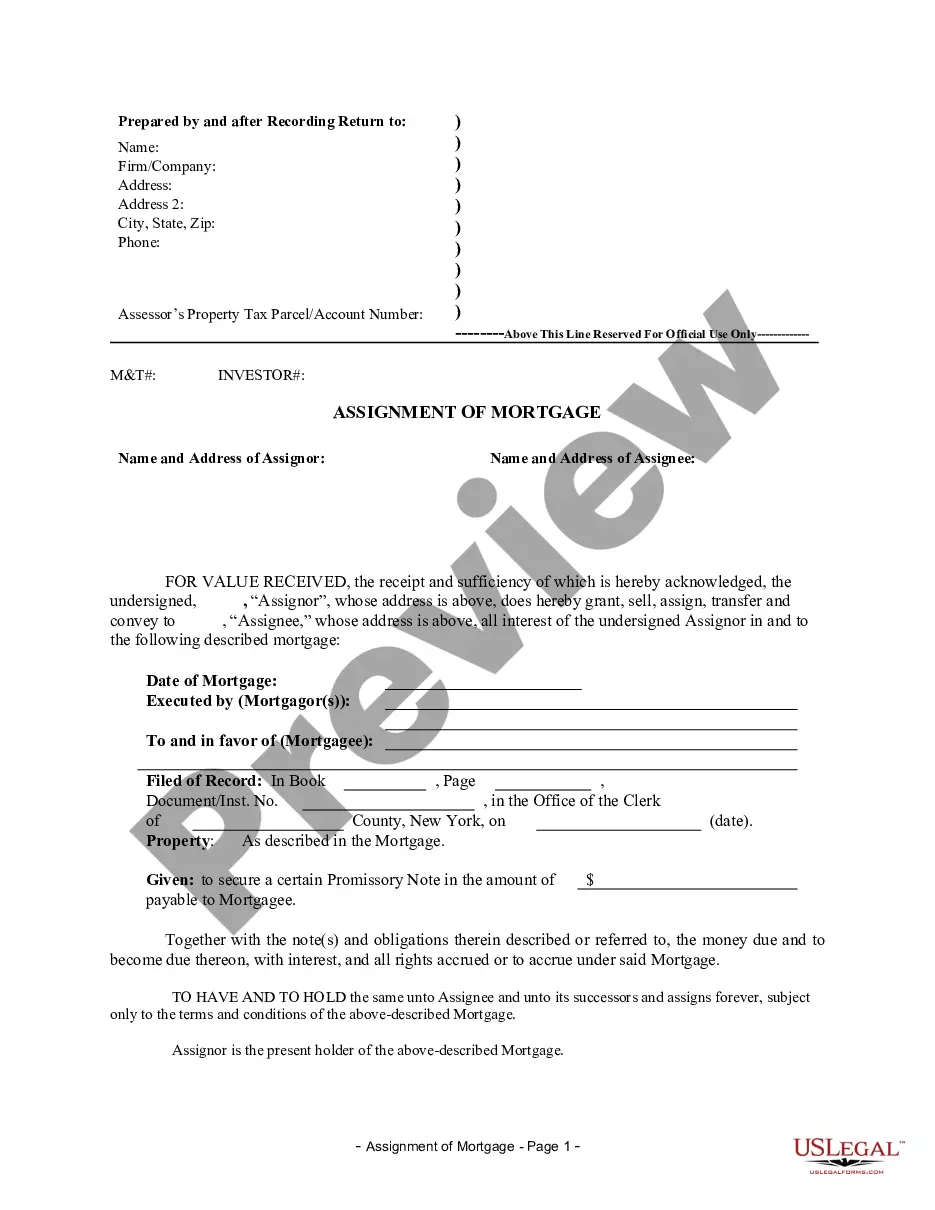

How to fill out Nevada Trust Agreement - Irrevocable?

It is feasible to dedicate numerous hours online seeking the legal format that complies with the state and federal requirements you desire.

US Legal Forms offers a vast array of legal templates that can be reviewed by experts.

You can easily download or print the Nevada Trust Agreement - Irrevocable from the service.

If available, use the Review button to examine the format as well.

- If you already have a US Legal Forms account, you can Log In and click on the Obtain button.

- Then, you can complete, modify, print, or sign the Nevada Trust Agreement - Irrevocable.

- Every legal format you obtain is yours indefinitely.

- To access an additional copy of any acquired form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct format for the region/city of your preference. Consult the form details to verify you have opted for the appropriate type.

Form popularity

FAQ

Though it is not mandatory for a Nevada trust to have a Nevada trustee, implementing one can provide distinct benefits. A local trustee is familiar with Nevada laws and can facilitate smoother administration of the trust. Using a Nevada Trust Agreement - Irrevocable with a Nevada trustee enhances your estate planning strategy.

A Nevada irrevocable trust does not necessarily require a Nevada-based trustee, but having one can offer advantages. A local trustee may better understand state laws and make management easier. Creating a Nevada Trust Agreement - Irrevocable with a local trustee helps you navigate the complexities while fulfilling legal requirements.

A California living trust can be valid in Nevada, but it's important to consider local laws and how they apply. If you move to Nevada, you may want to create a Nevada Trust Agreement - Irrevocable to take advantage of specific state provisions and protection. Consulting with an expert ensures that your trust aligns with Nevada regulations.

In Nevada, you do not need to record a trust document to make it effective. However, recording is recommended if your trust holds real estate or other significant assets. By understanding these details of a Nevada Trust Agreement - Irrevocable, you can maintain clear ownership and reduce potential disputes later.

The irrevocable trust law in Nevada establishes that once you create an irrevocable trust, you cannot change or revoke it without the consent of the beneficiaries. This type of trust provides benefits like asset protection and potential tax advantages. It's essential to understand the legal implications of a Nevada Trust Agreement - Irrevocable to ensure it meets your estate planning goals.

In Nevada, a trust can last for a maximum of 365 years, which provides ample time for managing and distributing assets. This long duration is particularly beneficial for a Nevada Trust Agreement - Irrevocable, as it allows families to maintain wealth across multiple generations. It's advisable to consult with a legal professional to ensure the trust is set up correctly and meets your long-term objectives.

The primary difference between a revocable and an irrevocable trust in Nevada lies in the control over the assets. A revocable trust allows the grantor to alter or dissolve the trust during their lifetime, while a Nevada Trust Agreement - Irrevocable restricts any changes once established. This difference impacts estate taxes, asset protection, and qualifications for government benefits, making it essential to choose the right type based on your financial goals.

An irrevocable clause in a trust signifies that the terms and conditions cannot be changed once established. This feature is crucial in a Nevada Trust Agreement - Irrevocable because it ensures that the grantor's intentions are preserved without the possibility of alterations. As a result, this type of clause provides greater security for beneficiaries and helps shield assets from creditors, fostering a stable financial environment for the future.

While most assets can be placed in a Nevada Trust Agreement - Irrevocable, there are exceptions. Typically, personal residences with mortgage liens, certain retirement accounts, and assets with outstanding loans cannot be transferred into the trust without tax implications or penalties. In addition, it's important that the assets belong to the grantor; otherwise, they may not qualify for inclusion in the trust.

When the grantor of a Nevada Trust Agreement - Irrevocable passes away, the trust doesn't dissolve. Instead, the assets in the trust remain protected and are managed according to the terms established in the trust document. This means that the designated beneficiaries will receive the assets as planned, thereby ensuring the intentions of the grantor are honored. It's vital for individuals to clearly outline their wishes in the trust to avoid any potential disputes.

More info

PREVENTATIVE TRUSTEE ORGANIZATION TRUST AGREEMENT Acknowledged by each party in connection with the acquisition of the assets described in subparagraph (A)(viii) of this provision, the depository to be the entity named in the Declaration of Trust or the Trust Agreement executed under Section 6 of the Deposit Agreement; (i) an irrevocable deed transferring the assets described in subparagraph (A)(viii) of this provision to the depository by operation of law; (ii) an irrevocable trust deed executed by both the depository and the interested party; (iii) a court order approving the irrevocable transfer of assets; or (iv) an irrevocable deed executed under Section 7 of the Trust and Loan Agreement executed on behalf of the interested party; DATE AGREEMENT Date of signing March 29, 2013, May 19, 2012, Date of execution March 20, 2013, April 2, 2012 1. A complete copy of each of the documents listed above may be obtained from you by telephone at.