Title: Nevada Letter to Other Entities Notifying Them of Identity Theft — Comprehensive Guide Introduction: Identity theft is a major concern affecting individuals and organizations globally. In Nevada, individuals who have become victims of identity theft can take swift action to mitigate further damage by writing a formal letter to other entities affected by the theft. This detailed guide explores the vital aspects of composing a Nevada Letter to Other Entities Notifying Them of Identity Theft, providing essential information, templates, and types of letters. Types of Nevada Letters to Other Entities Notifying Them of Identity Theft: 1. Nevada Letter to Creditors: This type of letter primarily focuses on notifying creditors of the identity theft incident, urging them to cease fraudulent or unauthorized transactions and requesting account freezing to prevent further expenses. 2. Nevada Letter to Banks: Specifically designed for notifying banks, this letter aims to alert them about unauthorized account openings, suspicious transactions, or any potentially fraudulent activities associated with the victim's stolen identity. It includes a request to close existing accounts, investigate unauthorized transactions, and provide necessary support during the recovery process. 3. Nevada Letter to Insurance Companies: Individuals who have encountered identity theft affecting their insurance policies may need to send a formal letter to insurance companies. This letter clarifies the situation, requesting a freeze on existing policies, suspension of premium payments, and initiation of investigations to ensure the victim's rights are protected. 4. Nevada Letter to Government Agencies: Victims of identity theft must notify relevant government agencies, such as the Social Security Administration, Internal Revenue Service, or Nevada Department of Motor Vehicles, among others. This type of letter highlights the stolen identity's impact and seeks cooperation in rectifying any false information or fraudulent activities associated with the victim. Key Elements of a Nevada Letter to Other Entities Notifying Them of Identity Theft: 1. Formal Salutation: Begin the letter with a polite and professional salutation, addressing the recipient by their appropriate title (e.g., "Dear Manager" or "To Whom It May Concern"). 2. Victim's Information: Clearly state the victim's name, contact information, and any relevant identifiers, such as account numbers or policy numbers, to facilitate the investigation and resolution process. 3. Explanation of Identity Theft Incident: Provide a concise but comprehensive overview of the identity theft incident, including when it occurred, how it was detected, and any immediate actions taken to prevent further harm. 4. Request for Action: Clearly state the actions the victim expects the recipient to take, such as freezing accounts, conducting investigations, or providing necessary support during the recovery process. 5. Supporting Documents: Encourage the recipient to request any supporting documentation, such as police reports, identity theft affidavits, or any other evidence that can assist in the investigation or verification process. 6. Contact Information: Include the victim's contact information, including phone number and email address, to ensure smooth communication and provide a means for the recipient to reach out with updates or further queries. Conclusion: Writing a Nevada Letter to Other Entities Notifying Them of Identity Theft is crucial for victims seeking resolution and protection against further fraud. By promptly informing affected entities, individuals can enhance their chances of recovering stolen assets and restoring their financial well-being. Remember to adapt the letter's content and tone based on the specific recipient, providing accurate and relevant information to facilitate a swift resolution.

Nevada Letter to Other Entities Notifying Them of Identity Theft

Description

How to fill out Nevada Letter To Other Entities Notifying Them Of Identity Theft?

US Legal Forms - one of several biggest libraries of legal types in the States - gives an array of legal papers themes you can down load or print. While using internet site, you may get thousands of types for company and individual reasons, sorted by classes, states, or search phrases.You will discover the most recent models of types such as the Nevada Letter to Other Entities Notifying Them of Identity Theft in seconds.

If you have a monthly subscription, log in and down load Nevada Letter to Other Entities Notifying Them of Identity Theft from the US Legal Forms local library. The Acquire key can look on every develop you perspective. You get access to all earlier downloaded types in the My Forms tab of your respective accounts.

If you wish to use US Legal Forms the very first time, here are straightforward recommendations to obtain started:

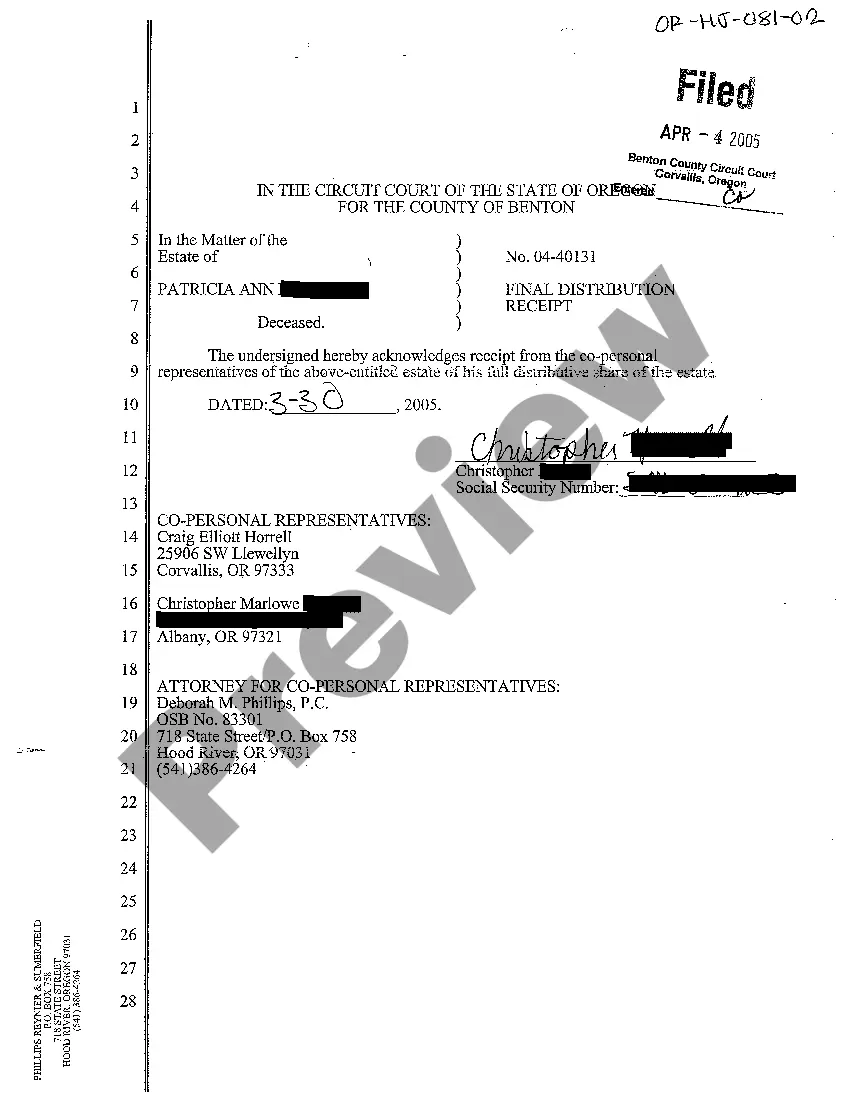

- Make sure you have picked out the right develop for your area/area. Select the Review key to check the form`s information. Look at the develop outline to ensure that you have chosen the right develop.

- In case the develop does not match your requirements, utilize the Lookup area near the top of the monitor to discover the the one that does.

- If you are satisfied with the form, verify your choice by clicking on the Purchase now key. Then, select the costs prepare you favor and provide your qualifications to sign up for the accounts.

- Procedure the financial transaction. Use your charge card or PayPal accounts to perform the financial transaction.

- Select the structure and down load the form on your own product.

- Make changes. Fill up, change and print and sign the downloaded Nevada Letter to Other Entities Notifying Them of Identity Theft.

Each and every format you included in your account does not have an expiry time and it is your own for a long time. So, if you want to down load or print yet another version, just visit the My Forms section and click on the develop you require.

Get access to the Nevada Letter to Other Entities Notifying Them of Identity Theft with US Legal Forms, probably the most extensive local library of legal papers themes. Use thousands of expert and status-distinct themes that meet your company or individual demands and requirements.

Form popularity

FAQ

Reporting Identity Theft to the Police Step 1: Obtain a Copy of Your FTC Identity Theft Report. After filing a report with the FTC, give the police a copy when you file a police report. ... Step 2: Provide a Photo ID. ... Step 3: Provide Your Address. ... Step 4: Provide Proof of Identity Theft.

File a complaint with the Federal Trade Commission by calling the Identity Theft Hotline at (877) 438-4338 or visiting identitytheft.gov. Keep a well-organized record of all the people you have contacted in relation to the incident, with their phone number and notes about what was said.

Defining Identity Theft Anyone convicted of using another person's identity can be punished with up to twenty years in prison and a $100,000 fine.

To report identity theft, contact: The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.

Nevada's identity theft law (NRS 205.463), makes it a crime to use personal identifying information of another individual with the intent to fraudulently obtain credit, property or services.

Anyone convicted of using another person's identity can be punished with up to twenty years in prison and a $100,000 fine.

Four Important Steps to Take: Place a fraud alert on your credit reports and review your credit reports. ... Close the accounts that you know or believe have been tampered with or opened fraudulently. ... File a report with your local law enforcement agency and apply for a Nevada Identity Theft Card.

Dear Sir or Madam: I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.