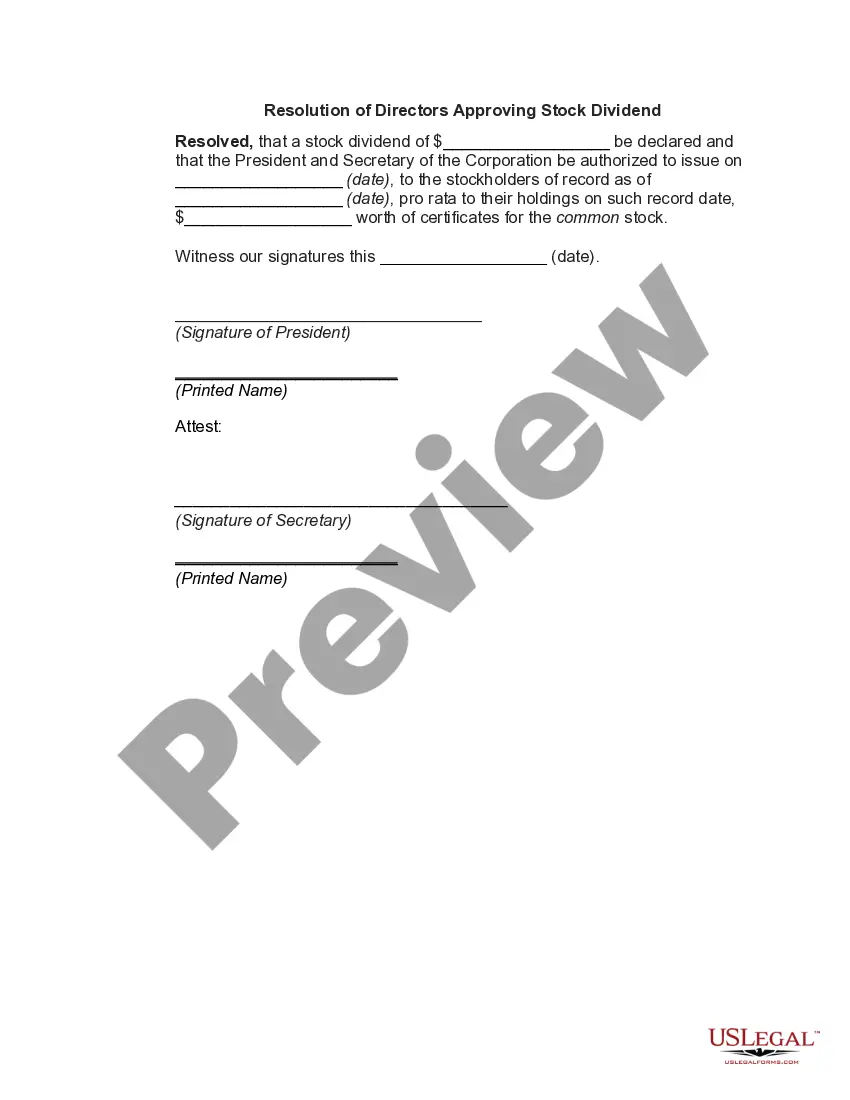

Nevada Stock Dividend - Resolution Form - Corporate Resolutions

Description

How to fill out Stock Dividend - Resolution Form - Corporate Resolutions?

US Legal Forms - one of the most important collections of legal documents in the United States - provides a vast selection of legal template documents available for purchase or printing.

By using the site, you can access numerous forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest versions of forms such as the Nevada Stock Dividend - Resolution Form - Corporate Resolutions in moments.

If you already possess a membership, Log In to access the Nevada Stock Dividend - Resolution Form - Corporate Resolutions within the US Legal Forms library. The Download button will appear on each document you view. You can find all previously saved forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the payment.

Select the format and download the document to your device. Edit it as needed. Fill out, modify, print, and sign the saved Nevada Stock Dividend - Resolution Form - Corporate Resolutions. Each template you add to your account does not expire and is permanently yours. Therefore, if you want to download or print another copy, simply go to the My documents section and click on the form you need. Access the Nevada Stock Dividend - Resolution Form - Corporate Resolutions with US Legal Forms, one of the most comprehensive collections of legal document templates. Utilize numerous expert and state-specific templates that fulfill your business or personal needs and criteria.

- Ensure you have chosen the correct form for your city/region.

- Click the Review button to examine the document's content.

- Check the form information to make certain you have selected the right document.

- If the form does not meet your requirements, use the Search box at the top of the page to find a suitable one.

- When satisfied with the form, confirm your selection by clicking the Acquire now button.

- Then, choose the pricing plan you wish and provide your details to register for an account.

Form popularity

FAQ

To create a shareholder resolution, start by drafting a clear statement of the proposal that requires shareholder approval. This document must be presented at a shareholder meeting where stakeholders vote on its adoption. Ensure that the resolution follows corporate bylaws and state regulations. Utilizing the Nevada Stock Dividend - Resolution Form - Corporate Resolutions can help you structure and present the proposal effectively.

A board resolution for the issue of shares is a document that provides official approval from the board of directors to issue new shares. This resolution should detail the number of shares, their class, and purpose for issuance. It's a critical step for maintaining corporate compliance and protecting shareholder interests. Using the Nevada Stock Dividend - Resolution Form - Corporate Resolutions can ensure your board resolution meets all requirements.

A director's resolution is a formal record of decisions made by a company's board of directors during a meeting. It documents vital actions such as approving financial statements, declaring dividends, or authorizing transactions. These resolutions ensure accountability and proper governance within the organization. Consider using the Nevada Stock Dividend - Resolution Form - Corporate Resolutions to effectively capture these important decisions.

To issue shares, a board resolution is typically required. This resolution confirms the board's intent to issue specific shares under designated terms. It is crucial to ensure that the issuance complies with state laws and the company's bylaws. To make the process easier, the Nevada Stock Dividend - Resolution Form - Corporate Resolutions can be employed to ensure all necessary components are addressed.

The key difference between a director's resolution and a shareholder resolution lies in who initiates the decision. A director's resolution is proposed and voted on by the board of directors, while a shareholder resolution is typically voted on by the company's shareholders. Both types of resolutions serve important functions in corporate governance, ensuring actions align with company interests. For clarity and organization, consider using the Nevada Stock Dividend - Resolution Form - Corporate Resolutions.

To write a corporate resolution, start by stating the company name and the date. Clearly outline the specific action being taken, such as approving a dividend distribution. Include the signatures of the directors or shareholders present at the meeting. Using the Nevada Stock Dividend - Resolution Form - Corporate Resolutions can provide a structured format to ensure all necessary details are included.

A corporate resolution is a formal document that captures the decisions made by a corporation's governing body. It is critical for documenting actions like approvals for mergers, shareholder meetings, or dividend declarations. The Nevada Stock Dividend - Resolution Form - Corporate Resolutions offers a structured way to create these documents, helping your company maintain good governance and compliance.

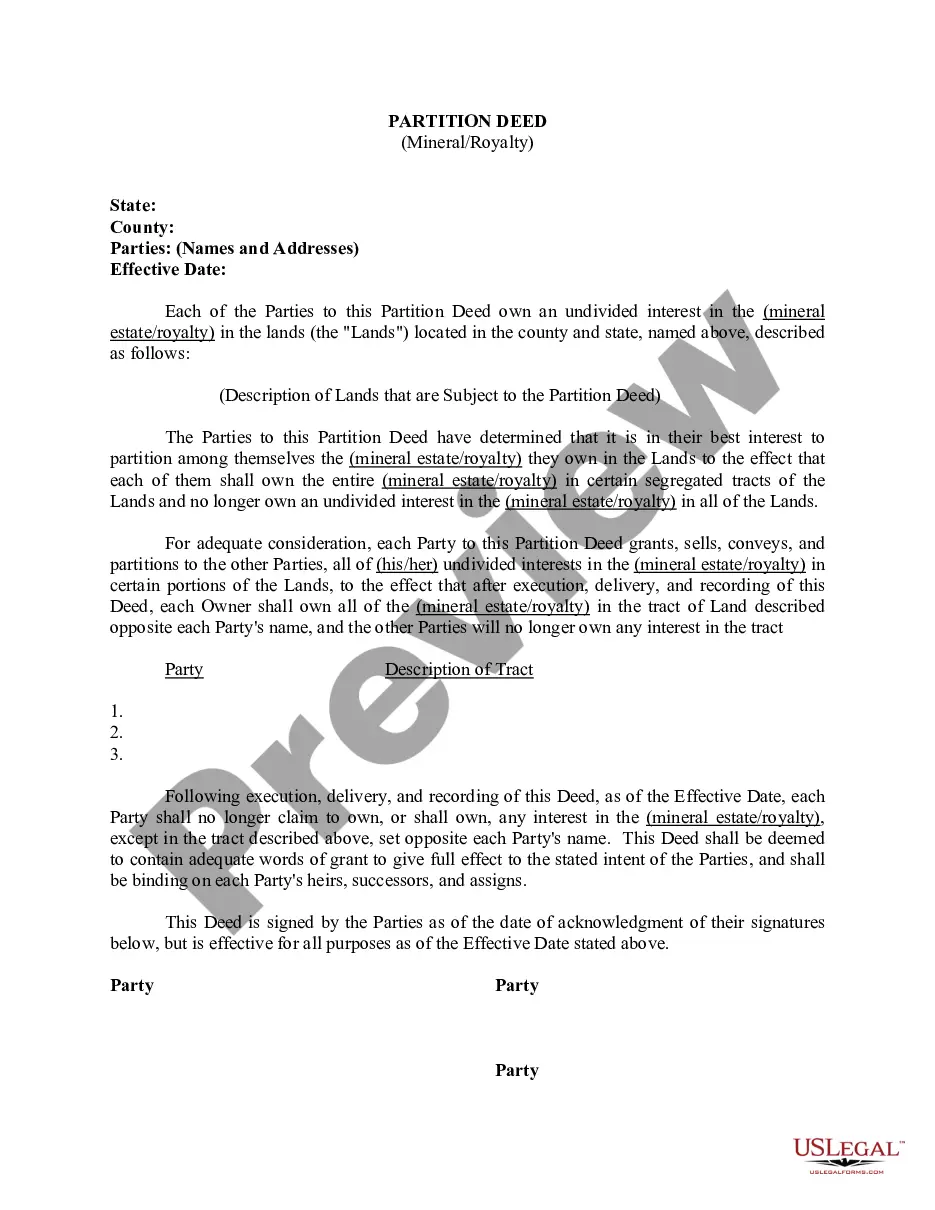

A corporate resolution for share transfer formally documents the agreement on transferring ownership of shares between parties. This resolution protects both the seller and the buyer by clarifying the terms and conditions of the share transfer. To make this process smoother, consider using the Nevada Stock Dividend - Resolution Form - Corporate Resolutions to ensure all necessary details are included and legally sound.

Section 78.1955 of the Nevada Revised Statutes relates to the ability of corporations to issue stock dividends. This section provides guidelines on how corporations can allocate dividends to shareholders based on their shares. Understanding this statute can help you utilize the Nevada Stock Dividend - Resolution Form - Corporate Resolutions efficiently when planning your corporation's financial strategies.

A corporate resolution form is a legal document that records decisions made by a corporation’s board or shareholders. It details the authorized actions or approval given concerning company affairs, such as issuing stock or appointing officers. The Nevada Stock Dividend - Resolution Form - Corporate Resolutions is a valuable tool for creating these important records and ensuring your company stays organized and compliant.