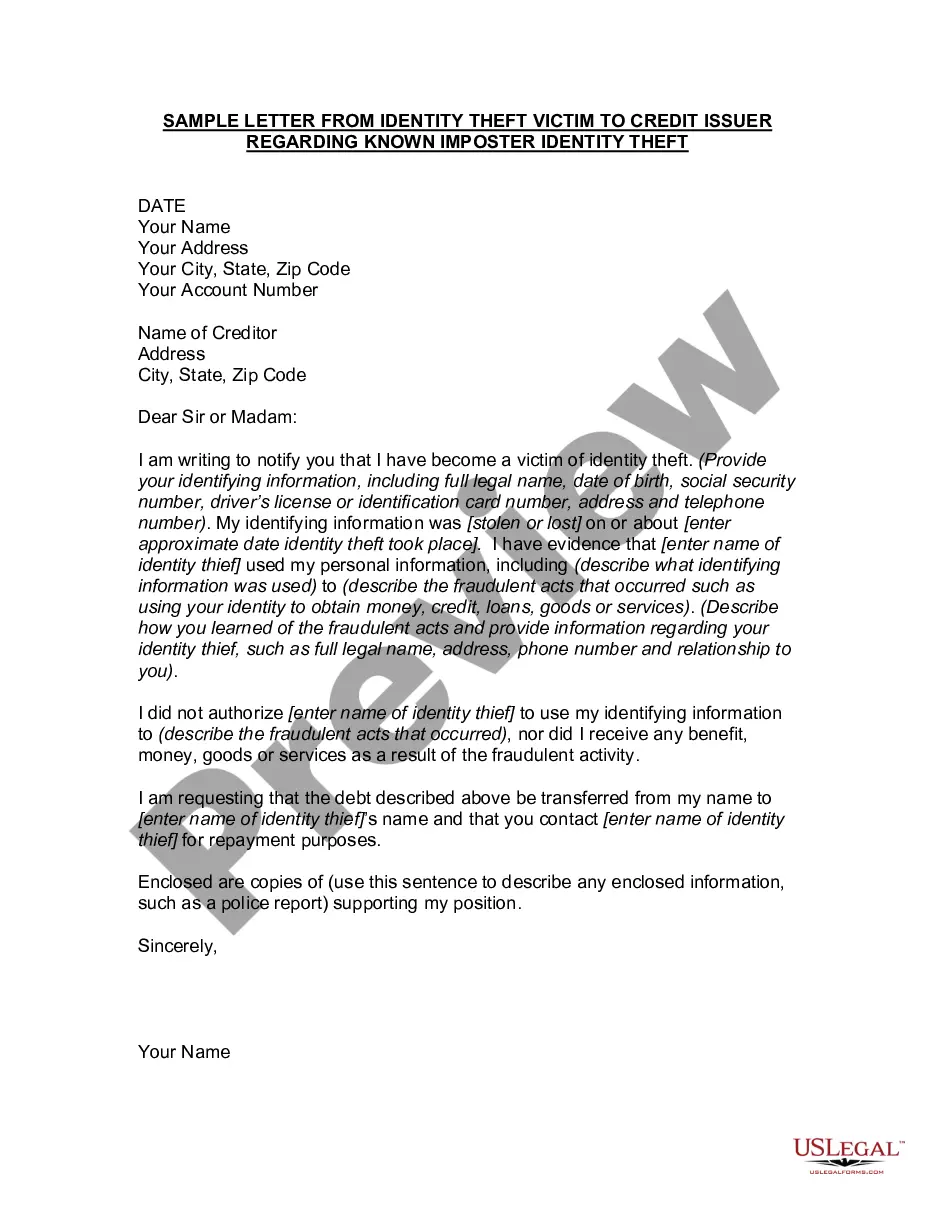

Title: Nevada Letter from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft Keywords: Nevada, letter, identity theft victim, credit issuer, imposter identity theft, known imposter, credit reporting agencies, fraudulent accounts, personal information, law enforcement, affidavit, fraud alert, stolen identity, account freeze, dispute resolution process, Fair Credit Reporting Act (FCRA), Identity Theft and Assumption Deterrence Act (IT ADA) Description: A Nevada letter from an identity theft victim to a credit issuer regarding known imposter identity theft is an important tool to report and address fraudulent activities conducted under stolen personal information. This letter serves as a formal complaint, notifying the credit issuer about the imposter's unlawful actions and seeking immediate resolution. Nevada's identity theft victims are advised to address their concerns by sending a formal letter to the credit issuer involved. There may be several types of Nevada letters from identity theft victims, including: 1. Nevada Letter of Notification: In this type of letter, the victim informs the credit issuer about the known imposter identity theft, providing details such as the date of discovery, description of fraudulent accounts, and any evidence supporting the claim. This document acts as a starting point for the resolution process. 2. Nevada Letter Requesting Account Freeze: If the victim suspects that multiple unauthorized accounts have been opened in their name, they may request the credit issuer to freeze all accounts and prevent further fraudulent activity. This type of letter emphasizes the urgency of the situation and highlights the need for immediate action to safeguard the victim's financial well-being. 3. Nevada Letter Requesting Fraud Alert Activation: Victims may also request the credit issuer to activate a fraud alert on their credit report, notifying potential lenders and creditors about the fraudulent activities. This step adds a layer of security to the victim's credit profile and makes it more difficult for imposters to open new accounts. 4. Nevada Letter Requesting Removal of Fraudulent Accounts: Once the victim has identified specific fraudulent accounts, they can send a letter requesting the credit issuer to remove these accounts from their credit report. This letter should provide evidence of the imposter's fraudulent actions and emphasize the victim's intention to hold the credit issuer responsible for any negative consequences resulting from the imposter's activities. 5. Nevada Letter Seeking Assistance with Dispute Resolution Process: In cases where the credit issuer has been unresponsive or uncooperative, victims may write a letter seeking assistance in resolving disputes related to the fraudulent accounts. This type of letter may be directed to the credit issuer's dispute resolution department, urging them to comply with their obligations under the Fair Credit Reporting Act (FCRA) and the Identity Theft and Assumption Deterrence Act (IT ADA). It is important for Nevada identity theft victims to maintain copies of all correspondence, including these letters, for future reference. Victims should also consider reporting the identity theft to law enforcement and filing an affidavit of identity theft. By taking prompt action and working closely with credit issuers and relevant authorities, victims can minimize the impact of imposter identity theft and protect their financial reputation.

Nevada Letter from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft

Description

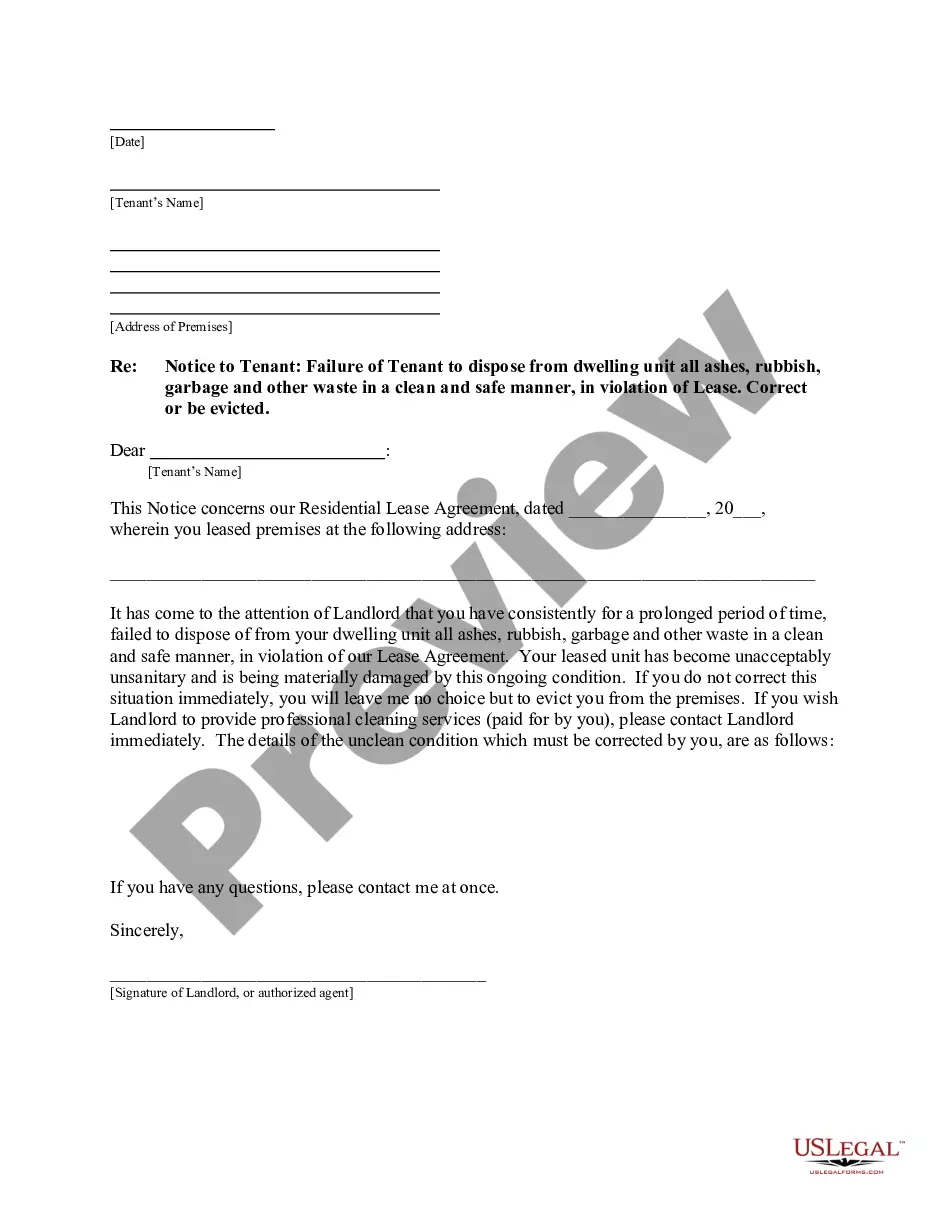

How to fill out Nevada Letter From Identity Theft Victim To Credit Issuer Regarding Known Imposter Identity Theft?

US Legal Forms - among the most significant libraries of legal forms in the United States - delivers a variety of legal document themes you may acquire or print out. Utilizing the site, you can get a huge number of forms for organization and specific uses, categorized by types, states, or search phrases.You can get the most up-to-date versions of forms much like the Nevada Letter from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft in seconds.

If you already have a subscription, log in and acquire Nevada Letter from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft through the US Legal Forms collection. The Obtain button will show up on every single type you look at. You have access to all earlier delivered electronically forms within the My Forms tab of your profile.

If you wish to use US Legal Forms for the first time, listed here are easy instructions to help you get started off:

- Be sure to have picked out the proper type to your metropolis/area. Select the Preview button to review the form`s information. See the type outline to actually have chosen the proper type.

- In the event the type does not fit your needs, make use of the Research industry at the top of the screen to discover the one which does.

- When you are happy with the shape, validate your choice by clicking on the Acquire now button. Then, select the rates strategy you like and give your references to register for the profile.

- Approach the transaction. Use your Visa or Mastercard or PayPal profile to complete the transaction.

- Select the file format and acquire the shape on the product.

- Make adjustments. Fill out, revise and print out and indication the delivered electronically Nevada Letter from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft.

Every design you included in your bank account does not have an expiration date and it is your own eternally. So, if you want to acquire or print out another version, just go to the My Forms section and click on on the type you will need.

Get access to the Nevada Letter from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft with US Legal Forms, one of the most comprehensive collection of legal document themes. Use a huge number of expert and status-certain themes that meet your organization or specific demands and needs.

Form popularity

FAQ

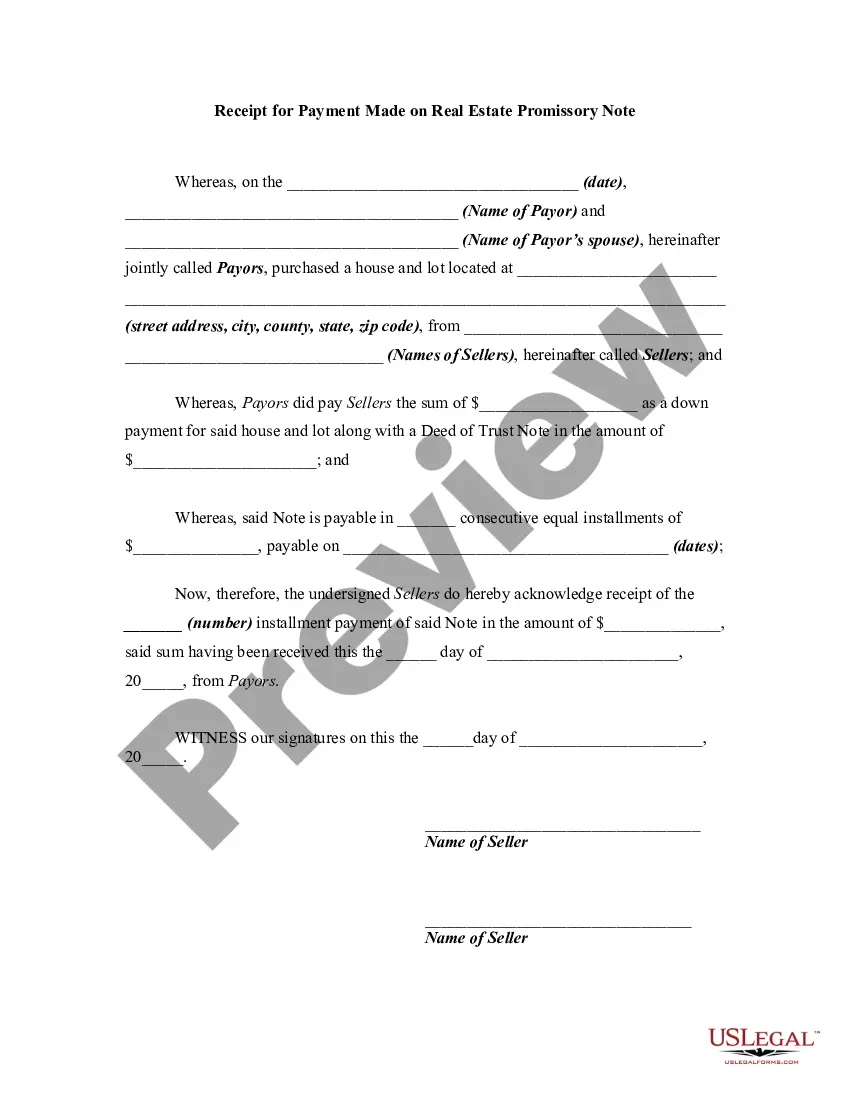

I am a victim of identity theft, and did not make the charge(s). I am requesting that the item(s) be blocked to correct my credit report. Enclosed are copies of (describe any enclosed documents) supporting my position. Please investigate this (these) matter(s) and block the disputed item(s) as soon as possible.

Dear Sir or Madam: I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.

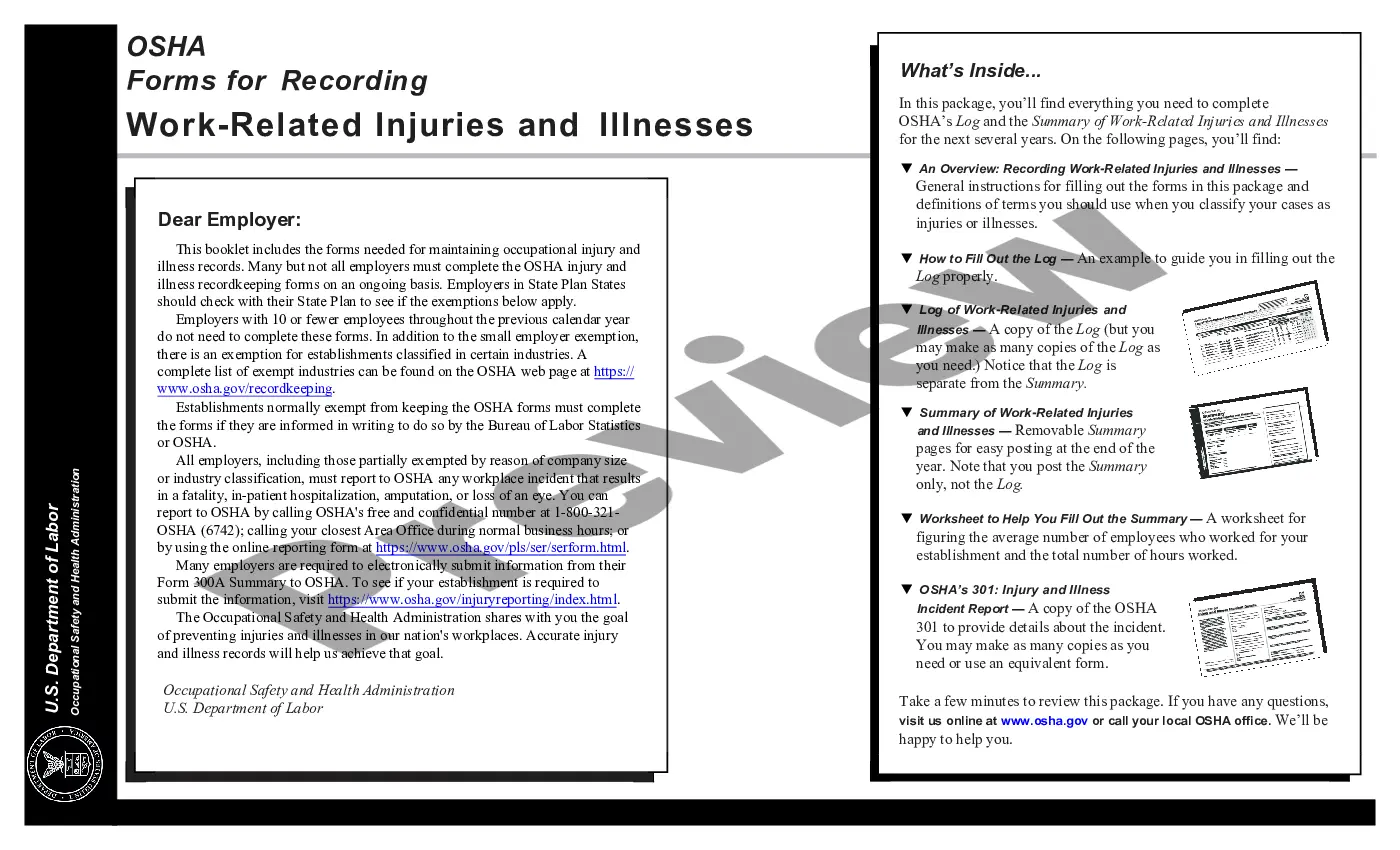

Use the ID Theft Affidavit Creditors may ask you to fill out fraud affidavits. The Federal Trade Commission's ID Theft Affidavit is accepted by the credit bureaus and by most major creditors. Send copies of the completed form to creditors where the thief opened accounts in your name.

I am a victim of identity theft, and I did not make [this/these] charge(s). I request that you remove the fraudulent charge(s) and any related finance charge and other charges from my account, send me an updated and accurate statement, and close the account (if applicable).

Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. You may want to enclose a copy of your credit report with the items in question circled.

Complete an ID Theft Affidavit and include it with your written statement. File a report with law enforcement officials and provide copies to any creditors needing proof of the crime.

Dear Sir or Madam: I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.

To report identity theft, contact: The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.