This form set up what is known as present interest trusts, with the intention of meeting the requirements of Section 2503(c) of the Internal Revenue Code.

Nevada Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children

Description

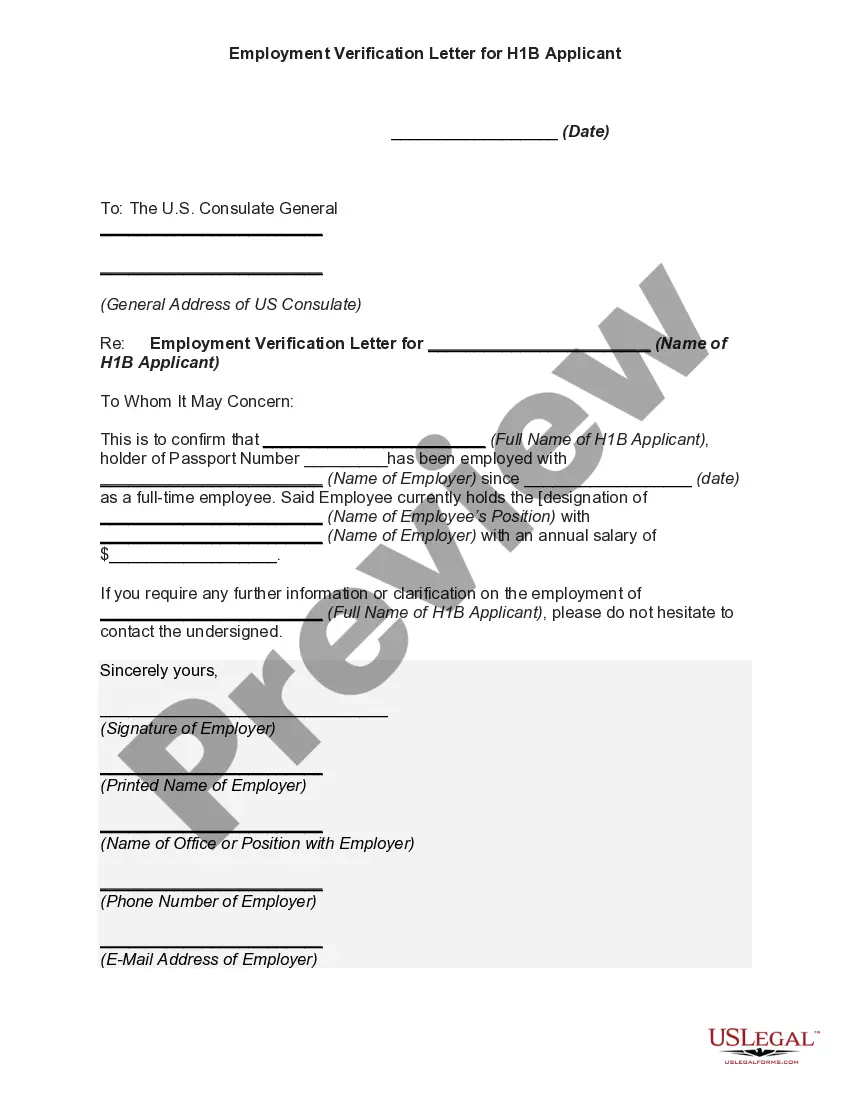

How to fill out Trust Agreement For Minors Qualifying For Annual Gift Tax Exclusion - Multiple Trusts For Children?

Have you ever been in a situation where you need documents for both business or personal reasons almost every time.

There are numerous legal document templates accessible online, but locating ones you can trust is not easy.

US Legal Forms offers thousands of document templates, such as the Nevada Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, which can be customized to meet state and federal requirements.

Once you locate the appropriate form, click Purchase now.

Select the payment plan you want, provide the necessary information to process your payment, and complete your purchase using your PayPal or Visa or Mastercard.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Nevada Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you require and ensure it is for the correct city/region.

- Use the Preview feature to review the document.

- Review the description to confirm you have selected the right form.

- If the form does not meet your needs, use the Lookup section to find the form that suits your requirements.

Form popularity

FAQ

Choosing the best type of trust for a minor largely depends on your financial goals. A 2503c trust is an excellent choice because it allows gifts to grow while providing access to funds when the child reaches adulthood. This trust structure also qualifies for the annual gift tax exclusion, which can be beneficial for families planning for their children's future. When considering a Nevada Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, consulting with experts via uslegalforms can guide you in making the best choice.

Gifts that fall under the annual exclusion limit do not need to be reported to the IRS. However, it's important to keep records of all gifts, especially when utilizing a Nevada Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children. This documentation can help provide clarity and transparency in the event of future inquiries or estate planning considerations.

Gifts made to irrevocable trusts may qualify for the annual exclusion if beneficiaries can withdraw the gift within a specified period. A Nevada Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children can be structured to meet these criteria, enabling you to take advantage of the exclusion. Always consult with a legal expert to ensure your trust meets the necessary conditions for this exclusion.

To qualify for the annual exclusion, gifts must be of present interest and generally given outright to the recipient. Utilizing a Nevada Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children can help ensure that gifts remain within the exclusion limit while providing structured support for minors. It's always wise to consult professionals to evaluate the specifics of each gift.

The federal gift tax limit applies to Nevada, which currently allows individuals to give a set amount each year without needing to report the gift. This limit can significantly benefit families utilizing a Nevada Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, helping to secure assets for minors while minimizing tax implications. Understanding this limit ensures that you effectively manage your gifting strategies.

In Nevada, trusts are generally not subject to state income tax. This favorable tax climate makes establishing a Nevada Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children an appealing choice for families. It's essential to consult with tax professionals to ensure compliance with federal tax laws and the specific needs of your trust.

The annual exclusion for gift splitting allows spouses to combine their individual gift exclusions. Currently, each individual can give a certain amount without incurring gift taxes. Therefore, when married couples use a Nevada Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, they can effectively double the amount they gift to their children under this provision.