Nevada Financial Consulting Agreement

Description

How to fill out Financial Consulting Agreement?

Are you presently in a location where you frequently require documents for either business or personal purposes almost every day.

There are numerous legal document templates available online, but finding ones you can rely on can be challenging.

US Legal Forms offers a vast array of document templates, including the Nevada Financial Consulting Agreement, which can be customized to comply with both state and federal regulations.

Once you find the appropriate template, click on Acquire now.

Select the pricing plan you want, fill in the necessary details to create your account, and pay for your order using PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you will be able to download the Nevada Financial Consulting Agreement template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the template you require and ensure it is for the correct city/area.

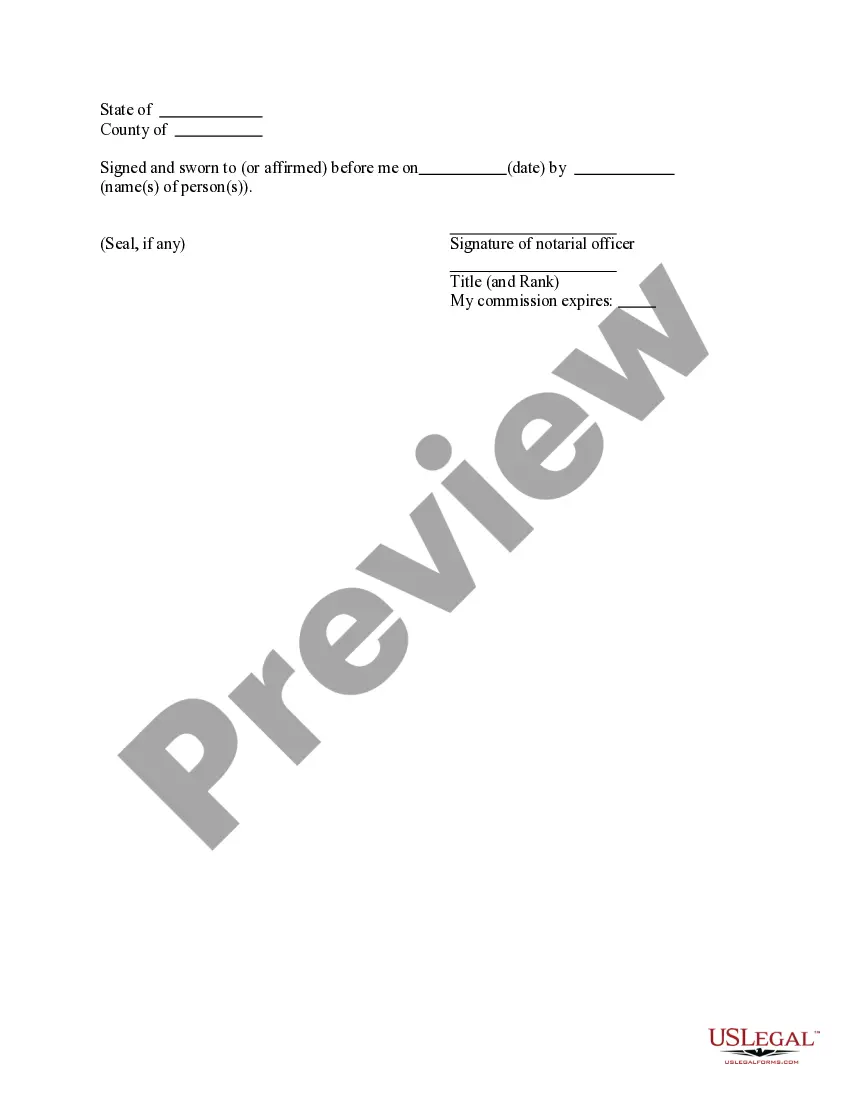

- Utilize the Preview button to review the form.

- Check the details to ensure you have selected the right template.

- If the template does not meet your needs, use the Search function to locate a template that matches your requirements.

Form popularity

FAQ

A contract is a broad legal document that can cover various types of agreements, while a service agreement specifically pertains to the provision of services. A service agreement details the work to be done, payment terms, and other conditions relevant to the service being provided. The Nevada Financial Consulting Agreement is a specific type of service agreement focused on consulting, clearly defining the relationship between the consultant and the client.

Setting up a consulting agreement involves outlining the nature of the services, defining the timeline, and specifying compensation. You should also include any clauses related to confidentiality and termination. Using a Nevada Financial Consulting Agreement template can simplify this process, ensuring that you cover all necessary aspects comprehensively and legally.

A Statement of Work (SOW) details the specific tasks and deliverables associated with a project, while a consulting agreement establishes the overall framework for the consulting relationship. Essentially, the SOW is a component of the consulting project, specifying who does what, when, and how. When you use a Nevada Financial Consulting Agreement, you can reference the SOW for details on project execution while maintaining the broader consulting terms.

While a consulting agreement is indeed a contract, it serves a specific purpose tied to providing consulting services. It lays out the expectations and responsibilities related to that consulting role. The Nevada Financial Consulting Agreement ensures that both parties understand their obligations, making it a vital tool for effective collaboration.

A consulting agreement is a specific type of contract that focuses on the advisory services provided by a consultant. While all consulting agreements are contracts, not all contracts are consulting agreements. The Nevada Financial Consulting Agreement is designed to address the nuances of consulting services, ensuring the consultant's role and compensation are clearly defined.

Yes, there is a notable difference between a contract and an agreement. A contract is a legally binding document that outlines specific commitments and obligations of the parties involved. On the other hand, an agreement may not always hold legal weight. Utilizing a Nevada Financial Consulting Agreement ensures that the terms of the consulting relationship are formally recognized and enforceable.

MSA stands for Master Service Agreement. It is a contract that defines the overarching terms under which multiple agreements will be executed between the parties. With an MSA in place, specific projects or services can be initiated without renegotiating the core conditions. The Nevada Financial Consulting Agreement can be part of this framework, allowing for streamlined project execution.

Consulting typically involves providing expert advice and strategic insights to clients, while contracting refers to a specific service agreement to perform certain tasks. In a consulting scenario, the focus is often on delivering knowledge and solutions. A Nevada Financial Consulting Agreement helps clarify these roles and sets the terms for the consulting engagement.

To write a Nevada Financial Consulting Agreement, start by defining the parties involved and their roles. Next, outline the services to be rendered, specifying deliverables and timelines. Include terms for payment, confidentiality, and termination. Lastly, ensure both parties review and sign the agreement to formalize their commitment, and consider using platforms like US Legal Forms for ready-to-use templates that simplify the process.

A Nevada Financial Consulting Agreement should clearly outline the scope of work, detailing the services the consultant will provide. It should specify payment terms, including rates and schedules, and include the duration of the agreement. Additionally, it's vital to incorporate confidentiality clauses to protect sensitive information and stipulate terms for termination to ensure both parties understand their rights and responsibilities.