Title: Nevada Agreement and Release for Working at a Novelty Store — Self-Employed: Overview and Types Introduction: The Nevada Agreement and Release for Working at a Novelty Store — Self-Employed is a legally binding contract designed to outline the terms and conditions of employment between a self-employed individual and a novelty store in the state of Nevada. This agreement ensures both parties are protected and provides clarity on various aspects of the working relationship. In Nevada, there are different types of agreements and releases that self-employed individuals may encounter when working at a novelty store. Let's explore these types in detail. 1. Independent Contractor Agreement: The Independent Contractor Agreement is a type of Nevada Agreement and Release for Self-Employed Individuals working at a novelty store. This agreement clearly defines the relationship between the self-employed individual and the novelty store as an independent contractor-client arrangement. It outlines the parties' rights and responsibilities, scope of work, payment terms, intellectual property rights, confidentiality, termination clauses, and dispute resolution mechanisms. 2. Non-Disclosure Agreement (NDA): In certain cases, a novelty store may require a self-employed individual to sign a Non-Disclosure Agreement. This agreement ensures that the self-employed person will not disclose any confidential or proprietary information they may come across during their employment at the novelty store. It protects the store's trade secrets, customer information, formulas, invention ideas, and any other sensitive company information from being shared without authorization. 3. Liability Release Agreement: A Liability Release Agreement is designed to protect the novelty store from any legal claims or liabilities that may arise due to employee negligence or accidents. This agreement serves as a waiver of liability, releasing the novelty store from any potential personal injury or property damage claims brought by the self-employed individual or any third parties due to the nature of the work performed when working at the novelty store. 4. Release of Claims Agreement: The Release of Claims Agreement is crucial when terminating the employment relationship between the novelty store and the self-employed individual. This agreement ensures that both parties release one another from any claims, demands, or disputes that may arise from the employment or its termination. It clarifies that once signed, the self-employed individual cannot pursue any legal action against the novelty store for any reason related to their employment. Conclusion: Nevada Agreement and Release for Working at a Novelty Store — Self-Employed consists of various types of legal agreements that safeguard the interests of both parties involved. These agreements range from the Independent Contractor Agreement that outlines the working relationship to the Liability Release Agreement that protects the novelty store from any potential liabilities. A thorough understanding of these agreements is crucial for self-employed individuals working at a novelty store in Nevada to ensure a fair and transparent employment relationship.

Nevada Agreement and Release for Working at a Novelty Store - Self-Employed

Description

How to fill out Nevada Agreement And Release For Working At A Novelty Store - Self-Employed?

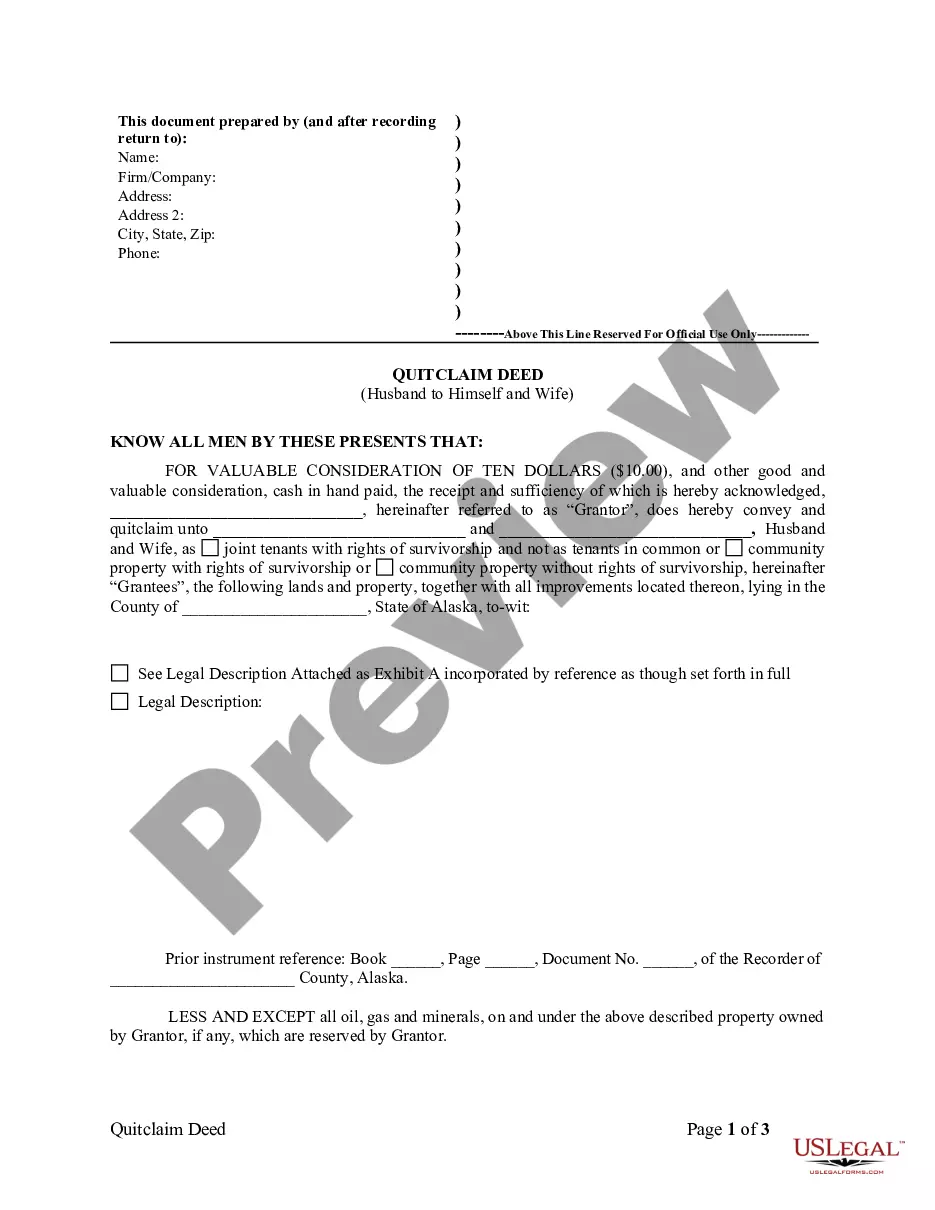

If you wish to be complete, acquire, or print sanctioned document templates, utilize US Legal Forms, the largest selection of legal forms, which can be accessed online. Take advantage of the site’s straightforward and convenient search to find the documents you need.

Many templates for business and personal uses are categorized by groups and states, or keywords. Use US Legal Forms to obtain the Nevada Agreement and Release for Working at a Novelty Store - Self-Employed with just a few clicks.

If you are already a US Legal Forms user, sign in to your account and click the Download button to receive the Nevada Agreement and Release for Working at a Novelty Store - Self-Employed. You can also access forms you have previously obtained from the My documents section of your account.

Every legal document template you purchase is yours forever. You have access to every document you acquired in your account. Click on the My documents section and select a document to print or download again.

Be proactive and acquire, and print the Nevada Agreement and Release for Working at a Novelty Store - Self-Employed with US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal needs.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Review option to examine the form’s content. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search bar at the top of the screen to find alternative versions of the legal document template.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose the payment plan that suits you and provide your details to register for an account.

- Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, modify and print or sign the Nevada Agreement and Release for Working at a Novelty Store - Self-Employed.

Form popularity

FAQ

Transitioning from full-time work to self-employment requires careful planning and execution. Start by assessing your financial situation and identifying potential clients or markets for your services. Drafting a Nevada Agreement and Release for Working at a Novelty Store - Self-Employed can provide you with a clear framework for your new venture. Additionally, consider consulting resources on the USLegalForms platform, which can guide you through the essential steps of your transition.

A B2B collaboration contract is a legal document that formalizes an agreement between two businesses working together. It outlines the roles, responsibilities, and expectations of each party involved in the partnership. Utilizing a Nevada Agreement and Release for Working at a Novelty Store - Self-Employed can facilitate these collaborations by ensuring both businesses understand their obligations and rights. This type of contract promotes a harmonious working relationship and fair terms.

If you are self-employed, you operate your own business. You are responsible for all aspects of your work, including completing tasks, managing finances, and handling client relationships. The Nevada Agreement and Release for Working at a Novelty Store - Self-Employed can help outline your responsibilities and protect your interests in business dealings. This agreement lays out the terms of your engagement, ensuring clarity in your self-employment.

Yes, you typically need a business license to operate as a self-employed individual in Nevada. This requirement applies even if you plan to work under a Nevada Agreement and Release for Working at a Novelty Store - Self-Employed. Acquiring this license not only ensures compliance with local regulations, but also establishes your credibility as a business owner. To simplify the process of obtaining the necessary documents and licenses, consider using the uslegalforms platform, which offers tailored solutions for self-employed individuals.

Yes, 1099 employees are required to obtain a business license in Nevada. This requirement helps you operate legally and establishes your credibility in the marketplace. To navigate this process seamlessly, consider using the Nevada Agreement and Release for Working at a Novelty Store - Self-Employed for guidance on licensure and compliance.

An independent contractor in Nevada is an individual contracted to perform services for a business, while retaining significant control over how those services are delivered. This means you operate autonomously, which influences taxes and liability considerations. The Nevada Agreement and Release for Working at a Novelty Store - Self-Employed will help clarify these important distinctions.

Nevada follows the 'at-will' employment doctrine, meaning employers can terminate independent contractors and employees for nearly any reason, as long as it does not violate discrimination laws. Understand your rights by reviewing the provisions in the Nevada Agreement and Release for Working at a Novelty Store - Self-Employed, which also addresses termination scenarios.

Yes, 1099 contractors typically need a business license to legally operate in Nevada. Securing this license helps you establish your business while complying with local regulations. The Nevada Agreement and Release for Working at a Novelty Store - Self-Employed provides essential insights into licensing requirements pertinent to your work.

Nevada law defines independent contractors as individuals who provide services under their control, without direct supervision from a business. This legal designation affects tax and liability responsibilities. To ensure compliance, familiarize yourself with the rules outlined in the Nevada Agreement and Release for Working at a Novelty Store - Self-Employed.

Independent contractors in Nevada are usually exempt from mandatory workers' compensation insurance. Despite this, it is wise to look into insurance options to protect yourself from work-related injuries. The Nevada Agreement and Release for Working at a Novelty Store - Self-Employed covers important safety aspects that can help you make informed decisions.

More info

A Nevada independent contractor agreement covers more than the contract itself. The agreement sets out expectations, responsibilities and payment terms. Independent Contractor Agreements are used in states such as Nevada LAW REQUEST STATEMENT Independent Contractor Agreement Please wait you have exceeded this time limit! Please log in or register to continue.