Nevada Lease of Business Premises - Real Estate Rental

Description

How to fill out Lease Of Business Premises - Real Estate Rental?

If you require to fully, download, or create authentic document templates, utilize US Legal Forms, the most extensive compilation of official forms available online.

Utilize the website's simple and convenient search to find the documents you need.

Various templates for commercial and personal uses are classified by categories and tags, or keyword searches.

Step 4. Once you have found the form you need, select the Buy now button. Choose your preferred pricing plan and enter your information to create an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Use US Legal Forms to find the Nevada Lease of Business Premises - Real Estate Rental with just a few clicks.

- If you are currently a US Legal Forms customer, sign in to your account and click the Acquire button to get the Nevada Lease of Business Premises - Real Estate Rental.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

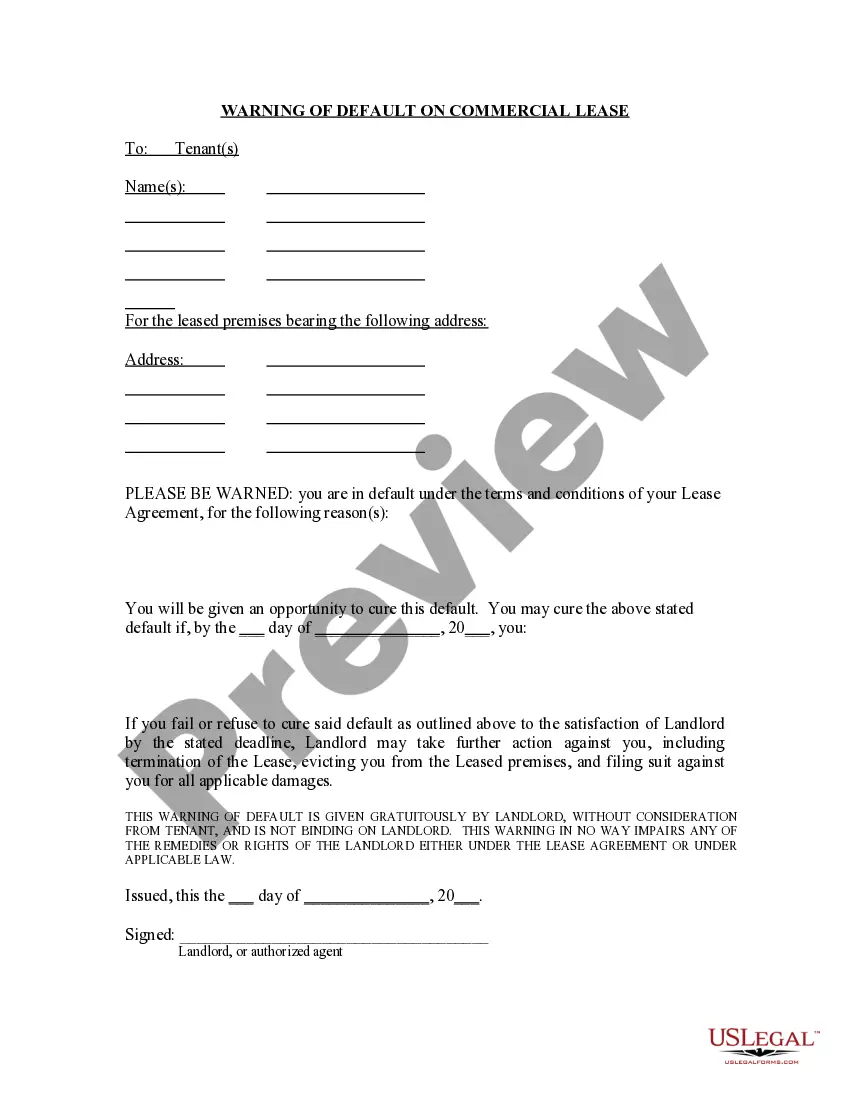

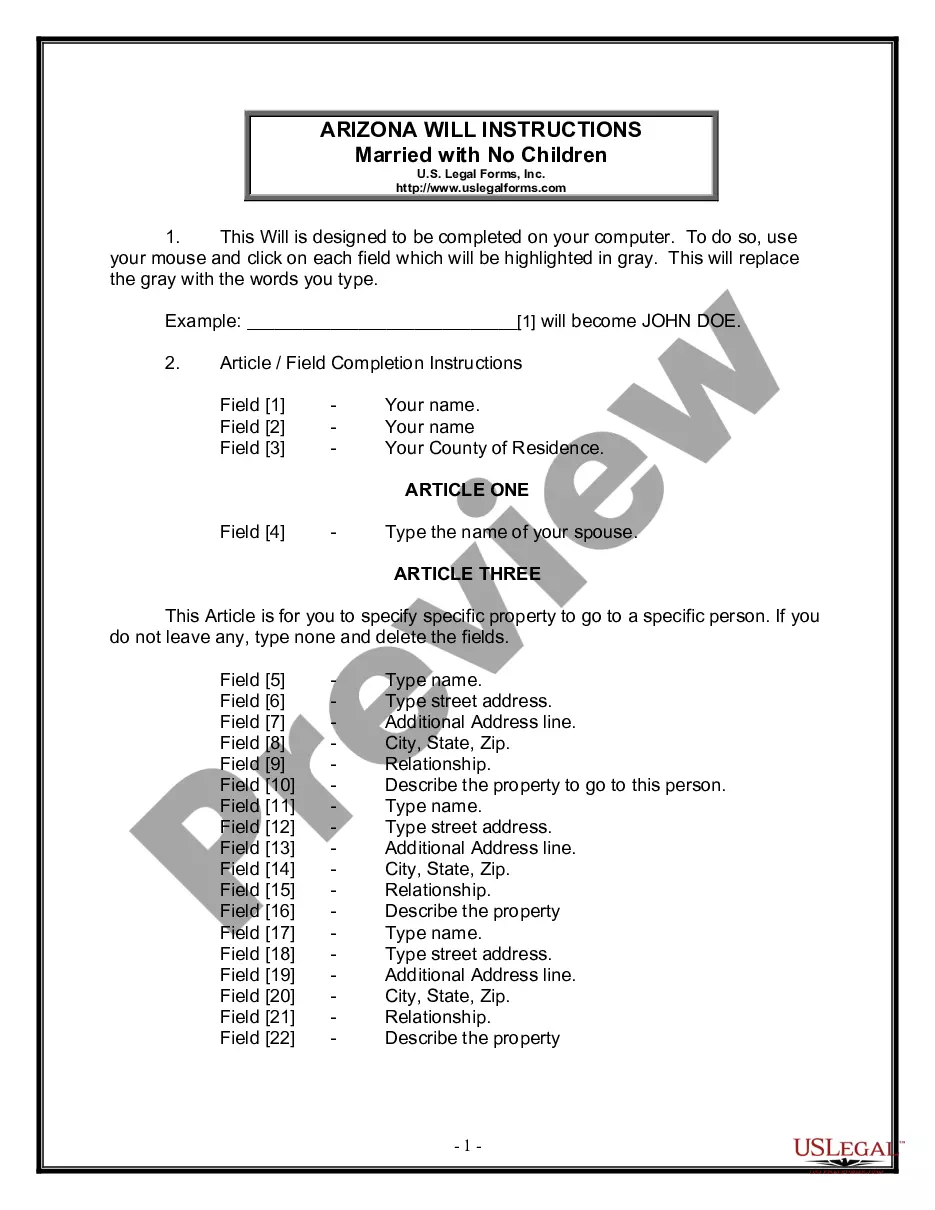

- Step 2. Utilize the Review option to check the form’s details. Remember to read the information.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal form format.

Form popularity

FAQ

Rental laws in Nevada regulate landlord-tenant relationships, covering aspects like security deposits, eviction procedures, and lease terms. These laws ensure that both landlords and tenants understand their rights and responsibilities, promoting fairness in real estate transactions. For anyone involved in a Nevada Lease of Business Premises - Real Estate Rental, being familiar with these laws helps avoid complications.

To assign a commercial lease, the tenant must obtain the landlord's consent, often specified in the lease agreement. This involves providing the landlord with the new tenant’s details and seeking their approval. Understanding how to properly assign a Nevada Lease of Business Premises - Real Estate Rental is crucial, as it helps maintain a smooth transition and ensures compliance with lease terms.

The most common lease is the residential lease, typically utilized for renting living spaces. However, in a commercial context, the gross lease is frequently used, offering clarity and simplicity for tenants. Whether you’re dealing with a residential or a Nevada Lease of Business Premises - Real Estate Rental, knowing the common lease types helps you make informed choices.

The most common type of leasehold is the tenancy for years, which has a specific start and end date. This type of lease provides stability for both landlords and tenants, as the terms are clearly defined from the outset. In the context of a Nevada Lease of Business Premises - Real Estate Rental, this arrangement can help businesses plan their operations effectively.

The three main types of leases are gross leases, net leases, and modified gross leases. In a gross lease, the landlord covers all property expenses, including taxes and maintenance. A net lease shifts certain expenses, like property taxes or insurance, to the tenant. Understanding these types is essential when considering a Nevada Lease of Business Premises - Real Estate Rental.

An addendum to a lease in Nevada is an additional document that modifies or adds specific terms to the original lease agreement. It allows property owners and tenants to customize aspects of their arrangement, such as rental rates, maintenance responsibilities, or duration of the lease. When drafting a Nevada Lease of Business Premises - Real Estate Rental, including an addendum can clarify expectations and prevent future disputes.

Leases generally fall into several categories, including gross leases, net leases, percentage leases, and more. Each type carries distinct financial implications and responsibilities for tenants and landlords. Understanding these differences is crucial when negotiating a Nevada Lease of Business Premises - Real Estate Rental to ensure clarity in expectations and obligations.

The best lease type for commercial property largely depends on your business needs and financial situation. Many business owners prefer net leases as they provide control over operational expenses, which can be beneficial in the long run. When drafting a Nevada Lease of Business Premises - Real Estate Rental, assess your priorities to determine the most suitable lease structure.

The most common lease term for office space typically ranges from three to five years. This duration allows tenants to establish stability while providing landlords a reliable income flow. For those considering a Nevada Lease of Business Premises - Real Estate Rental, this term often strikes a balance between flexibility and commitment.