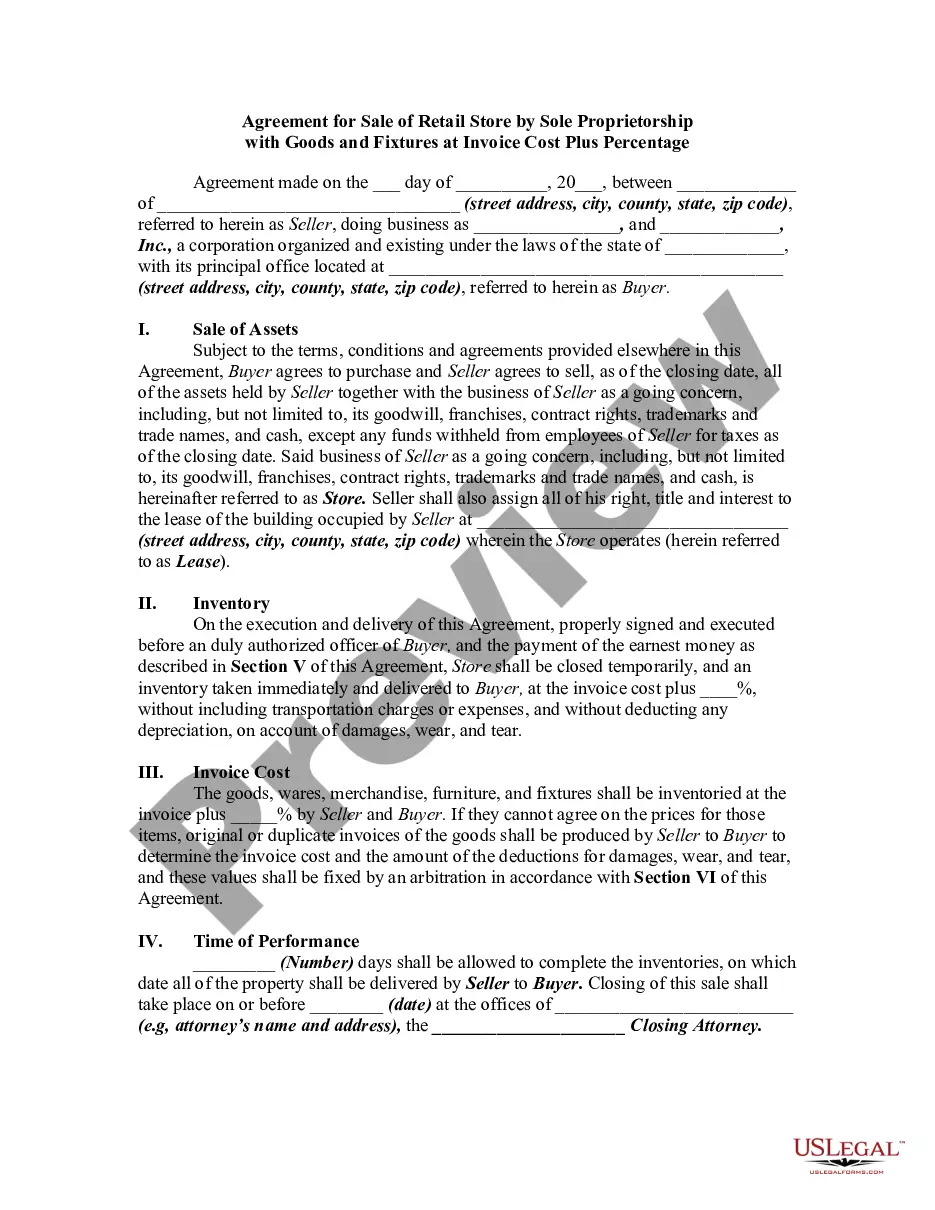

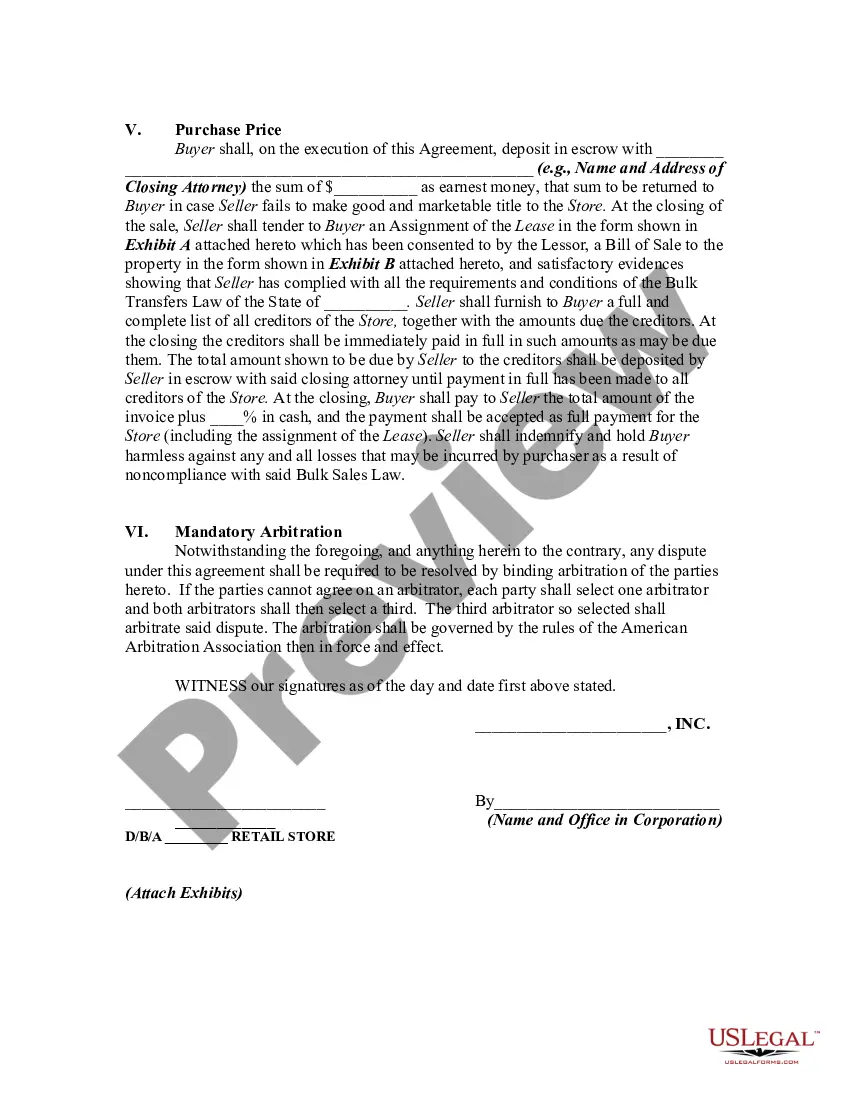

Nevada Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage

Description

How to fill out Agreement For Sale Of Retail Store By Sole Proprietorship With Goods And Fixtures At Invoice Cost Plus Percentage?

US Legal Forms - one of the most prominent collections of legal documents in the USA - provides a vast selection of legal document templates available for download or printing.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the most recent versions of forms such as the Nevada Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage in just a few minutes.

If the form does not meet your requirements, utilize the Search field at the top of the screen to find the one that does.

If you are satisfied with the form, confirm your selection by clicking the Get now button. Then, choose the payment plan you desire and provide your details to create an account.

- If you have a subscription, Log In to download the Nevada Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage from your US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously downloaded forms from the My documents tab in your account.

- For first-time users of US Legal Forms, here are some simple instructions to initiate your experience.

- Make sure you have selected the correct form for your city/county.

- Click the Preview button to examine the contents of the form.

Form popularity

FAQ

Yes. Remote sellers registered in Nevada to collect and remit sales and use taxes are required to collect both the state and local sales or use taxes that apply to the transaction.

Yes. Any purchase, other than inventory, made by a retailer from a non-registered vendor, for use in the business, is subject to Use Tax and must be reported on the monthly or quarterly Sales and Use Tax return. Examples of this are supplies, forms, or equipment that is not re-sold.

Goods that are subject to sales tax in Nevada include physical property, like furniture, home appliances, and motor vehicles. Prescription medicine, groceries, and gasoline are all tax-exempt.

Nevada sales tax details The Nevada (NV) state sales tax rate is currently 4.6%. Depending on local municipalities, the total tax rate can be as high as 8.265%. Other, local-level tax rates in the state of Nevada are quite complex compared against local-level tax rates in other states.

All purchases of tangible personal property by mail order or from catalogs are subject to Use Tax if Nevada Sales Tax is not charged by the seller. 4. A Nevada business orders a computer system from an out-of-state dealer who delivers or ships the system to its Nevada business address.

Sellers that purchase taxable goods for resale should obtain a resale certificate. A buyer purchasing an item for resale must submit a valid resale certificate to the seller at the time of purchase.

Nearly all tangible personal property transferred for value is taxable. Most goods, wares and merchandise are taxable in Nevada. Services necessary to complete the sale of tangible personal property are taxable.

If a good or business is exempt, the government doesn't tax the sale of the good, but producers cannot claim a credit for the VAT they pay on inputs to produce it.

Goods that are subject to sales tax in Nevada include physical property, like furniture, home appliances, and motor vehicles. Prescription medicine, groceries, and gasoline are all tax-exempt.

Resale CertificateThis form must be used when the holder of a sales tax permit purchases something that he will later resell. It allows the permit holder not to be charged tax. Remember that if you are purchasing something for your own use that you will not resell, you must pay the sales taxes due. Resale Certificate.