An escrow may be terminated according to the escrow agreement when the parties have performed the conditions of the escrow and the escrow agent has delivered the items to the parties entitled to them according to the escrow instructions. An escrow may be prematurely terminated by cancellation after default by one of the parties or by mutual consent. An escrow may also be terminated at the end of a specified period if the parties have not completed it within that time and have not extended the time for performance.

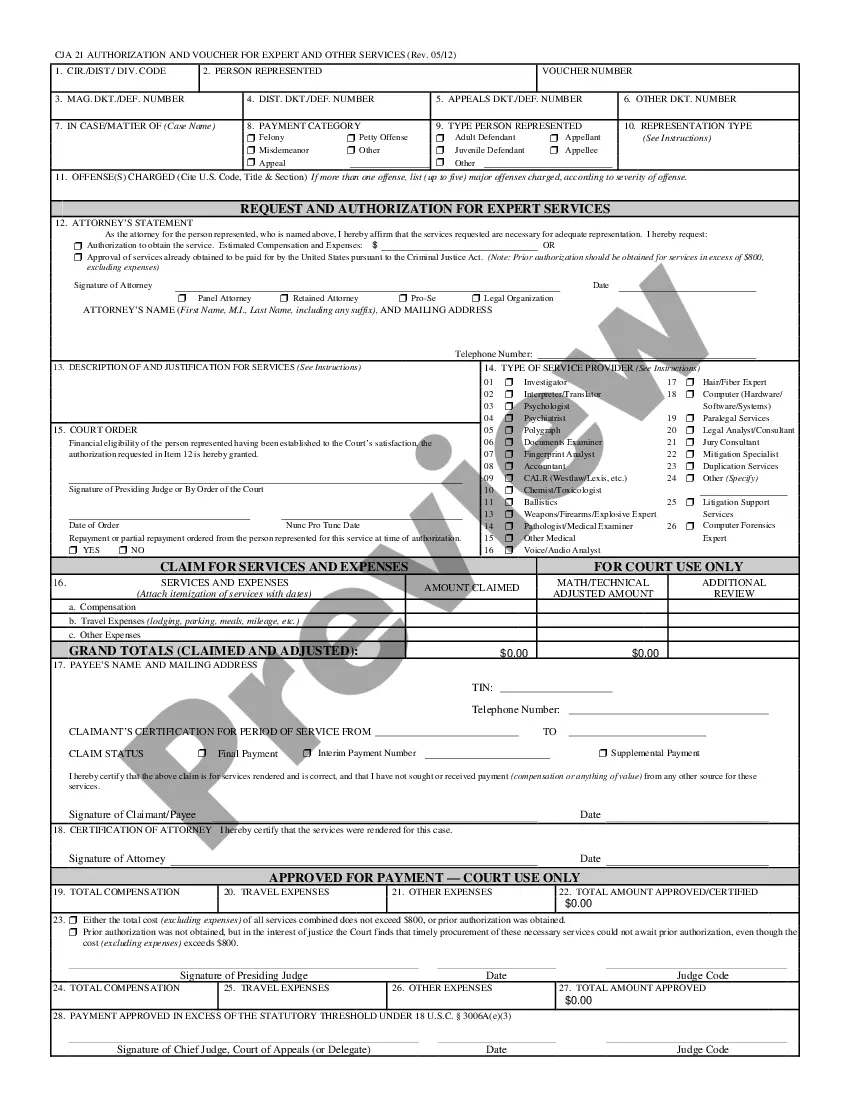

Nevada Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow

Description

How to fill out Instructions To Title Company To Cancel Escrow And Disburse The Funds Held In Escrow?

You can spend multiple hours online searching for the legal document template that fulfills the state and federal requirements you need.

US Legal Forms offers thousands of legal documents that have been reviewed by professionals.

You can download or print the Nevada Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow from the platform.

To find another version of the form, use the Search area to locate the template that meets your needs and requirements.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, edit, print, or sign the Nevada Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow.

- Each legal document template you purchase is yours forever.

- To obtain another copy of any purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple steps below.

- First, ensure that you have selected the correct document template for the region/city you choose.

- Read the form description to confirm you have selected the right template.

Form popularity

FAQ

An escrow account is a neutral third-party account where funds are held during a transaction until all conditions are met. Essentially, it protects both the buyer and seller by ensuring that the funds are only released when both parties deliver their obligations. For anyone involved in a property transaction in Nevada, understanding the Nevada Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow is essential for knowing how to navigate this process effectively. This adds a layer of security and trust to your dealings.

Several factors can lead to the termination of an escrow, including mutual agreement between parties, a failure to meet contractual obligations, or specific contingencies outlined in the agreement. If either party withdraws from the transaction, the title company may also consider this a valid reason. Understanding the Nevada Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow can clarify which situations apply. Always ensure that any termination is documented appropriately.

If you wish to cancel your escrow, you'll start by contacting the title company handling your escrow account. Provide them with a formal request that states your intent to cancel, along with any pertinent transaction details. By adhering closely to the Nevada Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow, you can facilitate the cancellation. It’s wise to keep a copy of your request for your records.

To cancel escrow, you need to provide clear instructions to the title company managing your escrow account. Typically, this involves submitting a written request that includes all relevant details of the transaction. Following the Nevada Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow helps ensure a smooth process. Be sure to review the specific terms outlined in your escrow agreement as they may dictate the required steps.

Closing a transaction in escrow signifies that all terms of the agreement have been satisfied, and the transaction can proceed. At this point, the title company will distribute funds and finalize property ownership transfer. If you face any issues, reviewing the Nevada Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow may provide the guidance you need.

Terminating a buyer's agreement typically requires mutual consent or valid grounds for cancellation. Document your reasons clearly and notify the parties involved. Following the Nevada Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow can help guide you through this process effectively.

Withdrawing from escrow involves notifying the title company of your decision to cancel. You should submit a formal request, citing the reason for withdrawal. It’s crucial to follow the Nevada Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow to ensure the proper return of any held funds.

Closing of escrow occurs when all the conditions of a transaction are met and the ownership of the property is officially transferred. During this process, the title company disburses funds to the seller and provides the buyer with the necessary documentation. Understanding the Nevada Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow is essential if you need to cancel this process.

To terminate escrow, you should first ensure that both parties consent to the decision. Next, provide the title company with written instructions that comply with Nevada Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow. Following these steps will ease the disbursement process and ensure a smooth cancellation.

Breaking escrow means that one or both parties decide to cancel the transaction before closing. This can occur due to a variety of reasons, such as failure to meet contingencies or inability to secure financing. If you've decided to break escrow, consult the Nevada Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow for the correct steps to follow.