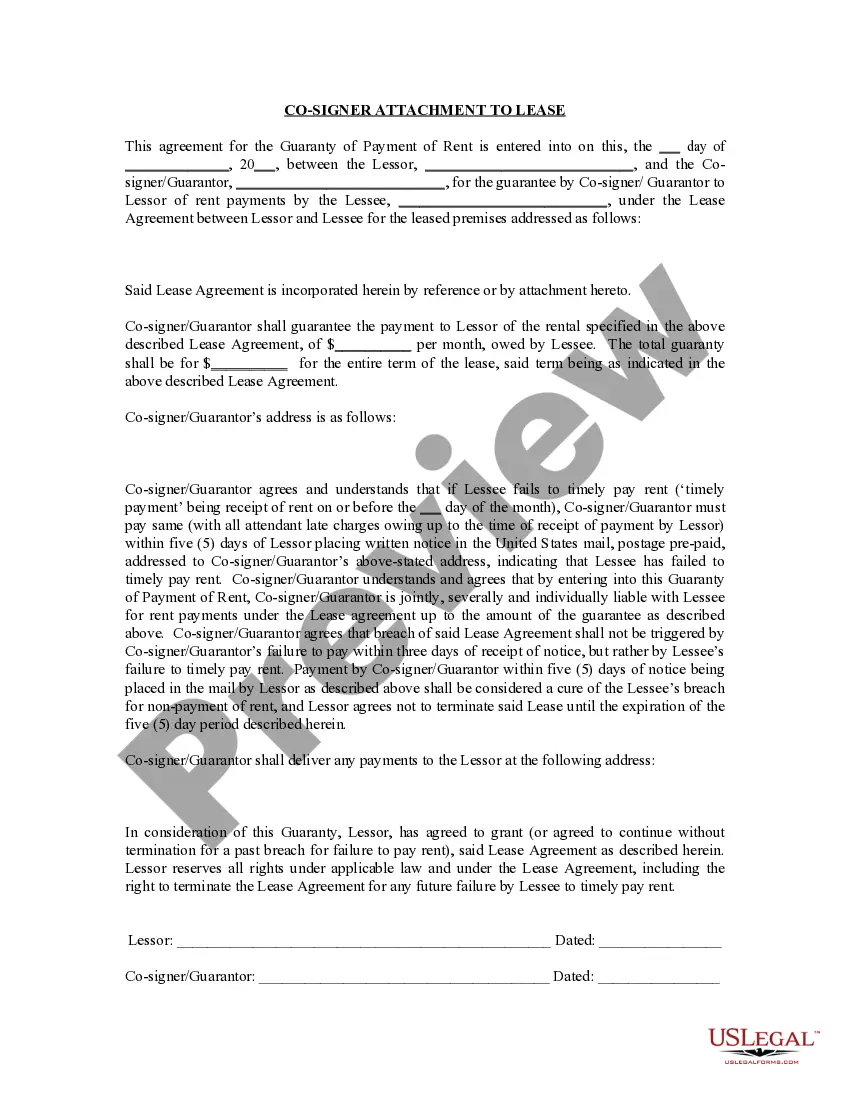

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law. A conditional guaranty contemplates, as a condition to liability on the part of the guarantor, the happening of some contingent event. A guaranty of the payment of a debt is distinguished from a guaranty of the collection of the debt, the former being absolute and the latter conditional.

A Nevada Conditional Guaranty of Payment of Obligation is a legal agreement that outlines the responsibilities of a guarantor to ensure the fulfillment of a financial obligation or debt by a party referred to as the primary obliged. In this case, the guarantor acts as a secondary source of payment, providing security to the creditor or lender in case the primary obliged fails to meet the requirements of the agreement. This conditional guaranty is specifically designed to function within the legal framework of Nevada, and as such, it adheres to the state's laws, regulations, and jurisdiction. It is vital for individuals, businesses, or organizations involved in financial transactions to understand the terms and conditions set forth in this agreement. The Nevada Conditional Guaranty of Payment of Obligation typically contains various crucial elements such as: 1. Parties Involved: This agreement identifies the parties involved, including the guarantor, the primary obliged, and the creditor or lender. 2. Obligations and Liabilities: It defines the obligations and liabilities of the guarantor. The guarantor promises to be responsible for the full or partial repayment of the debt or obligation, plus any interest, fees, or costs that may be incurred. 3. Release and Discharge: This section outlines the circumstances under which the guarantor's liability may be released or discharged, such as full repayment by the primary obliged or specific events defined by the agreement. 4. Default and Remedies: It describes the potential consequences and remedies available to the creditor or lender in case of default by the primary obliged. These may include pursuing legal action or seeking payment from the guarantor. 5. Governing Law: The agreement specifies that it is governed by the laws of Nevada, ensuring compliance with the state's legal requirements and regulations. Different types of Nevada Conditional Guaranty of Payment of Obligation may include: 1. Limited Guaranty: This type of guaranty limits the obligations and liabilities of the guarantor to a specific amount or particular conditions. 2. Unlimited Guaranty: Under this guaranty, the guarantor assumes full responsibility for the debt or obligation, without any limits on the amount or conditions. 3. Continuing Guaranty: A continuing guaranty covers multiple obligations or debts over an extended period. It remains in effect until terminated or discharged by the parties involved. In summary, a Nevada Conditional Guaranty of Payment of Obligation is a legal agreement designed to secure the repayment of a debt or obligation from a secondary source, known as the guarantor. Understanding the terms and conditions of this agreement is essential for all parties involved to ensure compliance with Nevada's laws and regulations.