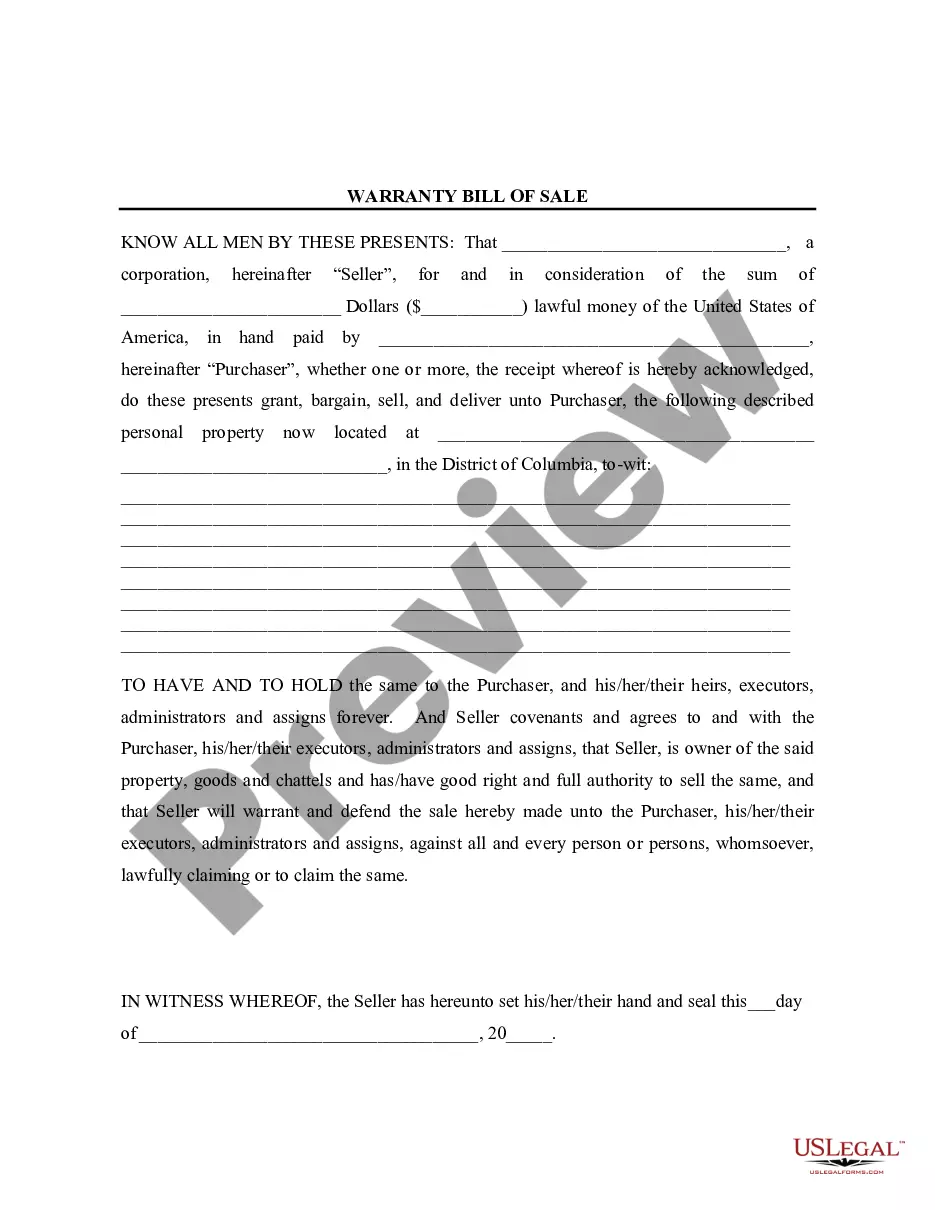

This form is a sample of an agreement to renew (extend) the term of a trust agreement. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

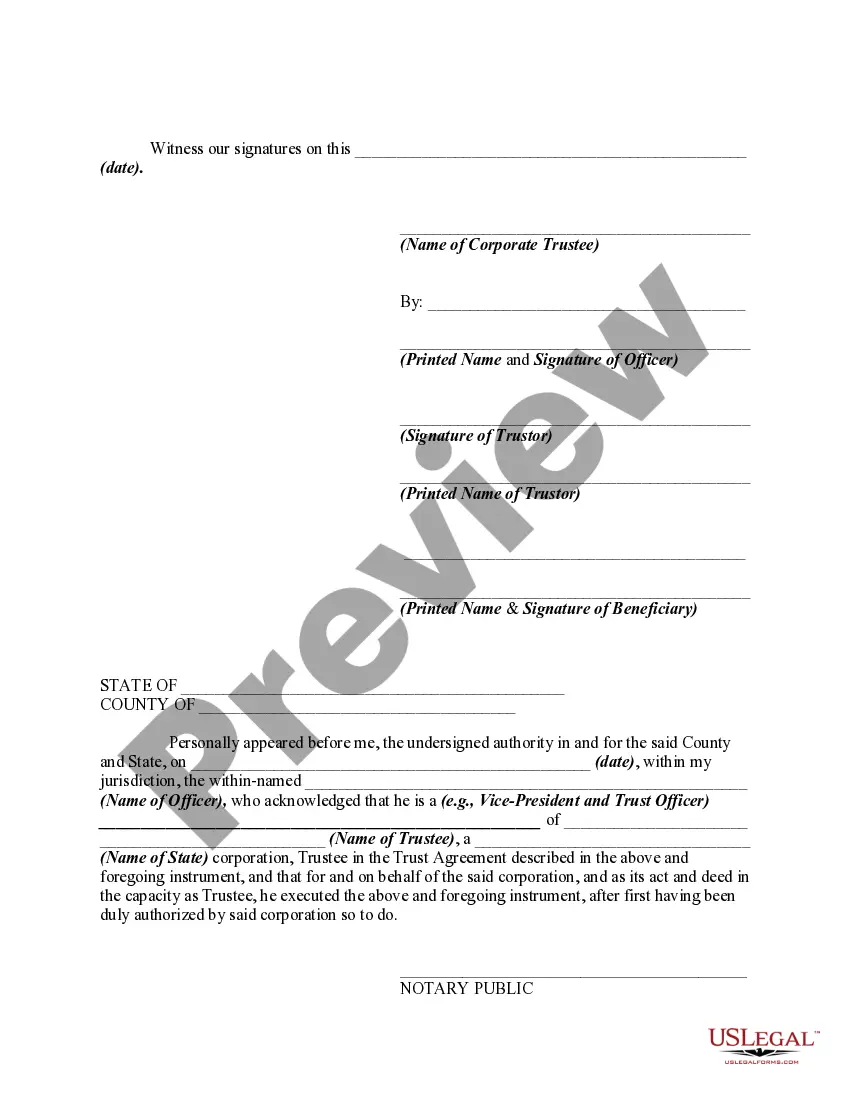

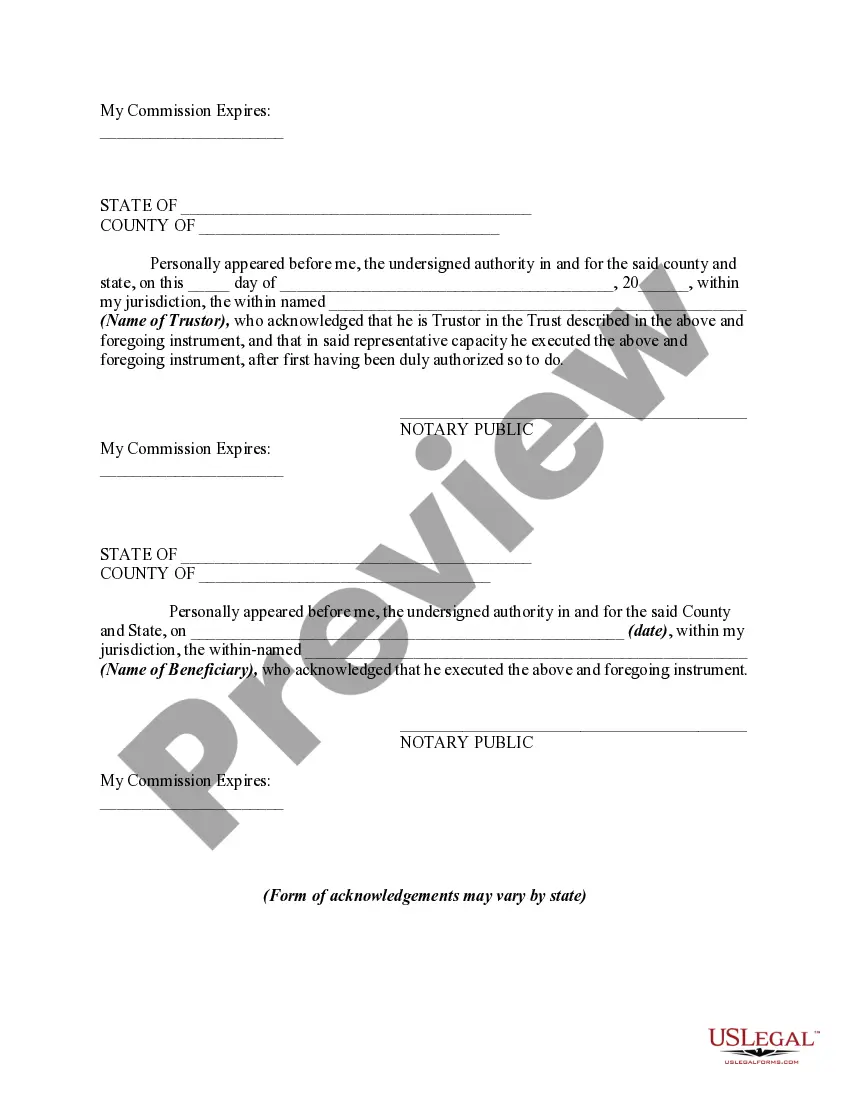

The Nevada Agreement to Renew Trust Agreement is a legal document that outlines the process of renewing an existing trust agreement in the state of Nevada. This agreement ensures that the trust will continue to be legally binding and effective for a predetermined period of time. In order to initiate the renewal process, the trustee and the beneficiaries must enter into a new agreement, which is commonly referred to as the Nevada Agreement to Renew Trust Agreement. This document encompasses various important terms and conditions that govern the renewal of the trust. The primary purpose of executing the Nevada Agreement to Renew Trust Agreement is to extend the life of the trust. This is particularly crucial in cases where the initial trust agreement has a fixed term or is set to expire. By renewing the trust, the parties involved can maintain control over the trust assets and continue enjoying the benefits and protections that it provides. There are several types of Nevada Agreement to Renew Trust Agreements, depending on the specific circumstances and objectives of the parties involved: 1. General Renewal Agreement: This is the most common type of trust renewal agreement. It allows for the trust to be extended for a predetermined period of time, typically mentioned in the original trust agreement. 2. Amendment and Restatement Agreement: In some cases, the trust agreement may require significant changes or modifications. In such instances, an amendment and restatement agreement is executed, which not only extends the trust but also incorporates the necessary amendments. 3. Termination and Renewal Agreement: In situations where the trust's purpose, beneficiaries, or terms need to be altered substantially, a termination and renewal agreement is employed. This agreement terminates the existing trust and creates a new trust with revised provisions. 4. Revocable Trust Extension Agreement: Revocable trusts, which can be modified or terminated by the person who created the trust (granter), may require an extension agreement to prolong the trust's duration beyond the granter's lifetime or a specified period. When executing the Nevada Agreement to Renew Trust Agreement, it is imperative to consult with a qualified attorney who specializes in trust law. This ensures that the agreement adheres to the legal requirements and accurately reflects the intentions of the parties involved. Additionally, seeking professional advice can help mitigate potential risks and clarify any ambiguities in the existing trust agreement.