One principal advantage of insurance trusts is that they permit a greater flexibility in investment and distribution than may be effected under settlement options generally included in the policies themselves. Another advantage is that such trusts, like other gifts of insurance policies, may afford substantial estate tax savings.

Nevada Irrevocable Trust Funded by Life Insurance

Description

How to fill out Irrevocable Trust Funded By Life Insurance?

US Legal Forms - among the most extensive compilations of legitimate documents in the USA - offers a broad selection of legitimate document templates that you can download or create.

By utilizing the website, you can access thousands of templates for business and personal use, categorized by types, states, or keywords. You can find the most recent document types such as the Nevada Irrevocable Trust Funded by Life Insurance in just a few minutes.

If you already hold a monthly subscription, Log In and download the Nevada Irrevocable Trust Funded by Life Insurance from the US Legal Forms library. The Download button will appear on every document you view. You can access all previously acquired templates in the My documents section of your account.

Complete the purchase. Use a credit card or PayPal account to finish the transaction.

Select the format and download the template to your device. Edit. Complete, modify, and print or sign the acquired Nevada Irrevocable Trust Funded by Life Insurance. Every template you add to your account does not have an expiration date and is yours permanently. So, if you need to download or create another copy, simply visit the My documents section and click on the template you desire. Access the Nevada Irrevocable Trust Funded by Life Insurance with US Legal Forms, the most thorough library of legitimate document templates. Utilize thousands of specialized and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are some simple steps to help you get started.

- Ensure you have chosen the correct template for your city/state. Click the Preview button to review the form’s details.

- Examine the form information to verify that you have chosen the correct template.

- If the template does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the template, confirm your selection by clicking the Acquire now button.

- Next, choose the pricing plan you prefer and provide your information to register for an account.

Form popularity

FAQ

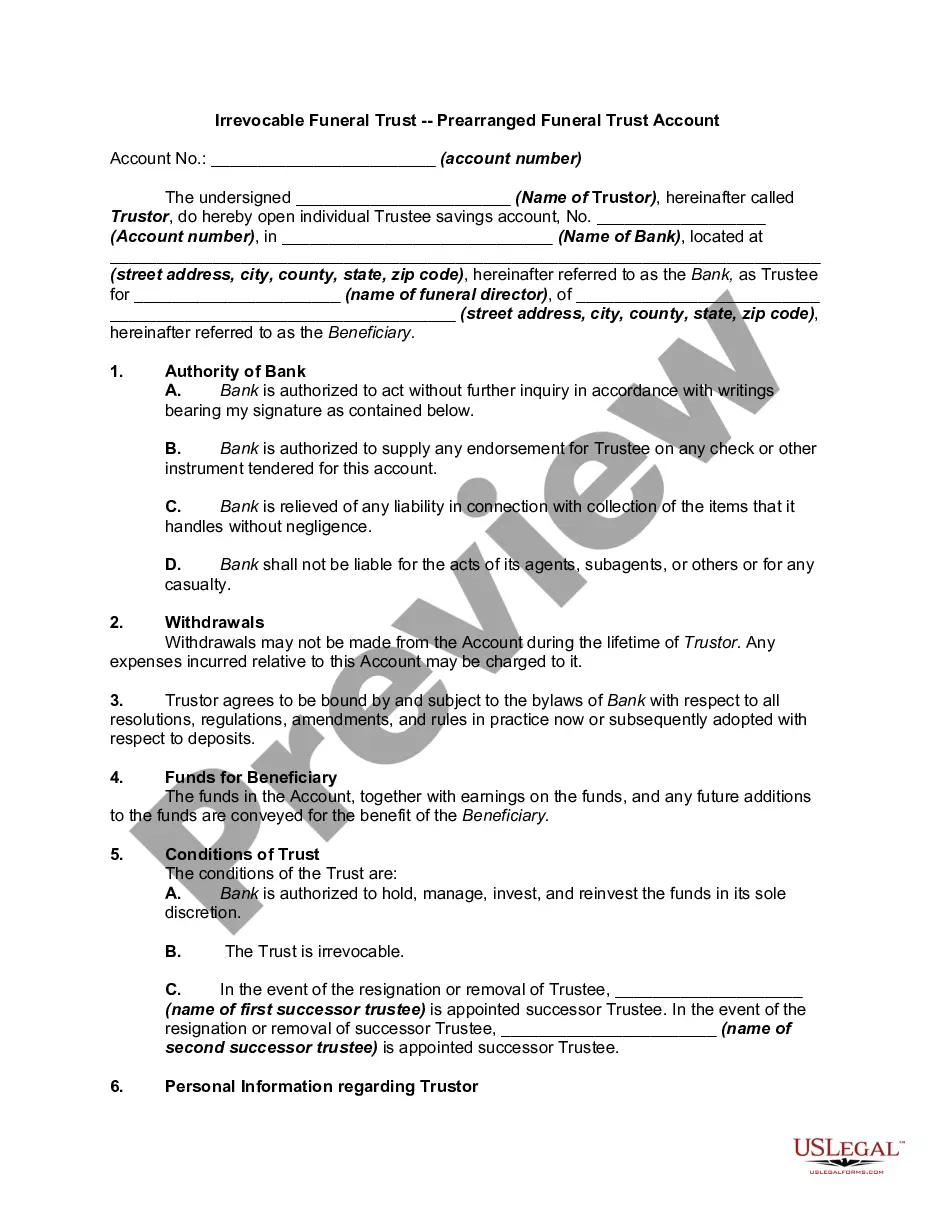

In Nevada, the irrevocable trust law allows individuals to create trusts that cannot be modified or revoked once established. This is particularly beneficial for asset protection and estate planning, making it easier to shield your assets from creditors. The Nevada Irrevocable Trust Funded by Life Insurance offers unique advantages, such as tax benefits and control over how your life insurance proceeds are distributed. Understanding these laws can guide you in maximizing the benefits of your trust.

To fund a Nevada Irrevocable Trust Funded by Life Insurance, you must first establish the trust with a qualified attorney. Then, you can designate the trust as the beneficiary of your life insurance policy. This process ensures that the death benefit goes directly to the trust, protecting the funds from estate taxes. Additionally, consider any premium payments and how they can be handled within the trust to maintain its tax advantages.

Yes, you can place life insurance in an irrevocable trust, and doing so can provide substantial benefits, including potential estate tax savings. A Nevada Irrevocable Trust funded by life insurance allows you to control the policy and ensure that the proceeds are managed according to your wishes. Working with a legal expert can help streamline this process and optimize your trust's structure.

Typically, life insurance proceeds received by an irrevocable trust, such as a Nevada Irrevocable Trust funded by life insurance, are not subject to income tax. This characteristic allows the trust to bypass taxation on the death benefit, providing a robust tool for wealth transfer. Nevertheless, consulting a tax professional is crucial to navigate the specifics of your trust.

The 3-year rule indicates that if the insured individual passes away within three years of transferring a life insurance policy to an irrevocable trust, the death benefit may still be included in their estate for tax purposes. Thus, the trust must be established and funded well in advance to benefit fully from tax advantages. This guideline is essential for estate planning with a Nevada Irrevocable Trust funded by life insurance.

An irrevocable life insurance trust may need to file a tax return depending on its income. If the trust earns interest, dividends, or other taxable income, it mandates a tax return submission. Understanding these nuances ensures you comply with tax laws and keeps your Nevada Irrevocable Trust funded by life insurance in good standing.

You may need to file a tax return for a Nevada Irrevocable Trust funded by life insurance if the trust generates income. While the life insurance proceeds are not taxable, any earnings from the trust assets could require a filing. Make sure to keep detailed records and consult a tax advisor for accurate guidance on your trust's tax responsibilities.

Life insurance proceeds received by a Nevada Irrevocable Trust funded by life insurance are generally not taxable. This means that, when the insured passes away, the trust can receive the death benefit without incurring taxes on the amount. However, it's always wise to consult with a tax professional to understand your specific situation and ensure compliance with tax regulations.

The 3 year look back rule for an Irrevocable Life Insurance Trust (ILIT) means that any life insurance policy transferred to the trust must be held for at least three years before you pass away. If the transfer occurs within this timeframe, the IRS may include the policy in your estate for tax purposes. Proper planning and consultation through platforms like uslegalforms can help you navigate this rule effectively.

The 3 year look back on life insurance refers to the period during which the IRS can review transfers of life insurance policies to determine if they were done to avoid estate taxes. With a Nevada Irrevocable Trust Funded by Life Insurance, if the policy is transferred within three years of your death, it may be brought back into your estate for tax calculations. Understanding this rule is crucial for effective estate planning.