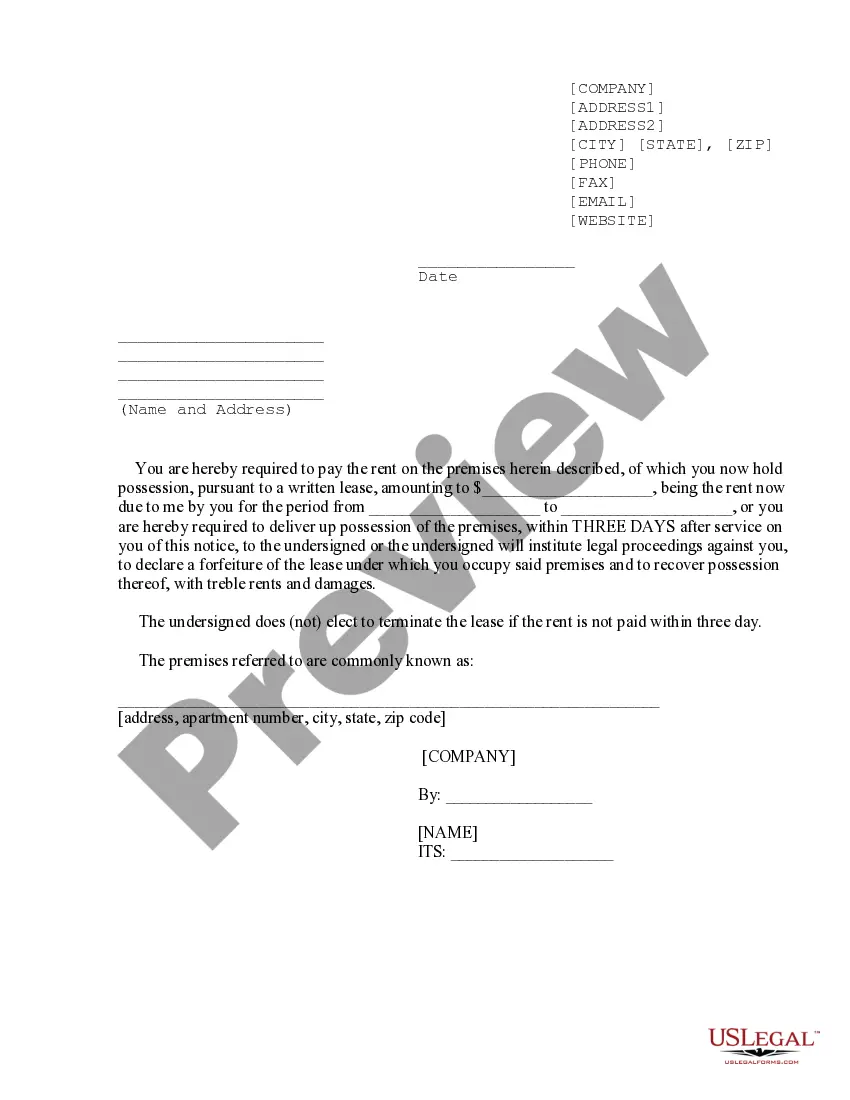

The Fair Debt Collection Practices Act (FDCPA) prohibits harassment or abuse in collecting a debt such as threatening violence, use of obscene or profane language, publishing lists of debtors who refuse to pay debts, or even harassing a debtor by repeatedly calling the debtor on the phone. Also, certain false or misleading representa?¬tions are forbidden, such as representing that the debt collector is associated with the state or federal government, or stating that the debtor will go to jail if he does not pay the debt. This Act also sets out strict rules regarding communicating with the debtor.

The FDCPA applies only to those who regularly engage in the business of collecting debts for others -- primarily to collection agencies. The Act does not apply when a creditor attempts to collect debts owed to it by directly contacting the debtors. It applies only to the collection of consumer debts and does not apply to the collection of commercial debts. Consumer debts are debts for personal, home, or family purposes.

Title: Nevada Initial Letter or Notice from Collection Agency to Debtor: A Comprehensive Explanation Introduction: In the state of Nevada, when a debtor fails to repay their outstanding debts, a collection agency may initiate contact by sending an initial letter or notice. This crucial communication serves to inform the debtor of their outstanding obligations and initiate the debt collection process. This article will delve into the specifics of what a Nevada Initial Letter or Notice from Collection Agency entails, its purpose, and potential types one may encounter. 1. Purpose of the Nevada Initial Letter or Notice from Collection Agency: The primary aim of this initial communication is to notify the debtor about their default or delinquent account and request prompt payment. Collection agencies must adhere to Nevada's collection laws, which outline the steps that must be followed to ensure fair and ethical debt collection practices. This initial letter or notice serves as the starting point for resolving the outstanding debts. 2. Content of the Nevada Initial Letter or Notice from Collection Agency: a) Identification: The letter or notice will include the identification of the collection agency initiating contact. This includes the agency's name, address, phone number, and the contact person responsible for handling the account. b) Details of the Debt: The initial communication will provide a detailed breakdown of the outstanding debt, including the original creditor's name, account number, amount owed, and the date on which the debt became delinquent. It may also include any associated interest or fees accrued. c) Payment Options: Nevada collection agencies must inform the debtor of their rights regarding repayment options. The letter should specify acceptable payment methods, such as online payment portals or mailing instructions, alongside any deadlines or considerations for payment arrangements. d) Verification Rights: Debtors have the right to request verification of the debt within a specified timeframe. The letter should include information about how to exercise this right, including the process for disputing the debt and requesting further documentation. e) Consequences of Non-Payment: The Nevada Initial Letter or Notice from Collection Agency must clearly outline the potential consequences of non-payment. This may include legal actions, credit reporting, potential wage garnishment, or other remedies available under Nevada law. 3. Types of Nevada Initial Letters or Notices from Collection Agencies: a) Standard Initial Notice: A typical initial letter reminding the debtor of the outstanding debt, due dates, and payment options. b) Notice of Collection Lawsuit: In some cases, if the debt remains unpaid, the collection agency may send a notice informing the debtor of an impending lawsuit if no action is taken promptly. c) Notice of Wage Garnishment: This type of letter alerts the debtor that their wages are subject to garnishment unless the debt is satisfied or a repayment agreement is established. Conclusion: Receiving a Nevada Initial Letter or Notice from a Collection Agency can be an unsettling experience for debtors. However, understanding the purpose, contents, and potential variations of these notices enables debtors to take prompt action, resolve their financial obligations, and protect their rights. It is crucial for both debtors and collection agencies to observe the applicable laws to maintain fair and transparent debt collection practices in Nevada.